Report Overview

UK AI in Military Highlights

UK AI in Military Market Size:

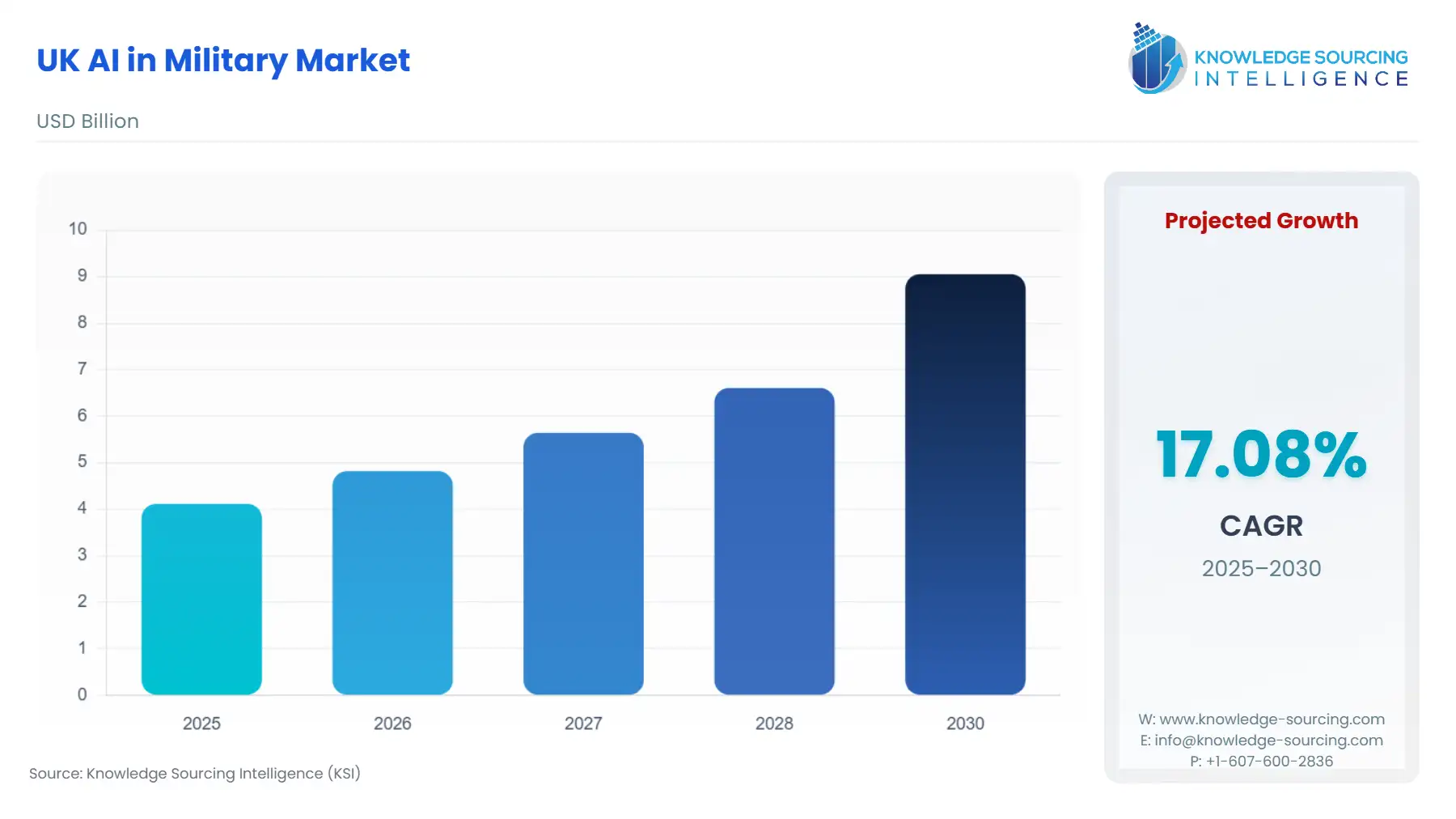

The UK AI in Military Market is expected to grow at a CAGR of 17.08%, rising from USD 4.116 billion in 2025 to USD 9.055 billion by 2030.

The UK AI in Military market is undergoing a fundamental transformation, shifting the Ministry of Defence's operational focus from platform-centric superiority to information and algorithmic dominance.

This strategic pivot is codified within the Defence AI Strategy, establishing a national imperative to harness Artificial Intelligence for enhanced battlefield awareness and accelerated decision cycles. The market operates at the nexus of high technology and stringent ethics, with investment directed towards solutions that augment, rather than replace, human commanders.

________________________________________

UK AI in Military Market Analysis:

Growth Drivers

- The overarching catalyst propelling market expansion is the MOD's clear operational mandate to secure a 'decision advantage' by leveraging data. This strategic necessity directly increases demand for AI-driven command and control (C2) systems that can fuse vast quantities of data from disparate sensors in real-time.

- Furthermore, the persistent threat of sophisticated, contested operating environments necessitates advanced Machine Learning algorithms to rapidly identify and classify threats in dense, complex signal spaces. This capability directly creates demand for specialized, ruggedised AI-enabled hardware and software capable of operating reliably at the tactical edge, outside of traditional, centralised data architectures.

Challenges and Opportunities

- The foremost challenge facing the market is the ethical complexity surrounding autonomy, where the regulatory requirement for meaningful human control constrains the demand for fully autonomous offensive systems. This constraint, however, creates a significant opportunity: a surge in demand for sophisticated Human-Machine Teaming (HMT) solutions, including explainable AI (XAI) interfaces that translate algorithmic output into actionable intelligence for human operators.

- Furthermore, the inherent skills gap in data science within the Defence sector acts as a constraint, yet simultaneously fuels a high-value opportunity in the Services component segment for specialist external consultants and managed AI deployment/maintenance contracts.

Supply Chain Analysis

The UK AI in the Military supply chain is inherently non-physical, dominated by software and intellectual property (IP), creating unique logistical dependencies. The core production hubs are concentrated within the UK's academic and tech ecosystem clusters, such as those in London, Cambridge, and major aerospace/defence sites. Critical dependencies include high-performance Hardware components like Graphics Processing Units (GPUs) and Field-Programmable Gate Arrays (FPGAs) necessary for real-time processing at the edge, which introduce global semiconductor supply chain complexity. The principal logistical challenge is the secure, rapid integration and deployment of sensitive software onto legacy or air-gapped military platforms, requiring robust digital engineering partnerships between the large Primes and niche software SMEs.

Government Regulations

The UK's regulatory framework for military AI emphasises responsible adoption, which directly influences procurement and technology development pathways.

Jurisdiction / Key Regulation / Agency / Market Impact Analysis

UK Ministry of Defence (MOD) / Defence Artificial Intelligence Strategy (DAIS) / Mandates a clear path for AI adoption, establishing a verifiable pipeline of funding and setting strategic priorities that define demand in specific sectors (e.g., C2, Intelligence).

UK Government / 'Ambitious, Safe, Responsible' (ASR) Framework (June 2022) / Creates a non-negotiable ethical boundary, limiting demand for fully autonomous lethal systems and driving demand towards transparent, traceable, and human-in-the-loop decision-support systems (Explainable AI - XAI).

MOD / AI Ethics Advisory Panel (AIEAP) / Provides oversight on ethical deployment, directly impacting the design and training data requirements for AI systems, increasing the cost and complexity of the Software and Services components to ensure compliance.

UK AI in Military Market Segment Analysis:

By Application: Surveillance & Reconnaissance

The imperative for persistent, all-weather intelligence gathering across vast geographical and spectral domains drives exponential demand for AI within the Surveillance and Reconnaissance (ISR) segment. Modern multi-domain operations generate a data volume (imagery, signals intelligence, video) far exceeding human analytical capacity. This operational pressure directly propels the procurement of Machine Learning and Computer Vision systems capable of automated target recognition, anomaly detection, and real-time sensor fusion. Specifically, demand focuses on AI to autonomously classify objects of interest from Synthetic Aperture Radar (SAR) or Electro-Optical/Infra-Red (EO/IR) feeds, reducing the 'sensor-to-shooter' chain timeline. Furthermore, the requirement to process data on low-bandwidth connections at the tactical edge necessitates demand for on-board, embedded AI software rather than cloud-based solutions, creating a distinct market for optimising complex models for minimal computing footprints.

By Technology: Machine Learning

Machine Learning (ML) constitutes the foundational technological driver across the market, specifically increasing the demand for Software and Services tailored to pattern recognition. The UK MOD's focus on data-driven decision advantage requires supervised and unsupervised ML models to solve complex military problems, such as predictive maintenance in Logistics & Transportation and anticipatory threat modelling in Cybersecurity. The necessity is not for generic ML tools but for specialized algorithms trained on classified military datasets for high-fidelity tasks like classifying adversarial intent or identifying systemic vulnerabilities in network architecture. This specialization mandates expert data scientists and MLOps (Machine Learning Operations) services, reinforcing the high-value nature of the technical services segment and creating a dependence on secure, sovereign AI development environments.

UK AI in Military Market Competitive Environment and Analysis:

The UK AI in Military market is dominated by a few large defence Primes, whose competitive strategies centre on leveraging vast system integration expertise while strategically co-opting innovation from the domestic tech ecosystem. Competition focuses on the ability to embed trustworthy AI into existing platforms and secure major system-of-systems integration contracts.

- BAE Systems: BAE Systems is strategically positioned as a leading systems integrator, focusing on the convergence of digital and physical domains. The company's strategy pivots on creating digital backbones that integrate multi-domain data. A core offering is the PropheSEA® data integration solution, designed to fuse disparate sensor data into a common operating picture, enabling quicker, AI-assisted C2 decision-making. This product exemplifies the firm's commitment to providing the core software infrastructure necessary for the MOD's "AI Ready" transformation.

- Rolls-Royce: Rolls-Royce's competitive strategy focuses on applying its deep engineering expertise to the naval and air platforms domain, with an increasing emphasis on digitalisation and automation for efficiency. The company is actively integrating digital twin technology and AI-assisted engineering into its defence operations, most notably within its Submarines division. This approach streamlines manufacturing processes and enhances through-life support, directly reducing costs and increasing the operational availability of critical naval assets for the Royal Navy, a key factor in future naval defence procurement decisions.

- Leonardo UK: Leonardo UK commands a strong position in the AI-enabled sensor and electronic warfare (EW) markets. The company's strategic positioning centres on delivering "Cognitive Intelligent Sensing" (CoInS) by integrating AI directly into radar, EW, and electro-optical systems. This drives demand for its products by offering a demonstrable force multiplier—the ability for a sensor to autonomously detect, classify, and even counter threats with minimal human intervention—a direct response to the need for speed in contested environments.

UK AI in Military Market Recent Developments:

- October 2025: Rolls-Royce and Siemens Digital Engineering MOU. Rolls-Royce Submarines signed a Memorandum of Understanding (MOU) with Siemens to advance digital optimization in its engineering operations. The agreement is designed to create a 'digital backbone' for the lifecycle support of nuclear naval reactors, directly aiming to reduce time-to-production and enhance the efficiency of support services for the Royal Navy.

- August 2025: BAE Systems invested in Oxford Dynamics, a specialist in autonomy and mission simulation technology. This strategic minority investment was intended to accelerate the development of next-generation capabilities for autonomous military platforms, including the integration of simulation tools to validate complex AI algorithms prior to operational deployment.

- May 2025: Leonardo UK announced a partnership with UK-based Faculty AI to accelerate the development of next-generation defence technologies, including Cognitive Intelligent Sensing (CoInS) and advanced Electronic Warfare (EW). The collaboration focuses on bringing AI-driven capabilities out of the lab and into the hands of the armed forces, specifically focusing on sensors that can self-orient without human input.

UK AI in Military Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.116 billion |

| Total Market Size in 2031 | USD 9.055 billion |

| Growth Rate | 17.08% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Technology, Application, Platform |

| Companies |

|

UK AI in Military Market Segmentation:

- BY COMPONENT TYPE

- Hardware

- Software

- Services

- BY TECHNOLOGY

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- BY APPLICATION

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- BY PLATFORM

- Land-based Force

- Naval Force

- Air Force

- Space Force