Report Overview

Japan Electric Commercial Vehicles Highlights

Japan Electric Commercial Vehicles Market Size:

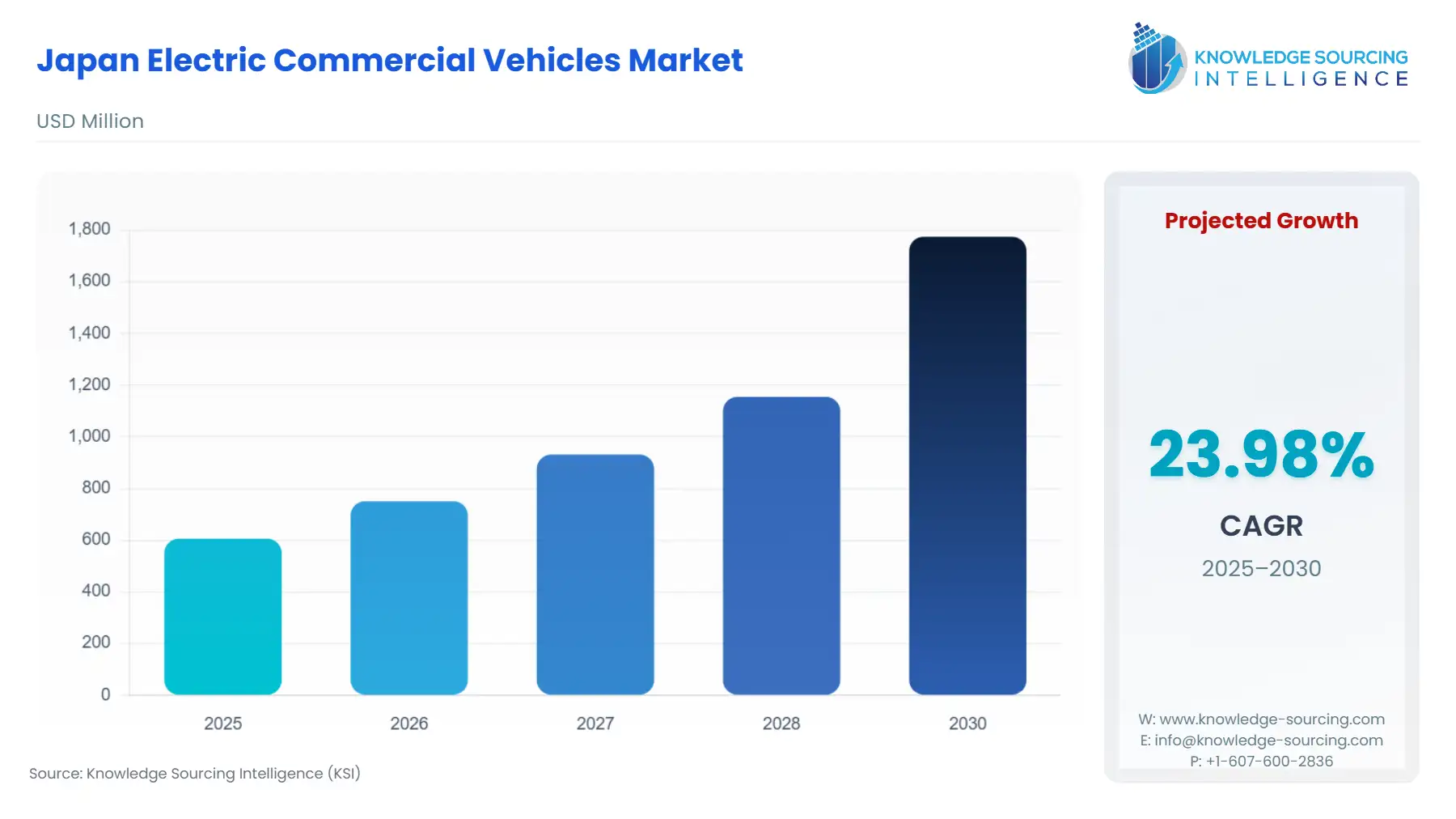

The Japan Electric Commercial Vehicles Market is anticipated to advance at a CAGR of 23.98%, climbing to USD 1.775 billion in 2030 from USD 0.606 billion in 2025.

The Japanese Electric Commercial Vehicles (eCV) market is navigating a complex transition, driven by an imperative for national decarbonization while simultaneously confronting structural market challenges. The government's commitment to achieving net-zero greenhouse gas emissions by 2050 has created a regulatory environment that favours Clean Energy Vehicles (CEVs). This policy pressure, coupled with the rapid growth of e-commerce, is transforming the commercial transport sector.

Japan Electric Commercial Vehicles Market Analysis:

- Growth Drivers

The primary catalyst propelling the ECV market is Japan’s commitment to aggressive emissions reduction targets. The government's goal to achieve a 46% reduction in greenhouse gas emissions by 2030, and net-zero by 2050, makes fleet electrification an unavoidable strategic imperative for logistics and public transportation operators. This regulatory pressure explicitly creates demand for zero-emission commercial vehicles (BEVs and FCEVs) as fleet renewal cycles align with sustainability mandates. Additionally, direct government subsidies for CEVs, with higher allowances for vehicles featuring Vehicle-to-Home (V2H) or power-exporting capabilities, provide an immediate reduction in the capital expenditure burden. This direct financial incentive is a crucial factor, prompting fleet managers to procure electric alternatives over cheaper, conventional internal combustion engine (ICE) models, thereby accelerating market adoption.

- Challenges and Opportunities

The principal challenge facing the market is the fragmented and insufficient charging infrastructure. The scarcity and deterioration of existing public charging stations, coupled with safety regulations that increase the installation cost of high-output chargers, generate significant "range anxiety" and operational concerns for fleet operators, particularly for heavy-duty applications. This infrastructure constraint directly depresses demand for high-mileage BEV trucks by increasing effective TCO and reducing operational efficiency.

The chief opportunity lies in the synergy between Fuel Cell Electric Vehicles (FCEVs) and Japan's industrial strengths. Japanese manufacturers possess deep expertise in hydrogen technology, making FCEVs a viable, long-term solution, especially for long-distance transport and buses, where refuelling time and energy density are critical. Government-led efforts to expand the hydrogen refuelling network offer a clear pathway to unlock demand in the heavy-duty segment, sidestepping the current limitations of battery technology for long-haul logistics.

- Raw Material and Pricing Analysis

The electric commercial vehicle is a physical product, making raw material supply crucial. The cost and supply stability of key battery materials—lithium, nickel, and cobalt—directly influence the final pricing of BEVs. Japan maintains a substantial downstream position in the global battery supply chain, accounting for approximately 14% of global cathode material production capacity and 11% of anode material production. Dependence on imported raw minerals from upstream mining regions creates pricing volatility, which vehicle manufacturers often pass on to commercial buyers. Consequently, fluctuations in the cost of these materials can increase the initial purchase price of BEVs, acting as a constraint on demand, particularly for price-sensitive small and medium-sized enterprises (SMEs) operating commercial fleets.

- Supply Chain Analysis

The Japanese eCV supply chain is characterized by a high degree of integration between domestic vehicle manufacturers and specialized material/component suppliers. Key dependencies include the global supply of battery cells and critical raw materials. While Japanese firms excel in the production of highly technical battery components (cathode and anode materials), the final assembly of battery cells and the sourcing of raw minerals are subject to global geopolitical and logistical complexities. Logistical hubs in the Kanto and Chubu regions are central to EV production. This reliance on an extensive, multi-geography supply network introduces vulnerability to disruptions, potentially delaying ECV deliveries and creating uncertainty for fleet planning, thereby tempering immediate demand growth.

Japan Electric Commercial Vehicles Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Japan (National) |

Clean Energy Vehicle (CEV) Subsidies Program |

Directly reduces the capital cost for purchasing BEVs, PHEVs, and FCEVs, making them financially competitive against conventional vehicles, thus immediately stimulating fleet demand. |

|

Japan (National) |

Goal for 100% Electrified Vehicle Sales by 2035 (New Passenger Vehicles) |

While focused on passenger vehicles, this long-term policy signal forces a strategic shift in the domestic automotive industry toward electrification, driving greater R&D investment and product availability in the commercial sector. |

|

Japan (National) |

Well-to-Wheel Zero Emission Policy |

Establishes a framework for zero-carbon emissions across the entire vehicle lifecycle, mandating a systemic transition in the commercial transport sector and sustaining demand for both BEV and FCEV technologies. |

Japan Electric Commercial Vehicles Market Segment Analysis:

- By Application: Logistics and Transportation

The Logistics and Transportation segment is the primary growth factor of ECV, driven fundamentally by the country’s burgeoning e-commerce market. The final-mile delivery imperative in densely populated urban and metropolitan areas creates a perfect use case for light-duty electric vans and trucks. These vehicles benefit from predictable, shorter routes that mitigate range anxiety and allow for hub-based, overnight depot charging, effectively managing the existing public infrastructure deficit. Corporate sustainability mandates (Scope 3 emissions reduction) further reinforce this demand, as large logistics providers are under pressure to decarbonize their fleets to align with customer and investor expectations. This segment exhibits the strongest immediate demand for Battery Electric Vehicles (BEVs) due to the simplicity of operation and lower running costs compared to ICE equivalents.

- By Propulsion Type: Fuel Cell Electric Vehicle (FCEV)

The FCEV segment holds a critical, albeit nascent, role, driven by the unique operational requirements of heavy-duty commercial transport. For long-distance haulage and scheduled public bus routes, the superior energy density and rapid refuelling capability of hydrogen overcome the two major limitations of BEVs: downtime and weight. The requirement is currently policy-led and focused on initial fleet adoption for demonstration projects, particularly for route buses and heavy-duty trucks, where payload capacity and continuous operation are non-negotiable. The major domestic Original Equipment Manufacturers (OEMs) are strategically investing in FCEV development, recognizing it as the critical technology pathway to decarbonize the large, long-haul segment that is otherwise resistant to current BEV solutions.

Japan Electric Commercial Vehicles Market Competitive Analysis:

The Japanese Electric Commercial Vehicles market is dominated by incumbent domestic players who are leveraging their existing market share and logistics relationships to drive the transition.

- Mitsubishi Fuso Truck and Bus Corporation (MFTBC): MFTBC is a key first-mover, evidenced by its launch of the all-electric light-duty eCanter, the first series-produced electric light-duty truck in Japan. Its strategy centers on localizing production and forming strategic partnerships to offer integrated EV solutions, including services like the joint establishment of the 'EVNION PLACE' online platform. This platform aims to provide comprehensive EV-related services regardless of brand, targeting the entire ecosystem to facilitate fleet transition and secure customer loyalty.

- Isuzu Motors Limited and Toyota Motor Corporation: This alliance represents a strategic pivot toward FCEV technology. The companies have agreed to jointly develop a next-generation fuel cell route bus, combining Isuzu's flat-floor electric bus platform with Toyota's advanced Fuel Cell system. Their strategic positioning focuses on standardizing parts to reduce costs and specifically targeting the public transportation and heavy-duty segments, which require the operational capabilities of FCEVs to achieve zero-emission mandates.

Japan Electric Commercial Vehicles Market Developments:

- September 2025: Isuzu Motors Limited and Toyota Motor Corporation Announcement: Isuzu and Toyota announced an agreement to jointly develop next-generation Fuel Cell (FC) route buses for commercialization, with production scheduled to begin in fiscal year 2026.

- March 2024: Mitsubishi Corporation, Mitsubishi Fuso Truck and Bus, and Mitsubishi Motors Joint Venture: The three companies announced the joint establishment of EVNION Inc. to operate an online platform, "EVNION PLACE," offering comprehensive EV-related services for commercial and passenger vehicles in Japan.

Japan Electric Commercial Vehicles Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.606 billion |

| Total Market Size in 2031 | USD 1.775 billion |

| Growth Rate | 23.98% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Vehicle Type, Propulsion Type, Power Output, Application |

| Companies |

|

Japan Electric Commercial Vehicles Market Segmentation:

- BY VEHICLE TYPE

- Buses and Coaches

- Trucks

- Light-Duty Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Vans

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicles (FCEV)

- BY POWER OUTPUT

- Up to 150 kW

- 150-250 kW

- Above 250 kW

- BY APPLICATION

- Logistics and Transportation

- Public Transportation

- Construction (Excavators, Loaders, Others)

- Mining

- Agriculture (Tractors, Harvesters, Others)

- Others