Report Overview

Global 3D Stacking Market Highlights

3D Stacking Market Size:

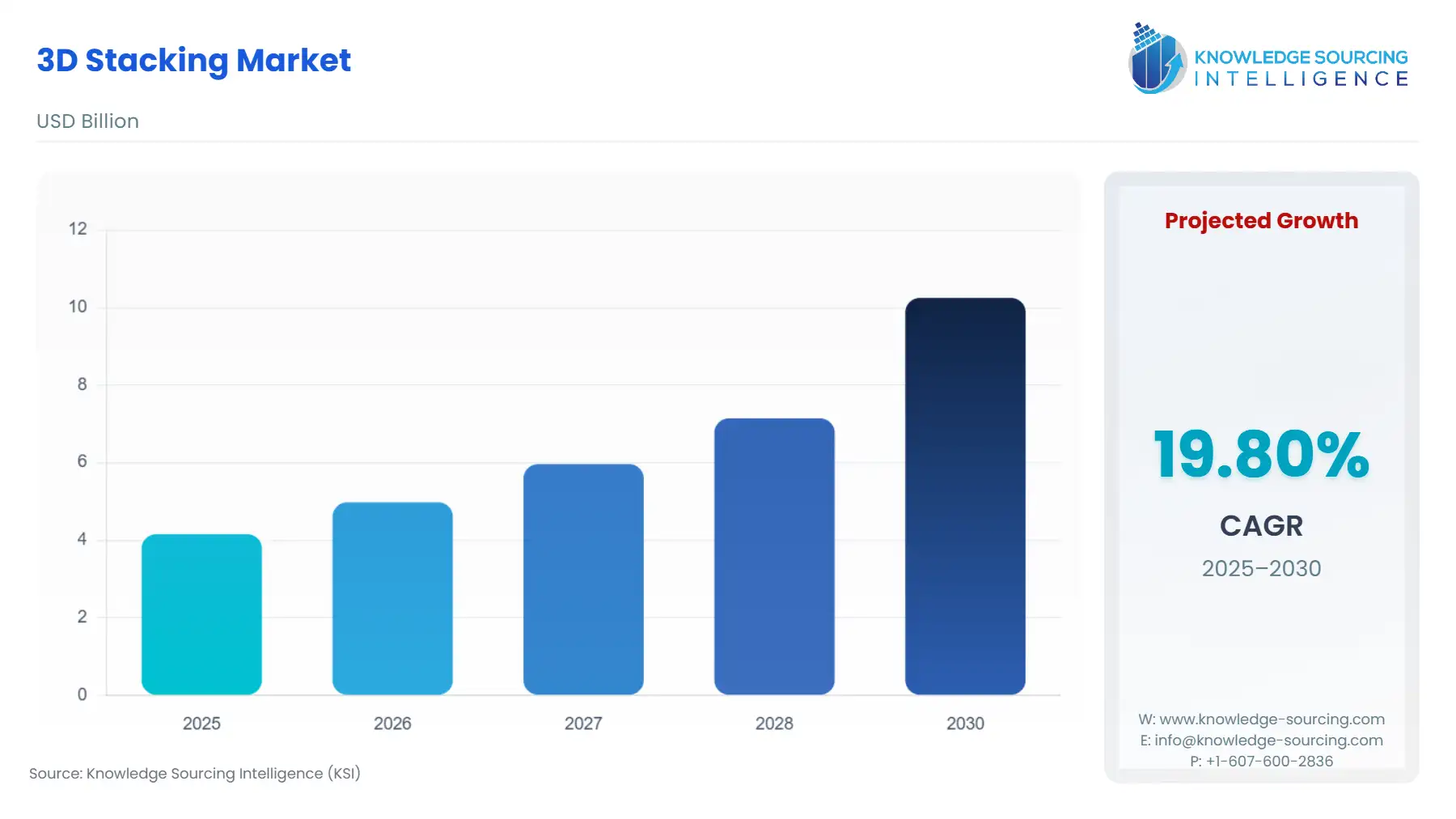

The 3D Stacking Market is anticipated to grow at a CAGR of 19.80% over the forecast period to reach US$10.251 billion by 2030, increasing from an estimated value of US$4.155 billion in 2025.

3D stacking technology is the process of creating 3DIC in the Z-axis direction of chips or creating structures through interconnection. It is used for the integration of microsystems and is referred to as an advanced system in package manufacturing technology.

3D stacking is used to combine two or more chips having different functions into the vertical direction without changing their functionality in the original package. 3D stacking technology helps in the integration of circuit layers through different processes and on different types of wafers available. This helps the manufacturers in the market to optimize their products to a remarkable level when compared with traditional single wafers.

Advantages of 3D stacking include improved performance, decreased power consumption, enhanced memory bandwidth, and a smaller form factor. These qualities make it an excellent choice for applications that need small and efficient electrical systems.

3D Stacking Market Growth Drivers:

- Increasing energy efficiency demand is contributing to the growth of the 3D stacking market

Increasing requirements of energy efficient components due to rising energy-related concerns have contributed to the growth of the 3D stacking technology market. 3D stacking technology helps the manufacturer to optimize their products by decreasing power consumption and making them more precise, and it also helps to enhance product functionality within the resources available.

Increased battery demand by mode in various vehicle types from 2020 to 2022 is as follows, for LDV it was 129.7 GWh/year in 2020 which jumped to 501.9 GWh/year in 2022, for buses was 14.1 GWh/year in 2020 which expanded to 13.0 GWh/year in 2022, and others had 23.9 GWh/year in 2020 to 35.6 GWh/year in 2022.

Among various products, one of the products is the S2MUA02 Samsung Power IC designed for mobile phones to provide them with the desired power to handle devices like True Wireless Stereo. It is based on Cortex®-M0 MCU and has 128kb eFlash along with 12kb SRAM. It supports 5V wire charging and is available in a 5.19mm x 5.19mm size.

Increasing demand for energy-efficient electronic devices due to increasing power-related issues, along with the stringent regulations by the government, is propelling the demand for the 3D stacking technology market.

- Increasing demand for LEDs contributes to the growth of the 3D stacking market

The market of LED has increased in recent times because of increasing demand due to its numerous advantages, such as energy efficiency and better performance than traditional lighting systems. LED is being used in various industries like automotive, construction, and lighting. Through 3Dd stacking technology LED size can be reduced and also made more efficient. 3D stacking allows LED manufacturers to maximize the output and reduce the surface area.

According to IEA, in 2022, LED demand increased along with its lighting efficiency. While countries across the globe have started to replace incandescent lamps with LED lighting, it is expected that it will replace them very soon. As per the report, about 50% of the global LED sales are from residential lighting.

According to global residential LED lighting sales by technology in the Net Zero Scenario in 2020 is 43.3% which further increased to 50.5% in 2022.

3D stacking technology used in LED manufacturing allows the manufacturer to make it more efficient and to reduce its size without affecting its output.

3D Stacking Market Restraints:

- Design complexity hampers the growth of the market

3D stacking is used to reduce the size of the product and increase its efficiency, but sometimes it tends to increase the complexity of the design, which in turn requires more expertise to understand. Also, this technology makes the cost of the product much higher than it used to be before the usage of this technology. Thus, apart from having numerous benefits that help in the growth of the market, there are also some factors that hamper the growth of the market.

3D Stacking Market Segmentation Analysis:

- The 3D stacking market is segmented based on different types

The 3D stacking market is segmented based on different types into logic ICs, imaging & optoelectronics, memory devices, MEMS/Sensors, LEDs, and others. Logic ICs are integrated circuits found in microprocessors and microcontrollers. This allows for denser transistor integration and shorter connection lengths.

3D stacking technology helps in improving optoelectronic systems by combining different sensors into one and reducing their size without affecting their functionality. 3D stacking is also used in the making of memory devices because, due to this technology size of the memory devices can be reduced, and also their capacity can be increased. It also enhances the memory density and reduces the latency.

Microelectromechanical systems (MEMS) and sensors are used in various industries such as automotive, consumer electronics, and healthcare. 3D stacking helps in reducing their size and also helps in integrating them with other semiconductor components.

3D Stacking Market Geographical Outlook:

- North America region is anticipated to hold a significant share of the 3D stacking market

North America is anticipated to hold the majority share of the 3D stacking market. Innovation is led by various North American semiconductor companies like Intel, NVIDIA, Qualcomm, AMD, and Micron. These companies invest largely in research and development of advanced technologies like 3D stacking.

The region has various institutions that regularly invest their resources into semiconductor research and development. North America is anticipated to be a leader in semiconductor manufacturing, research, and innovation, due to which demand for advanced solutions like 3D stacking is continuously growing.

3D Stacking Market Key Developments:

- September 2025: Synopsys confirmed a collaboration with TSMC to support advanced 3D stacking and CoWoS packaging technologies with certified EDA flows and IP for multi-die solutions on TSMC’s N2P and A16 processes.

- August 2025: TSMC launched its 3DFabric Alliance, formalizing a family of 3D stacking and advanced packaging technologies, including SoIC and CoWoS, to support system-level integration innovations.

- August 2025: Socionext announced its expanded 3DIC portfolio, including advanced 3D die stacking and 5.5D packaging, and successfully taped out a device using TSMC’s SoIC-X 3D stacking in face-to-face configuration.

- April 2025: Intel announced updates to its Foundry roadmap, unveiling the 18A-PT variant supporting Foveros Direct 3D stacking with hybrid bonding interconnects, enabling vertical die stacking on advanced nodes.

3D Stacking Market Company Products:

- Intel® Core™ i9 Processors– Intel® Core™ i9 processors include a performance hybrid architecture built for intelligent performance, optimized creation, and increased tuning, allowing gamers to game at up to 6.0 GHz clock speeds.

- ePad LQFP/TQFP– Amkor's ExposedPad LQFP/TQFP power IC packages improve thermal efficiency by up to 110% compared to normal LQFP and TQFP packages. They can lower the loop inductance in high-frequency applications and be linked to the ground. These packages should be soldered directly to the PCB for the best thermal and electrical performance.

3D Stacking Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| 3D Stacking Market Size in 2025 | US$4.155 billion |

| 3D Stacking Market Size in 2030 | US$10.251 billion |

| Growth Rate | CAGR of 19.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in 3D Stacking Market |

|

| Customization Scope | Free report customization with purchase |

3D Stacking Market Segmentation:

- By Device Type

- Logic ICs.

- Imaging & Optoelectronics.

- Memory Devices

- MEMS/Sensors

- LEDs

- Others

- By Type

- Monolithic

- Die Stacking

- Wafer Stacking

- By End-User

- Automotive

- Telecommunications

- Manufacturing

- Healthcare

- Manufacturing Consumer Electronics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America