Report Overview

Polypropylene Catalyst Market - Highlights

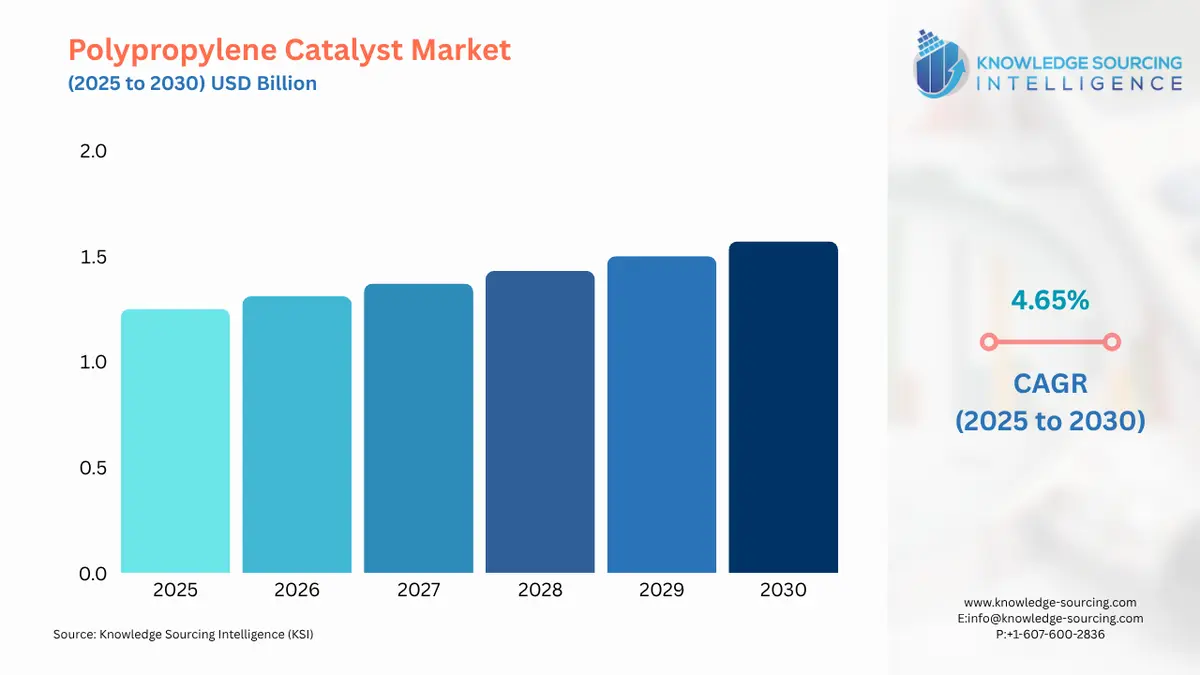

Polypropylene Catalyst Market Size:

The polypropylene catalyst market is anticipated to have a market size of US$1.569 Billion in 2030, growing from US$1.250 billion in 2025 at a CAGR of 4.65%.

Polypropylene catalysts are initiators and regulators of the polymerization process, which changes propylene monomer into a polymer of polypropylene. They determine most properties of the final polypropylene product: its molecular weight, stereoregularity, and crystallinity. The two types of catalysts commonly used in the process are Ziegler-Natta and metallocene, the latter being the less applied type. These catalysts are crucial in producing a wide variety of polypropylene products with tailored properties to meet the diverse needs of various industries.

The increasing focus on sustainability is also influencing the market as innovations in catalyst technologies are being driven. The producers are focusing on developing catalysts that enable the production of recyclable and eco-friendly polypropylene to match environmental regulations and consumer demands. The emerging economies are rapidly industrializing and urbanizing, adding to the market growth by raising their polypropylene production capacities. These trends, along with improvements in catalyst performance and product customization, are all contributing to the steady expansion of the polypropylene catalyst market globally.

What are the drivers of the polypropylene catalyst market?

- Increasing Demand in the Automotive Industry

The expanding automotive industry drives the polypropylene catalyst market highly due to increasing demand for lightweight, durable, and cost-effective materials. It is critical in reducing vehicle weight, enhancing fuel efficiency, and fulfilling stringent environmental regulations, particularly with the emergence of electric vehicles (EVs). Considering its strength, chemical resistance, and recyclability, it is widely used for interior components, exterior bumpers, fenders, and battery housings for electric vehicles. Advanced catalyst technologies allow the production of high-performance polypropylene with tailored properties, with the potential to enhance toughness and aesthetics.

The OICA (International Organization of Motor Vehicle Manufacturers) stated that overall vehicle production rose 10% in 2023 compared to 2022. Further, the total number of vehicles produced is 93,546,599; out of this, 67,133,570 are cars, and 26,413,029 are commercial vehicles. These figures come from the major economies of India, China, Canada, Germany, France, Japan, the United States, etc. As the automobile industry also focuses on sustainability, demand for polypropylene, and correspondingly for polypropylene catalysts, might increase due to eco-friendly and cost-efficient automobile manufacturing.

- Advancements in Technology

Technological advancement in polypropylene catalysts has greatly improved the efficiency, sustainability, and versatility of the production process. Innovations such as SSCs have control polymer properties with higher yield and faster cycles, while the Ziegler-Natta catalyst has improved reactivity, selectivity, and lower environmental impact.

These innovations enhance the quality and purity of polypropylene and tend to make production more efficient and environment-friendly by using less waste and emissions. Moreover, improved catalysts allow higher recyclability of polypropylene, which helps in working towards global sustainability goals and enhances the overall value of advanced catalyst technologies.

Major challenges hindering the growth of the polypropylene catalyst market:

High production costs for advanced catalysts and regulatory pressures for more sustainable processes are the major challenges for the polypropylene catalyst market. The competition from alternative materials and biopolymers limits polypropylene's market share. Fluctuating raw material prices and dependence on the petrochemical industry add to the risks. Additionally, technological gaps in recycling and a lack of skilled professionals hamper efficiency and growth. Market consolidation restricts competition, which slows innovation. These factors collectively have been constraining the polypropylene catalyst market’s growth.

Polypropylene catalyst market geographical outlook:

- The polypropylene catalyst market is segmented into five regions worldwide

Geography-wise, the market of polypropylene catalysts is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Rapid industrialization and urbanization, especially in countries like China and India, drive the Asia Pacific polypropylene catalyst market due to increased demand from the packaging, automotive, and textile industries. Furthermore, the region has a strong manufacturing base and competitive export advantage for boosting polypropylene catalyst consumption. Packaging industry growth is largely being driven by e-commerce and retail development, mainly for cost-effectiveness, making polypropylene their material of choice. In addition, the automotive industry’s expansion with rising consumer demand for EVs will promote the market. Due to government investments in infrastructure and production lines, the increased usage of materials in applications is assured. For example, Invest India claims that the Indian construction market will reach USD 1.4 trillion by 2025, whereas the cities alone will contribute 70% of the national GDP.

Demand from prime sectors such as automotive, packaging, and construction drives the North American market. The transition to electric vehicles and fuel-efficient solutions increases the use of polypropylene catalysts in automotive parts and batteries. In line with this, in 2022, Canadian imports of automotive parts and components totaled US$15.4 billion, close to 2020 levels. The United States share in the total Canadian automotive import market remains dominant at approximately 62%. With the increasing focus on sustainability, recycling activities also support the adoption of polypropylene catalysts for eco-friendly packaging. Continuous technological advancements in production processes improve polypropylene's performance. The region's high industrial base and strong economy further drive the market.

The automotive and packaging industries are the main drivers of the European polypropylene catalyst market. Increasing demand for lightweight and durable materials in the construction sector and growing consumer preference for sustainable packaging solutions are driving the market growth. In this regard, according to Eurostat, in December 2023, compared with December 2022, production in construction increased by 1.9% in the euro area and by 2.4% in the European Union. Eurostat states that the average annual output in construction for 2023 compared with 2022 is slightly higher. However, in the EU, building construction increased by 1.1% in 2023 compared to 2022, and civil engineering increased by 4.1%. This rise in the construction industry reflects an overall increase in raw materials for its inputs.

Recent developments in the polypropylene catalyst market:

- In November 2022, Lummus Technology, a global provider of process technologies and value-driven energy solutions, launched its Novolen® PPure ™ polypropylene (PP) portfolio, a new grade range of polymers suitable for supporting the production of high-quality products for automotive, healthcare components, and food packaging materials. The new non-phthalate process technology saves energy and improves the catalyst's hydrogen response.

Polypropylene catalyst market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Polypropylene Catalyst Market Size in 2025 | US$1.250 billion |

| Polypropylene Catalyst Market Size in 2030 | US$1.569 billion |

| Growth Rate | CAGR of 4.65% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Polypropylene Catalyst Market |

|

| Customization Scope | Free report customization with purchase |

Polypropylene Catalyst Market Segmentations:

- By Type

- By Production Process

- Bulk Process

- Gas-Phase Process

- Slurry Phase

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America