Report Overview

US AI in Military Highlights

US AI in Military Market Size:

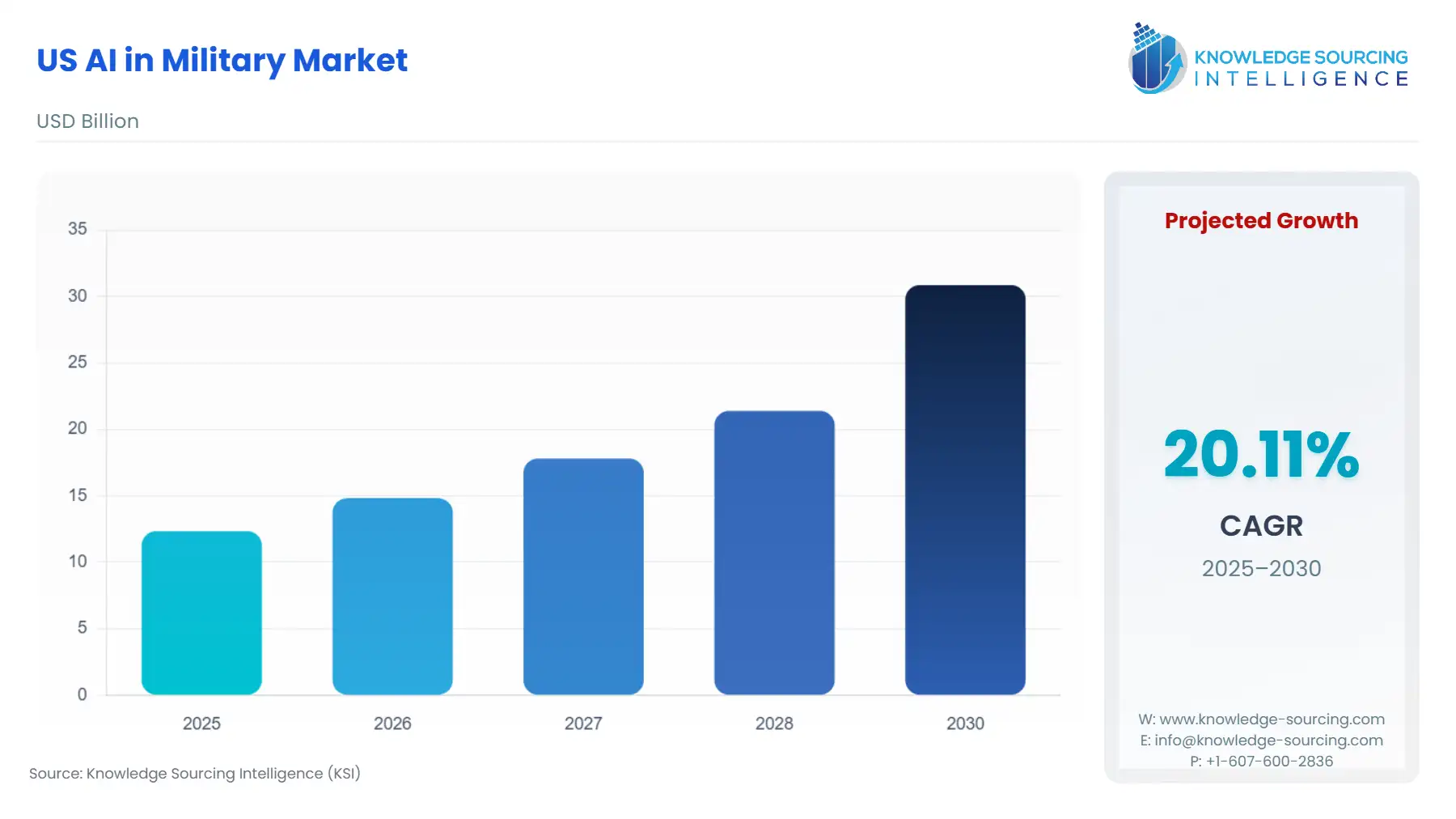

The US AI in Military Market is expected to grow at a CAGR of 20.11%, rising from USD 12.347 billion in 2025 to USD 30.868 billion by 2030.

The U.S. Artificial Intelligence (AI) in Military Market is undergoing a rapid, technology-driven transformation, moving decisively from research and development into widespread operational deployment.

This market is a national security imperative, primarily shaped by the strategic competition with near-peer adversaries and the need for the U.S. military to retain a technological and operational advantage.

________________________________________

US AI in Military Market Analysis:

Growth Drivers

- Escalating geopolitical tensions directly propel demand for AI systems that enable faster, more accurate operational decisions than human-only teams. The documented increase in U.S. defense spending, including a dedicated funding request of $1.8 billion for AI programs in fiscal year 2025, translates directly into a high volume of procurement contracts for AI-enabled platforms and services.

- Furthermore, the operational imperative for enhanced situational awareness and data processing forces the military to demand AI platforms capable of processing the vast, real-time data streams from satellites, drones, and sensors. This environment creates urgent demand for advanced machine learning and computer vision software to automate threat recognition and information distillation at the tactical edge.

Challenges and Opportunities

- A primary challenge facing the market is the fundamental difficulty in procuring and integrating advanced AI technology using traditional, linear, and time-consuming DoD procurement processes. This bureaucratic friction constrains the ability of defense primes and innovative start-ups to deploy cutting-edge, iteratively developed AI software quickly, thereby limiting near-term market scale.

- Simultaneously, a significant opportunity exists in the accelerating demand for predictive maintenance and logistics optimization. AI algorithms that can analyze equipment telemetry to anticipate failures, a capability increasingly sought since 2017, create sustained, non-lethal demand across all service branches for Software and Services contracts focused on improving fleet readiness and supply chain resilience.

Supply Chain Analysis

The US AI in the Military supply chain is inherently dual-use and global, characterized by a fundamental dependency on high-performance semiconductor components, primarily manufactured in concentrated hubs outside the U.S. This critical reliance on foreign foundries introduces geopolitical and trade constraints, creating a significant point of vulnerability and increasing demand for domestic, high-security AI hardware fabrication. The software component, which dominates the market by revenue, is equally complex, relying on open-source libraries and third-party commercial technology, which mandates stringent security protocols for data provenance and model integrity. This software complexity drives specific demand for advanced AI model development platforms and rigorous supply chain risk management services to mitigate intellectual property theft and malicious model manipulation.

Government Regulations

Jurisdiction / Key Regulation / Agency / Market Impact Analysis

U.S. Department of Defense (DoD) / DoD Ethical Principles for AI (2020) / Mandates that all AI systems must be responsible, equitable, traceable, reliable, and governable. This increases development costs and lengthens the testing phase for autonomous weapons, favoring larger contractors with the resources to comply with rigorous verification and validation standards.

U.S. Department of Commerce (DOC) / Export Administration Regulations (EAR) / Controls on advanced technology exports (e.g., high-performance semiconductors, certain AI software) / Restricts the transfer of high-end AI components and "know-how" to designated foreign adversaries. This limits the potential global scale of U.S. defense AI companies but simultaneously reinforces demand for secure, proprietary, and highly-controlled AI solutions exclusively for U.S. military and allied forces.

U.S. Congress / Defense Appropriations Act (Annual) / Dedicated funding for specific AI programs (e.g., $1.8B requested for FY2025 AI programs) / Directly creates and guarantees demand for targeted AI technologies. This high-level, programmatic funding bypasses general budget cycles and compels immediate acquisition and rapid prototyping in areas like battlefield autonomy and data fusion.

US AI in Military Market Segment Analysis:

By Application: Warfare Platforms

The Warfare Platforms segment, which includes AI integration into autonomous aerial vehicles (UAVs), ground combat units, and naval systems, is the most demanding in terms of high-performance, resilient AI. Its necessity is driven by the mandate for unmanned teaming and autonomous target engagement to reduce human exposure to risk. The core demand is for robust AI software platforms, such as Palantir's Gotham or Anduril's Lattice, that can execute mission autonomy at the tactical edge without continuous human input or reliable network connectivity. This necessitates investment in specialized, radiation-hardened hardware for deployment on platforms and sophisticated computer vision algorithms for real-time object recognition and threat classification. The high stakes of kinetic operations translate to an uncompromising demand for reliable, explainable, and certified AI models, pushing the market toward companies that can successfully navigate the DoD's stringent ethical and safety requirements for lethal autonomy. This segment's growth is directly correlated with the DoD's pivot toward multi-domain operations, requiring AI to synchronize sensor data and combat platforms across air, land, and sea.

By Platform: Air Force

The Air Force platform segment is profoundly shaped by the goal of achieving collaborative combat aircraft (CCA) capability and maintaining decision superiority in air-to-air engagements. The Air Force's reliance on manned-unmanned teaming (MUM-T) drives demand for AI that can autonomously navigate, surveil, and execute tactical maneuvers, reducing the cognitive load on human pilots. This specifically increases procurement of Deep Learning and Machine Learning algorithms for signal processing, anomaly detection within electronic warfare environments, and predictive maintenance for complex aircraft systems. Major contractors like Boeing and Lockheed Martin are heavily invested in this segment, with the demand focused on embedding AI directly into flight-critical systems. The sheer volume of sensor data generated by modern aerial platforms—from ISR assets to fighter jets—creates a continuous, high-volume demand for software solutions that can fuse and present actionable intelligence to commanders at the speed of relevance. The necessity for AI to operate effectively in GPS-denied or communications-degraded environments further emphasizes the demand for edge-computing hardware and robust, non-network-dependent AI models.

US AI in Military Market Competitive Environment and Analysis:

The US AI in Military market exhibits an established competitive environment led by traditional aerospace and defense primes alongside disruptive, software-first technology firms. Competition centers not merely on technical capability but on the speed of contract delivery, the ability to operate within secure DoD environments, and compliance with the DoD's Responsible AI principles.

Palantir Technologies

Palantir's strategic positioning is rooted in its proven ability to unify fragmented military data landscapes through its flagship platforms, Gotham and AIP (Artificial Intelligence Platform). Gotham is designed for defense and intelligence clients, providing a secure operating system for analyzing vast amounts of sensor data to surface actionable operational insights. A significant example of its strategic leverage is the TITAN (Tactical Intelligence Targeting Access Node) program, for which Palantir was selected to deliver the next-generation deep-sensing capability. This win in March 2024 reinforces Palantir's role as a core provider of AI/ML-enabled command and control (C2) and data fusion for the U.S. Army, focusing on integrating data across all echelons for multi-domain operations.

Anduril Industries

Anduril Industries is strategically positioned as a purveyor of software-defined defense, aiming to accelerate the integration of commercially developed autonomy into military hardware. Their core operating system, Lattice, is a proprietary AI backbone designed to fuse data from various proprietary and third-party sensors (e.g., drones, ground sensors) to create a real-time, comprehensive operational picture. Anduril's focus on uncrewed and autonomous systems, particularly in the counter-UAS domain, has been a key driver of their growth. For instance, in August 2025, the company was selected by the United States Special Operations Command (USSOCOM) for a multi-year contract to accelerate the development and deployment of mission autonomy software for multi-domain uncrewed systems, demonstrating its penetration into high-priority, rapid acquisition programs.

US AI in Military Market Recent Developments:

- August 2025: Anduril Industries announced plans to open a new office in Seoul and formed partnerships with local industry, including a contract with Korean Air, Aerospace Business Division, to co-develop UAS products and explore local manufacturing. This expansion, sourced from the company's official press releases, indicates a strategic commitment to the Indo-Pacific region, which increases future demand for U.S.-developed military AI and autonomous systems among U.S. allies.

- April 2025: Shield AI, a developer of AI-powered autonomy for military aircraft, acquired the Data Driven Readiness software tools from Crowdbotics. This acquisition, verifiable through Shield AI's press releases, represents a direct M&A activity focused on consolidating software capability. The move strengthens Shield AI's product offering, Hivemind, by integrating tools for training data generation and readiness assessment, enhancing the robustness and deployability of its autonomous flight software.

- March 2024: The U.S. Army selected Palantir Technologies to deliver the TITAN (Tactical Intelligence Targeting Access Node) in the Prototype Maturation Phase. This significant product launch/contract award, verifiable on the company's newsroom, centers on deploying the Army's first AI-defined vehicle. This development is a core growth driver for Palantir's AI-enabled software to power improved targeting and situational awareness capabilities for the U.S. Army's ground-based intelligence infrastructure.

US AI in Military Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 12.347 billion |

| Total Market Size in 2031 | USD 30.868 billion |

| Growth Rate | 20.11% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Technology, Application, Platform |

| Companies |

|

US AI in Military Market Segmentation:

- BY COMPONENT TYPE

- Hardware

- Software

- Services

- BY TECHNOLOGY

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- BY APPLICATION

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- BY PLATFORM

- Land-based Force

- Naval Force

- Air Force

- Space Force