Report Overview

UK Electric Commercial Vehicles Highlights

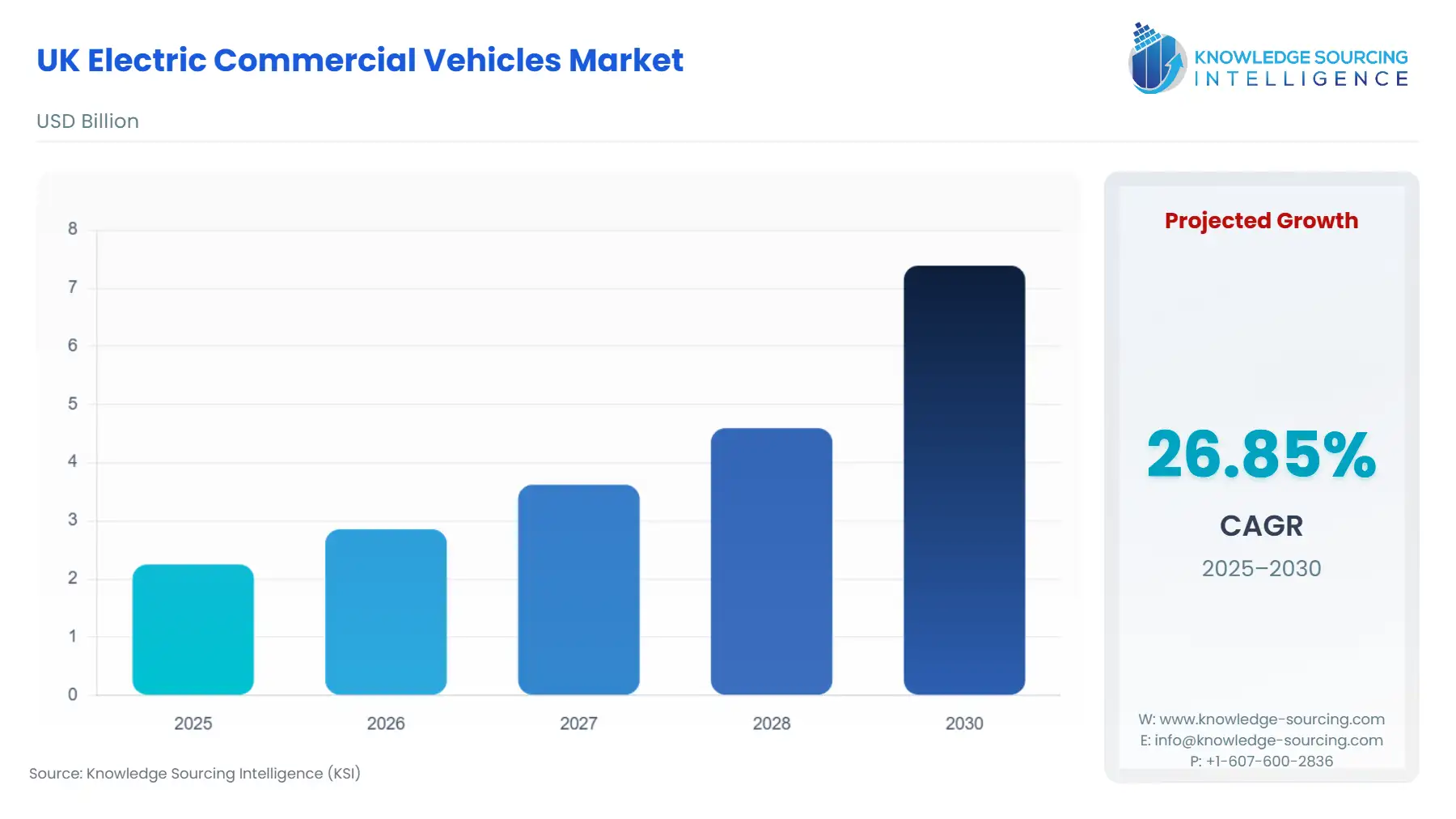

UK Electric Commercial Vehicles Market Size:

The UK Electric Commercial Vehicles Market is forecast to expand rapidly at a CAGR of 26.85%, reaching USD 7.391 billion in 2030 from USD 2.25 billion in 2025.

The UK Electric Commercial Vehicles (eCV) market is navigating a critical transition phase, shifting from an incentivized niche to a mandated core segment within the nation’s decarbonization strategy. The regulatory environment is now the primary structural catalyst, creating a non-optional demand floor for manufacturers and fleet operators. While the absolute number of zero-emission Light Goods Vehicles (LGVs) registered in 2024 increased, the maintained percentage market share signals that a necessary acceleration is required to meet the ZEV mandate's progressively rising targets. The Heavy Goods Vehicle (HGV) segment remains in nascent development, reflecting the pronounced technological and infrastructural challenges associated with battery energy density and long-haul charging.

UK Electric Commercial Vehicles Market Analysis:

- Growth Drivers

The primary factor propelling market expansion is the Zero Emission Vehicle (ZEV) Mandate. This regulation sets non-negotiable annual sales quotas for manufacturers, starting with 10% of new van sales in 2024 and rising to 100% by 2035. This statutory requirement forces a supply-side shift, compelling manufacturers to allocate a greater proportion of ECVs to the UK market, which, in turn, increases model availability and competition, directly increasing the demand-side choice for fleet operators.

Another critical driver is the Total Cost of Ownership (TCO) parity push, which is heavily supported by government-backed financial stimuli. The extension of the Plug-in Van and Truck Grants, offering discounts of up to £5,000 for large vans and up to £25,000 for large trucks (as of August 2025), significantly lowers the high initial capital expenditure barrier. By making the TCO more financially viable compared to internal combustion engine (ICE) counterparts, these grants directly stimulate purchasing demand from cost-sensitive small and medium-sized enterprise (SME) fleets. Furthermore, the removal of the requirement for additional training for zero-emission van drivers (despite their heavier weight) cuts red tape and operational costs, facilitating wider fleet adoption.

- Challenges and Opportunities

The central challenge constraining expansion is the lack of robust, large-scale battery manufacturing capacity within the UK. The country currently possesses only one operational gigafactory with a capacity below 2GWh, far short of the projected 100GWh requirement by 2030 needed to satisfy domestic automotive demand. This supply deficit creates a strategic dependency on imported cells and components, increasing exposure to global supply chain volatility and pricing pressures, which ultimately hinders domestic eCV production scale and raises final vehicle costs, thereby depressing demand.

A significant opportunity lies in the Depot Charging Infrastructure Grants. The Depot Charging Scheme, which covers 75% of chargepoints and civil costs up to £1 million per organization, directly addresses the 'last mile' of fleet electrification. Since over 80% of new zero-emission vehicles are registered to company keepers, enabling fleet operators to establish proprietary, high-capacity charging hubs reduces their reliance on the still-developing public network. This reduces risks in the operational transition for fleet managers, providing certainty on charging availability and cost, which is a major accelerator of large-scale fleet demand.

- Raw Material and Pricing Analysis

Electric Commercial Vehicles are physical assets critically dependent on Lithium-ion battery technology. The pricing dynamics of key raw materials, particularly lithium, cobalt, and nickel, exert a direct upward pressure on the final vehicle cost. The UK's minimal domestic refining and cell manufacturing capacity necessitates reliance on global supply chains, predominantly centered in Asia. This geopolitical concentration of critical minerals and midstream processing capacity makes the UK market highly vulnerable to global price fluctuations and potential export restrictions, which directly translates into higher input costs for UK-bound ECVs compared to regions with localized supply chains. The immediate ramification is that the upfront cost of eCVs remains elevated, which sustains the TCO gap that public grants are required to bridge to maintain demand momentum.

- Supply Chain Analysis

The global eCV supply chain is characterized by a high degree of dependence on Asian nations for the most critical components: battery cells and magnets. Key production hubs for the finished vehicles destined for the UK market include both domestic and European facilities. However, the logistical complexity is primarily rooted in the long-distance, single-source nature of the battery supply chain. This configuration creates vulnerabilities to geopolitical risk and transit delays. Furthermore, the lack of a mature, circular economy for battery recycling and second-life applications in the UK adds a future dependency constraint. The UK’s "gigafactory gap" means that while vehicle assembly may occur locally, the high-value, high-impact component sourcing remains external, limiting the ability to localize supply, stabilize costs, and respond rapidly to domestic demand spikes.

UK Electric Commercial Vehicles Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

UK Government |

Zero Emission Vehicle (ZEV) Mandate |

Directly mandates a minimum ZEV sales trajectory (e.g., 10% of new vans in 2024), forcing manufacturers to allocate supply to the UK, directly increasing vehicle availability and stimulating demand from fleet buyers to comply with internal sustainability targets. |

|

UK Government (DfT/OZEV) |

Plug-in Van and Truck Grants |

Provides non-repayable financial support (£2,500-£25,000) for vehicle purchase, substantially mitigating the high upfront capital cost of ECVs, making TCO more competitive and accelerating immediate fleet purchasing decisions. |

|

UK Government (OZEV) |

Electric Vehicle Infrastructure Grant for Staff and Fleets / Depot Charging Scheme |

Offers up to 75% funding for on-site charge point installation, de-risking the operational switch for fleets by ensuring reliable, private, and managed charging infrastructure, which removes a major roadblock to large-scale adoption. |

UK Electric Commercial Vehicles Market Segment Analysis:

- By Application: Logistics and Transportation

The logistics and transportation segment constitutes the largest and most immediate growth driver of ECV, particularly for light and medium-duty vehicles. The segment’s expansion is driven by two commercial pressures: the operational necessity to comply with Ultra-Low Emission Zones (ULEZ) in major urban centers and the mounting corporate sustainability mandates from major retailers and e-commerce platforms. Operating an ICE vehicle in ULEZ areas incurs daily charges, which directly and immediately erode profit margins for logistics firms. The acquisition of an Electric Light Commercial Vehicle (e-LCV) is, therefore, a strategic financial decision that eliminates a recurring operational penalty. Furthermore, major corporate clients are increasingly mandating zero-emission delivery clauses in contracts, effectively making eCV adoption a precondition for securing and retaining high-value business, which directly accelerates purchasing decisions across the fleet. The 'return-to-base' nature of many logistics operations also aligns perfectly with current battery range and overnight depot charging capabilities, thus mitigating range anxiety and public infrastructure constraints.

- By Vehicle Type: Vans (e-LCVs)

Vans, or Electric Light Commercial Vehicles (e-LCVs), are the vanguard of the UK eCV market, driven by the strong commercial-use case. The need for e-LCVs is primarily fueled by their suitability for last-mile delivery and localized trades, which are operations defined by predictable routes and sub-200-mile daily distances. The total volume of new zero-emission LGV registrations exceeding 22,000 in 2024 underscores this segment's maturity. This growth is further solidified by the clear TCO advantage due to lower maintenance costs and significant fuel savings compared to their diesel equivalents, especially when considering high-mileage urban use where regenerative braking is most effective. The rising ZEV Mandate targets for vans are forcing high-volume vehicle manufacturers to prioritize this segment, increasing both product choice and price competition, which is a direct growth catalyst for small businesses and large parcel carriers alike.

UK Electric Commercial Vehicles Market Competitive Analysis

The UK eCV market is defined by a dichotomy: established automotive giants dominating the van segment and specialized new entrants shaping the heavy-duty sector. Competition is intensifying as manufacturers race to meet ZEV mandate targets.

- Ford Pro

Ford Pro commands a dominant position, particularly in the e-LCV segment. Their strategic positioning leverages the ubiquity and familiarity of the Transit nameplate. The Ford E-Transit, which was the best-selling two-tonne electric van in Europe in 2023, is the key product. The company’s strategy involves building an integrated ecosystem of charging, software (e.g., Ford Pro Telematics), and servicing, aiming to offer a productivity-boosting solution rather than just a vehicle, thereby capturing large, established fleet accounts.

- DAF Trucks

DAF Trucks, a PACCAR subsidiary, leads the conventional UK truck market (above 6.0-tonnes GVW) with a 30% share in 2023. Their focus is on translating this heavy-duty leadership into the electric sector with the New Generation XD Electric and XF Electric trucks. DAF's strategy centers on modular powertrains and Paccar electric motors, with battery options offering ranges of over 500 kilometers. The introduction of features like an optional ePTO (Electric Power Take-Off) is critical to addressing demand from specific segments, such as refrigerated transport or construction applications, which require power for auxiliary equipment.

UK Electric Commercial Vehicles Market Developments:

- April 2025: Kia UK made a major commitment to the commercial sector by launching its Platform Beyond Vehicle (PBV) plans and simultaneously revealing the fully electric PV5 van for the UK market. The launch, coinciding with the Commercial Vehicle Show, included the opening of pre-orders for the PV5 Cargo and Passenger versions, which offer up to 247 miles of range. Critically, Kia also announced the establishment of a dedicated network of professional business van centres across the country to handle sales, servicing, and after-sales support for its new electric van lineup.

- January 2025: In a landmark fleet acquisition, Amazon placed an order with Daimler Truck AG for 200 Mercedes-Benz eActros LongHaul battery-electric heavy-duty trucks. This order is a crucial step for Amazon's decarbonisation goals in its logistics network and confirms the eActros LongHaul's role in future carbon-free transportation services, particularly in the UK and Germany. The acquisition signals a major commitment by a key logistics operator to long-haul electric trucking capability in the UK, moving beyond smaller electric vans.

UK Electric Commercial Vehicles Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.25 billion |

| Total Market Size in 2031 | USD 7.391 billion |

| Growth Rate | 26.85% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Vehicle Type, Propulsion, Power Output, Application |

| Companies |

|

UK Electric Commercial Vehicles Market Segmentation:

- BY VEHICLE TYPE

- Buses and Coaches

- Trucks

- Light-Duty Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Vans

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicles (FCEV)

- BY POWER OUTPUT

- Up to 150 kW

- 150-250 kW

- Above 250 kW

- BY APPLICATION

- Logistics and Transportation

- Public Transportation

- Construction (Excavators, Loaders, Others)

- Mining

- Agriculture (Tractors, Harvesters, Others)

- Others