Report Overview

Taiwan Shampoo Market - Highlights

Taiwan Shampoo Market Size:

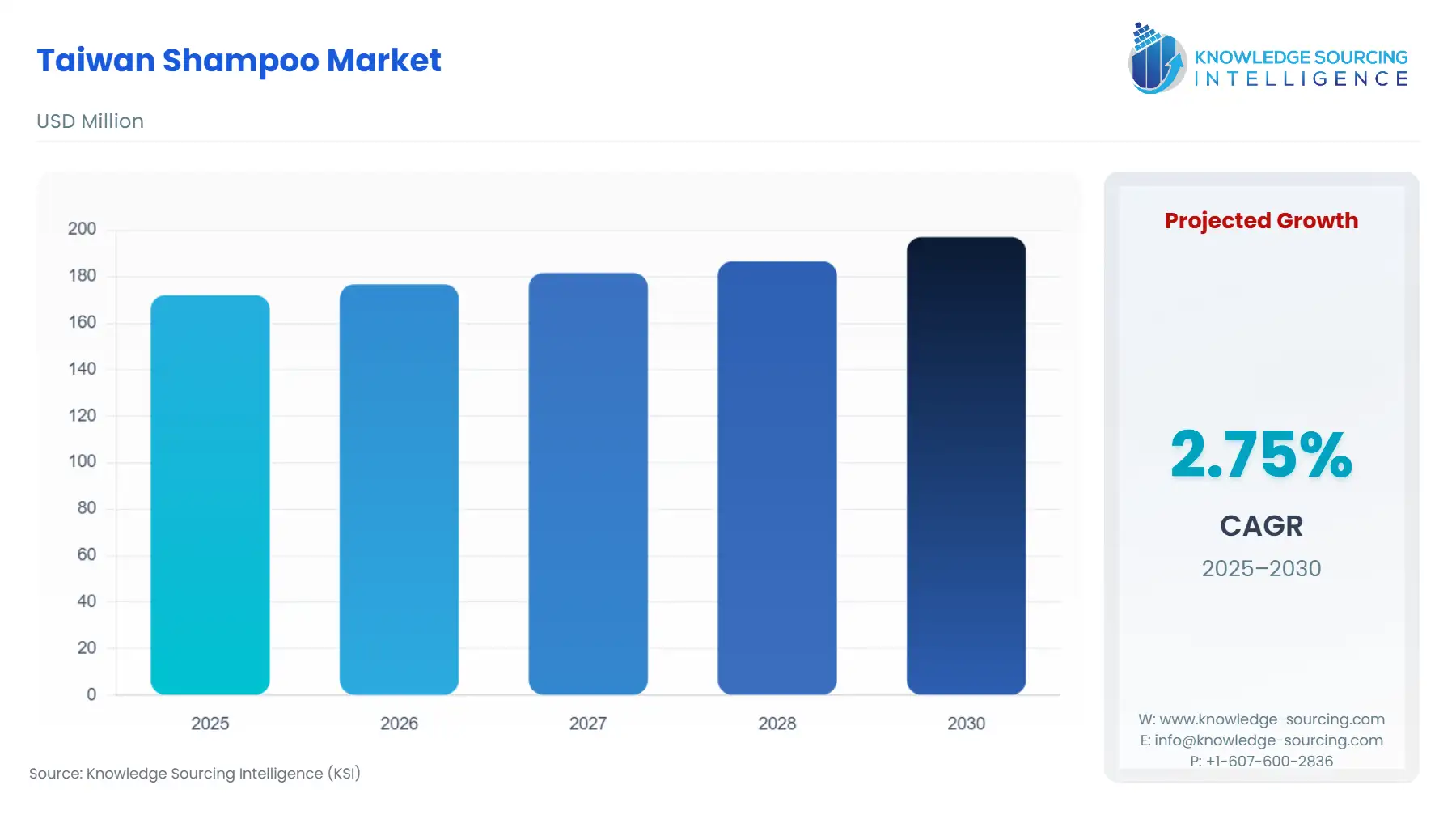

The Taiwan shampoo market is projected to grow at a CAGR of 2.75% during the projected period (2025-2030), reaching a market size of USD 0.197 billion by 2030 from USD 0.172 billion by 2025.

The market for shampoo in Taiwan is expanding quickly due to shifting consumer habits, growing health consciousness, and an increase in demand for premium personal care items. Taiwanese consumers are growing increasingly selective and are looking for shampoos that provide advantages, including damage repair, dandruff prevention, scalp nourishing, and anti-hair loss. Natural and organic components are becoming increasingly popular in the market, and many consumers are choosing sulfate-free or herbal-based formulas that are kind to their skin and the environment. Consumer preferences are still being shaped by Korean and Japanese cosmetic trends, with multipurpose formulas and elegant, minimalist packaging becoming increasingly popular. Additionally, consumers can now compare items and read reviews due to the extensive usage of digital platforms, which greatly impacts their purchasing decisions.

Taiwan Shampoo Market Overview & Scope:

The Taiwan shampoo market is segmented by:

- Product: The Taiwan shampoo market is divided into two segments based on product, medicated/special purpose and non-medicated/regular. The non-medicated/regular segment is expected to hold the largest market share in Taiwan due to its broad availability and growing acceptability of mass-produced products. Non-medicated shampoos are more extensively used than their counterparts since they are more affordable and easier to locate. Additionally, the increasing availability of counter alternatives at pharmacies and drug stores is driving the income of the non-medicated shampoo category.

- Application: The two market types based on application are domestic and commercial. The domestic segment is expected to dominate the market. The reasons driving the growth of the domestic segment include the increasing number of toddlers and babies using baby shampoos and the significant product use for personal hygiene purposes in the home. It is anticipated that the increasing number of companies advertising their hair grooming products on social media and through celebrity endorsements would increase demand from Taiwanese home consumers.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. Across Taiwan, these elements made a substantial contribution to the revenue generated by multinational corporations. The segment's growth is driven by expanding projects and capacity-building initiatives carried out by international corporations.

Top Trends Shaping the Taiwan Shampoo Market

- Innovation in Products Driven by Climate

Taiwan's humid subtropical environment frequently causes issues like frizz, dandruff, oily scalps, and heat sensitivity. Customers therefore prefer shampoos that address climate-related issues, which has resulted in a rise in clarifying and anti-frizz formulas. Silk proteins for resistance to humidity, tea tree oil for cooling, and bamboo charcoal for detoxification are common constituents. To capitalize on this demand, local manufacturers are providing products that are specifically advertised as "Made for Taiwan’s Weather."

- Demand for Medicated and Functional Shampoos

Interest in pharmaceutical shampoos has increased due to a rise in hair-related health issues, including postpartum hair loss, atopic dermatitis, and scalp psoriasis. Shampoos with chemicals like salicylic acid, coal tar, or ketoconazole are being marketed not only through pharmacies but also in beauty retail stores with softer packaging and additional cosmetic benefits.

Taiwan Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

- Impact of Local Indie Brands, J-Beauty, and K-Beauty: Taiwanese customer preferences are significantly influenced by J-Beauty's and K-Beauty's emphasis on delicate, multi-layered care. These local beauty ideologies have contributed to the normalization of pH-balancing cleansers, micellar water shampoos, and scalp serums. Meanwhile, local Taiwanese businesses are becoming more well-known by fusing contemporary cosmetic science with traditional herbal medicines (such as ginseng, ginger, or mugwort). This blend of regional and global factors propels ongoing market innovation and diversity.

- AI-Powered and Customized Haircare Preferences: Personalized and adaptable shampoo formulas are becoming more and more popular, particularly with younger customers. Customization is becoming more and more popular, depending on things like lifestyle, hair texture, and scalp type. Stronger engagement is being seen by brands that provide modular shampoo systems, AI-assisted consultations, or quiz-based customization.

Challenges:

- Criticism of Greenwashing and Marketing Claims: As eco-friendly and clean beauty has gained popularity, some Taiwanese customers are becoming conscious of false advertising claims, or "greenwashing." Trust rapidly erodes when firms don't offer unambiguous, transparent evidence of their sustainability or ingredient benefits. This distrust causes consumers to make cautious purchases, which makes it harder for brands to develop strong emotional bonds and devoted followings in the absence of true transparency and third-party approvals.

Taiwan Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including Shaan Honq International Cosmetics Corp, Biocrown Biotechnology Co., Ltd, Wellsoon Technology Co., Ltd, YOU LEE Chemical Industry Co., Ltd, TENART Biotech Limited, and SHIEUN TA Industry Co., Ltd.

- Acquisition: In April 2024, Kao Corporation unveiled "Melt," a high-end hair care brand that prioritizes rest and self-care. This introduction is a component of Kao's plan to restructure its hair care business by emphasizing upscale goods that appeal to customers' emotions. The "melt" brand serves Taiwan's expanding need for high-end hair care products.

Taiwan Shampoo Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Taiwan Shampoo Market Size in 2025 | US$0.172 billion |

| Taiwan Shampoo Market Size in 2030 | US$0.197 billion |

| Growth Rate | CAGR of 2.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Kaohsiung, Taichung, New Taipei City, Taoyuan, Hsinchu, Others |

| List of Major Companies in the Taiwan Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

Taiwan Shampoo Market Segmentation:

By Product

By Application

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Manufacturers

By Region