Report Overview

Treatment-Resistant Depression Treatment Market Highlights

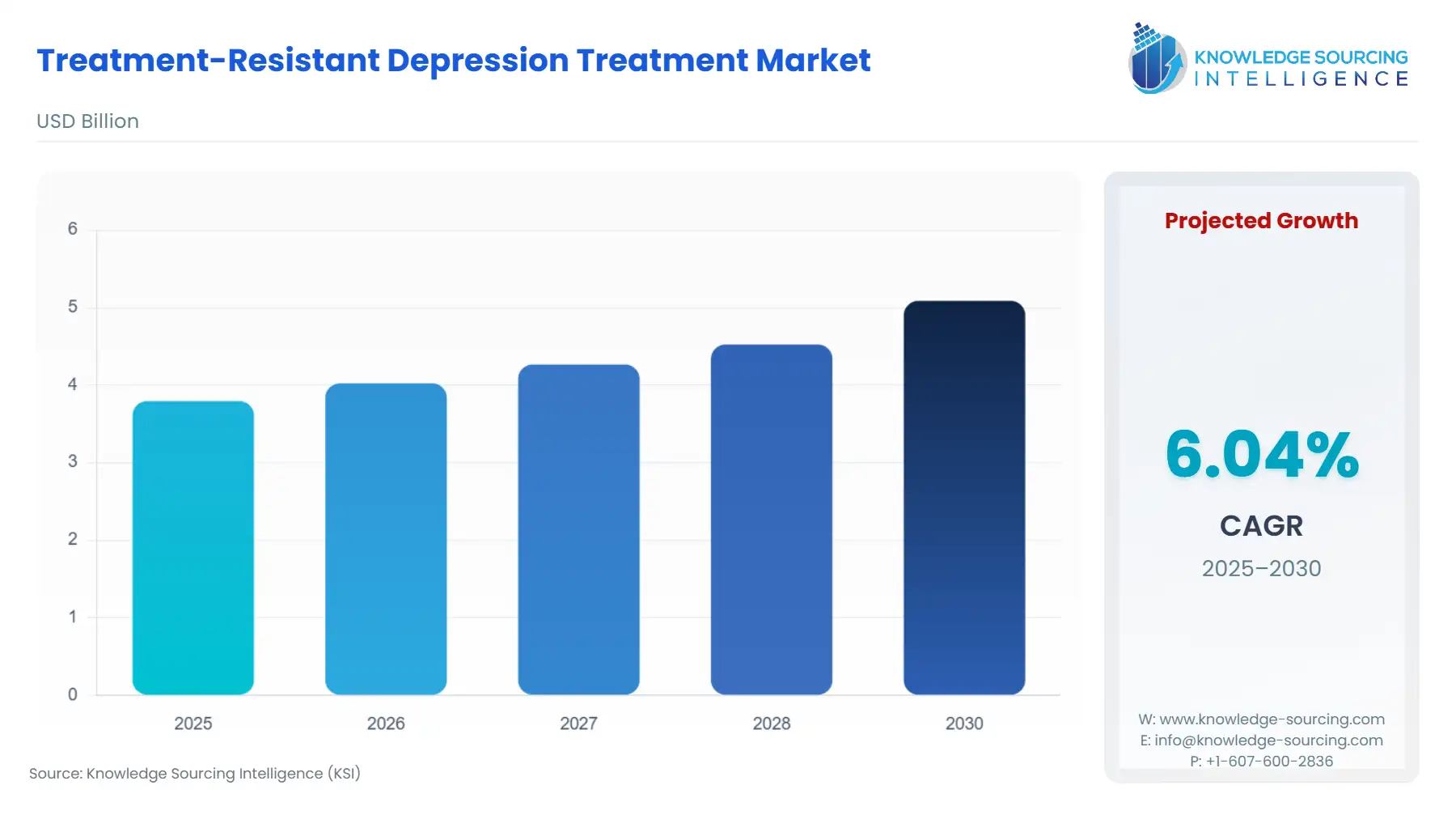

Treatment-Resistant Depression Treatment Market Size:

The Treatment-Resistant Depression Treatment Market is projected to expand at a 5.87% CAGR, attaining USD 5.342 billion in 2031 from USD 3.794 billion in 2025.

The treatment-resistant depression treatment market is anticipated to grow at a steady pace throughout the forecast period. Treatment-resistant depression (TRD) is a mental state condition when a person has received depression medication twice but the condition is not improving. By switching to anti-depressants or pharmacogenetic testing, TRD can be improved. The rising prevalence of TRDs in major depression disorders coupled with higher suicide rates is driving the growth potential of the treatment-resistant depression treatment market. Additionally, the increased awareness among people coupled with government initiatives and research activities is further expected to bolster the treatment-resistant depression treatment market.

Treatment-Resistant Depression Treatment Market Drivers:

Rising Depression Cases

The rising cases of depression globally are pushing the demand for TRDs medication thereby propelling the treatment-resistant depression treatment market size. According to WHO, nearly 5% of adults suffer from depression globally with a total of 280 million people suffering from depression. Around 30% of 280 million people suffering from depression are having treatment-resistant depression as per the Brain Therapy TMS which means that there is an urgent need for more effective treatments. Women are more prone to major depressive disorder and treatment-resistant disorder with a ratio of 2.6 to men. These rising cases of TRDs along with their severe impact on the individual are driving the market growth of treatment-resistant depression medication.

Rising Suicidal Cases

Depression may cause suicide raising the concern for advanced depression treatment methods. According to WHO, around 7 million people die from suicide each year and it is the fourth-leading cause of death in people aged between 15-29 years. The Virginia Tech School of Education states that depression and suicide are correlated and the people suffering from depression during winter months don’t abate going into the spring months. Moreover, one death per eleven minutes happened from suicide in the US in 2021 totaling 48,183 dead people. The growing number of suicide cases and their relation with depression are contemplated to bolster the treatment-resistant depression treatment market.

Increasing Awareness about Depression Outcomes

People are becoming aware of their mental state and are eager to help someone suffering from depression. Several institutions are initiating a campaign to raise awareness regarding the same. WHO works to increase awareness among people about the outcomes of depression as a part of an integrated approach to chronic disease management. European Mental Health Action Plan from 2013-2020 encourages its member states to implement suicide prevention. World Mental Health Day campaign was also co-launched by WHO, United for Global Mental Health, ad World Federation for Mental Health to encourage people to take strong actions for self-mental health. Moreover, the Indian government also launched a National Mental Health Programme to encourage the application of mental health knowledge and ensure the availability of minimum mental healthcare to the people. These initiatives to raise awareness among people leading to more people visiting the mental health care providers are expected to aid the treatment-resistant depression treatment market.

Novel Treatment Developments

The treatment-resistant depression treatment market key players are advancing the treatment methods through expert research and clinical trial. Currently, augmentations strategies of second-generation antipsychotics and lithium seed are the strongest medication for TRDs. S-Ketamine is a novel treatment approved specifically for TRDs and various studies show the rapid sustained effect on mental health. In September 2021, XWPharma Ltd. announced doses of its XW10508 in a human study. Moreover, the approval of treatment-resistant depression treatments by the US FDA in the region is further anticipated to widen the treatment-resistant depression treatment market size.

Opportunities in the Market

The growing cases of depression affecting mental health provide a great growth opportunity in the treatment-resistant depression treatment market. Investments by the institutions in the treatment-resistant market are further propelling the growth of the market thereby providing an opportunity to enter the market. For instance, USD$ 25 million of seed funding was announced by Minded from Streamlined Ventures, Link Ventures, SALT Fund, THE FUND, Care.com, Bolt, RXBAR, Glit.com, WTI, Gaingels, Unicorn Ventures, and The Tiger Fund in February 2021. Moreover, the mental health start-ups funding increased from USD$ 2.7 billion in 2020 to USD$ 5.1 billion in 2021. This increased funding provides a good chance for new entrants to enter the treatment-resistant depression treatment market.

Treatment-Resistant Depression Treatment Market Geographical Outlook:

North America is the Dominant Market

The North American region is expected to contribute significantly to the treatment-resistant depression treatment market owing to a huge number of depression cases, modern medication research services, and a strong healthcare system. According to US Psych Congress, one in five patients with major depressive disorder suffered from treatment-resistant depression in 2019 and around 6.6 million people in the US have major depressive disorder. Moreover, government regulations and more approval from the FDA for treatment-resistant depression medications are further expected to widen the scope of treatment resistant depression market in the region.

Treatment-Resistant Depression Treatment Market Key Players:

Pfizer Inc is one of the leading biotechnology companies serving for over 150 years. Pfizer provides solutions to a wider range of health problems including oncology, infection vaccines, inflammation and immunology, and depression among others. PRISTIQ is suggested for adults with major depressive disorder.

Hikma Pharmaceuticals Plc, founded in 1978 is a UK-based manufacturer of non-branded generic and in-licensed pharmaceutical products. Recently, Hikma launched neostigmine methylsulfate injections for hypersensitivity and peritonitis.

Novartis AG is committed to delivering more medicine to people regardless of their locations. The company offers solutions to multiple diseases including dry eye, migraine, malaria, heart failure, and depression. Currently, MIJ-821 for treatment-resistant depression is under phase II trial which is developed on NMDA receptor technology.

Global Treatment-Resistant Depression Treatment Market is analyzed into the following segments:

By Type

Mild

Severe

By Drug Type

NMDA

Antidepressants

Antipsychotics

Others

By Route of Administration

Oral

Parenteral

Others

By Distribution Channel

Online

Offline

Hospital Pharmacies

Drug Stores

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others