Report Overview

Artificial Intelligence (AI) In Highlights

AI in Oncology Market Size:

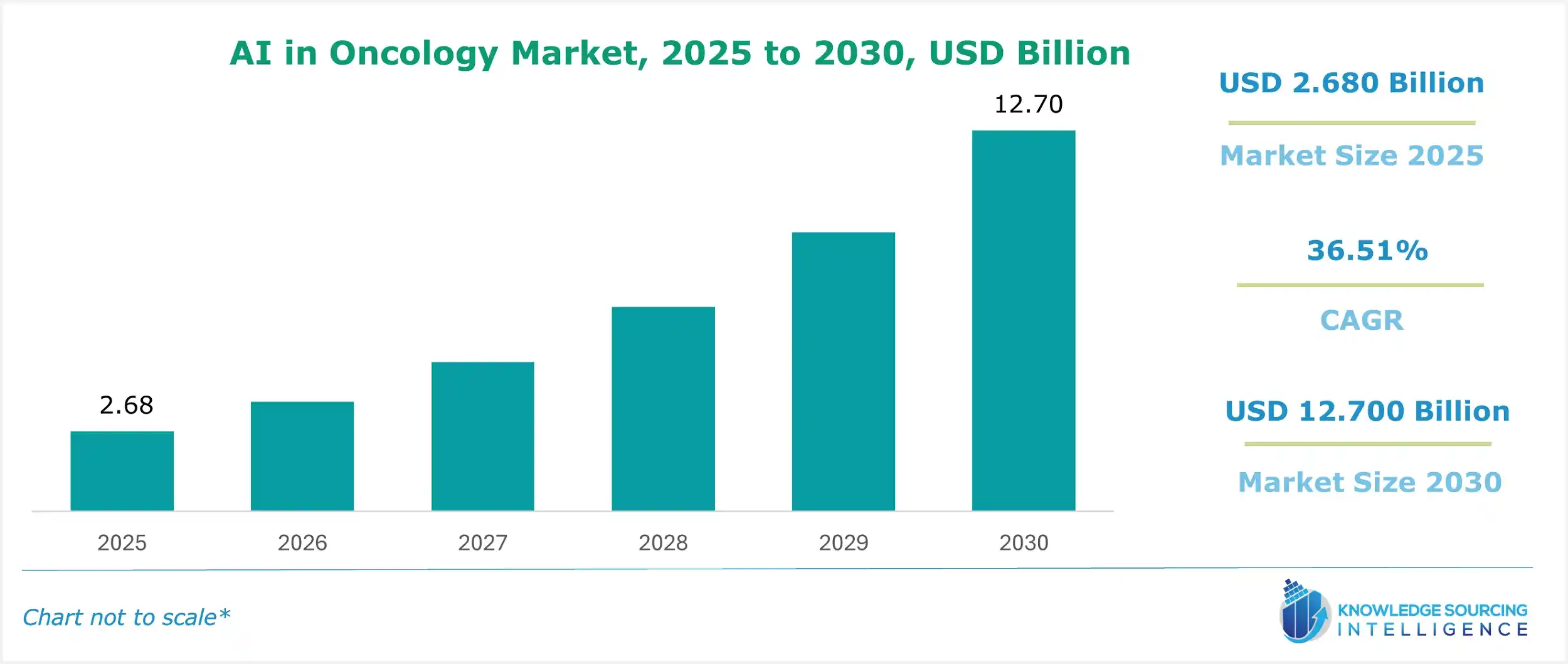

The Artificial Intelligence (AI) in Oncology Market is expected to grow at a CAGR of 36.51%, reaching a market size of US$12.700 billion in 2030 from US$2.680 billion in 2025.

The oncology discipline has seen tremendous breakthroughs with the help of artificial intelligence (AI). Multiple advantages of AI are driving its increased adoption in cancer studies, thereby propelling AI in the oncology market. Moreover, the growing prevalence of cancer cases, coupled with an aging population and their higher risk of cancer, is also expected to boost this market. Additionally, market players' research initiatives and funds for AI incorporation and product launches are further aiding AI in the oncology market.

Additionally, growing product approval of medical devices linked to AI is projected to accelerate market expansion. For instance, the U.S. FDA-approved DermaSensor is the first AI medical device to detect skin cancer as of January 2024.

Future applications of AI in cancer care would hold revolutionary promise and include precision medicine, early detection, and individually designed treatment regimens. This can completely change cancer diagnosis and treatment, as AI can spot minute patterns when viewing complex datasets and give real-time insights. With such a new epoch, better patient outcomes and healthcare delivery would emerge.

AI in Oncology Market Growth Drivers:

- Advantages of AI in Oncology contribute to its market growth

A major growth driver of AI in the oncology market is the many benefits of including AI in cancer studies. For instance, AI algorithms can scan mammograms, CT scans, or MRI images for early symptoms of cancer. This area is where algorithms frequently identify patterns and outliers that human radiologists may not see or even miss, thus leading to earlier diagnosis and possibly better outcomes. For oncologists, AI would peruse everything, from patient data and medical history to clinical guidelines, in support of the design of a treatment plan.

Based on factors such as the size, site, and character of patients, AI-based algorithms would be capable of recommending optimum pathways in treatment. AI models, if needed, can further analyze data from patient clinical records and treatment histories to predict the development of an illness, treatment response, and prognosis.

- The Increasing Incidence of Cancer Cases is contributing to Artificial Intelligence (AI) in oncology market growth

The continually spreading cancer and the severe call for its treatment and early diagnosis can grow the market of AI in oncology. For instance, the WHO estimated that there were about 20 million new cases of cancer and 9.7 million cancer deaths in 2022.

The rate estimates that in every 5 people, one person suffers from cancer throughout their life. Cancer claims the lives of more than 1 in 9 males and 1 in 12 females worldwide. Besides this, the WHO also mentioned that many cancers are curable if treated early and properly. Considering AI may facilitate early detection and better outcomes, increasing cases translates to higher utilization of AI in oncology.

- Increased Research and Funding Initiatives are anticipated to propel the market share

There are several prospects for using AI due to funded research aiding AI in the oncology market. For example, AI capabilities are being used by the NCI's intramural research program to enhance prostate and cervical cancer screening. In collaboration with the Department of Energy (DOE), the Cancer Moonshot financed two significant initiatives that use supercomputing skills and capacity for cancer research with the program's relaunch in 2022.

- The Aging Population will grow the demand during the forecast period

Living with cancer becomes more difficult as people get older. Since the early symptoms of cancer may be considered confusing or familiar pains of old age, many of the cancers in the elderly are diagnosed at a later age. According to WHO, more people are above 60 years old than those less than five years of age, and the percentage of the world population above 60 years is going to increase by 12% between 2015 and 2050. AI helps to analyze images and facilitates early cancer detection, which may help oncologists treat cancer better.

AI in Oncology Market Restraints:

- High investment costs are anticipated to hamper the market growth

Even though advances in technology have made AI more accessible, it still costs a lot of money to develop complex AI algorithms and solutions that are tailored for precision oncology and medical imaging analysis applications. Hardware, analytical software tools, neural network development, data storage infrastructure, and the recruitment of skilled oncologists and data scientists all require substantial financial resources. Costs are also associated with accessing large annotated medical imaging datasets. These high capital needs are problematic, particularly for startups and smaller businesses. The inability of many startups to raise capital may limit market expansion.

AI in Oncology Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

The North American region is expected to hold a significant share of AI in the oncology market during the forecasted period. The launch of AI for oncology has reduced overall cancer treatment costs without affecting the quality of treatment, which is anticipated to positively impact the North American market. Various factors attributed to this growth are rising cancer cases, an aging population, a strong healthcare presence, and the adoption of AI. For example, cancer is the second-most leading cause of death in the US, as per the American Cancer Society, with around 1.9 million cases in 2022 and 6,09,360 cancer deaths in the country. As per the same source, the fastest-growing age group in the US is adults over 85. Moreover, major market players such as Azra AI, IBM, and Intel Corporation are further expected to propel AI in the oncology market through technological advancements.

Recent Developments in AI in Oncology Market:

- November 2025: Lunit AI Maps Tumor-Immune Landscape at SITC 2025. Lunit presented research on its AI solution mapping tumor-immune interactions to predict immunotherapy responses and identify antibody targets, using multimodal data from over 1,000 patients to advance precision oncology.

- November 2025: Oracle and Ci4CC Partner to Accelerate Oncology Innovation. Oracle collaborated with Ci4CC to integrate AI into oncology workflows, leveraging Oracle Cloud Infrastructure for real-time data analysis and EHR interoperability to speed up cancer research and personalized treatments.

- November 2025: Flatiron Health Announces Research at ESMO AI Congress 2025. Flatiron Health showcased AI-driven real-world evidence studies at ESMO AI, including predictive models for immunotherapy efficacy in lung cancer, using de-identified patient data to inform precision medicine strategies.

- January 2024, Apollo Cancer Centre launched India's first AI Precision Oncology Centre. The center will lead oncologists, patients, and caregivers toward the best possible time-bound results by envisaging gigantic possibilities with AI.

List of Top AI in Oncology Companies:

- Azra AI

- IBM

- Siemens Healthcare GmbH

- Intel Corporation

- GE HealthCare

AI in Oncology Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI in Oncology Market Size in 2025 |

US$2.680 billion |

|

AI in Oncology Market Size in 2030 |

US$12.700 billion |

| Growth Rate | CAGR of 36.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI in Oncology Market |

|

| Customization Scope | Free report customization with purchase |

AI in Oncology Market Segmentation:

- By Component Type

- Software Solutions

- Hardware

- Services

- By Cancer Type

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Brain Tumor

- Others

- By Treatment Type

- Chemotherapy

- Radiotherapy

- Immunotherapy

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America