Report Overview

Sugar Alcohol Market - Highlights

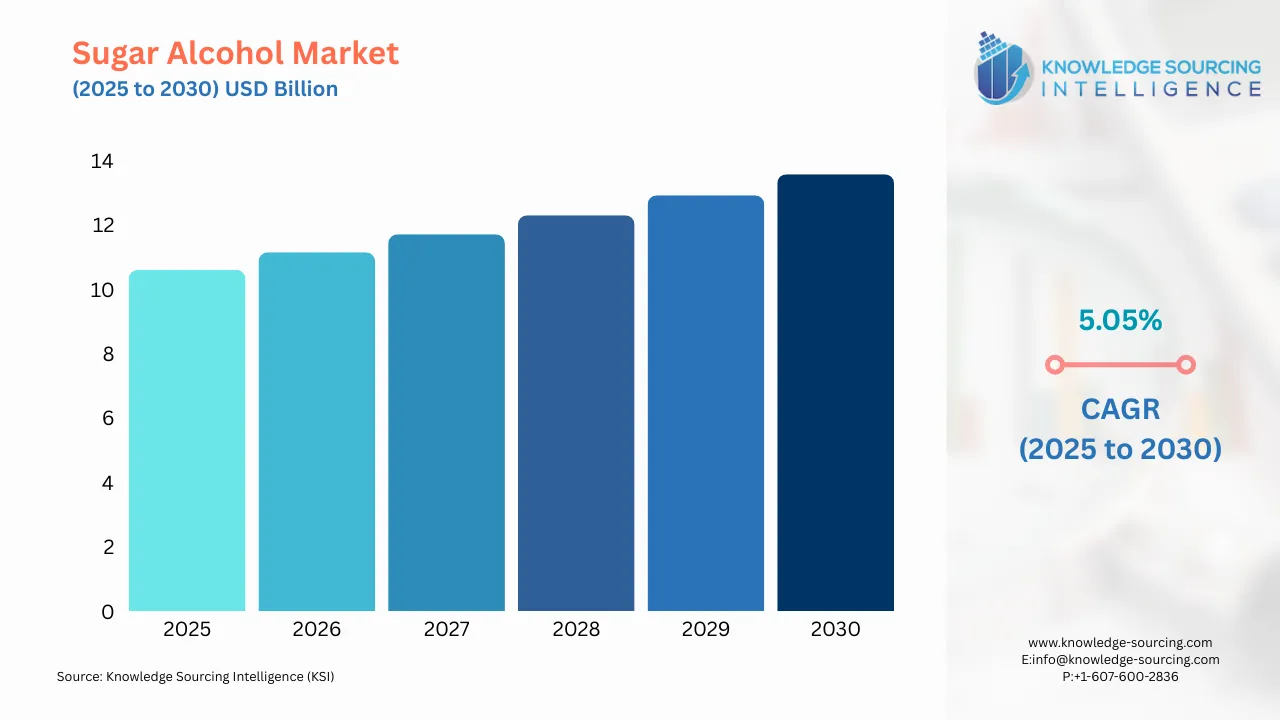

Sugar Alcohol Market Size:

The sugar alcohol market is expected to grow at a rate of 5.05% CAGR, reaching a market size of USD 13.6 billion in 2030 from USD 10.6 billion in 2025.

Sugar alcohol is an organic molecule derived from sugars with a hydroxyl carbon. The market for sugar alcohol is rising because of the various new drivers that have emerged in the recent past. Sugar alcohols, sometimes called polyols, are common sugar substitutes in several foods and drinks and are also used widely in the pharmaceutical industry. Sugar alcohols are low-calorie, low-glycemic-index replacements for normal sugar. It is becoming favored by consumers who are now becoming more health conscious which is increasing the market demand for sugar alcohol.

Further, the growing interest in low-carb food and beverage products and peaking health consciousness has stirred the sugar alcohol market into a frenzy and will boost it for several years in the future. Furthermore, increasing obesity and diabetes occurrences in the countries aforementioned will pump demand in the market.

Sugar Alcohol Market Growth Drivers:

Rising cases of diabetes and an increased obese population are contributing to the sugar alcohol market expansion.

Sugar receives the most shares of blame for the disturbingly high incidence of obesity and diabetes. For instance, undiagnosed and diagnosed cases of diabetes make up 9.7 million and 29.3 million people, respectively. As a result, consumers are becoming more cautious in their sugar intake and favor products that provide better nutritional value. Such lifestyle modifications are part of the understanding people are getting concerning the products that they consume, especially those concerning the obesity and diabetes epidemics. The vast majority of people around the world seem to be increasing dramatically their intake of low-calorie food. All these factors may contribute to the increase in the market.

Increased R&D investment is anticipated to increase the market demand

Many people spend their money on food and nutraceuticals that support healthy lifestyles. In addition, increasing discretionary income and consumer spending as well as knowledge of how to live a healthy lifestyle further stimulate demand for low-calorie and sugar-free food products in many countries. Thus, utilizing sugar substitutes such as sugar alcohols may create a buzz. This can be an opportunity for polyol producers to seek diversification while still being relevant in sugar alcohol. For instance, researchers at Zhengzhou University in China have advanced in synthesizing sugar alcohols and functional sugars by engineering Yarrowia lipolytica.

Rising demand for sugar-free products is also increasing the market demand

The rising consumption of sugarless food products in different developed countries is enhancing market growth. It has become more popular among consumers to consume sugarless products, and people also know such labeling claims, including no sugar. This caused a positive impact on the market. Faster lifestyle pace and urbanization have decreased the intake of sugars and artificial sweeteners. In many businesses of food and beverages, people use sugar replacement, which is also known as 'sugar-free.' Due to the popularity of this trend, many companies have started producing sugar-free products.

Sugar Alcohol Market Segment Analysis:

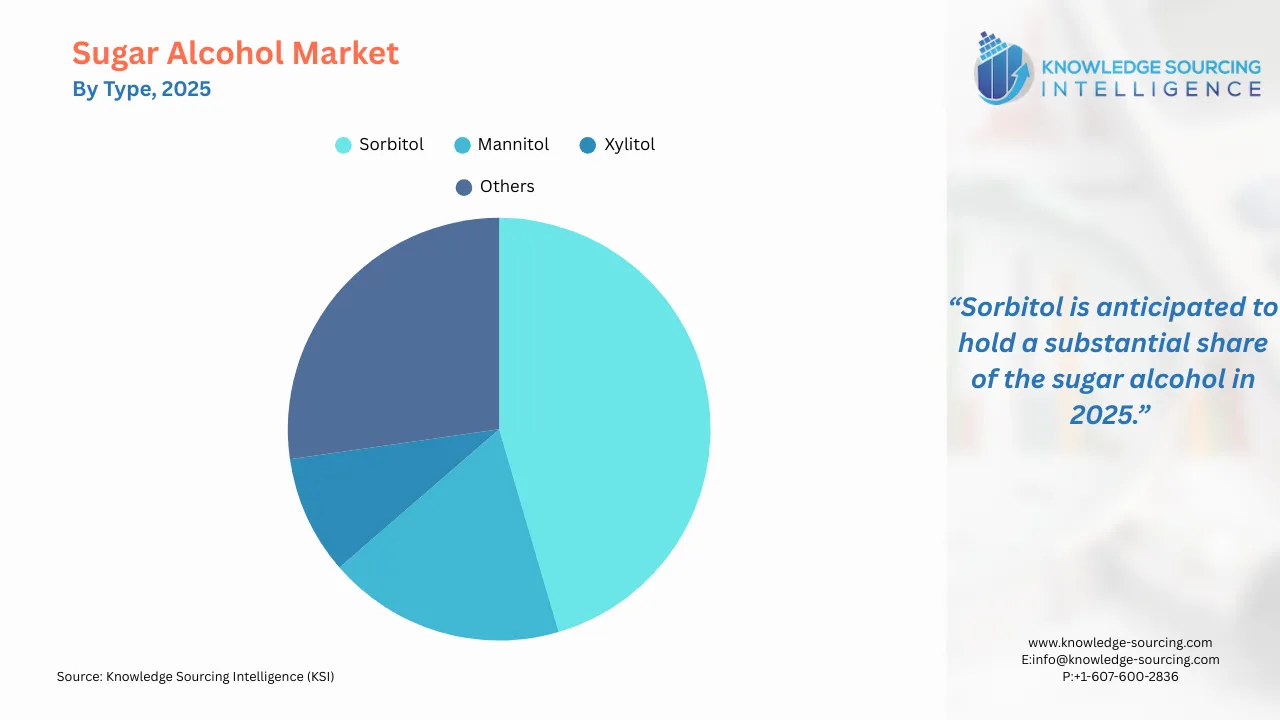

By type, sorbitol is anticipated to grow during the forecast period

Demand for sorbitol itself changes according to demand for end uses in the relevant sectors. The availability of raw starch sources such as potato and corn in potato and corn-rich pockets countries like India, China, and Brazil may increase production by the end of the forecast period. Also, the number of raw material suppliers in China and India is likely to increase with the expansion of agriculture, driven by lower labor costs and increasing global demand.

Moreover, sorbitol is also used in biofuel production. Biofuels are naturally derived fuels promoted by organizations such as the European Commission and the Environmental Protection Agency through the establishment of favorable legislation. Such growing interest in biofuels, along with government support, is likely to increase the number of manufacturers in the future years. Demand for sorbitol is anticipated to rise throughout the projected period due to increased research and applications, especially in developed regions. For instance, Sunar Misir, a leading player in the corn-derived sweetener sector, produces Sorbitol powder known as Sunsorb in Turkey, with a large investment in technologically sophisticated production.

By form, syrup is anticipated to grow during the forecast period.

The demand for syrup sugar alcohol is rising because of its applications in beverages. The manufacturers have developed all sugar alcohols so they can easily create a market for their syrup sugar alcohols. Syrup sugar alcohol also has health benefits as sorbitol finds its application in gelatin capsules and liquid dosing as a plasticizer and anti-crystallizing agent. It's a self-sustaining environment that syrup sugar alcohol industries find through consumer awareness of new food and beverage products.

By application, food and beverages are anticipated to grow during the forecast period.

Sugar alcohols are widely used in food manufacturing considering that their functional and organoleptic properties make them suitable for reduced, sugar-free, or no-sugar products. Technological advances are the key reasons attributed to sugar alcohols being utilized more in diet-related or health products and foods these days. Sugar alcohols are moisture, flavor, and sweetness controllers, which is another reason they are preferred in baked products.

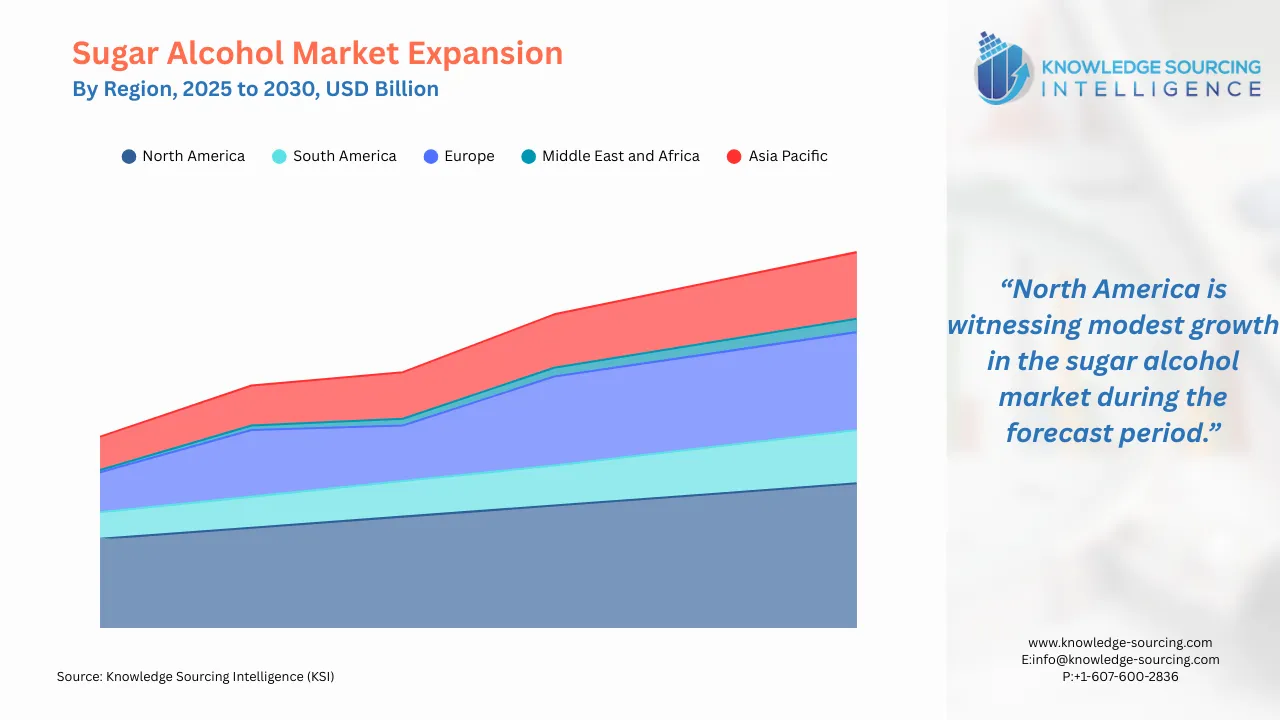

Sugar Alcohol Market Geographical Outlook:

North America is witnessing exponential growth during the forecast period.

North America has been considered one of the major factors in the increase in demand for sugar alcohol products. There has been a remarkable transition in the region toward lively health-conscious living habits, which marks the surge of demand for goods with reduced calories from sugar alcohols. An increase in the number of diabetes patients, obesity, and other health conditions increases the demand for low-calorie products. The major drivers for the market for sugar alcohols are a growing number of lifestyle diseases due to activity, rising consciousness about health and wellness, and greater varieties of products available.

Sugar Alcohol Market Key Launches:

In February 2024, Gujarat Ambuja Exports installed a Sorbitol machine capable of producing 100 tonnes per day (TPD) at their site in Hubli, Karnataka. This becomes Gujarat Ambuja the largest sorbitol maker in India.

List of Top Sugar Alcohol Companies:

ADM

Cargill Incorporated

Ingredion Incorporated

Tate & Lyle

DuPont

Sugar Alcohol Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 10.6 Billion |

| Total Market Size in 2030 | USD 13.6 Billion |

| Forecast Unit | USD Billion |

| Growth Rate | 5.05% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Form, Application, Geography |

| Companies |

|

Sugar Alcohol Market Segmentation:

By Type

Mannitol

Sorbitol

Xylitol

Lactitol

Isomalt

Maltitol

Hydrogenated Starch Hydrolysates (HSH)

Others

By Form

Syrup

Powder

Crystal

By Application

Chemicals

Pharmaceuticals

Food & Beverages

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Italy

Others

Middle East and Africa

Saudi Arabia

Israel

UAE

Others

Asia Pacific

China

Japan

South Korea

India

Indonesia

Taiwan

Thailand

Others