Report Overview

North America Shampoo Market Highlights

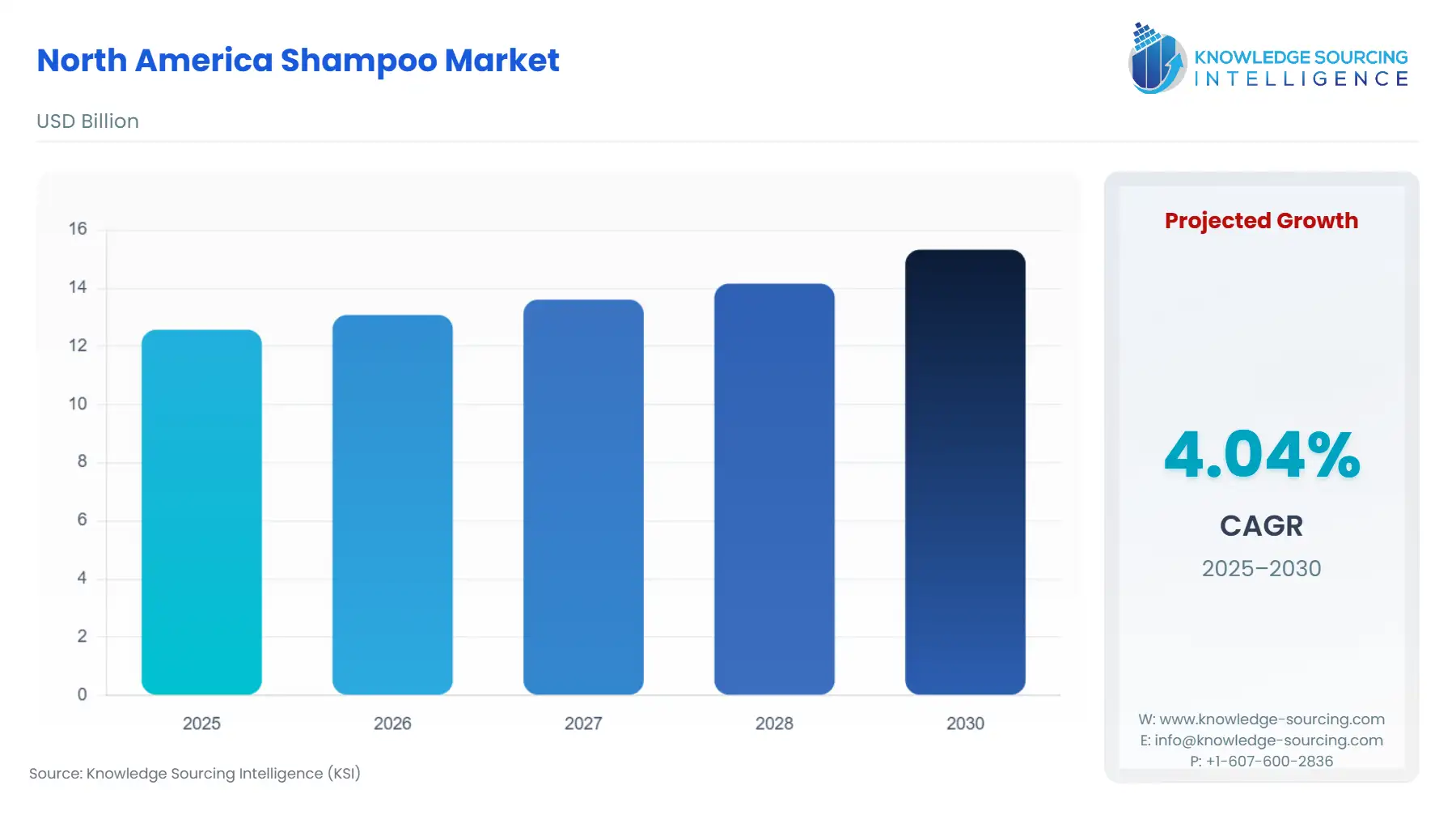

North America Shampoo Market Size:

The North America Shampoo market is estimated to grow from USD 12.574 billion in 2025 at a CAGR of 4.04% to USD 15.328 billion in 2030.

The North American shampoo industry worldwide is driven mainly by growing awareness of personal grooming and hygiene among consumers, especially higher disposable incomes in developing economies. Nowadays, lifestyle changes and living in cities have resulted in a higher demand for premium and unique hair care products, including color-protect shampoos, shampoos with herbal ingredients, and products for dandruff in North America. Changes in social media, new celebrity endorsements, and different beauty trends inspire companies to develop and differentiate their products. The development of e-commerce and enhanced distribution networks also has a significant part to play in increasing market access and consumer reach globally.

North America Shampoo Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The North America Shampoo market is segmented by:

- Product: The North American shampoo market is divided into medicated/special purpose and non-medicated/regular products. The non-medicated/regular segment remains the market leader because of its extensive availability, affordability, and high consumer appeal. They are readily available in supermarkets, drugstores, and pharmacies, making them convenient for daily use. Their over-the-counter status and compatibility with daily hygiene practices support their large market share. Meanwhile, sales in the medicated segment are rising since more people are aware of scalp care, and dandruff and psoriasis are becoming more common.

- Application: The market for North America is organized into domestic and commercial applications. The high demand for personal hygiene causes the residential segment to make up a significant part of the market. Consumption of baby shampoos and special products for a sensitive scalp has also increased in the segment. Celebrities, influencers, and advertisements designed to increase consumer awareness are all increasing demand. The commercial segment, such as hospitality services, spas, and salons, is also increasing steadily, led by an increasing demand for premium hair care products of the quality found in salons.

- Distribution Channel: North America's shampoo industry is divided between online retailers, convenience stores, supermarkets and hypermarkets, and others. Supermarkets and hypermarkets continue to be the leading channel because of product visibility, promotions in the store, and customer preference to check personal care products physically. Nevertheless, the retailing from online channels is also picking up a huge pace, particularly after the pandemic, thanks to convenience, assortment, and subscription-based concepts. Most consumers also base their choice on reviews and online marketing, further stimulating web growth. Convenience stores have a small but steady contribution to impulse and travel-size buying.

- Region: In North America, the U.S. market is anticipated to dominate the shampoo market, followed by Canada and Mexico. The U.S. has the most revenue because of a high demand for premium, organic, and personalized hair care products. Increased popularity of clean beauty and eco-friendly packaging is driving buying habits. In Canada, multicultural hair creates diversity in product ranges. Widespread demand for low-cost shampoo is seen in Mexico, though premium shampoos are also entering the market in cities. Wherever you look in the region, consumers are knowledgeable, brand rivalry is fierce, and continuous product formulation improvements shape the market.

Top Trends Shaping the North America Shampoo Market:

- Increase in Demand for Natural and Clean Ingredients

Among the most important changes in North American consumer behavior is the desire for shampoos containing clean, natural, and botanical ingredients. Consumers are now shying away from products containing tough chemicals such as sulfates, parabens, silicones, and artificial fragrances. Brands that provide ingredient transparency and support "free-from" messaging are sailing smoothly. This phenomenon is also being driven by the increased availability of ingredient knowledge via social media, beauty blogs, and health-oriented platforms. Consequently, even mass-market players are reformulating their offerings to meet clean beauty standards.

- Rise in Personalized Hair Care

The increasing need for customized and bespoke hair care is transforming the shampoo market in North America. People are no longer accepting one-size-fits-all solutions; rather, they are looking for shampoos that are customized to their specific hair type, texture, scalp health, lifestyle, and even geography. As a result, brands are emerging with AI-powered diagnostics, hair quizzes, and DNA-based customization. Customized shampoos guarantee improved performance, and this has inspired a wave of innovation in formulations and marketing. This appeal is especially true for millennials and Gen Z consumers who believe in self-expression and individuality.

North America Shampoo Market Growth Drivers vs. Challenges:

Drivers:

- Increased Government and Corporate Funding: Personal care with a focus on hair care is increasing, which is significantly contributing to product sales. Manufacturers of hair care products are effectively solving several hair issues, such as dandruff, thinning of hair, sebum secretion, and excessive hair loss, through the launch of anti-hair fall and anti-dandruff North America Shampoo. Product sales will continue to increase even further due to the remarkable growth of this trend. To diversify their portfolios, some prominent companies are introducing new products.

- Expanding Industry Applications: More industry participants are shifting towards customization to cater to a host of customer choices and hair care needs. Key players in the market are testing new ingredients that may enhance the quality of their products. The global market for protein- and vitamin-based products with numerous health benefits is increasing, and ingredients such as biotin, probiotics, and fruit vitamins are being researched. Personalization and the introduction of new products by large players will thus likely increase the growth of the global North America Shampoo market.

Challenges:

- Qubit Stability and Error Rates: One of the biggest challenges facing the growth of the global market is counterfeit hair care products, such as Shampoos, conditioners, and hair oils. Consumer trust in the market is undermined by counterfeit products because they raise questions about the authenticity and quality of hair care products. Consumers who encounter fake or sub-standard products might lose confidence, reducing their faith in buying the same. Genuine brands are often copied by illegal or counterfeit hair products, damaging the reputation of the original brand.

North America Shampoo Market Regional Analysis:

- United States: Since the US personal care industry is established, its customers are big spenders, and main companies like Procter & Gamble, Johnson & Johnson, and L’Oréal USA operate there, the country is projected to take the lead in the North American shampoo market. Its strong retail infrastructure, easy access to shampoos in all formats, and quick uptake of new organic and specialty variants make the US market leader.

Moreover, American customers are interested in green, customized, and transparent products, encouraging the shampoo industry to introduce more new and different products. Also, the pressure of online marketing, social media platforms, and e-commerce websites further propels development, making America the primary revenue earner and trendsetter in the North American shampoo market.

North America Shampoo Market Competitive Landscape

The North American shampoo market is competitive, with a mix of established players and specialized innovators driving its growth.

- Company Collaboration: In November 2024, CeraVe, the leading dermatologist-recommended skincare brand in the US and the unchallenged skincare winner adored by dermatologists and customers alike, announced its eagerly awaited entry into haircare. CeraVe Anti-Dandruff Shampoo and Conditioner breakthrough system that wipes away up to 100% of visible flakes without compromising the scalp barrier and also reduces mild to moderate dandruff symptoms, yet keeps hair healthy and soft.

- Product Innovation: In November 2024, WOW Skin Science, the trend-setting natural hair, skin, and lifestyle company, launched its innovative WOW Skin Science Apple Cider Vinegar shampoo, which hit shelves in the United States.

North America Shampoo Market Scope:

| Report Metric | Details |

| North America Shampoo Market Size in 2025 | USD 12.574 billion |

| North America Shampoo Market Size in 2030 | USD 15.328 billion |

| Growth Rate | CAGR of 4.04% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | United States, Canada, Mexico |

| List of Major Companies in the North America Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

North America Shampoo Market Segmentation:

By Product

By Application

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Geography

- United States

- Canada

- Mexico