Report Overview

Shampoo Market Size, Share, Highlights

Shampoo Market Size:

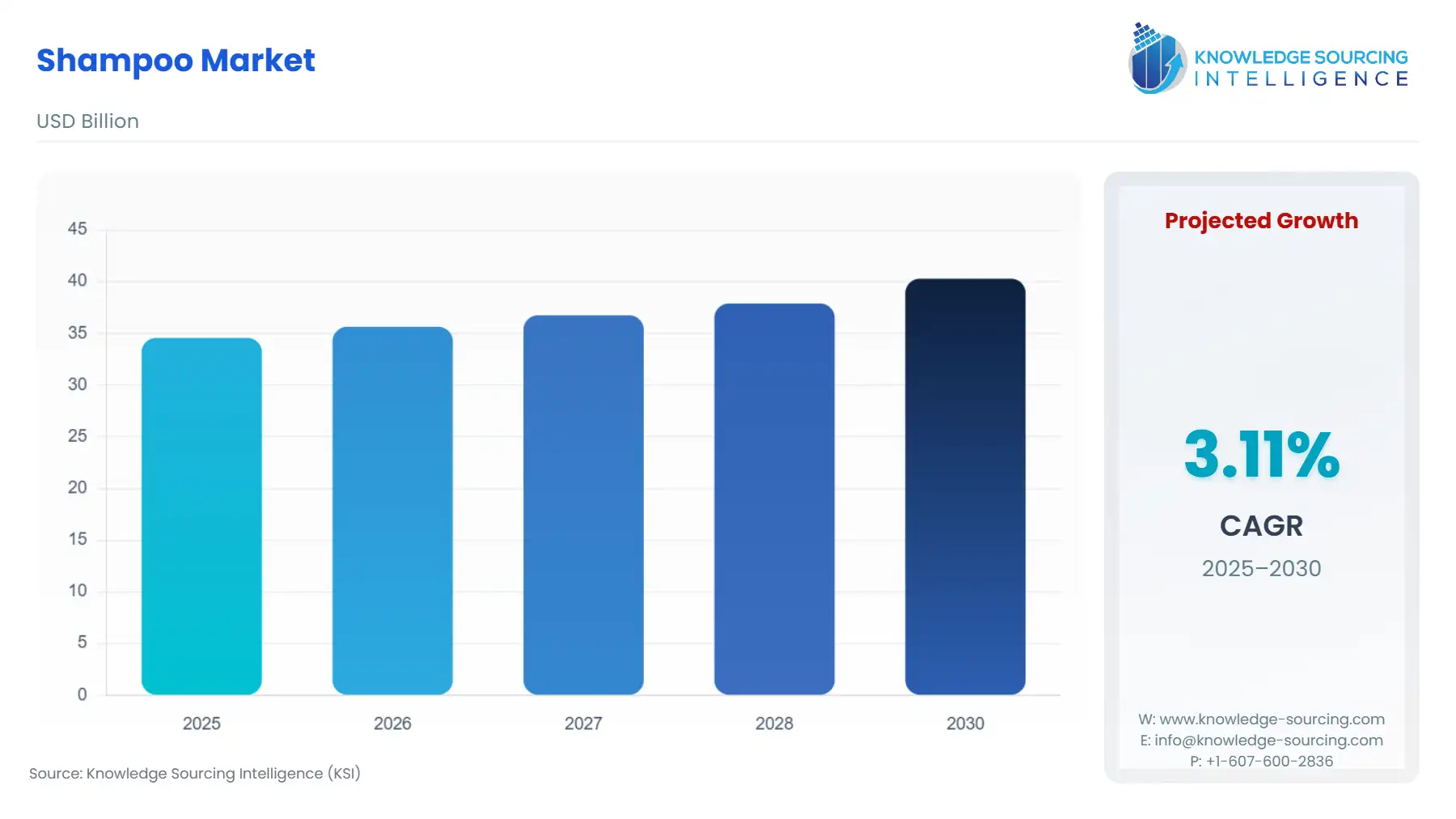

The Shampoo market is estimated to grow at a CAGR of 3.11%, growing from USD 34.576 billion in 2025 to USD 40.303 billion in 2030.

The shampoo industry worldwide is driven mainly by growing awareness of personal grooming and hygiene among consumers, especially higher disposable incomes in developing economies. Lifestyle shifts and urbanization have contributed to more demand for premium and specialty hair care products like color-protect, herbal, and anti-dandruff shampoos. Social media impact, celebrity endorsements, and changing beauty trends also drive product innovation and brand differentiation. The development of e-commerce and enhanced distribution networks also has a significant part to play in increasing market access and consumer reach globally.

Shampoo Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Shampoo market is segmented by:

- Product: The shampoo market is segmented into two, i.e., non-medicated/regular and medicated/special purpose, based on the product. The non-medicated/regular segment is expected to dominate the shampoo market share, owing to common availability and increasing mass-production product acceptance globally. Since non-medicated shampoos are readily available and less costly than their counterparts, non-medicated products are in common use. Moreover, revenue of the non-medicated shampoo segment is fueled by the increased dispensing of over-the-counter counterparts in drug shops and pharmacies.

- Application: The market is divided into two segments along the lines of application, domestic and commercial. The household segment is expected to dominate the market due to the extensive product line. Marked product usage for personal hygiene in the home and the increasing base of toddlers and infants using baby shampoos are some of the additional factors driving the growth of the household segment. The increasing base of companies marketing their hair care products using celebrity endorsements and social media is likely to increase demand among home shoppers globally.

- Distribution Channel: The market has been segmented into online stores, convenience stores, hypermarkets and supermarkets, and others according to the distribution. The option of a variety of products being present on the shelves of supermarkets enabled supermarkets and hypermarkets to capture most of the market. It allows the customers to be aware of their options and buy a particular product or set of products according to their hair care needs. The growth of the segment was assisted by the emerging fashion for purchasing personal care items in bulk from department stores and supermarket outlets.

- Region: By geography, the shampoo market is divided into North America, South America, Europe, Asia-Pacific, and the Rest of the World. High demand for premium, organic, and salon-grade shampoos is driven by health-oriented consumers and strong brand loyalty in North America. The same trend is also seen in Europe, with a trend towards sustainable and environmentally friendly products, which is highly supported by rigorous legislation on cosmetic ingredients. Asia-Pacific is the region with the fastest growth, driven by a huge population base, growing disposable incomes, and rising awareness of personal care, especially in nations such as China, India, and Japan. The region has a strong presence of local and global brands catering to various hair types and cultural values.

Top Trends Shaping the Shampoo Market

- Increasing Consumer Demand for Natural and Organic Products Will Create Growth Opportunities

The Increasing awareness of harmful effects is increasing demand for organic and natural products. Rather than chemicals such as sulfates, parabens, and synthetic perfumes, consumers demand products that are made with natural ingredients such as plant extracts, essential oils, and botanicals. In response to this phenomenon, some leading industry players are creating new products that are made with organic and natural ingredients.

- Personalized and Tech-Driven Formulations

Personalized beauty products have reached the shampoo market owing to innovations in AI, machine learning, and direct-to-consumer models. Consumers are being given the option of modifying shampoo formulas for their own hair types, needs, and objectives by online quizzes or diagnostic tools offered by companies. These bespoke formulations recognize specific problems like color-treated hair, frizz, scalp sensitivity, or curl pattern, and imbue a feeling of uniqueness and specificity that is unattainable in mass-produced shampoos. Startups and digitally-native brands are at the forefront, leveraging data to optimize formulas and form more intimate customer relationships. This movement is consistent with the larger trend toward hyper-personalization in beauty and strengthens brand loyalty through more intense interaction.

Shampoo Market Growth Drivers vs. Challenges

Drivers:

- Increased Government and Corporate Funding: Personal care with a focus on hair care is increasing, which is significantly contributing to product sales. Manufacturers of hair care products are effectively solving several hair issues, such as dandruff, thinning of hair, sebum secretion, and excessive hair loss, through the launch of anti-hair fall and anti-dandruff shampoo. Product sales will continue to increase even further due to the remarkable growth of this trend. To diversify their portfolios, some prominent companies are introducing new products.

- Expanding Industry Applications: More industry participants are shifting towards customization to cater to a host of customer choices and hair care needs. Key players in the market are testing new ingredients that may enhance the quality of their products. The global market for protein- and vitamin-based products with numerous health benefits is increasing, and ingredients such as biotin, probiotics, and fruit vitamins are being researched. Personalization and the introduction of new products by large players will thus likely increase the growth of the global shampoo market.

Challenges:

- Qubit Stability and Error Rates: One of the biggest challenges facing the growth of the global market is counterfeit hair care products, such as shampoos, conditioners, and hair oils. Consumer trust in the market is undermined by counterfeit products because they raise questions about the authenticity and quality of hair care products. Consumers who encounter fake or sub-standard products might lose confidence, reducing their faith in buying the same. Genuine brands are often copied by illegal or counterfeit hair products, damaging the reputation of the original brand.

Shampoo Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific shampoo market is witnessing robust expansion fueled by a range of influential factors. Accelerating urbanization and enhanced disposable incomes in nations such as India, China, Indonesia, and Vietnam are resulting in rising expenditure by consumers on personal grooming and care products. For instance, the Indian cosmetics sector is predominantly classified into skin care, hair care, oral care, fragrances, and colour cosmetics segments. The overall market size is anticipated to reach US$ 20 billion by 2025 with a Compound Annual Growth Rate (CAGR) of 25%. In contrast, the international cosmetics business is expanding at 4.3% CAGR and will touch US$ 450 billion by 2025.

Increased awareness of scalp and hair wellness, fueled by social media and beauty bloggers, is driving demand for focused shampoos addressing hair fall, dandruff, and dryness. Moreover, the increasing demand for organic and natural products is fueling innovation, with various brands introducing herbal, sulfate-free, and paraben-free products. Increased retail infrastructure, such as e-commerce websites, has also accelerated the availability of products, particularly in rural and tier-2 cities. All these are collectively driving the continuous growth of the Asia Pacific region's shampoo market.

Shampoo Market Competitive Landscape

The Shampoo market is competitive, with a mix of established players and specialized innovators driving its growth.

- Company Expansion: In February 2025, Cécred, the brand bringing transformational hair care to all, announced its initial expansion into retail through Ulta Beauty, the country's largest beauty retailer.

- Company Collaboration: In November 2024, CeraVe, the leading dermatologist-recommended skincare brand in the US and the unchallenged skincare winner adored by dermatologists and customers alike, is excited to announce its eagerly awaited entry into haircare. CeraVe Anti-Dandruff Shampoo and Conditioner breakthrough system that wipes away up to 100% of visible flakes without compromising the scalp barrier and also reduces mild to moderate dandruff symptoms, yet keeps hair healthy and soft.

- Product Innovation: In November 2024, WOW Skin Science, the trend-setting natural hair, skin, and lifestyle company, launched its innovative WOW Skin Science Apple Cider Vinegar Shampoo hit shelves in the United States. Nature-based innovation lies at the core of this revolutionary item, setting WOW Skin Science apart from the rest of the industry.

Shampoo Market Scope:

| Report Metric | Details |

| Shampoo Market Size in 2025 | USD 34.576 billion |

| Shampoo Market Size in 2030 | USD 40.303 billion |

| Growth Rate | CAGR of 3.11% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

Shampoo Market Segmentation:

By Product

By Application

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa