Report Overview

Digital Fault Recorders (DFR) Highlights

Digital Fault Recorders Market Size:

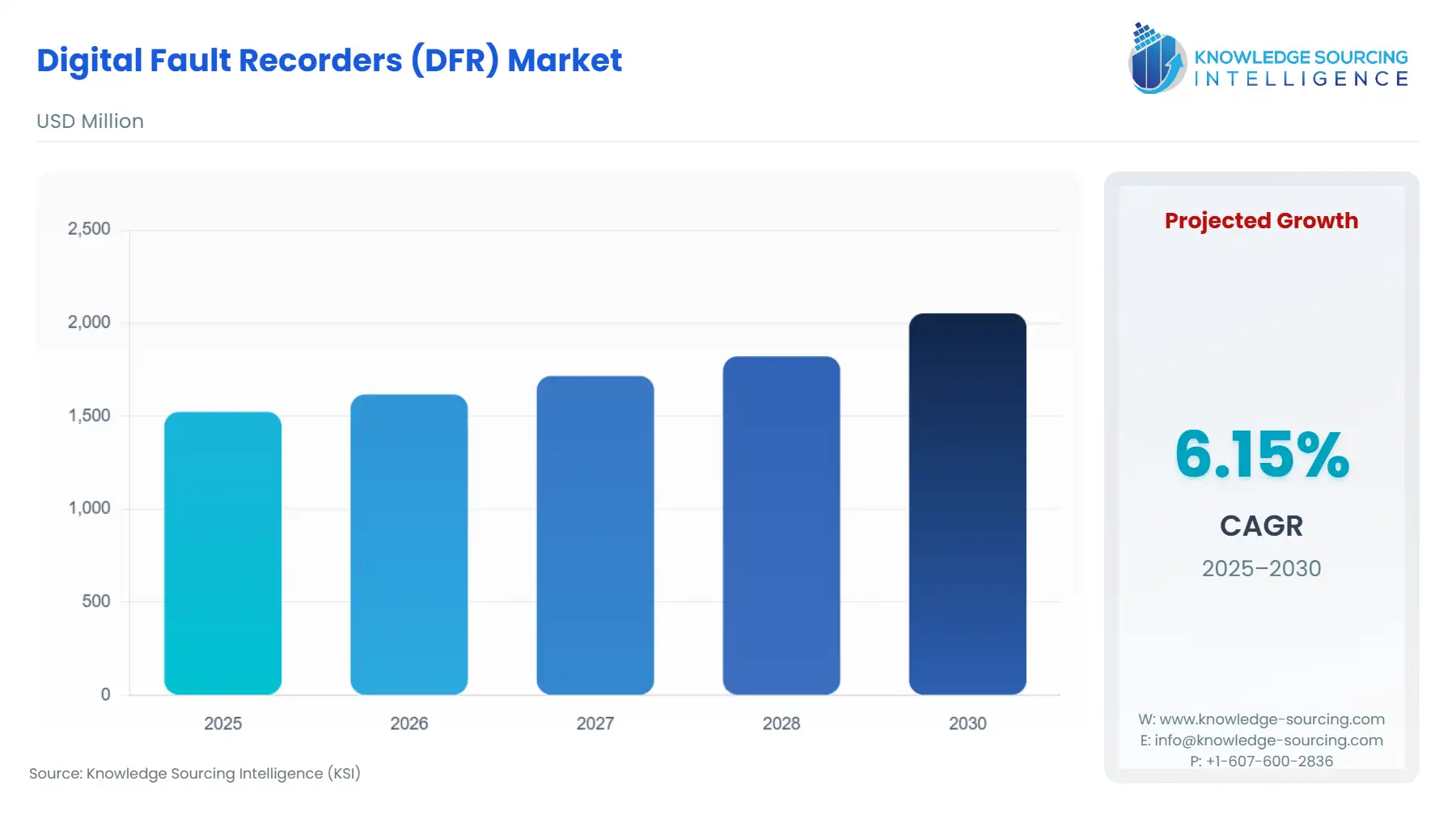

Digital Fault Recorders (DFR) Market is set to grow at a 5.98% CAGR, growing from USD 1.523 billion in 2025 to USD 2.157 billion in 2031.

Digital Fault Recorders Market Trends:

In the realm of power systems, digital fault recorders (DFRs) stand as intelligent electronic sentinels, meticulously capturing binary data during transient events. These crucial devices, typically stationed within substations, diligently monitor power lines, transformers, and circuit breakers, safeguarding the integrity of the grid. The wealth of data amassed by DFRs proves invaluable to various stakeholders, empowering protection and plant maintenance engineers to pinpoint system defects and vulnerabilities, system operators to delve into low-frequency oscillations and power swings, and system planners to scrutinize system performance and evaluate the influence of newly integrated distributed generation sources. The versatility of DFRs, coupled with their ability to consolidate diverse data types under a single software platform, cements their position as indispensable standalone systems. Anticipating the future, advancements in DFR technology may unveil enhanced data processing software, capable of autonomously analyzing fault records and minimizing the demand for manual intervention.

The digital fault recorder market is witnessing robust growth and is poised for continued expansion in the years to come. These intelligent electronic devices capture binary data during power system transients, utilizing communication protocols to store and retrieve the recorded information. DFRs are extensively employed in substations, monitoring power lines, transformers, and circuit breakers. The data collected by these devices proves invaluable for protection and plant maintenance engineers in identifying system faults and weaknesses, for system operators in studying low-frequency oscillations and power swings, and for system planners in evaluating system performance and assessing the impact of newly integrated distributed generation. The versatility of DFRs and their ability to collect and analyze diverse data types with a single software package justify their deployment as standalone systems. The digital fault recorder market is segmented by installation, station, and voltage. The installation segment is further divided into generation, transmission, and distribution. The market is driven by the surging demand for digital substations, which has emerged as the primary catalyst for digital fault recorder market growth.

Digital Fault Recorders Market Growth Drivers:

Growing Demand for Digital Substations: The increasing demand for digital substations has become a major driver for the growth of the digital fault recorder market. Digital substations require advanced monitoring and recording capabilities, and DFRs play a crucial role in providing the necessary data for analysis and maintenance.

Expansion of Transmission Infrastructure: The growth in investment in transmission infrastructure, aimed at creating a more reliable power supply system, is driving the demand for digital fault recorders in the transmission segment. DFRs are essential for monitoring and recording fault events in transmission systems, which is vital for ensuring system reliability and stability.

Need for Reliable Electricity Supply: The increasing demand for reliable electricity supply, coupled with the growing installation of energy-efficient devices, is driving the demand for digital fault recorders. DFRs play a critical role in monitoring power grids and ensuring the reliability of electrical supply, which is essential for meeting the growing power demand in residential and industrial sectors.

Advancements in Grid Infrastructure: Government and private entities around the world are working rigorously to expand transmission and distribution networks and build new power grid infrastructure. This expansion and modernization of grid infrastructure require advanced monitoring and recording capabilities, driving the demand for digital fault recorders.

Technological Advancements: The continuous technological advancements in DFRs, such as the introduction of enhanced data processing software to automatically analyze fault records, are driving their adoption. These advancements are making DFRs more efficient and capable of providing valuable insights for system analysis and maintenance.

List of Top Disruptive Behavior Disorder Treatment Companies:

General Electric offers DR60 which is a compact digital fault recorder (DFR) that is designed for use in harsh utility and industrial environments. It is a one-box solution that provides comprehensive fault recording and analysis capabilities.

Siemens offers SIPROTEC 7KE85 a high-performance fault recorder with integrated measurement of synchrophasor (PMU) by IEEE C37.118 and power-quality measurement by IEC 61000-4-30. It is a modular and flexible device that can be configured to meet the specific needs of any application.

Digital Fault Recorders Market Segmentation Analysis:

Prominent growth in the transmission segment within the digital fault recorders market:

The transmission segment of the digital fault recorders (DFR) market is experiencing significant growth due to several factors. One of the primary drivers is the expansion of transmission infrastructure. As investments in transmission infrastructure increase to create a more reliable power supply system, the demand for DFRs in this segment is also growing. These recorders play a crucial role in monitoring and recording fault events in transmission systems, ensuring system reliability and stability. Another factor contributing to the growth of the transmission segment is the rising demand for reliable electricity supply. With the increasing installation of energy-efficient devices and the growing power demand in residential and industrial sectors, the need for DFRs is also escalating. DFRs play a critical role in monitoring power grids and ensuring the reliability of electrical supply, meeting the growing power demand.

Furthermore, the continuous advancements in grid infrastructure are driving the demand for DFRs in the transmission segment. Government and private entities worldwide are actively expanding transmission and distribution networks and building new power grid infrastructure. This expansion and modernization of grid infrastructure require advanced monitoring and recording capabilities, further fueling the demand for DFRs, particularly in the transmission segment. In summary, the prominent growth in the transmission segment of the DFR market can be attributed to the expansion of transmission infrastructure, the need for reliable electricity supply, and the continuous advancements in grid infrastructure. These factors are driving the demand for DFRs in this segment, making it a key area of growth for the DFR market.

Digital Fault Recorders Market Geographical Outlook:

The North America region is expected to hold a significant share of the digital fault recorder market:

The North American region is poised to maintain a dominant position in the digital fault recorders (DFRs) market, driven by several factors. One key driver is the burgeoning information and communication technology (ICT) sector, which necessitates a dependable power supply. The United States, in particular, stands as a global ICT hub, housing some of the world's most renowned companies. Governments and private entities across the region are also making substantial investments in cutting-edge technologies and smart grids to ensure a reliable electrical supply, further propelling the growth of the DFR market. Another factor stimulating DFR demand in North America is the escalating need for unwavering electricity supply. This rising demand, coupled with the increasing adoption of energy-efficient devices, is propelling the demand for DFRs. DFRs play a crucial role in monitoring power grids and ensuring a stable electrical supply, which is essential for meeting the growing power demands of the residential and industrial sectors.

Furthermore, continuous advancements in grid infrastructure are fueling the demand for DFRs in North America. Governments and private entities across the region are actively engaged in expanding transmission and distribution networks, as well as constructing new power grid infrastructure. This expansion and modernization of grid infrastructure necessitate advanced monitoring and recording capabilities, further intensifying the demand for DFRs in the region. In conclusion, the North American region is expected to retain a significant share of the DFR market owing to the robust growth of the ICT sector, the increasing demand for reliable electricity supply, and ongoing advancements in grid infrastructure.

Digital Fault Recorders Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Digital Fault Recorders Market Size in 2025 | USD 1.523 billion |

Digital Fault Recorders Market Size in 2030 | USD 2.053 billion |

Growth Rate | CAGR of 6.16% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Digital Fault Recorders Market |

|

Customization Scope | Free report customization with purchase |

Digital Fault Recorders (DFR) Market Segmentation

By Speed

High-Speed

Low-Speed

Steady Speed

By Voltage

Up to 66 kV

66 to 220 kV

Greater than 220 kV

By Application

Sub-Stations

Power Plants

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others