Report Overview

Philippines Instant Coffee Market Highlights

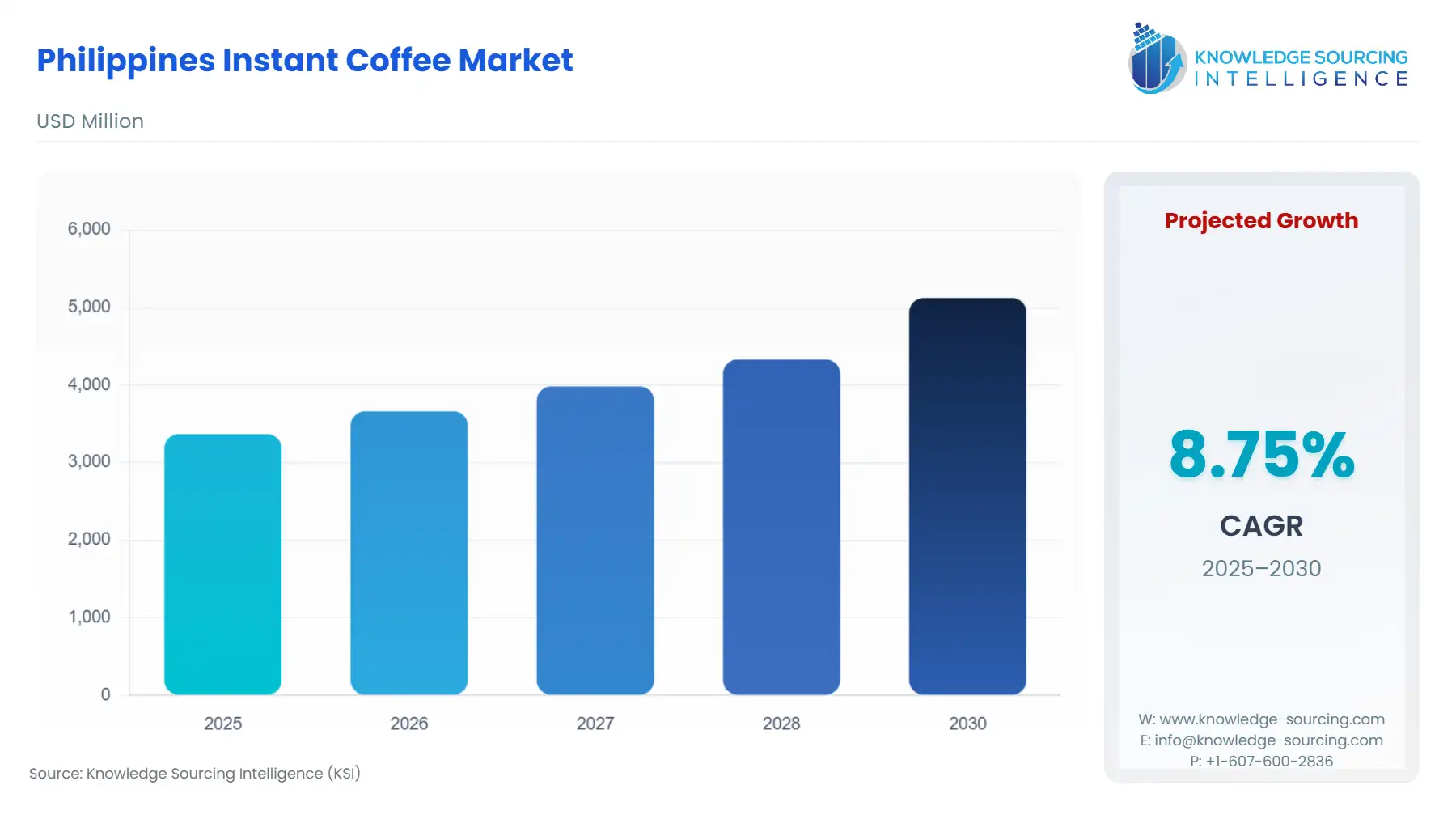

Philippines Instant Coffee Market Size:

The Philippines Instant Coffee Market is estimated to grow at a CAGR of 8.75%, from USD 3,368.856 million in 2025 to USD 5,124.424 million by 2030.

The Philippines instant coffee market anchors a vital segment of the nation's beverage sector, where convenience intersects with daily routines amid a burgeoning urban workforce. With estimated strength of 116.8 million people, many in dual-income households, instant formats dominate due to their affordability and ease traits that resonate in a context of limited local production. Green bean output hovers below one-third of consumption needs, compelling processors to blend domestic Robusta with imports, a dynamic that shapes pricing and availability. This imbalance underscores the market's sensitivity to global fluctuations, yet it also highlights instant coffee's role as a bridge between resource constraints and escalating per capita intake.

Philippines Instant Coffee Market Analysis

Growth Drivers

Rising urbanization and workforce participation propel demand for instant coffee by aligning with the need for rapid preparation in time-strapped routines. According to the data provided by the “World Urbanization Prospects 2025” issued by the United Nations Department of Economic and Social Affairs, the estimated total urban population in Philippines in 2025 stood at 65.136 million and is expected to grow up to 81.172 million. Likewise, the same report also stated that nearly 43.3% of the urban population resided in towns followed by 42% in cities. Likewise, according to the International Labor Organization (ILO), in 2024, the total labor participation was 61% with employment growth at 1.4%.

Hence, these demographics favour instant formats over labor-intensive brewing, as evidenced by the sector's dominance in sachet sales through convenience outlets. Industry Roadmap notes that dual-income families prioritize products that shave minutes off mornings, directly boosting instant uptake in city-centric channels annually. This shift creates a feedback loop as instant coffee embeds in daily habits, and its affordability also encourages habitual consumption thereby expanding market penetration among young professionals who view it as a low-barrier energy staple.

Private sector investments in farmer productivity further catalyze demand by ensuring steady raw material flows that keep prices competitive. Major market players namely Nestlé through its subsidiary Nestlé Philippines which id amongst the leading processor has invested in amplifying the local Robusta purchases via the “NESCAFÉ Plan”, which aimed to increase the local farmer’s coffee productivity by providing them hand-on training and fulfilling all their farming aspects. Furthermore, the government rehabilitation programs inject vitality by rehabilitating aging trees and bolstering processing infrastructure, which curbs supply volatility and heightens instant coffee's appeal as a dependable choice. Hence, establishment of strategies such as “Philippines Coffee Industry Roadmap” has played a major role in expanding the country’s coffee production to meet the required consumer demand. These measures, concentrated in Robusta-heavy regions thereby stabilizing green bean availability for spray-dried processing which is the backbone of instant variants, thereby preventing shortages that could spike prices and erode affordability. Resultantly, consistent supply fosters consumer confidence, driving annual demand uptick as families stockpile familiar brands without fear of disruptions.

Export-oriented quality upgrades, though secondary, indirectly amplify local demand by elevating Philippine Robusta's profile and attracting premium blending investments. The roadmap's emphasis on Good Agricultural Practices has certified farms like those in Davao del Sur, yielding award-winning beans that command higher farmgate prices. Processors integrate these into hybrid instant lines, blending local robustness with imported finesse to craft variants that appeal to aspirational consumers seeking "elevated everyday" options. This innovation loop fueled by efforts to support output rise sustains interest among middle-class buyers, who increased instant purchases in urban surveys, as enhanced quality perceptions justify modest premiums while maintaining core accessibility.

Climate adaptation strategies embedded in public-private pacts fortify long-term demand by mitigating yield risks that could otherwise constrain supply. Strategic collaboration between government and market players such as Nestlé has aimed to establish coffee centres and upskill farmers to improve their deployment of draught resistant varieties across production zones has preserved instant coffee's role as an economic staple, thereby encouraging sustained household consumption

Challenges and Opportunities

Supply shortages from low yields and aging trees constrain instant coffee demand by intermittently hiking prices, deterring budget buyers who comprise majority of the market. Production fluctuation has impacted consumption threshold, as senescent farms beyond productive age show less yield. This gap forces import reliance, exposing the sector to global volatility. Moreover, consumers, facing eroded purchasing power, deferred non-essential buys, evidenced a dip in low-end instant sales per PSA trade data, underscoring how fragility in upstream production directly mutes downstream pull.

Climate variability exacerbates these headwinds, slashing harvests and eroding confidence in instant coffee as a reliable staple. The lack of access to necessary infrastructure for coffee production especially during drought has impacted the beans quality with number of farms constantly shrinking. Hence, such shrinkage has prompted stockpiling premiums, alienating price-elastic households and stalling demand growth. Furthermore, market access barriers for smallholders further dampen demand by limiting quality beans for premium instant lines. With most of farms under 2 hectares, fragmented logistics inflate transport costs, thereby sidelining rural outputs from urban factories. This inefficiency favors imports, which captured maximum share of soluble forms and suppresses local variant diversity. Hence, this leads to consumers shun inconsistent quality and opting for brewed alternatives amid perceived unreliability, directly capping instant's convenience-driven appeal.

The public-private collaborations unlock opportunities to amplify demand through yield boosts and supply resilience. Governing authorities such as the Department of Agriculture signing MoU (Memorandum of Understanding) with market leaders namely Nestlé under the “Philippines Coffee Industry Roadmap 2021-2025” to bolster Robusta production in regions like Mindanao has played a major role in reigniting the production scale and improving the overall supply for instant blends.

Digital distribution channels present a demand multiplier by bridging rural-urban divides and tailoring to e-savvy buyers. E-commerce penetration showing constant progression fueled by the improvement in internet adoption and rapid urbanization has impacted the instant coffee buying with platforms like Lazada enabling direct farm-to-factory links that cut middlemen costs. This agility sustains instant availability during disruptions especially in harsh climatic conditions while personalized recommendations flagging low-sugar options drew more health-focused shoppers, elevating category pull in a market where offline still rules.

Raw Material and Pricing Analysis

Robusta beans dominate as the primary raw material for Philippine instant coffee, comprising over most of local cultivation and suiting spray-dried processes due to their robust flavour retention post-extraction. Supply chains hinge on smallholder farms averaging 1-2 hectares, where post-harvest drying and hulling adding more in the overall farmgate costs before milling into soluble forms. According to the data provided by the Philippines Statistics Authority, from January to March 2025, the farmgate price for arabica was PHP 290.97 per/kg, robusta was at PHP 265.75 per/kg, and liberica was at PHP 183.33 per/kg.

Supply Chain Analysis

The global supply chain for Philippine instant coffee originates in Robusta hubs like Vietnam and Indonesia, funneled through Manila ports to processors in Luzon and Mindanao. Key production nodes cluster in Quezon (CALABARZON) for blending and Tanauan for spray-drying, reliant on domestic greens augmented by imports. Logistical complexities arise from archipelagic geography, and inter-island shipping via roll-on/roll-off vessels which incur delays during typhoons, while rural collection from small farms bottlenecks hulling, adding costs.

Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

Philippines | Coffee Industry Roadmap 2021-2025 / Department of Agriculture (DA) | This framework mandates yield targets that will directly boosting raw bean supply for instant processing thereby stabilizing prices and elevating demand among affordability-focused consumers by ensuring consistent sachet availability. |

Philippines | Republic Act No. 10611 (Food Safety Act of 2013) / Department of Agriculture | Enforces hygiene standards from farm to factory, certifying more instant coffee facilities and reducing contamination recalls which builds consumer trust and drives uptake in urban channels where safety perceptions gate purchases. |

Philippines Instant Coffee Market Segment Analysis

By Product Type: Spray-Dried Instant Coffee

Spray-dried instant coffee commands the lion's share of the Philippine market, leveraging Robusta's heat-stable properties for mass production and aligning with consumer preferences for economical, robust brews. This segment thrives on urban demand drivers, where quick dissolution in hot water suits majority of dual-income households rushing through commutes. Key drivers stem from workforce expansion in business process outsourcing

By Region: CALABARZON

CALABARZON emerges as a demand powerhouse for instant coffee, driven by its industrial density and 14 million residents fueling on-the-go consumption. The region according to the Philippines Statistics Authority, nearly constitutes for 13.68% of bearing trees of Philippines, and is experiencing a positive uplift in strategic investments to bolster its economic outlook. According to the Department of Economy, Planning, and Development, in 2024, total approved investment in CALABARZON reached PHP 731.80 billion which marked a considerable growth over 2023’s investment figure. Such investment has provided opportunities to bolster crop production including coffee which is estimated to drive the regional market expansion.

Philippines Instant Coffee Market Competitive Environment and Analysis

The Philippine instant coffee landscape concentrates around a handful of processors, with players like Nestlé Philippines holding a significant share through scale and farmer integration followed by Universal Robina Corporation.

Nestlé through its subsidiary Nestlé Philippines anchors its positioning via the NESCAFÉ Plan, sourcing maximum of Mindanao's Robusta. The company’s key products include “NESCAFÉ Instant Creamy White Coffee”, “NESCAFÉ Instant Sugarfree Creamy White”, and “NESCAFÉ Instant Sugarfree Original”,which are majorly used in urban areas. The company through strategic partnership with governing authorities under the “Philippines Coffee Industry Roadmap 2021-2025” has further promoted sustainability branding.

Universal Robina Corporation (URC) carves a mass-market niche with affordable 2-in-1 mixes. The company emphasis on fulfilling the rural demand with official strategies focus on volume via hypermarket dominance. Likewise, its active participation in product development that meet the dynamic market trends has positively impacted its market presence. Company’s “Great Taste Instant” comprise blend of granulated BUO Ang Tapang and BUO Ang Lasa coffee.

Philippines Instant Coffee Market Developments

September 2025: Avalanche Coffee announced the launch of its 3-in-1 instant coffee in Philippines which formed a key part of the company’s business expansion strategy thereby supporting its global growth objective.

Philippines Instant Coffee Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 3,368.856 million |

| Total Market Size in 2030 | USD 5,124.424 million |

| Forecast Unit | Million |

| Growth Rate | 8.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Product Type, Distribution Channel, Region |

| Geographical Segmentation | Bicol, Cagayan Valley, CALABARZON, Others |

| Companies |

|

Philippines Instant Coffee Market Segmentation:

By Type

Robusta

Arabica

Liberica

By Product Type

Freeze-Dried Instant Coffee

Spray-Dried Instant Coffee

Others

By Distribution Channel

Online

Offline

Supermarket/ Hypermarket

Convenience Stores

Others

By Region

Bicol

Cagayan Valley

CALABARZON

Others