Report Overview

Residential Solar Market - Highlights

Residential Solar Market Size:

Residential Solar Market, at a 7.92% CAGR, is expected to grow to USD 135.997 billion in 2031 from USD 86.106 billion in 2025.

Residential Solar Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

The residential solar market is predicted to show strong growth during the forecast period. Residential solar energy involves harnessing the sun's clean, renewable energy to generate electricity for households and apartment complexes. Residential solar energy systems can be either roof-mounted, adhering to the structure of the home, or ground-mounted, standing independently on the property. The decline in solar panel costs, proactive government initiatives, and progressive technological advancements collectively act as key drivers propelling the growth of the residential solar industry.

Residential Solar Market Segmentation Analysis:

The falling cost of solar panels bolsters the residential solar market growth.

The declining cost of solar panels is a major factor propelling the growth of the residential solar market. Over the years, advancements in technology, increased production capacity, and improved economies of scale have significantly reduced the cost of solar panels. This price reduction has made solar energy more affordable for the average homeowner and with solar power becoming increasingly cost-competitive compared to traditional electricity sources, it is now an economically viable choice for a larger segment of the population. For instance, in April 2022, the cost of domestic solar modules produced by Original Equipment Manufacturers (OEMs) experienced a reduction of 10%.

Government initiatives drive the residential solar market expansion.

Government-led initiatives have been a significant driver in the growth of the residential solar industry. Favorable policies such as tax incentives, rebates, and subsidies have lowered the financial burden of installing solar panels, making them more accessible to a larger portion of the population. For instance, in 2023, the Indian government launched a subsidy program exclusive to residential homes. Under this initiative, households installing solar rooftop systems with a capacity between 1kW to 3kW are eligible for a 40% subsidy. Meanwhile, for larger installations with capacities ranging from 4kW to 10kW, a 20% subsidy is provided.

Technological advancement drives residential solar market growth.

Technological advancements in solar technology and storage systems are significantly propelling the growth of the residential solar market. Improvements in photovoltaic technology have not only led to more efficient and durable solar panels but have also reduced costs, making solar power increasingly affordable for homeowners. Concurrently, the advent of advanced solar storage systems, like high-capacity lithium-ion batteries, allows for the storage and use of solar-generated electricity even during periods of low sunlight or during the night. This has amplified the utility and reliability of solar power for residential use. For instance, in 2023, Sungrow introduces its cutting-edge all-in-one residential solar-storage-EV charging solution, now featuring an integrated AC EV charger alongside the 3-phase hybrid inverter and battery system for home.

Residential Solar Market Geographical Outlook:

North America is projected to dominate the residential solar market.

North America is expected to account for a significant share of the market due to proactive government initiatives and substantial investments in renewable energy infrastructure. The supportive regulatory environment, aggressive investment, and technological progression have positioned the region at the forefront of the residential solar market. For instance, in June 2023, the Biden-Harris administration initiated a $7 billion Solar for “All Grant Competition” aimed at funding residential solar programs designed to reduce energy costs for families. This ambitious venture underscores the administration's commitment to expanding access to affordable, clean energy for households across the nation. Also, in June 2023, Bright secured $31.5 million in Series C financing, a critical step towards broadening its reach in delivering solar power to households and enterprises throughout Mexico.

Residential Solar Market Growth Drivers:

Intermittent energy production may restrain the residential solar market.

The ability of solar panels to produce energy is directly dependent on sunlight, creating a challenge for energy generation during cloudy conditions or nighttime. Although there are innovative energy storage solutions, such as advanced battery systems, they are an additional investment over the already substantial initial cost of the solar panel system itself. This elevated entry cost can potentially discourage homeowners from adopting solar energy, especially those in regions with less predictable sunlight or households on a tighter budget. Furthermore, these storage systems also necessitate space and may require maintenance, adding to the complexity and potential costs of the solar energy setup.

Residential Solar Market Company Products:

Grid-Tie Rooftop Solution: Tata Power Solar Systems Ltd, a part of the TATA Group, provides cutting-edge grid-tie rooftop solutions, accommodating a wide range of areas from 100-500sq ft, 500-1000sq ft, to over 1000 sq. ft. These versatile systems, available in both single and three-phase variants, are designed to suit different residential needs and spaces. Depending on the size and capacity, these solutions can generate anywhere from 1,400 units to an impressive 14,000 units annually, offering a sustainable and efficient power solution for various residential settings.

List of Top Residential Solar Companies:

Trina Solar Co., Ltd

Canadian Solar Inc.

IBC SOLAR AG

JinkoSolar Holding Co., Ltd

Sunpower Corporation

Residential Solar Market Scope:

Report Metric | Details |

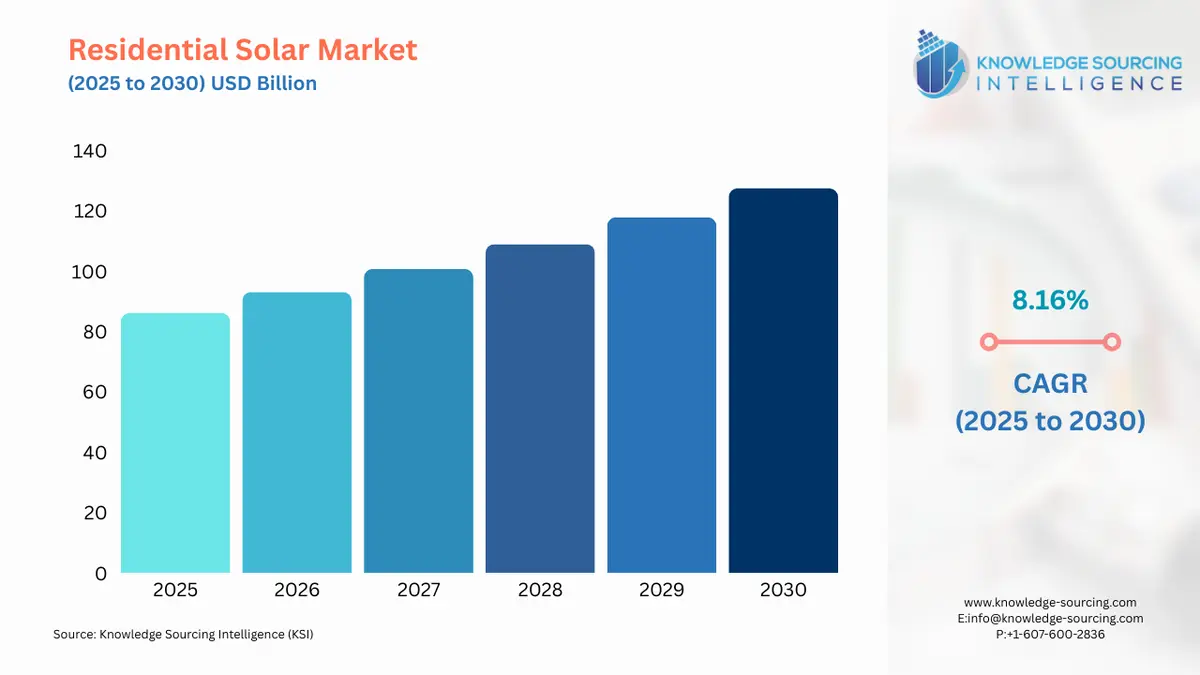

Residential Solar Market Size in 2025 | USD 86.106 billion |

Residential Solar Market Size in 2030 | USD 127.452 billion |

Growth Rate | CAGR of 8.16% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Residential Solar Market |

|

Customization Scope | Free report customization with purchase |

Residential Solar Market Segmentation

By Panel Type

Monocrystalline

Polycrystalline

Thin-Film

By Mounting Type

Rooftop Mounted

Ground Mounted

Others

By Power Output

Up to 100 W

100 to 200 W

Greater than 200 W

By Area

Rural

Urban

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others