Report Overview

Utility Scale Solar Market Highlights

Utility Scale Solar Market Size:

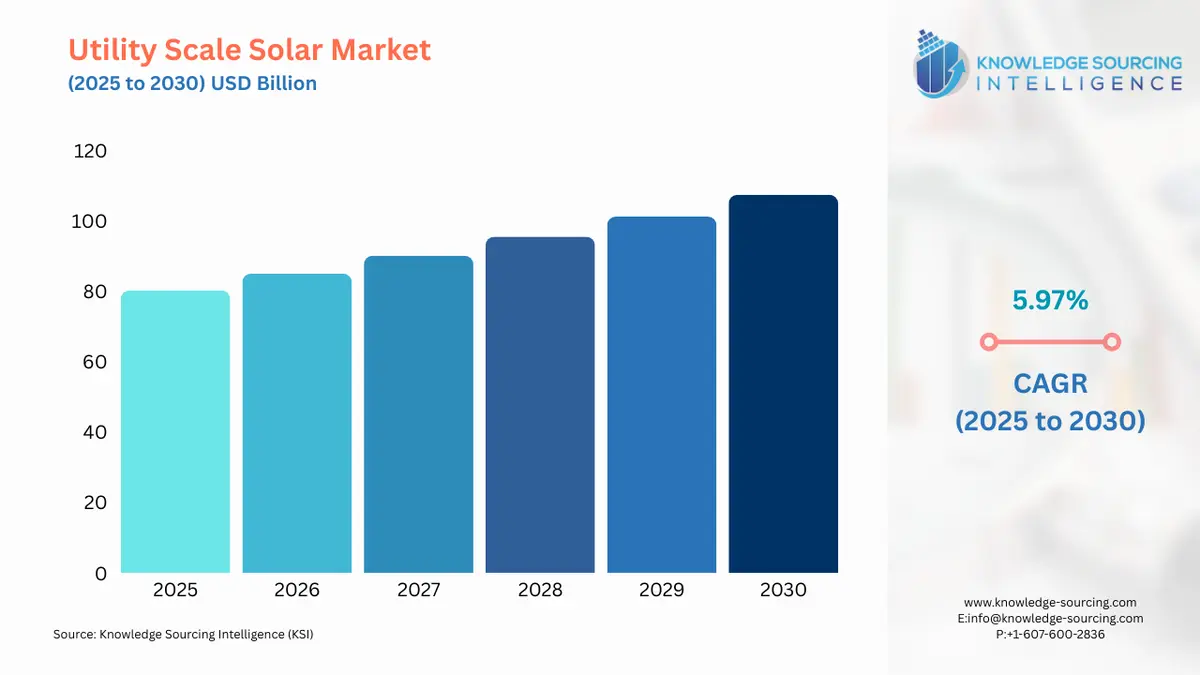

Utility Scale Solar Market is projected to expand at a 5.79% CAGR, attaining USD 112.533 billion in 2031 from USD 80.277 billion in 2025.

Utility Scale Solar Market Trends:

A utility-scale solar facility refers to an installation that produces solar energy and contributes it directly to the electrical grid, thereby providing a utility with a source of renewable power. The utility-scale solar market is categorized by two main technologies such as solar photovoltaic and concentrating solar thermal power. The utility-scale solar industry is expected to grow owing to the rising adoption of utility-scale solar systems, their cost-effective nature followed by favourable government initiatives and increasing investments.

Cost-Effective nature of solar energy systems bolsters the utility-scale solar market.

Solar energy costs are declining due to advancements in technology, economies of scale, and increased efficiency in manufacturing processes, leading to more affordable and competitive solar panels and systems. This trend has made solar energy more cost-effective and a more economically viable option for utility companies and large-scale power producers. Lower costs mean higher potential returns on investment for utility-scale solar projects, making them more attractive for investors and developers. This cost-effectiveness also encourages governments and corporations to support the adoption of solar energy, thereby further propelling the growth of the utility-scale solar market. For instance, According to the International Renewable Energy Agency, in 2021, the costs associated with solar photovoltaic (PV) experienced a 13% decrease compared to the previous year, 2020.

Utility Scale Solar Market Segmentation Analysis:

Rise in demand for utility-scale solar drives the market size.

Utility-scale solar is primarily used to generate large amounts of electricity that can be fed into the grid, serving the power needs of many households and businesses. The electricity is produced at a lower cost per unit due to more efficient installation, maintenance procedures, and lower equipment costs per unit of energy produced. The falling cost of solar technologies and the growing global emphasis on reducing greenhouse gas emissions has made utility-scale solar projects more viable thereby augmenting the overall market growth. According to the International Energy Agency, in 2021, the addition of utility-scale solar capacity in China saw an increase of 4.1%, reaching a total of 27.7 (GW), compared to 2020.

Significant capital inflow drives utility-scale solar market growth.

The capital inflow into this sector accelerates the deployment of new utility-scale solar projects, contributing directly to market expansion. Investments often fund necessary components such as procurement of solar panels, construction of solar farms, and setup of grid connectivity, which are all crucial for the development and operation of utility-scale solar projects. Furthermore, increased investment also encourages advancements in solar technology, leading to improved efficiency and reduced costs, which in turn makes utility-scale solar energy more competitive with other power sources. For instance, in August 2022, Enfinity Global Inc. obtained long-term financing amounting to $242 million for three utility-scale solar photovoltaic (PV) plants in Japan. These recently completed plants have a combined capacity of 70 MW.

Utility Scale Solar Market Geographical Outlook:

North America is projected to dominate the utility-scale solar market.

North America is expected to be the market leader attributable to the region's expanding sophisticated infrastructure and noticeable efforts to increase the deployment of utility-scale solar projects. According to the Solar Energy Industries Association, in 2022, the cumulative capacity of utility-scale solar installations in the U.S. reached 91,776.54 (MW), marking a significant increase of 16% compared to 2021. Additionally, significant capital inflow, either from private investors or government-backed funds, is consistently boosting the development and expansion of utility-scale solar projects. For instance, in 2022, Enel North America constructed new utility-scale wind, solar, and storage facilities across the United States and Canada, contributing an additional capacity of 1.98 Gigawatts (GW).

Utility Scale Solar Market Growth Drivers:

Land and environmental issues may restrain the utility-scale solar market growth.

Utility-scale solar projects necessitate the acquisition of substantial tracts of land, a requirement that can pose a significant challenge in regions where such expansive space is scarce or unavailable. Additionally, the disposal of solar panels at the end of their lifecycle introduces another set of environmental challenges regarding waste management and recycling. Given these factors, there's a possibility that stakeholders could be more inclined to consider space-efficient alternatives, such as rooftop solar technology or floating solar photovoltaic systems. As a result, the potential shift towards these less land-intensive technologies could impose a restraint on the expansion of the utility-scale solar market. For instance, in July 2022, the Indian Government initiated a floating solar power plant at NTPC-Kayamkulam.

Utility Scale Solar Market Company Products:

Utility Scale: First Solar offers a Utility Scale solution that is perfectly tailored for large-scale utility applications, which demand the utmost performance and longevity. Utilizing First Solar's thin-film PV technology, this solution generates highly energy-efficient modules with an industry-leading degradation rate, temperature coefficient, and spectral and shading response. In addition to these performance benefits, First Solar's Utility Scale solution also boasts the smallest environmental footprint in the industry.

List of Top Utility Scale Solar Companies:

First Solar

Trina Solar Co., Ltd

Eaton Corporation

Jinko Solar

Azure Power Global Limited

Utility Scale Solar Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Utility Scale Solar Market Size in 2025 | USD 80.277 billion |

Utility Scale Solar Market Size in 2030 | USD 107.413 billion |

Growth Rate | CAGR of 5.97% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Utility Scale Solar Market |

|

Customization Scope | Free report customization with purchase |

Utility-Scale Solar Market Segmentation

By Technology

Solar Photovoltaic (PV)

Concentrating Solar Thermal Power (CSP)

By Panel Type

Monocrystalline

Polycrystalline

Thin Film

By Power

1 to 10 MW

10 to 20 MW

Above 20 MW

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others