How Tariffs Are Affecting the U.S. Automotive Tire Import Market

Introduction To U.S. Automotive Tire Import Market

Tariffs have changed the U.S. automotive tire import market to such an extent that the structure, cost, and sourcing patterns have significantly varied. Over the past several years, the mixture of antidumping (AD) and countervailing duties (CVD) layered on each other, alongside other trade measures like Section 301 tariffs on Chinese goods, had gradually increased the price of imported tires, and at the same time, importers had to change their procurement strategies entirely. At the beginning, Section 301 tariffs doubled or more. As a result of that, the supply was shifted to Southeast Asian countries such as Thailand, Vietnam, Indonesia, and South Korea. Nevertheless, after the surge of imports from these countries, the U.S. government set up new AD/CVD measures that were mainly aimed at the year 2021, where the biggest affected were passenger and light truck (PVLT) tires from Thailand, Taiwan, South Korea, and Vietnam. These duties added the costs that the goods had on arrival, and importers had to change their supplier portfolios, repricing contracts as well as seeking new sourcing destinations. After the Chinese tariffs, Thailand, which had been the largest supplier of passenger and commercial truck tires, got hit in 2024 with new antidumping tariffs on truck and bus radial (TBR) tires. The decision caused a shock to the tire distributors, commercial fleet operators, and logistics companies, as freight and transportation fleets are the major consumers of TBR tires, and there are very few domestic alternatives. The following factors are influencing the U.S. automotive tire import market:- Importers were forced to move their sourcing to Southeast Asia due to tariffs on Chinese tires.

- The landed cost of PVLT tires from Taiwan, South Korea, Vietnam, and Thailand increased due to antidumping and countervailing duties.

- The biggest source of supply for commercial fleets was disrupted by new tariffs on Thai truck and bus radial (TBR) tires.

- To protect themselves from tariff exposure, importers are diversifying toward countries like Brazil, Mexico, Malaysia, and India.

- Tire prices at wholesale and retail levels are rising across all segments due to higher import costs.

- Although there is less competition for domestic manufacturers, input costs are still rising.

- Fleets and retailers with narrow profit margins are finding it difficult to withstand price increases brought on by tariffs.

- Nearshoring, factory relocation, and mixed-sourcing tactics are reorganizing supply chains.

The Policy Drivers Behind the Shift

- Antidumping and Countervailing Duties (AD/CVD)

- Section 301 Tariffs on China

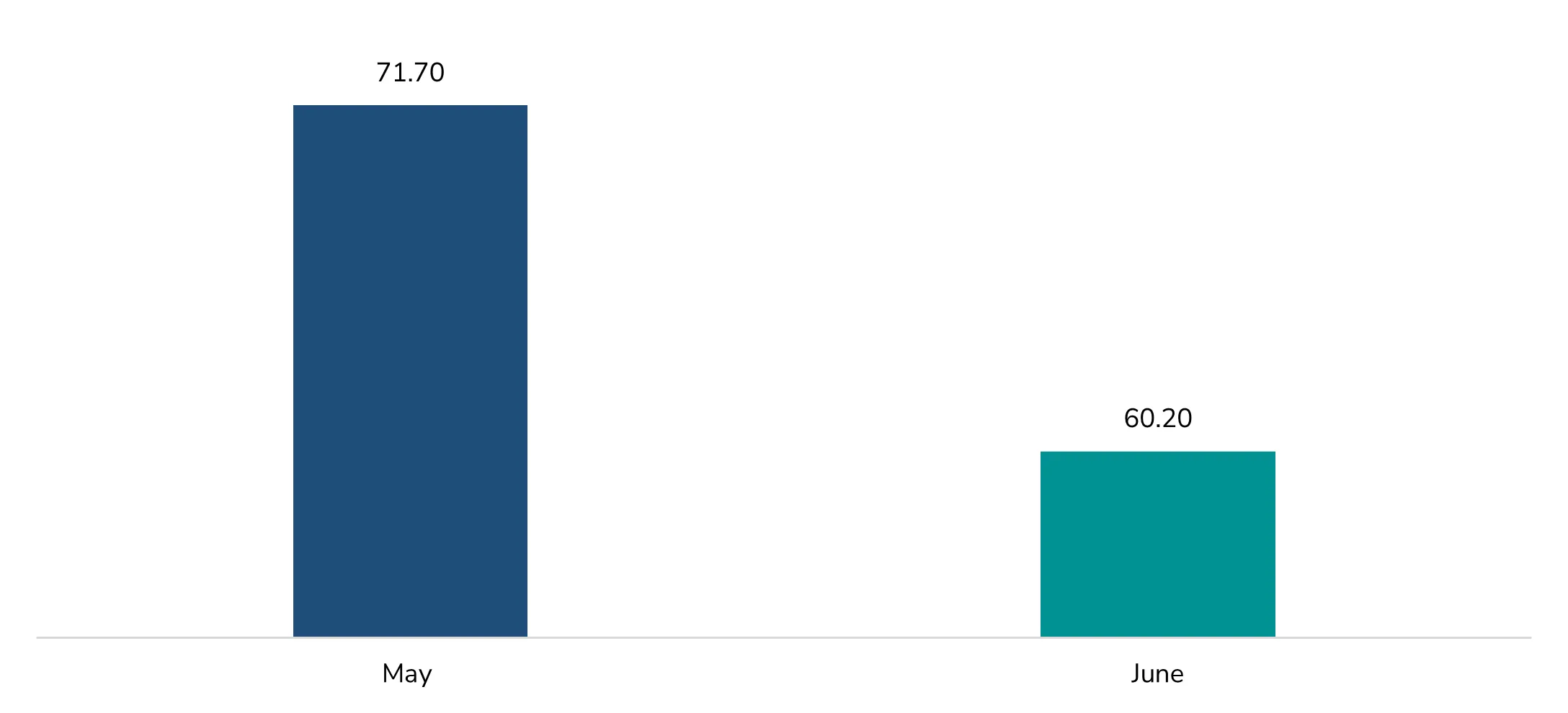

Source: U.S. Census Bureau and the U.S. Bureau of Economic Analysis

Source: U.S. Census Bureau and the U.S. Bureau of Economic Analysis

Changing Sources of Imported Tires

- Decline of China as a Primary Exporter

- Rise of Thailand, Vietnam, and Indonesia

Automotive Tire Market Insights

Understand the broader tire supply chain shifts with our report on the Automotive Tire Market, covering production capacities in Asia and diversification trends.Price Impacts on Businesses and Consumers

- Rising Costs for Importers and Distributors

- Domestic Manufacturers: A Mixed Advantage

- Retail and Consumer Pricing Pressures

Supply Chain Adaptation and Reorganization

- Diversified Manufacturing Strategies

- Nearshoring and USMCA Benefits

Legal and Regulatory Uncertainty

Tariffs caused by the AD/CVD law go through administrative reviews, where the officials decide whether to change the rates or issue retroactive payments. Consequently, importers face a financial risk as they must follow strict customs documentation and bonding requirements to comply with the law. Legal conflicts at the World Trade Organization (WTO) and diplomatic protests from the countries that are affected add another level of uncertainty. Though these issues may have an impact on future policy, they hardly ever lead to quick changes. Moreover, there is a bipartisan consensus in the U.S. to support domestic tire production against cheap imports. The political stability among the parties is minimizing the chances of decreased tariffs soon.Effects on Market Segments

- Passenger and Light Truck Tires (PVLT)

- Truck and Bus Radial Tires (TBR)

- Specialty Tires

- Bridgestone Americas: Bridgestone Americas, a unit of Bridgestone Corporation, Japan, is the second most prominent tire brand in the USA. The firm makes and sells a comprehensive line of car, light truck, and commercial vehicle tires to retail consumers and OEM (original equipment manufacturer) partners. Bridgestone operates several factories in different locations within the United States and has an overall dealer and distribution network that allows it to serve large quantities with ease. The company, using high-tech innovation, the concept of durability, and fuel-saving tire technology, has become a leading player in several market segments.

- Goodyear Tire & Rubber Company: Goodyear, which has its headquarters in Akron, Ohio, is the most identifiable tire brand in the U.S. The company makes a very wide range of tires for passenger cars, light trucks, commercial trucks, and specialty applications. To maximize the cost and supply flexibility, Goodyear merges domestic production with global sourcing. Its vast dealer network, creative product lineup, and solid OEM partnerships enable it to draw a large variety of the U.S. market, ranging from the economy to the premium segments.

Conclusion

Tariffs have not completely stopped tire imports into the U.S., but they have significantly changed the market. The supply chain that used to be heavily reliant on China has broken up and now spread over the countries of Southeast Asia, Latin America, South America, and even India. Importers are adjusting their tactics, but still, the prices are higher and less predictable. For producers, distributors, the sales network, and, finally, consumers, tariffs have become pivotal in setting the prices, making the plans, and deciding on the supply in the long run. The influence is still there, and the future flexibility, the breadth of the suppliers, and close monitoring of trade will be the factors that will determine the tire market.Go from Insight to Action with Our Market Research

You've seen the overview. Now, get the detailed data and strategic analysis you need to stay ahead in the automotive sector. Explore our related, in-depth reports. Each report includes comprehensive data, forecasts, and competitive analysis to empower your business decisions.Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently