Report Overview

Japan Electric Vehicle Powertrain Highlights

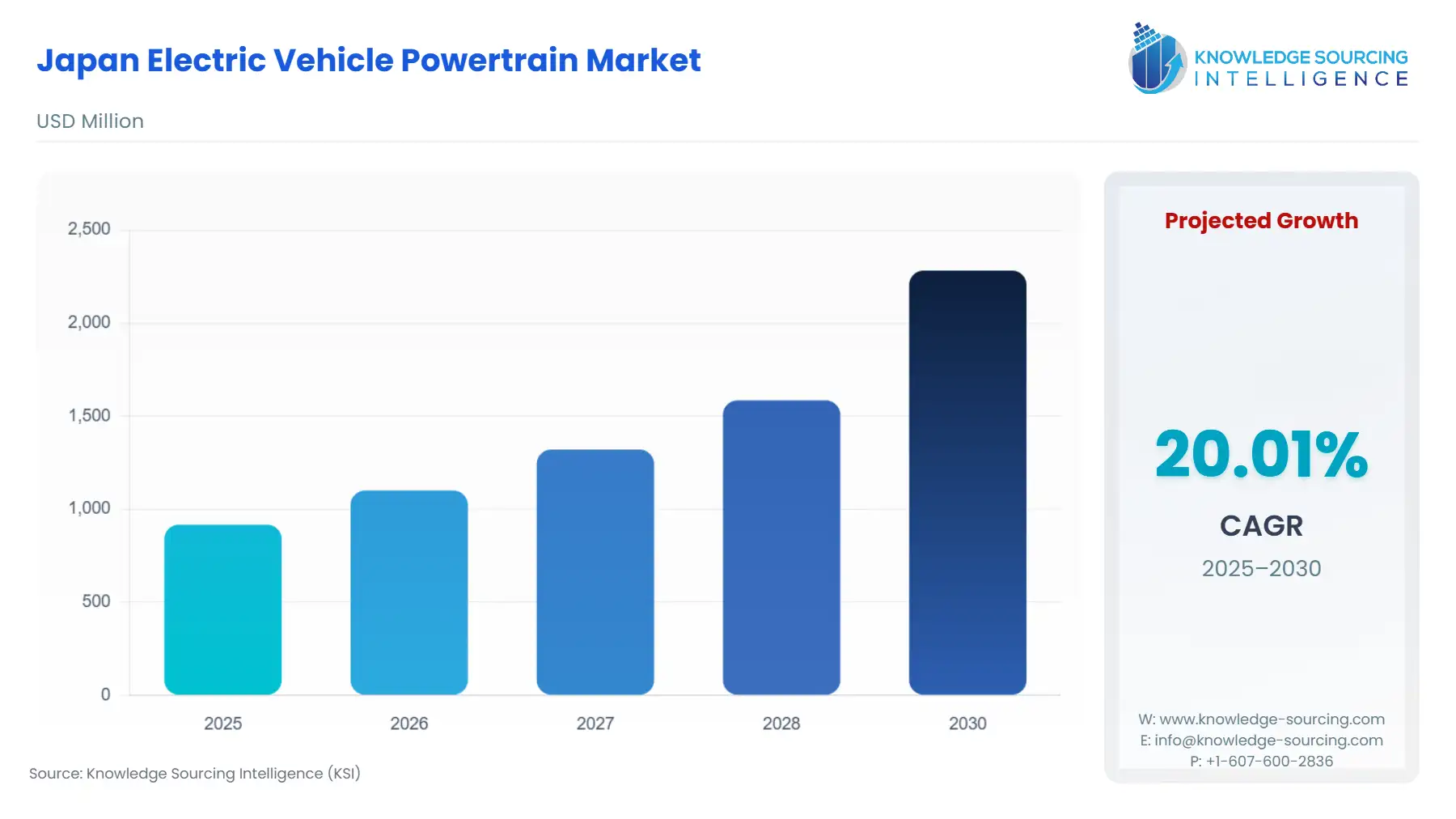

Japan Electric Vehicle Powertrain Market Size:

The Japan Electric Vehicle Powertrain Market is forecast to rise at a CAGR of 20.01%, attaining USD 2.283 billion in 2030 from USD 0.917 billion in 2025.

The Japanese electric vehicle (EV) powertrain market is undergoing a complex, dual-track transition defined by entrenched hybrid dominance and an incremental, policy-driven embrace of full electrification. While the government of Japan has set an ambitious goal to achieve 100% electrified vehicle sales by 2035, encompassing HEVs, the current market dynamic is heavily skewed towards hybrid systems. This unique national context creates a distinct procurement landscape for powertrain manufacturers. Components—including the Battery Management System (BMS), power electronics, and thermal management systems—must cater to the high-efficiency requirements of complex hybrid systems while also scaling for future BEV platforms, indicating a fragmented demand profile for suppliers.

Japan Electric Vehicle Powertrain Market Analysis

- Growth Drivers

The primary catalyst for market expansion is the governmental push toward a comprehensive electrified fleet. The Ministry of Economy, Trade and Industry (METI) set the goal of 100% xEV sales by 2035 (including HEVs), providing a clear long-term mandate for automakers. This policy directive drives demand for all types of electric powertrain components, including transmissions engineered for electric motors, specialized power electronics for voltage management, and sophisticated thermal management systems. Specifically, the government’s direct financial incentives, such as the CEV subsidies offered for BEVs and PHEVs (but not HEVs), directly stimulates increased demand for the more capital-intensive, high-voltage battery packs, electric motors, and inverters central to these fully electric architectures.

- Challenges and Opportunities

A significant challenge is the deep-seated consumer preference for HEVs, which dampens the acceleration of high-capacity BEV powertrain demand. The established hybrid infrastructure, coupled with consumer concerns over BEV charging convenience and initial purchase price, perpetuates the high demand for hybrid-specific electric drivetrains. This creates an immediate opportunity for suppliers specializing in compact, high-power-density electric motors and transmissions optimized for HEV architecture, serving as a critical bridge technology. Furthermore, the commitment by domestic OEMs to next-generation hybrid engines necessitates specialized components designed for tighter integration with electric units, ensuring sustained demand in the near term.

- Raw Material and Pricing Analysis

The electric vehicle powertrain is a physical product, making raw material supply and pricing a critical constraint. Battery components, particularly lithium, nickel, cobalt, and graphite, are essential to the Battery Pack and Battery Management System segments. Supply chain risk, characterized by reliance on foreign-sourced processed materials, directly influences the final cost of the powertrain, which can either suppress or accelerate the consumer demand for EVs. In response, government-led initiatives and private-sector agreements, such as the U.S.-Japan Critical Minerals Agreement (CMA) of 2023, aim to secure a diversified and resilient supply chain for these critical minerals, which, if successful, stabilizes component pricing and thereby increases the market's long-term affordability and demand predictability.

- Supply Chain Analysis

Japan's EV powertrain supply chain is characterized by a high degree of vertical integration among domestic keiretsu networks, though it maintains a global dependency for core raw materials. Key production hubs for finished components (e.g., power electronics, electric motors) are largely situated within Japan and nearby East Asia. The primary logistical complexity lies in the secure and timely sourcing of critical minerals and refined battery components. The development of next-generation batteries, specifically solid-state technology being pioneered by companies like Toyota, aims to reduce dependency on certain liquid electrolyte components and potentially reconfigure the supply chain closer to domestic manufacturing plants, thereby increasing domestic demand for specialized, high-precision assembly equipment.

Japan Electric Vehicle Powertrain Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Japan (GOJ / METI) |

Clean Energy Vehicle (CEV) Subsidy Program |

Direct demand creation for BEVs and PHEVs by reducing the final purchase price, making their more expensive powertrains (battery, power electronics) more accessible to consumers. |

|

Japan (GOJ / METI) |

Green Growth Strategy (100% electrified vehicle sales by 2035) |

Long-term, non-negotiable demand signal across all segments, compelling automakers to integrate electric powertrains (HEV, PHEV, BEV) into their entire vehicle portfolio. |

|

Japan (GOJ) |

Eco-Car Tax Break |

Provides tax exemptions/reductions for HEVs and xEVs, sustaining the high demand for hybrid powertrains which leverage a smaller, less costly electric drive system alongside an optimized ICE. |

Japan Electric Vehicle Powertrain Market Segment Analysis

- By Propulsion Type: Hybrid Electric Vehicle (HEV)

The HEV segment is the foundational growth driver for electric powertrain components in Japan. Unlike the BEV segment, HEV demand is not solely dependent on charging infrastructure expansion; instead, it capitalizes on existing gasoline infrastructure while addressing stricter fuel efficiency standards. This sustained consumer preference, evidenced by HEVs constituting the vast majority of "electrified" sales in recent years, drives a continuous, high-volume requirement for specific, highly optimized powertrain elements: power control units (PCUs), high-efficiency motor-generators, and compact, high-power-density battery management systems. Automaker strategies, such as the Toyota-Mazda-Subaru collaboration on electrification-compatible engines, reinforce this demand stream, positioning the HEV powertrain as the market’s volume workhorse for the foreseeable future. The necessity centers on components that minimize weight, maximize thermal efficiency, and integrate seamlessly with the internal combustion engine.

- By Vehicle Type: Passenger Car

The passenger car segment represents the overwhelming majority of total EV powertrain demand in Japan, capturing over 73.01% of the EV market revenue in 2024. This segment’s growth is directly correlated with two distinct consumer archetypes: the price-sensitive urban commuter and the higher-income household seeking advanced technology. The launch and subsequent stable sales of kei car BEVs, such as the Nissan Sakura and Mitsubishi eK X EV in 2022, directly increased demand for smaller-capacity, cost-optimized battery packs and motors tailored for urban use and shorter average driving distances (e.g., 811 km/month in the Kanto region). Concurrently, government incentives targeted at urban dwellers and upper-income groups further stimulate demand for sophisticated, larger-format BEV and PHEV powertrains, demonstrating a segmented but growing need for a diverse range of power electronics and thermal systems.

Japan Electric Vehicle Powertrain Market Competitive Analysis

The competitive landscape is characterized by established domestic automotive OEMs that are aggressively integrating powertrain manufacturing in-house or through tight keiretsu partnerships, contrasting with a nascent but growing presence of international BEV component suppliers. Dominant players leverage their long-standing expertise in hybrid electric vehicle technologies, translating to an immediate competitive advantage in high-volume, cost-optimized HEV powertrain component production.

- Toyota Motor Corporation

Toyota maintains a formidable strategic position, capitalizing on its decades-long dominance in HEV technology. The company's strategy emphasizes a "multi-pathway" approach to carbon neutrality, positioning HEVs as a core transitional product. Toyota announced in August 2022 a significant investment of 730 billion yen (US$5.6 billion) in Japan and the U.S. to boost the production of batteries for electric vehicles, with 400 billion yen dedicated to its Japanese facilities, including the Prime Planet Energy & Solutions Co. Himeji Plant. This capital injection directly targets vertical integration and scale-up of the Battery Pack and Battery Management System segments, ensuring internal supply chain resilience and a proprietary technological edge, particularly in its development of solid-state batteries.

- Honda Motor Co., Ltd.

Honda is actively recalibrating its portfolio, shifting its strategy to further enhance its HEV lineup for the transition period, with a goal of 2.2 million HEV sales by 2030. Concurrently, Honda is advancing its next-generation fuel cell module and BEV production. While Honda decided in June 2025 to revise its plan for a new, dedicated fuel cell module production plant in Moka City, Tochigi, to reduce initial capacity and delay full production, this pivot reflects a focus on optimizing investment in line with evolving global hydrogen and BEV market dynamics, while sustaining its core HEV powertrain business.

Japan Electric Vehicle Powertrain Market Developments

- September 2025: Toyota Launches Strategic Investment Subsidiary

Toyota announced the establishment of Toyota Invention Partners Co., Ltd. (TIP) with JPY 100 billion in capital. The subsidiary, alongside Woven Capital's new US$800 million Fund II, is aimed at accelerating strategic investment in next-generation technologies. This move signals an increased focus on disruptive innovation within the mobility ecosystem, including potential investments in advanced powertrain software, power electronics, and manufacturing processes.

- June 2025: Honda Revises Fuel Cell Production Plan

Honda Motor Co., Ltd. announced a change to its plan to establish a new production plant for its next-generation fuel cell module in Moka City, Tochigi, Japan. The revised plan will reduce initial production capacity and delay the timing for full production, leading Honda to opt out of a METI subsidy program. The adjustment reflects the company's reassessment of the global hydrogen market environment and a strategic realignment to ensure investment efficiency in its non-BEV powertrain portfolio.

- August 2022: Toyota Invests in Battery Production

Toyota announced an investment of 730 billion yen (US$5.6 billion) across Japan and the United States to boost production capacity for EV batteries, with 400 billion yen (US$3 billion) allocated to its Japanese plants, including the Himeji Plant of Prime Planet Energy & Solutions Co. The investment, with production commencing between 2024 and 2026, aims to increase the company's battery supply flexibility and meet the anticipated demand for both BEV and HEV architectures.

Japan Electric Vehicle Powertrain Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.917 billion |

| Total Market Size in 2031 | USD 2.283 billion |

| Growth Rate | 20.01% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Propulsion Type, Vehicle Type |

| Companies |

|

Japan Electric Vehicle Powertrain Market Segmentation:

- BY COMPONENT

- Battery Pack

- Transmission

- Power Electronics

- Battery Management System

- Thermal Management System

- Others

- BY PROPULSION TYPE

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

- BY VEHICLE TYPE

- Passenger Car

- Commercial Vehicle

- Others