Personal Emergency Response System Market Report, Size, Share, Opportunities, And Trends By Type (Landline, Mobile, Standalone), By End-User (Hospitals and Clinics, Specialized Services Facilities, Homecare), And By Geography - Forecasts From 2025 To 2030

Comprehensive analysis of demand drivers, supply-side constraints, competitive landscape, and growth opportunities across applications and regions.

Description

Personal Emergency Response System Market Size:

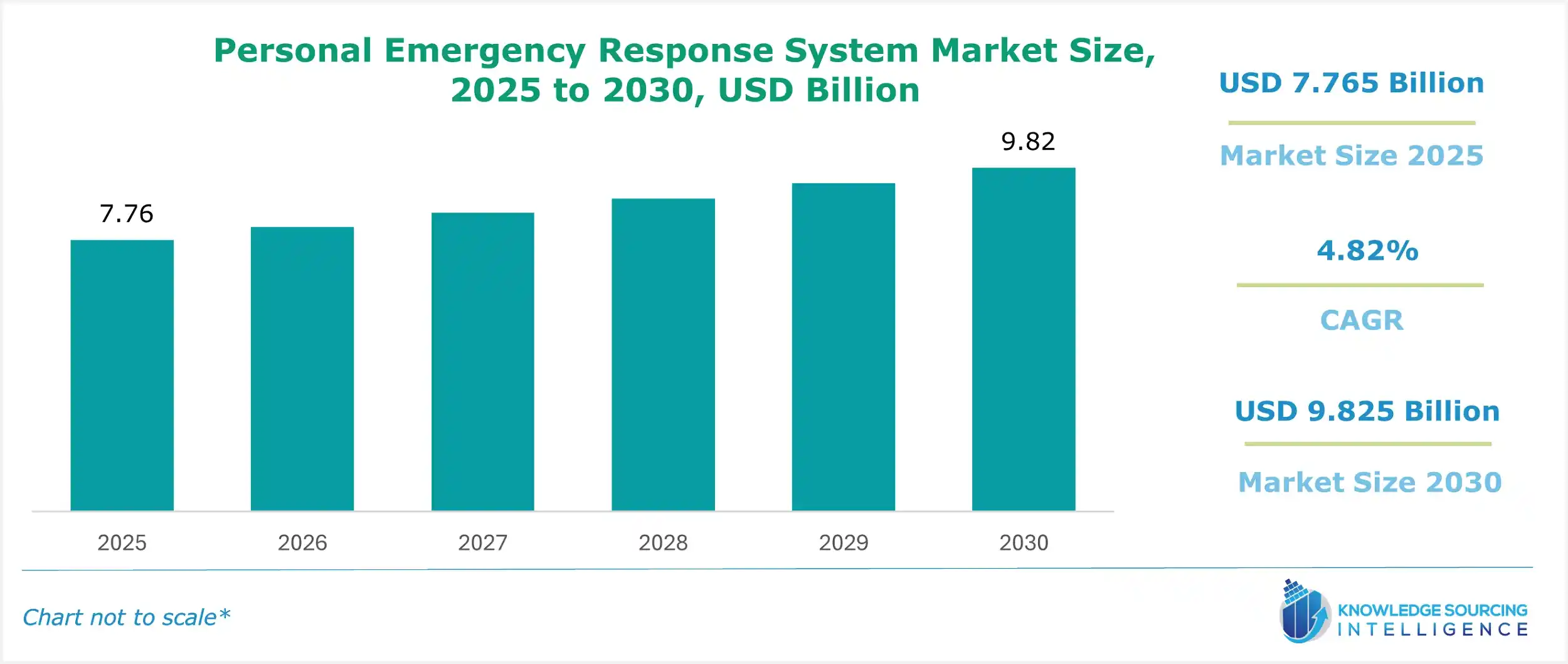

The Personal Emergency Response System Market is expected to grow from USD 7.765 billion in 2025 to USD 9.825 billion in 2030, at a CAGR of 4.82%.

Personal Emergency Response System Market Highlights:

- Enhancing senior safety: PERS devices are improving emergency response for elderly users.

- Driving mobile solutions: GPS-enabled mPERS are enabling real-time location tracking.

- Advancing AI analytics: Fall detection systems are boosting accuracy in emergencies.

- Expanding in Asia-Pacific: Aging populations are fueling rapid market growth.

- Integrating smart home tech: IoT is enhancing PERS connectivity and functionality.

- Promoting wearable devices: Smartwatches are providing accessible emergency alerts for seniors.

- Supporting healthcare policies: Government initiatives are driving PERS adoption globally.

To learn more about this report, request a free sample copy

Personal Emergency Response System Market Overview:

Personal Emergency Response Systems (PERS), also known as Medical Emergency Response Systems, are vital elderly care technologies that enable users to summon help by pressing a button. These medical alert systems and senior safety devices consist of a radio transmitter, a phone-connected console, and an emergency monitoring system. Equipped with fall detection systems and wearable medical alert devices like wristbands or smartphone-integrated solutions, PERS ensures rapid response to emergencies, enhancing senior safety for aging populations. They are critical for elderly healthcare, addressing panic attacks, life-threatening situations, and security concerns.

Mobile PERS (mPERS) extends protection beyond the home, leveraging GPS and cellular connectivity for real-time emergency monitoring services. This is particularly valuable for active seniors, providing location tracking and seamless communication with emergency response centers. The global rise in aging populations, especially in regions like North America, Europe, and the Asia-Pacific, drives demand for user-friendly PERS solutions. According to the World Health Organization, the global population aged 60+ is expected to reach 2.1 billion by 2050, fueling market growth.

Advancements in health monitoring technology, such as AI-driven analytics and IoT integration, enhance PERS functionality, offering features like automatic fall detection and vital signs monitoring. The market is supported by increasing caregiver demand and healthcare innovations, though challenges like high costs and limited awareness in developing regions may hinder growth. North America leads due to advanced healthcare infrastructure, while Asia-Pacific grows rapidly due to rising elderly populations and digital health adoption. The PERS market continues to evolve, delivering reliable, accessible senior care solutions to meet the needs of seniors and caregivers globally.

Personal Emergency Response System Market Trends:

The Personal Emergency Response Systems (PERS) market is advancing with smart home integration and IoT in healthcare, enhancing senior safety through seamless connectivity. AI fall detection improves emergency identification accuracy, while predictive health analytics leverages data to anticipate health risks. GPS tracking for seniors and cellular PERS, powered by 5G PERS devices, ensures real-time location monitoring for mobile seniors. Voice-activated medical alerts boost accessibility, and eSIM medical devices provide compact, global connectivity. These innovations drive elderly care technology, offering intelligent, connected solutions for proactive care.

The growing aging population, projected to reach 2.1 billion by 2050 (World Health Organization), fuels demand for user-friendly PERS. North America leads due to its advanced healthcare infrastructure, while the Asia-Pacific region grows rapidly with digital health adoption. Despite cost challenges, the PERS market evolves to deliver responsive, mobility-focused senior care solutions, transforming the elderly care landscape.

Personal Emergency Response System Market Growth Drivers:

- Rapid use of smartphones and GPS is expected to drive the market growth for Personal Response Emergency Systems.

After the technological expansion, many advancements took place in the healthcare industry, particularly the use of personal response systems by older patients, leading to a decrease in death rates and fewer threats to diseases. Due to the surge in smartphones and smartwatches, the elderly can now have access to healthcare centers quickly. They can make use of the automatic fall detection provided in the smartphone or smartwatch, GPS sensors, mobile personal emergencies, and smart home transmitters. New developments can be seen in wearable technology that tracks and monitors one’s health, which can help maintain a long and healthy lifestyle.

One of the key benefits of PERs (Personal Emergency Response Systems) is that it is suitable even for those who face language barriers or physical disabilities. The best development is GPS, which automatically tracks the geological data when a person faces an emergency. Another one is the WLAN and LAN network that allows one to connect to the actual location and provide health services. CDC (Centers for Disease Control) reported that deaths in old age are due to injury related to a fall, and more than 37% require immediate medical assistance. The technology detects the patient’s condition and plays alert alarms. The major benefit of this is that it does not require any cellular or wired technology.

Some companies, such as Philips Lifeline, have developed Auto Alert fall detection technology with GoSafe2 and HomeSafe Auto Alert. Another company, Bay Alarm Medical, has a high-tech smartwatch with a GPS button and a car system with crash detection. These systems are cost-effective compared to a nursing home facility for elderly people. According to the Department of Health and Human Services, the average cost of a nursing home is US$225 per day. Another technological development that contributes to the use of PERs is medical compliance and monitoring, which helps older people to take their medicines on time. As per the National Community Pharmacists Association, more than half of older people forget to take prescribed medications, leading to more long-term illness.

However, one of the drawbacks to PERs is the outdated systems that have not been updated with recent 5G technologies or Wi-Fi-based technologies, as some of them were 3G or 4G-based devices with limited facilities, such as GPS.

Personal Emergency Response System Market Geographical Outlook:

- During the forecast period, the Asia Pacific personal emergency market is expected to grow rapidly.

The Personal Emergency Response System (PERS) market is witnessing significant growth, particularly in the Asia-Pacific region, which is projected to experience rapid expansion due to increasing healthcare needs and technological advancements. PERS devices, designed to provide immediate assistance during medical emergencies, are critical for efficient health management, especially for the elderly and individuals with chronic conditions. These systems enable real-time emergency response, enhancing personal safety and healthcare accessibility.

In the Asia-Pacific region, countries like India, China, Japan, and South Korea are driving PERS market growth, fueled by rising health concerns and disease prevalence in developing nations.

The region’s aging population and increasing incidence of chronic diseases necessitate emergency response systems for timely intervention. Government initiatives play a pivotal role in market expansion. For instance, India’s Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) and Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) have improved healthcare infrastructure and emergency services, boosting demand for PERS devices (Government of India, 2024). Additionally, India’s Emergency Response Support System (ERSS), with its single emergency number 112, enhances crisis response, integrating PERS technology for faster assistance (Ministry of Home Affairs, India, 2023).

Technological advancements, such as wearable PERS devices, mobile apps, and IoT integration, are transforming the market by offering real-time monitoring and location tracking. These innovations improve user safety and enable healthcare providers to deliver prompt emergency care. The Asia-Pacific region’s rapid urbanization, growing middle-class population, and increasing healthcare investments further drive the adoption of PERS solutions. China and Japan, with advanced healthcare systems, lead in PERS innovation, while India and ASEAN countries like Thailand and Vietnam are emerging markets due to government support and digital transformation.

Globally, North America holds a significant share, driven by advanced healthcare infrastructure and high consumer awareness of personal safety devices. The United States and Canada leverage AI-powered PERS and telehealth integration to cater to the aging population. Europe, particularly Germany and the UK, follows with strong healthcare policies and demand for medical alert systems. The Middle East and Africa, and South America, are growing steadily, supported by healthcare modernization.

Challenges like high device costs and limited awareness in rural areas persist, but cost-effective solutions and government subsidies are addressing these barriers. The PERS market is poised for growth, driven by healthcare innovation, aging demographics, emergency response needs, and regional initiatives, with Asia-Pacific leading due to its healthcare advancements and policy support.

List of Top Personal Emergency Response System Companies:

- Bay Alarm Medical

- Medical Guardian LLC

- Lifeline

- Connect America

- Alert One Services, LLC

Personal Emergency Response System Market Scope:

| Report Metric | Details |

| Personal Emergency Response System Market Size in 2025 | USD 7.765 billion |

| Personal Emergency Response System Market Size in 2030 | USD 9.825 billion |

| Growth Rate | CAGR of 4.82% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Personal Emergency Response System Market |

|

| Customization Scope | Free report customization with purchase |

Personal Emergency Response System Market Segmentation:

- By Type

- Landline

- Mobile

- Standalone

- By End User

- Hospitals and Clinics

- Specialized Services Facilities

- Homecare

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- The Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

- Breath Analyzer Market

- Anti-Snoring Devices and Snoring Surgery Market

- Portable Glucose Monitor Market

Frequently Asked Questions (FAQs)

The personal emergency response system market is projected to reach a market size of USD 9.825 billion by 2030.

Personal Emergency Response System Market was valued at USD 7.765 billion in 2025.

The global personal emergency response system market is projected to grow at a CAGR of 4.82% over the forecast period.

The Asia Pacific is expected to grow rapidly in the personal emergency response system market.

Rapid use of smartphones and GPS is expected to drive the personal emergency response system market growth.

Table Of Contents

1. EXECUTIVE SUMMARY

2. MARKET SNAPSHOT

2.1. Market Overview

2.2. Market Definition

2.3. Scope of the Study

2.4. Market Segmentation

3. BUSINESS LANDSCAPE

3.1. Market Drivers

3.2. Market Restraints

3.3. Market Opportunities

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of New Entrants

3.4.4. Threat of Substitutes

3.4.5. Competitive Rivalry in the Industry

3.5. Industry Value Chain Analysis

3.6. Policies and Regulations

3.7. Strategic Recommendations

4. TECHNOLOGICAL OUTLOOK

5. PERSONAL EMERGENCY RESPONSE SYSTEM MARKET BY TYPE

5.1. Introduction

5.2. Landline

5.3. Mobile

5.4. Standalone

6. PERSONAL EMERGENCY RESPONSE SYSTEM MARKET BY END-USER

6.1. Introduction

6.2. Hospitals and Clinics

6.3. Specialized Services Facilities

6.4. Homecare

7. PERSONAL EMERGENCY RESPONSE SYSTEM MARKET BY GEOGRAPHY

7.1. Introduction

7.2. North America

7.2.1. USA

7.2.2. Canada

7.2.3. Mexico

7.3. South America

7.3.1. Brazil

7.3.2. Argentina

7.3.3. Others

7.4. Europe

7.4.1. United Kingdom

7.4.2. Germany

7.4.3. France

7.4.4. Italy

7.4.5. Others

7.5. Middle East & Africa

7.5.1. Saudi Arabia

7.5.2. UAE

7.5.3. Others

7.6. Asia Pacific

7.6.1. China

7.6.2. India

7.6.3. Japan

7.6.4. South Korea

7.6.5. Thailand

7.6.6. Others

8. COMPETITIVE ENVIRONMENT AND ANALYSIS

8.1. Major Players and Strategy Analysis

8.2. Market Share Analysis

8.3. Mergers, Acquisitions, Agreements, and Collaborations

8.4. Competitive Dashboard

9. COMPANY PROFILES

9.1. Bay Alarm Medical

9.2. Medical Guardian LLC

9.3. Lifeline

9.4. Connect America

9.5. Alert One Services, LLC

9.6. GUARDIAN ALARM

9.7. ADT LLC

9.8. Mobile Help

9.9. Lifefone Medical Alert Services

9.10. Lifestation Inc.

10. APPENDIX

10.1. Currency

10.2. Assumptions

10.3. Base and Forecast Years Timeline

10.4. Key Benefits for the Stakeholders

10.5. Research Methodology

10.6. Abbreviations

List of Tables

Table 1: Research Assumptions

Table 2: Personal Emergency Response System Market, Key Findings

Table 3: Global Personal Emergency Response System Market, By Type, USD Billion, 2020 to 2030

Table 4: Global Personal Emergency Response System Market, By End-User, USD Billion, 2020 to 2030

Table 5: Global Personal Emergency Response System Market, By Geography, USD Billion, 2020 to 2030

Table 6: North America Personal Emergency Response System Market, By Type, USD Billion, 2020 to 2030

Table 7: North America Personal Emergency Response System Market, By End-User, USD Billion, 2020 to 2030

Table 8: North America Personal Emergency Response System Market, By Country, USD Billion, 2020 to 2030

Table 9: South America Personal Emergency Response System Market, By Type, USD Billion, 2020 to 2030

Table 10: South America Personal Emergency Response System Market, By End-User, USD Billion, 2020 to 2030

Table 11: South America Personal Emergency Response System Market, By Country, USD Billion, 2020 to 2030

Table 12: Europe Personal Emergency Response System Market, By Type, USD Billion, 2020 to 2030

Table 13: Europe Personal Emergency Response System Market, By End-User, USD Billion, 2020 to 2030

Table 14: Europe Personal Emergency Response System Market, By Country, USD Billion, 2020 to 2030

Table 15: Middle East and Africa Personal Emergency Response System Market, By Type, USD Billion, 2020 to 2030

Table 16: Middle East and Africa Personal Emergency Response System Market, By End-User, USD Billion, 2020 to 2030

Table 17: Middle East and Africa Personal Emergency Response System Market, By Country, USD Billion, 2020 to 2030

Table 18: Asia Pacific Personal Emergency Response System Market, By Type, USD Billion, 2020 to 2030

Table 19: Asia Pacific Personal Emergency Response System Market, By End-User, USD Billion, 2020 to 2030

Table 20: Asia Pacific Personal Emergency Response System Market, By Country, USD Billion, 2020 to 2030

Table 21: Personal Emergency Response System Market, Strategy Analysis of Key Players

Table 22: Personal Emergency Response System Market, Mergers, Acquisitions, Agreements, and Collaborations

Table 23: Bay Alarm Medical, Products and Services

Table 24: Medical Guardian LLC, Products and Services

Table 25: Lifeline, Products and Services

Table 26: Connect America, Products and Services

Table 27: Alert One Services, LLC, Products and Services

Table 28: GUARDIAN ALARM, Products and Services

Table 29: ADT LLC, Products and Services

Table 30: Mobile Help, Products and Services

Table 31: Lifefone Medical Alert Services, Products and Services

Table 32: Lifestation Inc., Products and Services

List of Figures

Figure 1: Global Personal Emergency Response System Market Size, USD Billion, 2020 to 2030

Figure 2: Global Personal Emergency Response System Market Segmentation

Figure 3: Market Drivers Impact

Figure 4: Porter’s Five Forces Analysis: Bargaining Power of Suppliers

Figure 5: Porter’s Five Forces Analysis: Bargaining Power of Buyers

Figure 6: Porter’s Five Forces Analysis: Threat of New Entrants

Figure 7: Porter’s Five Forces Analysis: Threat of Substitutes

Figure 8: Porter’s Five Forces Analysis: Competitive Rivalry in the Industry

Figure 9: Global Personal Emergency Response System Market, Industry Value Chain Analysis

Figure 10: Global Personal Emergency Response System Market Share (%), By Type, 2025 and 2030

Figure 11: Global Personal Emergency Response System Market Attractiveness by Type, 2030

Figure 12: Global Personal Emergency Response System Market, By Type, Landline, USD Billion, 2020 to 2030

Figure 13: Global Personal Emergency Response System Market, By Type, Mobile, USD Billion, 2020 to 2030

Figure 14: Global Personal Emergency Response System Market, By Type, Standalone, USD Billion, 2020 to 2030

Figure 15: Global Personal Emergency Response System Market Share (%), By End-User, 2025 and 2030

Figure 16: Global Personal Emergency Response System Market Attractiveness by End-User, 2030

Figure 17: Global Personal Emergency Response System Market, By End-User, Hospitals and Clinics, USD Billion, 2020 to 2030

Figure 18: Global Personal Emergency Response System Market, By End-User, Specialized Services Facilities, USD Billion, 2020 to 2030

Figure 19: Global Personal Emergency Response System Market, By End-User, Homecare, USD Billion, 2020 to 2030

Figure 20: Global Personal Emergency Response System Market Share (%), By Geography, 2025 and 2030

Figure 21: Global Personal Emergency Response System Market Attractiveness by Geography, 2030

Figure 22: North America Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 23: North America Personal Emergency Response System Market Share (%), By Country, 2025 and 2030

Figure 24: North America Personal Emergency Response System Market Attractiveness, By Country, 2030

Figure 25: USA Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 26: Canada Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 27: Mexico Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 28: South America Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 29: South America Personal Emergency Response System Market Share (%), By Country, 2025 and 2030

Figure 30: South America Personal Emergency Response System Market Attractiveness, By Country, 2030

Figure 31: Brazil Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 32: Argentina Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 33: South America (Others) Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 34: Europe Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 35: Europe Personal Emergency Response System Market Share (%), By Country, 2025 and 2030

Figure 36: Europe Personal Emergency Response System Market Attractiveness, By Country, 2030

Figure 37: United Kingdom Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 38: Germany Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 39: France Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 40: Italy Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 41: Europe (Others) Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 42: Middle East and Africa Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 43: Middle East and Africa Personal Emergency Response System Market Share (%), By Country, 2025 and 2030

Figure 44: Middle East and Africa Personal Emergency Response System Market Attractiveness, By Country, 2030

Figure 45: Saudi Arabia Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 46: UAE Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 47: Middle East and Africa (Others) Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 48: Asia Pacific Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 49: Asia Pacific Personal Emergency Response System Market Share (%), By Country, 2025 and 2030

Figure 50: Asia Pacific Personal Emergency Response System Market Attractiveness, By Country, 2030

Figure 51: China Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 52: India Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 53: Japan Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 54: South Korea Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 55: Thailand Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 56: Asia Pacific (Others) Personal Emergency Response System Market, USD Billion, 2020 to 2030

Figure 57: Global Personal Emergency Response System Market Share (2023)

Figure 58: Bay Alarm Medical, Key Developments

Figure 59: Medical Guardian LLC, Key Developments

Figure 60: Lifeline, Key Developments

Figure 61: Connect America, Key Developments

Figure 62: Alert One Services, LLC, Key Developments

Figure 63: GUARDIAN ALARM, Key Developments

Figure 64: ADT LLC, Key Developments

Figure 65: Mobile Help, Key Developments

Figure 66: Lifefone Medical Alert Services, Key Developments

Figure 67: Lifestation Inc., Key Developments

Companies Profiled

Bay Alarm Medical

Medical Guardian LLC

Lifeline

Connect America

GUARDIAN ALARM

ADT LLC

Mobile Help

Lifefone Medical Alert Services

Lifestation Inc.

Related Reports

| Report Name | Published Month | Download Sample |

|---|---|---|

| In Vitro Diagnostics Market Report: Size, Share, Forecast 2030 | April 2025 | |

| Endocrine Testing Market Report: Size, Share, Forecast 2029 | April 2024 | |

| Global Liquid Biopsy Market: Size, Share, Trends, Forecast 2030 | December 2024 | |

| Ambulatory Services Market: Size, Share, Trends, Forecast 2030 | December 2024 | |

| Body Temperature Monitoring Market Size, Share, Forecast 2030 | September 2025 |