Report Overview

Spectrum Analyzer Market Size, Highlights

Spectrum Analyzer Market Size:

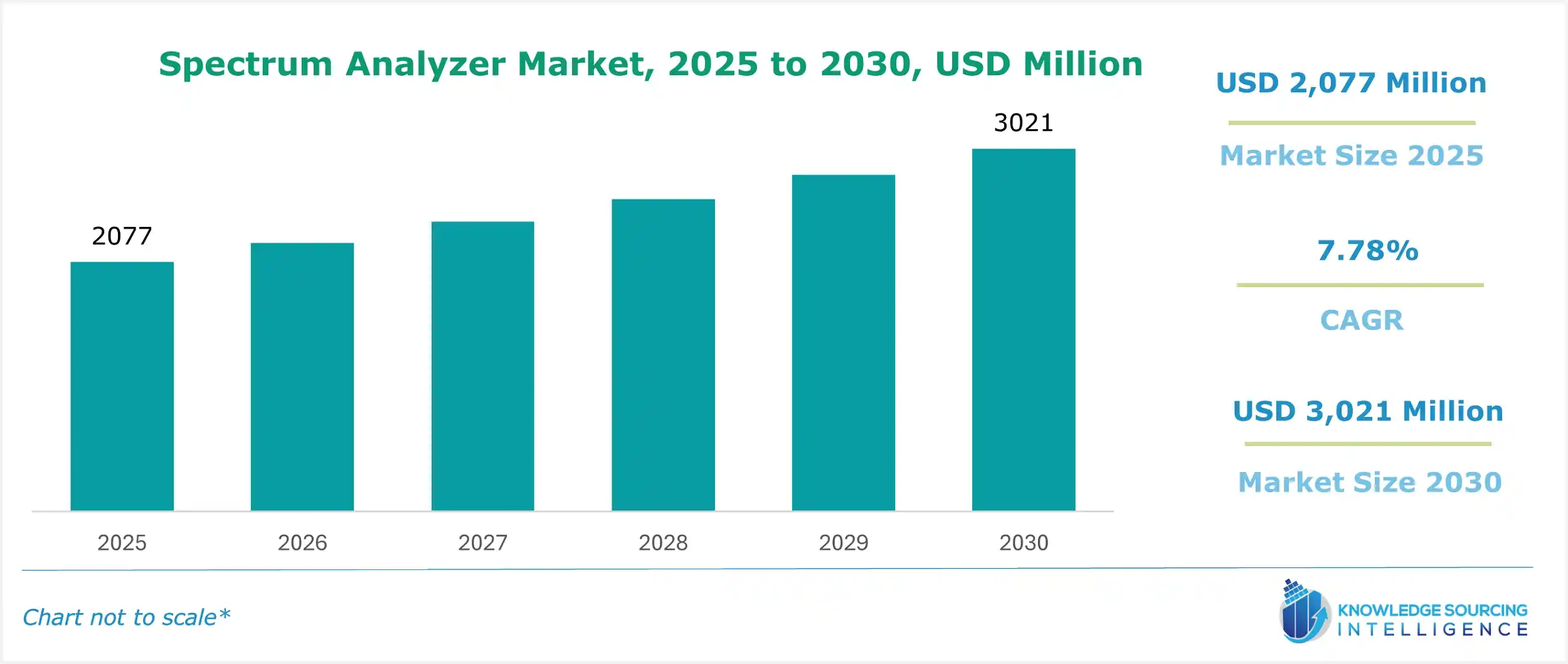

The spectrum analyzer market is expected to grow at a CAGR of 7.78%, reaching a market size of US$3,021 million in 2030 from US$2,077 million in 2025.

A spectrum analyzer is a testing instrument that measures various parameters in a circuit or a system at a radio frequency range. It measures the magnitude of internal signals versus frequency within the full frequency range. Spectrum analyzers are widely adopted in manufacturing, designing, and determining performance, error detection, and troubleshooting errors. These find application in end-user industries such as automotive and transportation, aerospace and defense, IT and communication, medical and semiconductors, and energy, among others.

Spectrum Analyzer Market Trends:

Growing demand for wireless technology among users worldwide has been the driving factor in the spectrum analyzer market. Besides, the wider adoption of portable and handheld spectrum analyzers coupled with multi-tasking features, bandwidth, and frequency advancements are major driving factors in the spectrum analyzer market. However, this industry's major constraints are the non-availability of cost-effective spectrum analyzers and the growing market for second-hand analyzers.

The spectrum analyzers market has been segmented based on type, form factor, application, and geography. Geographically, the analyzers market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East and African region.

Spectrum Analyzer Market Segment Analysis:

- Automotive to hold a significant market share.

By application, the market classification has been done as automotive and transportation, aerospace and defense, IT and telecommunication, medical and health care, semiconductors and electronics, and others. The automotive and transportation segment is projected to hold a significant market share during the forecast period. Growing demand for wireless technology is the major factor leading to the growth in this sector. Additionally, spectrum analyzers serve as equipment for these high-frequency applications. These analyzers aid in meeting automotive test radar requirements. Spectrum analyzers also support various engineering tasks, wideband components, and communication systems.

Spectrum Analyzer Market Geographical Outlook:

- The Asia Pacific is to witness lucrative growth opportunities.

Geographically, the global market distribution has been done in North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The Asian Pacific market is expected to hold a significant share due to rowing penetration and the need for spectrum analyzers in countries like China and India.

Moreover, the presence of key regional market players further supplements the share during the next five years. The growing demand for spectrum analyzers in the electronics and automotive industries is expected to propel market growth. This has resulted in significant investment into the spectrum analyzers market, developing high-frequency spectrum analyzers.

Spectrum Analyzer Market Key Development:

- In January 2025, Aaronia AG, a leading manufacturer of test and measurement solutions, launched SPECTRAN V6 TABLET, a portable spectrum analyzer that offers fast and precise measurement on the site.

Spectrum Analyzer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Spectrum Analyzer Market Size in 2025 | US$2,077 million |

| Spectrum Analyzer Market Size in 2030 | US$3,021 million |

| Growth Rate | CAGR of 7.78% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East, and Africa, Asia Pacific |

| List of Major Companies in the Spectrum Analyzer Market | |

| Customization Scope | Free report customization with purchase |

The Spectrum Analyzer Market is analyzed into the following segments:

By Type

- Real-Time Analyzers

- Swept-Tuned Analyzers

- Parallel Filter Analyzers

- Fourier Analyzers

- Vector Signal Analysis

By Form Factor

- Benchtop

- Portable

- Handheld

- Networked

By Frequency Range

- Less than 6 GHz

- 6GHz to 18 GHz

- More than 18 GHz

By End-user Industry

- Automotive and Transportation

- Aerospace and Defense

- IT and Telecommunication

- Medical and Healthcare

- Semiconductors and Electronics

- Industrial and Energy

- Others

By Geography

- Americas

- USA

- Europe, the Middle East, and Africa

- Germany

- Netherlands

- Others

- Asia Pacific

- China

- Japan

- Taiwan

- South Korea

- Others