Report Overview

Australia E-Hailing Market - Highlights

Australian E-Hailing Market Size:

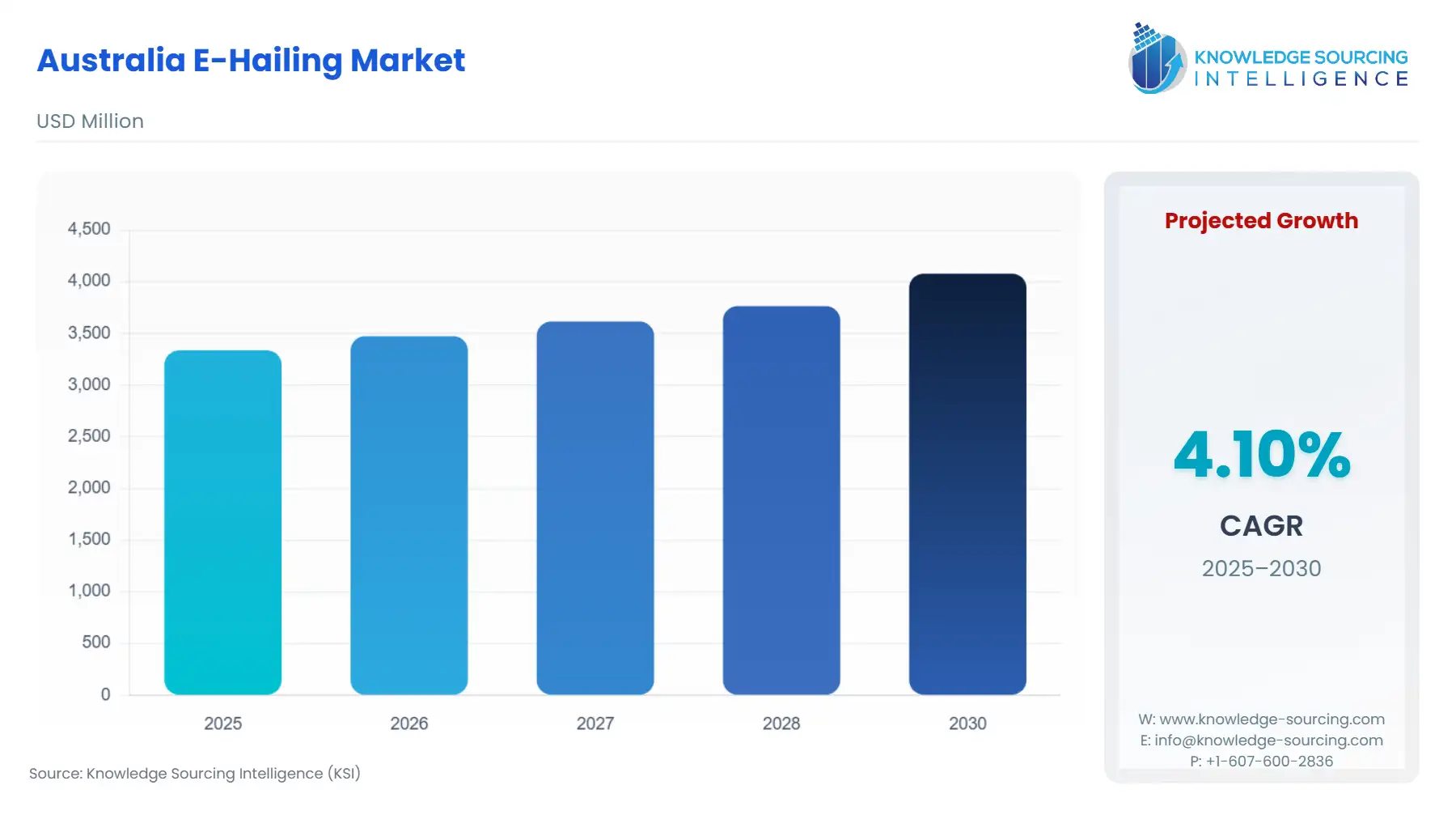

Australia E-Hailing Market is projected to grow at a 4.10% CAGR, reaching USD 4.080 billion by 2030 from USD 3.337 billion in 2025.

Australia's e-hailing industry continues to grow due to an increase in urban development and smartphone adoption. Global players are still coming to the fore, striving to have a place beside existing local platforms, fostering market competition within an e-hailing ecosystem. However, the continuing potential of the e-hailing industry continues to be slowed by differing regulatory challenges, an insufficiency of drivers, and fluctuating fuel prices. Equally, changing interest in electric and sustainable vehicles is opening as a pathway to new avenues of potential growth. With corporate and individual users increasing, the e-hailing industry is on track to be another foundation in Australia’s future urban mobility.

Australia E-Hailing Market Overview & Scope

The Australian E-Hailing Market is segmented by:

- Service Type: The reason ride hailing has a substantial share of the market is consumer preference for point-to-point, on-demand mobility, and especially in urban areas where car ownership is de-emphasised

- Device Type: Smartphones represent the largest share since mobile apps offer the primary channel for booking and payment

- Vehicle Type: Four wheelers control the market, providing safety, comfort, and accommodation for both personal and corporate users.

- End User: The primary driver of B2C demand comes from daily commuters, students, and travellers seeking an affordable, flexible mode of transport.

- Region: Sydney's e-hailing market is expanding rapidly, benefiting from an overwhelming amount of smartphones, solid tourism flows, and urban mobility requirements. The competitive environment between multiple platforms, regulatory oversight, and the demand for sustainable vehicles are informing adoption pathways and consequent development of the e-hailing market.

Top Trends Shaping the Australian E-Hailing Market

- Transition to Green Mobility: Increasing incorporation of AI algorithms and machine learning models in sensor fusion systems is enhancing real-time data processing, predictive analytics, and autonomous decision-making capabilities.

- Growth of Corporate Partnerships: Advances in sensor technology are enabling smaller, more affordable sensors, making sophisticated sensor fusion accessible for a wider range of robotic applications, including consumer and service robots.

- Growth of Digital Payments: App-based, cashless transactions are fast becoming the norm, improving convenience and customer confidence in e-hailing activities.

Australian E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Tourism: The increase in tourism is a key factor that is helping this market grow. In the year ending March 2025, Australia saw strong travel activity led largely by holiday travel with 3.3 million trips, up 11% year-on-year, which generated $12.0 billion in spend, an increase of 24%. Visiting friends and relatives accounted for the second-highest number of trips with 2.6 million, an increase of 3% from 2024, generating $5.3 billion in spend, which was an increase of 12% from 2024. Business travel, despite falling in spend by 8% from 2024 to $2.0 billion, had the most trips with 772,000, an increase of 4%. Last but certainly not least, education travel reported dues of 509,000 trips, an increase of 10%, along with the highest spend at $12.5 billion, up 11%.

Challenges:

- High Complexity: The e-hailing industry in Australia continues to face obstacles that include strict regulations, high compliance costs, competition with everyday taxis, driver shortages, fluctuating fuel prices, and concerns about sustainability. These obstacles can have a negative impact on profitability, service quality, and the stability of the market over the long term.

Australia E-Hailing Market Regional Analysis

- Melbourne: Melbourne's passenger e-hailing market is aided by a strong smartphone penetration, growing use of app-based mobility, e-hailing, and mobility-as-a-service platforms, and demand for sustainable forms of transport. Competition among global.

Australia E-Hailing Market Competitive Landscape

The market has many notable players, including Uber Technologies Inc., Didi Chuxing Technology Co., Swan Taxis, Blue Taxi, Premier Book Top, among others.

- Forum: In June 2025, Uber provided their first bi-annual Driver-partner Advisory Forum in Sydney for the 2025-2026 cycle with new driver-partner Advisors from all over Australia to understand the topics of: Uber support for driver-partners (phone/chat), Airport Trips, and the Uber Pro (bp fuel partnership).

Australia E-hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Australia E-Hailing Market Size in 2025 | USD 3.337 billion |

| Australia E-Hailing Market Size in 2030 | USD 4.080 billion |

| Growth Rate | CAGR during the forecast period |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Sydney, Melbourne, Brisbane, Perth, and Others |

| List of Major Companies in the Australia E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Australia E-hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- End User

- Personal (B2C)

- Corporates (B2B)

- By City

- Sydney

- Melbourne

- Brisbane

- Perth

- Others

Our Best-Performing Industry Reports:

Navigation:

- Australian E-Hailing Market Size:

- Australian E-Hailing Market Key Highlights:

- Australia E-Hailing Market Overview & Scope

- Top Trends Shaping the Australian E-Hailing Market

- Australian E-Hailing Market Growth Drivers vs. Challenges

- Australia E-Hailing Market Regional Analysis

- Australia E-Hailing Market Competitive Landscape

- Australia E-hailing Market Scope: