Report Overview

South Africa Shampoo Market Highlights

South Africa Shampoo Market Size:

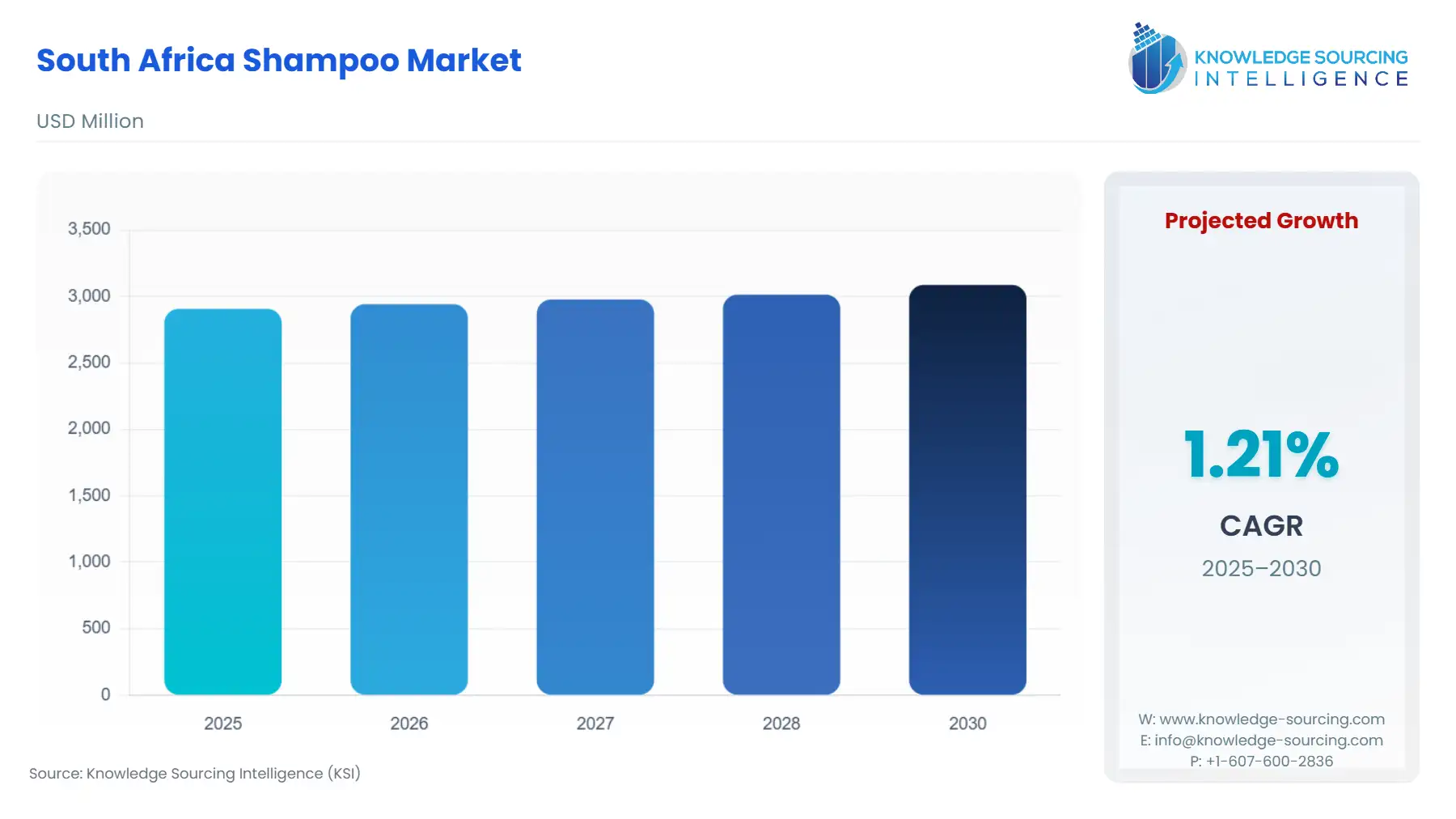

The South Africa Shampoo Market is projected to grow at a CAGR of 1.21 % from 2025 to 2030, reaching USD 3.088 billion in 2030 from USD 2.908 billion in 2025.

The growing consumer shift towards natural and organic products is one of the key factors shaping the market. More and more South Africans are demanding natural and organic shampoo products, leading to growth. In addition, the increasing expansion of e-commerce and increasing digital penetration are propelling the online market. The increasing concerns for curl maintenance and scalp health, due to South Africa’s diverse population, with a significant portion having type 3 and 4 (curly and coily) hair, are leading brands to specifically offer shampoos to target these concerns. Additionally, the hair coloring and styling trend is driving the market.

South Africa Shampoo Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The South Africa Shampoo Market is segmented by:

- Product: By product, the market is categorized into medicated/special purpose shampoos and non-medicated or regular shampoos. Medicated shampoos include shampoos targeted at dandruff, hair loss, scalp infections and other issues. While non-medicated shampoos are for general use for daily care.

- Application: By application, the market is divided into household and commercial segments. The household segment accounts for the majority share, driven by daily personal care routines. The commercial segment also has a considerable share, driven by increasing demand from salons, hotels and wellness centers. There is a dominant share of households that use shampoos on a daily basis. At the same time, the commercial segment also holds a considerable share for the use of shampoos in salons and barbershops.

- Distribution Channel: In terms of distribution channel, the market includes hypermarkets/supermarkets, convenience stores, online stores, and others. Hypermarkets/Supermarkets hold key dominance, particularly in urban centers. While the overall distribution channel is led by the convenience stores. The online segment is growing at a rapid rate and gaining a significant share of the market.

Top Trends Shaping Mexico’s Shampoo Market:

- One of the major trends that is impacting the market is the growing environmental consciousness among South Africans consumers. This is driving the demand for eco-friendly and sustainable shampoo products. This includes shampoo bars, waterless formulations like dry shampoos, and products with recyclable or biodegradable packaging.

- For example, O’right’s philosophy lies in a deep commitment to sustainability and the use of natural ingredients. It delivers hormone-free shampoo and kid-friendly shampoo in biodegradable or recyclable packaging. It reduces its reliance on synthetic compounds and with biodegradable formulations.

South Africa Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

- Evolving Consumer Preferences: One of the key factors driving the South African shampoo market is the increasing consumer preferences for hair and scalp. The increasing trend towards urban lifestyle is propelling the market to grow, heightening the need for specialized products for hygiene and grooming. A survey conducted in 2022 revealed that over 70% of urban South Africans allocate a portion of their budget to cosmetics and personal care products. The influence of social media, beauty influencers, and online tutorials has played a significant role in shaping consumer preferences and driving demand for various cosmetic products.

- Growing Demand for Natural and Organic Products: The natural hair movement is a significant driver of demand for herbal and organic shampoos in South Africa. South Africa’s diverse population is embracing their natural hair and is celebrating their curly, coily and kinky hair types. This movement encourages the use of sulfate-free, paraben-free, and natural ingredient-based shampoos to maintain hair health without harsh chemicals. Thus, local brands and global players are capitalizing on this by offering products tailored to African hair types. For example, in 2023, P&G acquired haircare brand Mielle Organics. Mielle Organics products are rooted in natural ingredients designed for black women.

- High Urbanization and Middle-Class Growth: High and ising urbanization and increasing middle-class growth are one of the key factors driving the shampoo market. This drives the demand for specialized and premium hair care products, including shampoos, by increasing consumer purchasing power and exposing them to beauty trends and accessing the modern retail channels.

South Africa is one of the most urbanized countries in Africa. As per the data from the World Bank, 69% of its total population is urban. It has grown from 65% in 2015 to 69% in 2023.

Challenges:

- Presence of Counterfeit Products: One of the challenges for the market is the circulation of counterfeit shampoos and unregulated products, which are typically low-cost imitations of popular brands, and while they appeal to price-sensitive consumers. This makes it difficult for authentic brands to maintain market share and pricing integrity, especially in economically disadvantaged areas.

South Africa Shampoo Market Competitive Landscape:

The market is moderately fragmented, with some notable key players such as Procter & Gamble, Unilever, Henckel AG & Co. KGaA , The Estee Lauder Companies Inc., Church & Dwight Co., Inc. , L’Oréal Group, and Johnson and Johnson.

- Product Launch and Premium Innovation: In May 2025, Unilever introduced its Damage Therapy range featuring breakthrough Bio-Protein Care technology, a patented formulation that replenishes lost hair protein and strengthens hair up to 10 times after use. The premium line of shampoos includes an intensive repair shampoo, conditioner, and serum mask, designed to target and repair damage from heat styling, coloring, and environmental stressors. This development positions the company towards the growing demand for premium, scientifically advanced hair care products in South Africa.

- Product Launch: In April 2025, O’right launched Tea Tree Shampoo, targeting South Africans seeking natural solutions for scalp and hair.

South Africa Shampoo Market Size:

| Report Metric | Details |

| South Africa Shampoo Market Size in 2025 | US$2.908 billion |

| South Africa Shampoo Market Size in 2030 | US$3.088 billion |

| Growth Rate | CAGR of 1.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Northern Mexico, Central Mexico, Southern Mexico |

| List of Major Companies in the South Africa Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

South Africa Shampoo Market Segmentation:

- By Product

- Medicated/Special Purpose

- Non-Medicated/Regular

- By Application

- Household

- Commercial

- By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others