Report Overview

Casino Management Systems Market Highlights

Casino Management Systems Market Size:

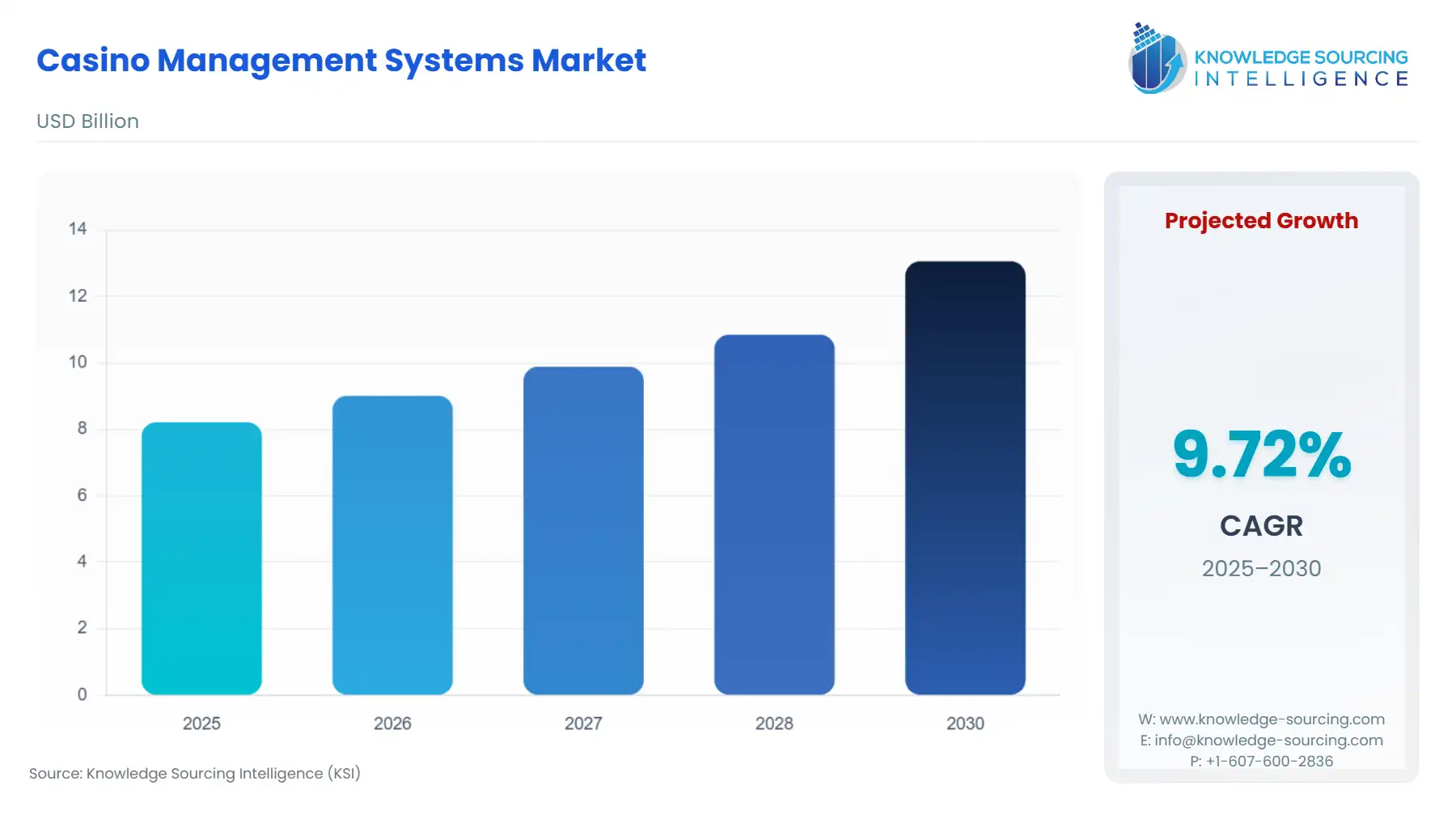

The Casino Management Systems Market is projected to expand at a 9.72% CAGR, achieving USD 13.063 billion by 2030 from USD 8.216 billion in 2025.

Casino Management Systems Market Analysis:

- Growth Drivers

Three forces are directly expanding demand for CMS. Record U.S. commercial gaming revenue has increased operator capex, supporting floor system replacements and loyalty/analytics upgrades. Cloud-native hospitality infrastructure, led by platforms such as Oracle OPERA Cloud and integrated solution announcements, is driving demand for CMS that unify guest profiles across gaming and non-gaming experiences. Vendor investments in mobile and AI-enhanced functionality, demonstrated in Agilysys’ 2024 G2E innovations, are prompting operators to modernize their stack to enable personalization, real-time offers, and self-service capabilities. These developments collectively strengthen the business case for consolidated CMS platforms across integrated resorts.

- Challenges and Opportunities

U.S. tariff policies, particularly those affecting electronic components, networking hardware, and imported IT systems from Asia-Pacific, are exerting a moderate but rising influence on the Casino Management Systems market. Since CMS platforms rely heavily on hardware-intensive infrastructures such as biometric scanners, surveillance integrations, IoT sensors, servers, and specialized terminals, tariffs on semiconductors, display units, and data-center equipment increase procurement costs for system integrators and casino operators. Vendors that import bill validators, RFID readers, or gaming machine interfaces are experiencing 5–12% higher hardware input costs, resulting in longer CMS deployment cycles and price-sensitive negotiations with casino groups.

Evolving regulatory requirements in Nevada, the UK, Singapore, and Colombia create compliance-related headwinds that lengthen certification cycles and increase deployment costs. This slows short-term rollout velocity but simultaneously raises sustained demand for CMS solutions with certified audit trails, AML monitoring, responsible-gaming controls, and reporting automation. Legacy integrations and on-premises customizations remain structural challenges that elevate implementation complexity; however, these constraints also increase professional services and managed-hosting demand. The opportunity lies in unified, cloud-enabled CMS platforms with pre-built integrations and advanced analytics that support multi-property operations, accelerating long-term migration toward enterprise-grade, regulator-approved systems.

- Supply Chain Analysis

Casino management systems rely on software delivery through cloud, hybrid, or on-prem architectures. Supply-chain dependencies center on global cloud-infrastructure providers, payment processors, cybersecurity partners, and integrations with slot machine manufacturers. Cloud-based hospitality platforms and CMS announcements indicate a shift toward hosted environments, creating reliance on regional data centers and regulatory approval for cloud deployments. On-premises systems still require hardware servers, networking equipment, and floor controllers with lead times influenced by component availability. Certification requirements by gaming authorities add an additional layer to the supply chain, requiring vendors to coordinate with third-party testing labs and maintain compliant release cycles.

Casino Management Systems Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States (Nevada) |

Nevada Gaming Control Board — Gaming Statutes & Regulations |

Technical standards for cashless wagering, mobile modules and audit controls raise operator demand for certified CMS with verifiable traceability and reporting capabilities. |

|

United Kingdom |

UK Gambling Commission — Remote Technical Standards (RTS) & LCCP |

RTS obligations drive demand for CMS upgrades incorporating player protection, software integrity, data reporting and audit readiness. |

|

Singapore |

Gambling Regulatory Authority — Casino Control Act |

Approval requirements for control and administrative systems increase demand for compliant CMS with strict auditability and system-governance controls. |

|

Malta |

Malta Gaming Authority — Technical Standards & Supervisory Priorities |

Enhanced oversight and technical testing obligations push operators to adopt CMS with pre-certified modules and rigorous documentation. |

Casino Management Systems Market Segment Analysis:

- Player Tracking (By Application)

Player tracking remains a central demand driver because it connects directly to revenue optimization, loyalty value, and cross-property customer engagement. Operators prioritize solutions that produce real-time behavioral analytics, spending patterns, and segmentation capabilities. Konami’s SYNKROS selection by JACK Entertainment demonstrates the industry’s shift toward high-availability loyalty engines capable of updating rewards, tiers and session data across large footprints. These systems integrate machine data, point-of-sale information, and mobile-wallet activity, which enables operators to craft targeted promotions while optimizing floor performance. Regulatory pressure on responsible gaming and advertising controls intensifies demand for tracking systems with spend monitoring, audit logs, and configurable intervention thresholds. As integrated resorts expand omnichannel loyalty, combining hotel, dining, retail, and gaming, player-tracking modules are increasingly the anchor that drives procurement of broader CMS suites. This makes the segment one of the most influential catalysts behind enterprise-level CMS upgrades and professional-services engagements.

- Large Casinos (By End-User)

Large casinos and integrated resorts require extensive CMS ecosystems capable of supporting high concurrency, multi-property operations, and complex revenue management across gaming and non-gaming services. Oracle’s OPERA Cloud adoption in major hospitality environments shows how enterprise resorts are increasingly unifying hotel, food-and-beverage, and gaming operations under a single technology framework, creating parallel demand for CMS capable of synchronizing guest data, loyalty records, and transaction histories. Large operators typically require robust analytics, API extensibility for slot vendors and payment providers, and multi-jurisdiction compliance capabilities. Their procurement processes involve stringent testing against regulatory standards and interoperability checks, increasing project duration but providing vendors with multi-year contracts and recurring maintenance revenue. These factors make large casinos the highest-value customer segment, driving demand not only for system licenses but for integrations, custom development, cybersecurity layers, and managed cloud hosting.

Casino Management Systems Market Geographical Analysis:

- US Market Analysis

Record commercial gaming revenue strengthens operator balance sheets and sustains CMS investment cycles. Nevada and New Jersey certification frameworks require detailed auditing and approved system configurations, increasing demand for compliant CMS platforms and certified integrations.

- Colombia Market Analysis (South America)

Coljuegos mandates real-time reporting, certified communication protocols, and approved back-office systems, creating strong demand for localized CMS functionality and operator-specific integrations that meet Colombian technical annex requirements.

- UK Market Analysis (Europe)

The UK Gambling Commission’s technical standards and compliance codes force operators to enhance system integrity, responsible gaming controls, and data reporting. This increases the need for updated, audit-ready CMS architectures.

- South Africa Market Analysis (Middle East & Africa)

The National Gambling Board maintains a stringent licensing and audit environment. Casinos operate under mandatory reporting frameworks that necessitate certified management systems, creating consistent demand for compliant CMS deployments.

- Singapore Market Analysis (Asia-Pacific)

The Gambling Regulatory Authority requires system approvals for control and administration modules. Integrated resorts must demonstrate full auditability and system governance, driving demand for CMS with regulator-approved architecture.

Casino Management Systems Market Competitive Environment and Analysis

Key companies include International Game Technology (IGT), Konami Gaming, Oracle, Agilysys, Playtech, Wavestore Global, Advansys, APEX Pro Gaming, and WIN Technologies. IGT’s ADVANTAGE CMS remains central to its strategy, supported by multi-year agreements such as the Red Earth Casino contract. Konami’s SYNKROS platform demonstrated competitive strength through its exclusive selection by JACK Entertainment. Agilysys focuses on integrated hospitality, gaming ecosystems, reinforced by its AI and mobile capability expansions announced at G2E 2024. Oracle maintains a strong presence via OPERA Cloud, which supports CMS integrations through a unified guest-profile architecture. These companies benefit from high switching costs, regulatory certification barriers, and long-term enterprise contracts.

Casino Management Systems Market Developments

- May 2025 — IGT signs a multi-year CMS agreement with Red Earth Casino.

- October 2024 — Agilysys unveils new AI-driven and mobile hospitality innovations at G2E 2024.

- April 2024 — Konami Gaming’s SYNKROS selected as the exclusive CMS for JACK Entertainment properties.

Casino Management Systems Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 8.216 billion |

| Total Market Size in 2031 | USD 13.063 billion |

| Growth Rate | 9.72% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Solution Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Casino Management Systems Market Segmentation:

- CASINO MANAGEMENT SYSTEMS MARKET BY SOLUTION TYPE

- Customer management

- Accounting and financial management

- Security and surveillance

- Analytics and reporting

- Marketing and promotions

- Others

- CASINO MANAGEMENT SYSTEMS MARKET BY APPLICATION

- Player Tracking

- Hotel and Hospitality Management

- CASINO MANAGEMENT SYSTEMS MARKET BY END-USER

- Small and Medium Casinos

- Large Casinos

- CASINO MANAGEMENT SYSTEMS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America