Report Overview

Malaysia E-hailing Market - Highlights

Malaysia E-hailing Market Size:

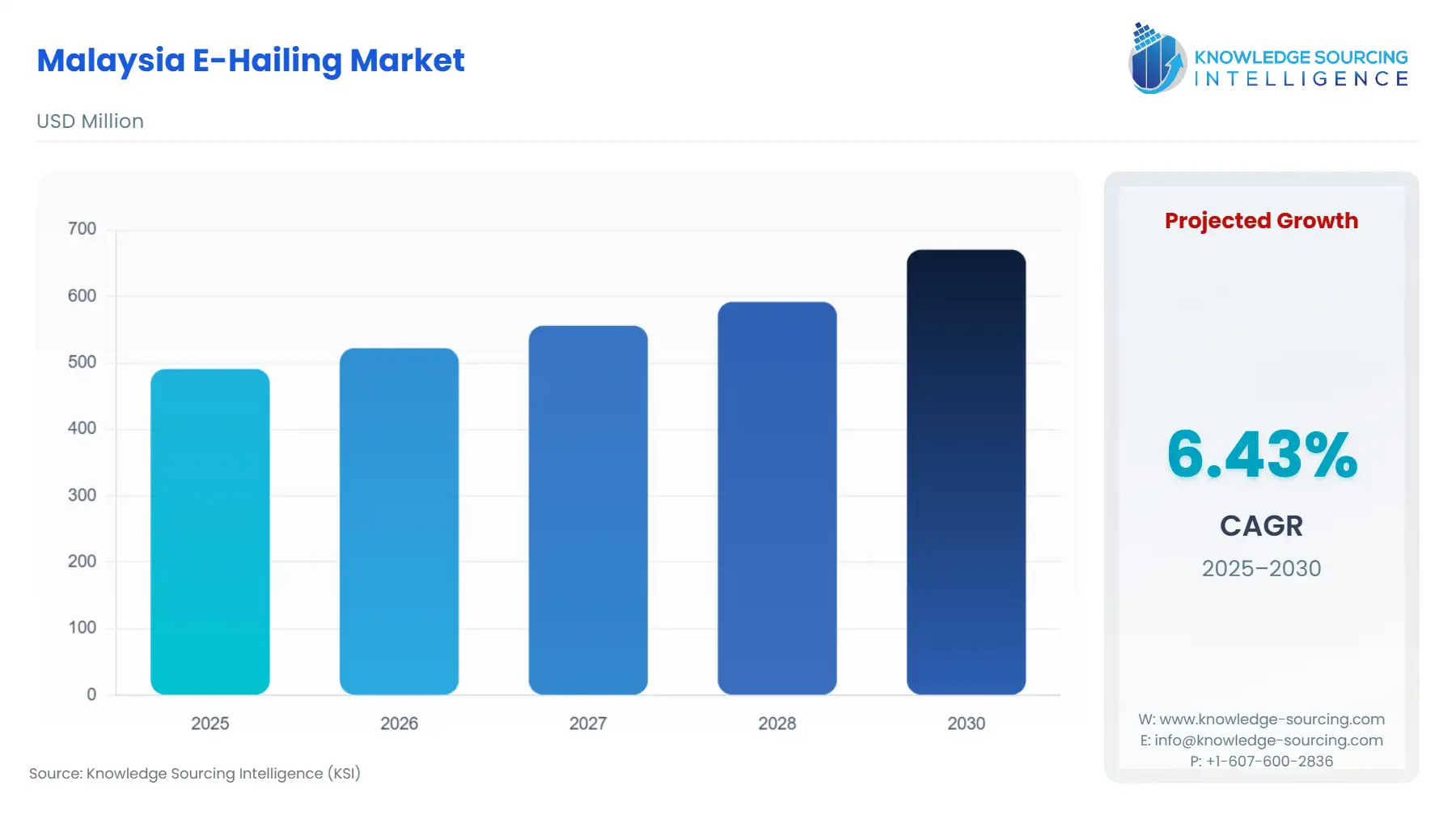

Malaysia E-Hailing Market, with a 6.44% CAGR, is anticipated to expand from USD 490.984 million in 2025 to USD 670.640 million by 2030.

The e-hailing market in Malaysia is experiencing rapid growth due to factors of urbanisation, increasing smartphone penetration and demand for transportation that is convenient. Ride-hailing services are the most dominant form of e-hailing transportation, providing cars, motorcycles and taxis via a mobile app on a smartphone. Major players in the e-hailing marketplace have adopted strategies to focus on safety, affordability, and seamless app-based digital payments to capture consumers. The rise of adoption among corporates and tourists, as well as government strategies for smart mobility solutions, are also contributing to the ongoing growth of the e-hailing market in Malaysia.

Malaysia E-hailing Market Overview & Scope

The Malaysian E-hailing Market is segmented by:

- Service Type: Ride-hailing services dominate the market in Malaysia for e-hailing, which people can access, whether it's app-based taxis or private cars for commuting in urban areas.

- Device Type: Smartphones capture the largest share because almost all e-hailing bookings happen via mobile apps on smartphones.

- Vehicle Type: Four-wheelers will account for a larger share of the travel, as being comfortable, safe, and being family and corporate popularities have created a large share and are the primary vehicles for premium and day-to-day ride-hailing decisions.

- End User: Personal users are expected to account for the largest share of the market, as they are the largest group of users of e-hailing.

- Region: The Georgetown e-hailing market is continuing to develop sustained momentum, enabled by developed urban centres and tourism. Ride-hailing alternatives that are typically booked through Smartphones dominate, and the market utilises both two-wheelers and four-wheelers

Top Trends Shaping the Malaysian E-hailing Market

- Integration of digital payments: The cashless transactions via mobile wallets are becoming standard across e-hailing platforms.

- Expansion of multi-modal services: Providers of e-hailing services are adding motorbikes, e-scooters, and other options to diversify offerings.

- Focus on safety and hygiene: There are enhanced safety features and sanitisation measures that are driving user trust post-pandemic.

Malaysia E-hailing Market Growth Drivers vs. Challenges

Drivers:

- Tourism: The increase in tourism is the primary driver of this market. In 2024, the country received 25 million international tourist arrivals - a 24.2 per cent increase from the previous year. Tourism revenue rose to 102.3 billion ringgit, whilst the Gross Value Added of Tourism Industries (GVATI) totalled 251.5 billion ringgit, of which 14.0 per cent is to GDP, a rise from 12.8 per cent in 2023.

Challenges:

- High Competition: Many challenges will have an impact on profitability. High competition, regulatory uncertainties, traffic congestion, increasing operational costs, and unpredictable fuel prices are examples of these challenges.

Malaysia E-hailing Market Regional Analysis

- Kuala Lumpur: The e-hailing market in Kuala Lumpur is rapidly evolving, fueled by the demands of urban commuters and travellers. The ride-hailing sector leads the market, with smartphones as the main booking device. Four-wheelers are the dominant means of transport, while convenience, lower fares, and safety characteristics continue to attract B2C users.

Malaysia E-hailing Market Competitive Landscape

The market has many notable players, including Riding Pink, Maxim Service, Grab, Bolt, Suol Innovations Ltd, and Kumpool Sdn Bhd, among others.

- Expansion: In June 2025, Bolt expanded its business to Klang Valley, Malaysia. They are offering 50% off their first 7 rides (maximum RM 10 per ride), while drivers pay a market-leading 15% commission.

- Collaboration: In January 2024, Grab Malaysia announced its supporting role as the 'Official e-Hailing and Food Delivery Partner' for Harimau Malaya. It will be pushing the national football team forward by harnessing the power of technology and innovation that the company is recognised for.

Malaysia E-hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Malaysia E-Hailing Market Size in 2025 | USD 490.984 million |

| Malaysia E-Hailing Market Size in 2030 | USD 670.640 million |

| Growth Rate | CAGR of 6.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Kuala Lumpur, Georgetown, Johor Bahru, and Others |

| List of Major Companies in the Malaysia E-hailing Market |

|

| Customization Scope | Free report customization with purchase |

Malaysia E-hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- End User

- Personal (B2C)

- Corporates (B2B)

- By City

- Kuala Lumpur

- Georgetown

- Johor Bahru

- Others

Our Best-Performing Industry Reports:

Navigation:

- Malaysian E-hailing Market Key Highlights:

- Malaysia E-hailing Market Overview & Scope

- Top Trends Shaping the Malaysian E-hailing Market

- Malaysia E-hailing Market Growth Drivers vs. Challenges

- Malaysia E-hailing Market Regional Analysis

- Malaysia E-hailing Market Competitive Landscape

- Malaysia E-hailing Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 8, 2025