Report Overview

India Shampoo Market - Highlights

India Shampoo Market Size:

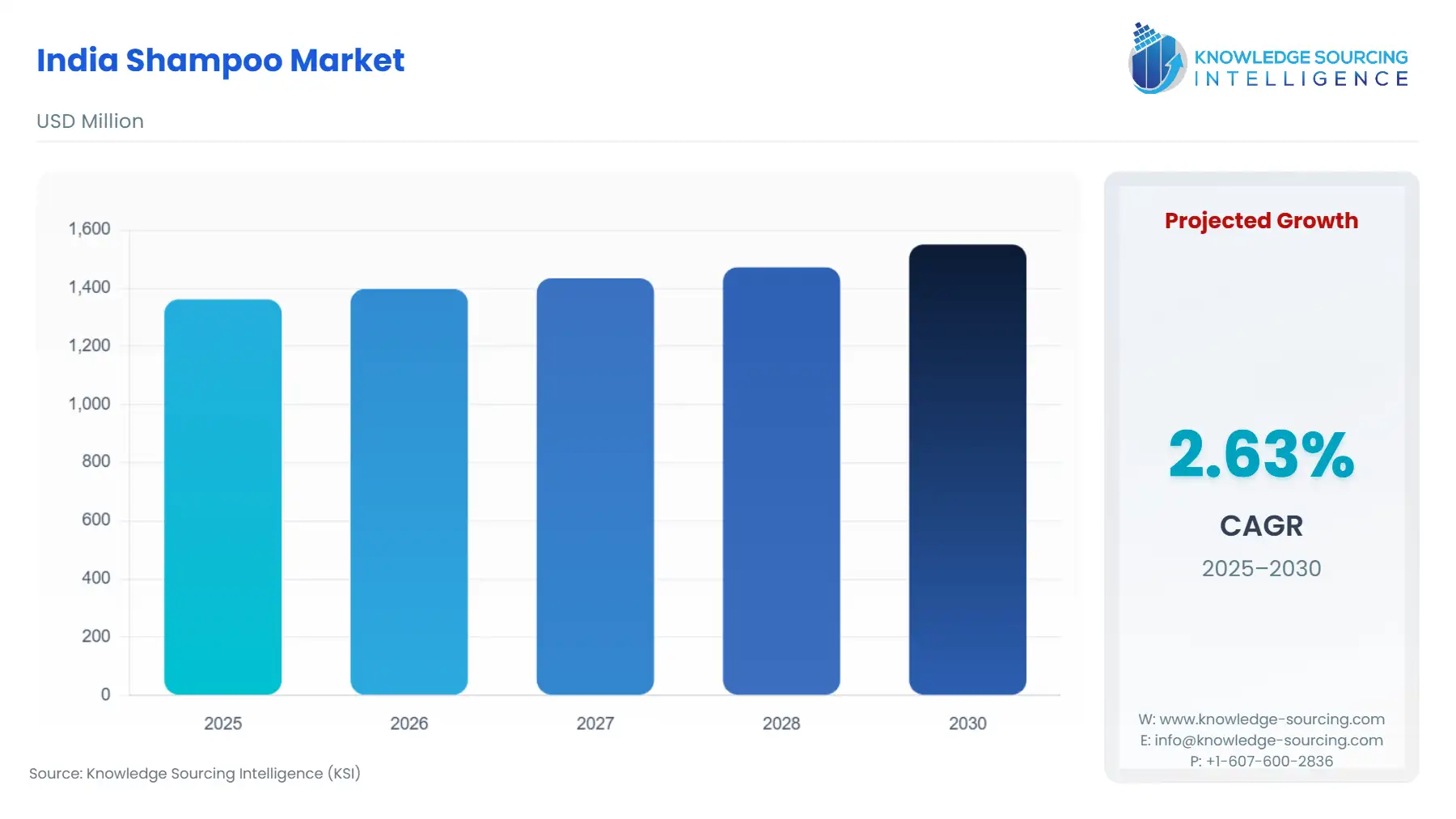

The Indian shampoo market is projected to grow at a CAGR of 2.63% during the projected period (2025-2030), reaching a market size of USD 1.551 billion by 2030 from USD 1.362 billion in 2025.

The current market trend offers an opportunity to mid-priced shampoo brands that emphasize fragrance elements, which have gained strong traction in coastal areas like Tamil Nadu, Kerala, and Gujarat, where users prefer a good quantity of lather, fragrance that lasts after washing hair, and endorsement of the scalp applicable to the humid weather. Brand performance in these areas indicates a positive response from consumers due to their climate-based haircare requirements.

The short-term view of the potential target is highly positive, with a clearly addressable consumer population of women working and youths aged 18 to 30 years in urban areas. They require long-lasting fragrance, hair softness, and frizz management to drive annual purchase decisions, especially in metropolitan cities with a high level of pollution and variations in weather conditions. Branding through a range of modernised packaging cues, inspiring digital storytelling by influencers, and performance cues suitably relating to aspirational urban needs will transform the brands from functional products to sensorial indulgences, positioning them as a freshness confidence solution in urban India.

Companies must comply with regulations on advertising claims, chemicals, and environmental standards, including restrictions on certain preservatives, sulfates, and microplastics. More brands are aligning with sustainability and eco-labeling standards, such as recyclable packaging and toxin-free products, to meet demand for safe, environmentally friendly products and to comply with regulatory requirements.

________________________________________

India Shampoo Market Overview & Scope:

The Indian shampoo market has developed into one of the most dynamic segments in the personal care industry. This is a result of increasing awareness of hygiene levels, higher disposable income levels, and aggressive brand penetration in urban and rural markets. It is anticipated that over 40% of India's population will reside in cities by 2030. This estimate has been derived from NITI Aayog's studies and reports.

The mid-range segment remains the most volume-driven, combining quality and affordability. Brands like Himalaya Wellness Company, Emami Limited, Patanjali Ayurved Limited, and Godrej Consumer Products Limited have a strong hold in this price range with formulations that are benefit-led, positioned around herbal care, nourishment, and family use. As hair care shifts from basic cleaning to benefit-led, hair care players in the mid-tier segment are expected to lead the market, creating a highly competitive and fast-growing space.

The Goods and Services Tax (GST) on various cosmetics was reduced from 18% to 5%. Essential daily use cosmetic products, such as hair oil, shampoo, shaving cream, shaving lotions, toothpaste, talcum powder, and face powder, became cheaper. The Council has also decided to reduce the tax rate on tooth powder from 12% to 5%. These changes have made cosmetic products more accessible and affordable.

The Indian market for shampoos is regulated thoroughly for the protection of consumers, to ensure product safety, and to maintain a guaranteed standard. The shampoos in the market must comply with the requirements of the Bureau of Indian Standards carefully regarding their ingredients, labelling, and the standard of manufacture. Shampoos claimed to be herbal, or nutraceutical products, may be supervised by the Food Safety and Standards Authority of India (FSSAI), and shampoos that are marketed in the form of drugs or as products for the control of dandruff or to provide relief are governed by the Drugs and Cosmetics Act, 1940.

The analysis by segment showed that the share of small format units was highest for personal care (95%), followed by food and beverage (78%) and home care (17%). The three products highly impacting unit sales of small formats were salty snacks (24%), shampoo (19%), and biscuits (15%), according to the 2024 report of India Plastics Pact.

The Indian shampoo market is dominated by a variety of players, including MNCs, Indian FMCG majors, and fast-growing D2C brands. Major players in this segment are Hindustan Unilever Limited, Procter & Gamble Hygiene and Health Care Ltd., and L'Oréal India Pvt. Ltd., all of which have a broad portfolio of unwieldy products, i.e., premium and mid-market segment shampoos. Companies like Marico Limited, Dabur India Limited, and Patanjali Ayurved Limited have greatly benefited from their herbal and Ayurvedic positioning. Fast-growing companies like Wow Skin Science, Mamaearth, and Emami Limited have established a niche for themselves in natural products, chemical-free products, and digital-first products. Main conventional players like Godrej Consumer Products Limited and Himalaya Wellness Company sustain their loyal user base with their herbal and medicated, and family-oriented shampoos. All these players, together, are responsible for creating the competitive environment of the Indian market.

In the upcoming years, the Indian shampoo market is expected to grow steadily across urban, semi-urban, and rural segments due to ongoing innovation in formulations, packaging, and targeted marketing.

The Indian shampoo market is segmented by:

Product: The shampoo market in India is separated into two product categories: medicated/special purpose and non-medicated/regular. The market share of shampoo in India is expected to be led by the non-medicated/regular category because of its broad availability and growing global acceptability of mass-produced products. Non-medicated products are extensively utilized since they are less expensive and easier to find than their counterparts. The increasing availability of over-the-counter alternatives at pharmacies and drug stores also contributes to the non-medicated shampoo segment's revenue.

End-users: End Users are divided into Urban Consumers and Rural Consumers. By Distribution Channel, the market is classified into Hyper Markets/Super Markets, Convenience Stores, Online Stores, and others.

Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

Price Range: By Price Range, it is classified into Economy Range, Medium Range and Premium Range.

________________________________________

Top Trends Shaping the India Shampoo Market

Hair Issues Caused by UV Rays and Pollution

Indian consumers are worried about UV rays, pollution, and hair loss. Brands are therefore expected to offer products with advanced benefits in addition to basic ones like nourishing and smoothing. Businesses can appeal to busy city people who want to maintain their hair with the least amount of effort by providing a range of benefits. These concerns are driving consumer interest in pollution-proof promises in the scalp and hair care industry. Products that contain beneficial components, such as antioxidants that protect against UV rays, heat, and pollution, will revolutionize the Indian haircare market.

Growing Attention to Sustainability

A notable trend in the Indian hair care industry is a greater emphasis on sustainability. Customers are looking for goods that are more environmentally conscious, with a focus on sustainable and eco-friendly production processes, packaging, and materials. Brands are increasingly creating goods with natural, organic, and biodegradable ingredients to avoid using harsh chemicals that can damage the environment. Growing awareness of animal welfare has also increased demand for vegan, cruelty-free hair care products. Packaging sustainability has grown in importance with more customers requesting items in recyclable, biodegradable, or refillable containers. To lessen their environmental impact, brands are implementing creative packaging solutions like minimalistic or plastic-free packaging.

________________________________________

India Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

Growing Awareness of Beauty and Urbanization: Urbanization and growing beauty consciousness are two major factors propelling the hair care market in India. India is becoming more urbanized as of January 2024, according to the World Bank group. 600 million people, or 40% of the total population, will live in towns and cities by 2036, up from 31% in 2011, and more than 70% of GDP will come from urban regions. Customers are paying more attention to appearance and personal care as cities grow, and lifestyles change. People in cities and towns are becoming more conscious of the importance of hair health and are more inclined to spend money on items that improve the overall look and condition of their hair.

Numerous Individuals Affected by Hair Loss: The country is becoming concerned about hair loss because of factors like genetic predisposition, poor food, stress, pollution, and bad lifestyle choices. As more people struggle with hair loss, they are looking for solutions like anti-hair fall shampoos, serums, oils, and conditioners that are made to stop or treat the issue. Increased demand for specialty hair care products that claim to strengthen and stop hair thinning is a result of growing awareness about hair health. Major manufacturers in the market have launched treatments designed especially to treat hair loss, enhanced with natural elements like biotin, caffeine, and herbal extracts.

Rising demand for fragrance-driven and climate-responsive shampoos: There is a growing demand for shampoos designed for lasting fragrance and maximum comfort for both hair and scalp in humidity, heat, and monsoonal conditions. Seasonal and annual meteorological conditions in Gujarat, Tamil Nadu and Kerala emphasize the importance of the functional performance of formulations that deodorise on the body level and provide a fresher sensory experience under prolonged heat and humidity. Monthly and yearly summaries by the IMD for 2023-2024 indicate persistent high humidity and recurrent extreme weather events, such as heavy rain/heat waves, driving demand for products that fulfil fragrance and functional performance under varying moisture and temperature conditions. The Action Plan controls the legislation, composition, labelling, and toxicity of these formulations, regulated under the Drugs & Cosmetics Act and the Cosmetics Rules, 2020. Both registration, labelling, and toxicology must also be addressed when new aromatic or functional compounds are added to shampoo products. The desirable criteria for highly efficient substances and methods related to these additional aspects of compliance are found in the Compliance frame and guidance documents issued by the CDSCO.

The latest government data of 2023–2024 weather and climate shows alternating episodes of high humidity, severe rainfall and hot weather across the three states, weather conditions which are consistent with consumer requests for shampoo products providing a cooling feel, rinsing without residues and all day olfactory effectiveness, and these records of weather provide an evidence base for the extent of demand in respect of 2023–2024. Central government guidance on manufacturing and supply emphasizes formulation stability under heat and moisture, accurate ingredient and safety claims, and proper labeling, governing formulation choices for products sold in coastal and peninsular climates.

Therefore, IMD climate data for 2023–2024 and CDSCO regulatory guidance provide essential information on environmental factors and compliance requirements for shampoos combining long-lasting fragrance with climate-responsive functional efficacy.

IMD reported that Gujarat State received 76.7 mm of rainfall in June 2024 and 408.0 mm in July 2024. The significant increase in rainfall during July has resulted in increased humidity levels. High humidity will lead to an oily and sticky scalp, accumulation of sweat, and discomfort in hair care. With these types of climatic conditions, consumers are seeking shampoos that will be good cleansers, while maintaining long-lasting fragrance and the freshness of the scalp. On days of sudden increased moisture or humidity, the climate-responsible formulations are of great value to consumers seeking consistent performance of shampoos during monsoon times. Such tendencies will directly lead to the increased growth rate of the shampoo market, catering to fragrance-driven and climate-responsible requirements in Gujarat.

Challenges:

Imitation and Counterfeit Items: The Indian hair care market faces a serious threat from counterfeit goods. The spread of counterfeit or inferior goods, frequently offered at reduced costs, is jeopardizing customers and eroding the reputation of respectable businesses. These fake goods might have negative side effects like allergic reactions, hair damage, and scalp irritation because they might not meet safety and quality standards. Also, customers are more likely to buy products that offer comparable advantages to well-known brands but lack the right formulation or quality due to the rising desire for reasonably priced hair care products. The problem is made worse by the extensive availability of fake hair care products, especially through unregulated internet marketplaces and street sellers.

Different Hair Types and Issues: A major obstacle faced by the Indian hair care market is the variety of hair types. Straight, wavy, curly, and coiled hair are among the many varieties found in India; each has unique requirements and maintenance regimens. Moreover, race, geography, environment, and lifestyle can all have an impact on how hair reacts to different treatments, making it challenging for brands to provide universally applicable solutions. Diverse hair issues are reported by customers, such as dryness, hair loss, dandruff, oily scalp, and damage from styling or exposure to the environment. Owing to the intricacy of these issues, businesses must constantly develop and provide specific goods like conditioners that restore moisture, anti-hair fall shampoos, dandruff treatments, and color protection items.

________________________________________

India Shampoo Market Segment Analysis:

By End-user: Urban Consumers

By end user, the Indian Shampoo Market is segmented into urban consumers and rural consumers. The Indian shampoo market among urban consumers is highly segmented, and this segmentation is significantly influenced by the level of urbanization and the income levels of the people. Urban consumers living in metro and mini-metro areas, where their population is concentrated, are the main factor behind the demand for premium and specialized products. This segment utilizes their higher disposable income and is more aware of the global trends through social media and influencers. Urban areas dominate the market due to organized retail and e-commerce, which are more accessible and offer AI-driven personalization and convenience.

Urban buyers of scent-based products associate a subtle and enduring fragrance with a premium experience; however, efficacy and safe ingredients often come first over strong scents. Urban areas have the potential to grow in the shampoo market, particularly for products that emphasize fragrance. Key market segments include premium and custom offerings. There is also a rising trend for eco-friendly, naturally scented variants, featuring popular profiles such as rose, jasmine, or sandalwood profiles that are trendy in urban India due to their connection to natural sources.

Shopping in urban areas, consumers fundamentally seek shampoos that cater to their specific issues, such as hair fall induced by pollution and stress, scalp health, and color protection. At the same time, they are gradually switching to natural, organic, and ayurvedic formulations such as those free from harsh chemicals like sulfates and parabens.

In October 2023, Traya presented significant results from its huge study of over 500,000 men. The figure disclosed indicates that more than half, i.e., 50.31% of the male population undergoing hair loss treatment in India, are below the age of 25. It also mentioned that about 65 percent of Indian men under 25 who experience hair loss also suffer from dandruff.

Based on the study, it is reported that 25.89% of guys aged less than 21 years have already reached Stage 3 and beyond. This figure is on an upward trend, with the age of the group changing to 21-25 years, and becomes 33.35%. It is a clear sign that hair loss has become a significant problem in this population, with the average age of Traya customers being 28 years old.

People in urban regions are moving towards the premium/luxury sector, where ingredient quality, brand reputation, and efficacy-backed claims, supported by clinical trials, such as onion extract anti-hair fall shampoo, are given high priority. Herbal shampoos are particularly welcomed in this category due to the health consciousness among the urban population, who are seeking herbal alternatives.

Urban professionals are mainly looking for fast solutions in grooming, like finishing spray or curl molding, to maintain a professional appearance, which is their main priority. They tend to use these products daily or several times a week compared to rural areas, where usage patterns may vary and depend more on lifestyle factors.

Furthermore, the relocation from 'one shampoo per family' to 'one shampoo per family member', specialized needs for men, kids, and certain hair types, trend in urban consumers in the country. This 'one shampoo per family member' change is a powerful factor behind the market expansion. A significant number of urban dwellers have gone for customized hair care routines, which will promote the overall market expansion in the country.

By End-user: Rural Consumers

The rural consumers hold a significant portion of the Indian population, 63 percent of the total population, according to 2024 World Bank data. The average monthly per capita consumption expenditure in rural areas was accounted for at Rs. 3,773 in 2022-2023, which increased by 9.2 percent to Rs. 4,122 in 2023-2024, as per the Indian Ministry of Statistics & Programme Implementation report titled ‘Survey on Household Consumption Expenditure: 2023-24’ of March 2025. This represents a mass market segment with increasing shampoo penetration in rural households; however, consumption is lower due to increased priority of value for money in rural regions, with affordable packaging like sachets and small bottles being more preferred as they offer value per wash.

Additionally, the rural consumers focus on basic, immediate benefits of shampoo, such as cleanliness and hygiene, reduced oiliness, strength, shine, and anti-dandruff protection. Rural customers also seek trusted herbal, Ayurvedic, or traditional composition shampoos, which are perceived to be safer with low or no side effects. Brand loyalty, especially regarding fragrance preferences, leads to frequent switching in rural towns where pricing, proximity, and eye-catching packaging influence consumers; however, value for money and sustainability practices build trust among the rural consumers.

Furthermore, media exposure, availability in local outlets, and cosmetic benefits over specialized ones influence the purchasing choices among rural Indian consumers. A study reported in July 2025 by IJLTEMAS titled, ‘A Study on Market Penetration of FMCG in Rural Markets in Prayagraj District’, reported that about 79 percent of the respondent from total of 175 respondent buy shampoo from FMCG products only with their priority being Dove, Clinic Plus, All Clear, Karthiga, Sunsilk, Meera Herbal, while about 8 percent purchase regional unbranded shampoo and rest 13 percent do not use any shampoo rather apply Shikakai and Arappu thool.

Additionally, rural consumers are attracted to appealing scents in fragrance-driven shampoo products. They consider scent as one of the substantial indicators of quality, compared to packaging and ease of use, as additional factors for a pleasant washing experience. The market potential for rural consumers lies in offering position or superior scent as a supplementary sensory benefit while keeping functional claims and price as the main points. Thus, value-conscious rural families prefer to buy sachets for both trial and low-risk purchases, while younger rural women and teens, seeking a luxurious smell, opt for small packs and seasonal promotions, along with a preference for those with in-store visibility.

India Shampoo Market Regional Analysis:

By State: Tamil Nadu

The local climatic conditions and cultural factors in Tamil Nadu are heavily influencing the demand for herbal shampoos. The humid climate causes excessive oiliness and discomfort of the scalp, which forces consumers to search for hair care products that relieve these conditions. Hence, the demand for herbal shampoos containing indigenous raw materials like neem, hibiscus, and amla is naturally preferred due to their natural advantages, including cooling effects, lowering the irritation of the scalp, and improving hair health, particularly appreciated during the hotter seasons.

The use of herbs in personal care is rich in tradition in the state, hence the popularity of herbal shampoos. The availability of local herbs and also the knowledge of their cleansing effects give further fillip to this variety of products. Furthermore, government initiatives and regulations promoting herbal industries further support these products. Government legislation plays an important role in the development of herbal shampoos, not only in Tamil Nadu but also in other Indian states. The Ministry of AYUSH has introduced schemes like the AYUSH Mark Certification, which helps in certifying the Ayurvedic, Siddha, and Unani preparations that conform to Good Manufacturing Practices (GMP), as per regulations on herbal shampoo manufacturing. This certification builds consumer trust in the products’ quality and efficacy. This has thus helped the growth of the herbal shampoo range of products. Further, the Drugs and Cosmetics Act, 1940, and the Drugs and Cosmetics Rules, 1945, establish regulations for the manufacture, sale, and distribution of cosmetics like herbal shampoos, ensuring their safety and effectiveness.

The growth in these segments is driven by a combination of climatic factors, cultural preferences, and regulatory support, leading to an increased demand for specialised shampoos in Tamil Nadu.

According to the IMD, Tamil Nadu received 588.2 mm of rainfall during October-December 2024, against the normal of 441.2 mm. The excess rainfall has led to prolonged humidity and moisture in the scalp, which further increased the demand for shampoos with properties that deal with excess oil, dandruff and control of odour. This change gives rise to consumer demand for climate-responsive formulations that have a fresh scalp feel without the occurrence of stickiness. Brands offering adaptive cleaning and lasting fragrance are definitely preferred in such climatic conditions, especially in humid regions like Tamil Nadu, where variations in weather induce variations in hair care preferences of consumers.

India Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including L'Oréal SA, Unilever PLC, Dove, TRESemmé, and Himalaya.

Sustainable product launch: In March 2025, Godrej Selfie, a shampoo-based hair color that costs Rs. 15, was released by Godrej Consumer Products with a focus on the South Indian market. This product offers a convenient and reasonably priced hair coloring solution to capture a Rs. 450 crore market opportunity.

Product Innovation: In August 2024, the Kerala Thaali Hair Care Range was introduced by the personal care brand Mamaearth. This unique variant combines the best of nature's goodness in a comprehensive hair care experience, paying homage to Kerala's rich cultural heritage and natural resources.

India Shampoo Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.362 billion |

| Total Market Size in 2030 | USD 1.551 billion |

| Forecast Unit | Billion |

| Growth Rate | 2.63% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product, Application, Distribution Channel, Manufacturers |

| Geographical Segmentation | Maharashtra, West Bengal, Madhya Pradesh, Tamil Nadu, Karnataka, Others |

| Companies |

|

India Shampoo Market Segmentation:

By Product

Medicated/Special-Purpose

Non-Medicated/Regular

By End-User

Urban Consumers

Rural Consumers

By Distribution Channel

Hypermarkets/Supermarkets

Convenience Stores

Online Stores

Others

By Price Range

Economy

Mid-Range

Premium

By States

Gujarat

Tamil Nadu

Kerala

Maharashtra

Karnataka

Others