Report Overview

Photovoltaic Noise Barrier Market Highlights

Photovoltaic Noise Barrier Market Size:

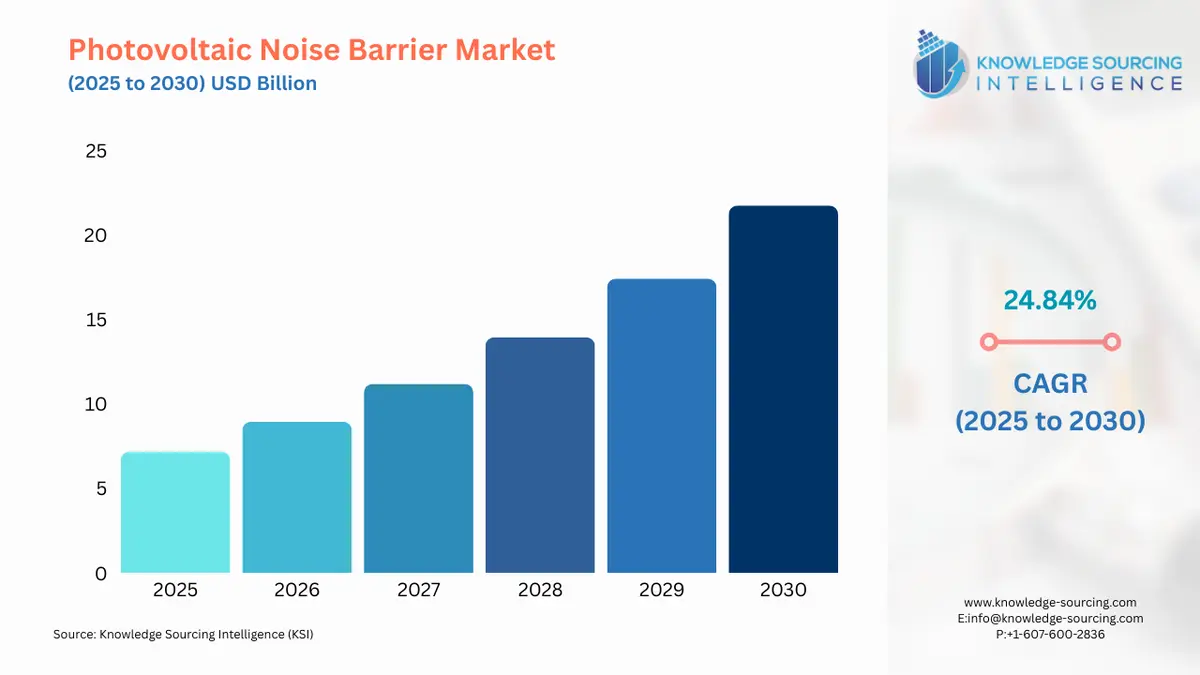

The Photovoltaic noise barrier market is expected to grow at a compound annual growth rate (CAGR) of 24.84% from US$7.172 billion in 2025 to US$21.738 billion in 2030.

Photovoltaic Noise Barrier Market Overview:

Photovoltaic noise barriers are wall-like structures that block traffic commotion and produce solar power. They are designed to address noise contamination close throughways and active roads, providing a substantial benefit over traditional noise barriers by combining noise diminishment with renewable vitality generation. Photovoltaic noise barriers (PVNBs) are crucial in the convergence of renewable energy infrastructure and environmental noise control. These structures have the potential to serve multiple purposes, as they combine conventional roadside noise barriers with utility-scale solar panels to deliver both noise reduction and electricity. PVNBs take advantage of existing linear infrastructure, roads, rails, and other built systems to produce clean energy without needing more land. Several prototype solutions demonstrate that the acoustic and electrical performance is achieved per meter of barrier. The market for photovoltaic (PV) noise barriers is positively impacted by increasing renewable energy requirements, rising infrastructure development, as well as government incentives for solar energy establishments. This can essentially increase the adoption of PV innovations in infrastructure projects initiated by many governments that utilize PV technologies, including noise barrier applications, in the coming years.

For instance, China's Belt and Road Initiative (BRI) aims to invest over $1 trillion in various infrastructure projects across various countries, including Asia, Europe, and Africa, including broad road and railway systems. These government development initiatives will result in noise pollution and will demand noise cancellation technology like PV noise barriers, which will expand the market in the future.

The global boom of solar capacity has acted as another key driver of growth. The Central Electricity Authority of India has reported India had an estimated total installed solar generation capacity of nearly 110.8?GW_AC as of May 31, 2025, contributing to 144?TWh produced in FY2024?25. The previous year’s total was about 116?TWh. The MNRE's role in the revised 2025 Quality Control Order confirms India's aim of maintaining a high quality of solar installations, by imposing that all modules will meet minimum efficiency requirements established by the Bureau of Indian Standards (BIS) 18% for mono?crystalline and thin film modules, and 17% for polycrystalline modules strictly 6 months from the date of publication of the Bureau of Indian Standards. Such quality requirements demonstrate that solar modules installed in PVNBs are designed to ensure durability and performance suitable for infrastructure.

Policy frameworks that support the deployment of PVNB also help in their deployment. The 2025 Union Budget reduced import tariffs on solar modules from 40% to 20% and solar modules were also reduced from 25% to 20%, effective February 2, 2025. Thus, the tariff reduction translates to a significant deduction in capital costs for developers of solar infrastructure. In addition, the Central Electricity Regulatory Commission continues to advocate social tariff reforms as part of solar government procurement for residential and commercial solar, with consultations on levelized generic tariffs commencing for FY? 2025–26.

The demand for PVNBs is also increasing as urbanisation and greater concern surrounding conventional noise rise. The World Health Organisation considers traffic noise to be a significant health hazard, and Solar-Inova notes that acceptable daytime levels in human habitation typically range between 50–65 dB, depending on the circumstance, but that PVNB are designed to be appropriate sound mitigation systems for this purpose. In higher traffic areas, PVNB can mitigate noise and generate electricity for lighting, EV charging stations, or electricity to feed back into the grid, providing both environmental and human benefits.

Additionally, technological innovation and advanced PV noise barrier systems are being developed for more efficient solar power generation and noise cancellation. It will act as a driving force behind the expansion of the photovoltaic noise barrier market in the coming years.

The photovoltaic noise barrier market is estimated to grow at a moderate rate. Research and development (R&D) enhances the efficiency, durability, and affordability of photovoltaic cells, which may lead to improvements in their technology. Hence, photovoltaic noise barriers are more effective than conventional means in reducing noise pollution while generating clean power from sunlight, which is leading to market growth.

India's total electricity capacity has soared to 452.69 GW, with renewable energy sources accounting for a notable share of the total power generation capacity. As of October 2024, renewable energy-based electricity generation capacity is 203.18 GW and constitutes more than 46.3 per cent of the nation's combined generating capacity. This represents a substantial transformation in India's energy portfolio, as the country embraces cleaner, non-fossil-fuel-based sources of energy, and the renewable energy trend continues to build momentum. A diverse collection of renewable energy resources contributes to the enormous renewable capacity. Solar power is the leader in this capacity at 92.12 GW, which is a critical step for a country like India that maximizes the use of sunlight. Wind power capacity is 47.72 GW, taking advantage of huge coastal and inland wind corridors present in the nation. Hydropower capacity, which is an important part of the renewable capacity, is coming from large hydro projects with a combined capacity of 46.93 GW, and small hydro project capacity of 5.07 GW, tapping into rivers and waterways across the country as another reliable renewable energy source.

Biopower, including biomass and biogas energy resources, contributes a combined capacity of 11.32 GW to the renewable energy total. These bioenergy projects are important for generators to harness waste agricultural biomass and other organic materials to generate power, and represent another way for India to diversify its sustainable energy sources. Collectively, these renewable resources can help the nation lower its reliance on traditional fossil fuels while aiding in the transition to a more sustainable and resilient energy future. The recent boom, propelled by favourable policies and financed by market investments, creates an enabling environment for photovoltaic noise barriers and renewable energy-generating infrastructure. This was based upon the sustainability in the traffic noise environment created by the photovoltaic noise barriers, as we know other projects such as wind turbines are unidirectional whereas integrating solar energy is multi-dimensional; for example, we can consider light through both energy, urban noise pollution reduction justifies the need for it, reducing economic losses by expanding a protection device to have a larger economic potential. In reverting to man-made noise in urban areas, solar as a growing energy in particular is consistent across different generations, producing consistent power output, Hence, it can reduce the commercially viable financial burden, and continually examine photovoltaic noise barriers as a new and viable sustainable infrastructure development across highways and railways.

Photovoltaic Noise Barrier Market Drivers:

- Rising infrastructure development is anticipated to propel market growth.

The market is primarily driven by the rapidly increasing urbanization, which requires broad advancement of transportation systems like highways, railways, and urban transit frameworks, which in turn requires noise mitigation arrangements such as noise barriers. As per the UNCTAD Handbook of Statistics 2023, the urban population is anticipated to reach 56.9%, with developed nations having a better share at 79.7% compared to the developing countries at 52.3% in 2022. In addition, the urban population will observe a constant increase, with it being 4,162 million in 2017 and rising to 4,540 million in 2022. It is predicted to grow to 6,605 million by 2050.

Further, with new roads, highways, railways, and airports being constructed in urban cities, noise pollution becomes a concern for adjacent communities. Photovoltaic noise barriers offer an arrangement by relieving noise amid construction and after the infrastructure is fully operational. For instance, in June 2022, Mitrex, a Toronto-based manufacturer of integrated photovoltaics, introduced the world's first sound-absorptive solar highway noise barrier, a photovoltaic noise barrier (PVNB). The obstruction offers a Noise Reduction Coefficient (NRC) rating of up to 0.7, solar power generation, and improved aesthetics for roads and highways, making the path for an economical future.

- Trade tariffs and shifting solar supply chains

Changes in global trade policy are significantly affecting the global PVNB markets. In the United States, tariff actions made under Section 301 and other trade-related actions have directly increased costs for solar modules and components fundamental impediments to PVNB implementation. As of January 1, 2025, United States tariffs on crystalline silicon solar cells and wafers from China doubled to 50%, and further tariffs were implemented throughout 2024 and 2025, further increasing costs. By early 2025, the United States had imposed a sweeping 20% tariff on all solar imports from China beyond the previously imposed Section 301 tariffs, which had effectively increased rates by 70%. Chinese tariffs are applied to modules, polysilicon, wafers, and bifacial panel materials that are commonly used for noise barrier use cases.

At the same time, U.S. restrictions on imports associated with solar components from Southeast Asia-from 14%-to 3500% of tariffs-are measures that were implemented to combat Chinese solar cells that were routed through Malaysia and Vietnam, causing impediments with the supply chains as a whole and forcing project developers to rethink cost structures, materials sourcing and feasibility

To respond to these pressures, U.S. policymakers have even more strongly reinforced the domestic incentive economics of solar under the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act. These laws offer a 30 % Investment Tax Credit (ITC) for solar installations through 2033, with potential add-ons raising the maximum to 50% under certain conditions. However, just as with trade tariffs, effects will offset tax incentives, making PVNB projects more costly despite subsidies.

Europe presents a more mixed situation. Germany's Renewable Energy Sources Act is continuing to reinforce solar integration through a series of feed-in tariffs and auction mechanisms, but growing material and labour costs create indirect economic barriers, increasing the prices of solar products.

The interaction of high rates of import tariffs combined with domestic incentives creates an often precarious but changing situation. For PVNB developers, this could involve choosing alternative supply chains (importing components from countries with zero or low tariff regimes), and creating more domestic manufacturing. Additionally, projects accepted in North America or Europe must now undertake a thorough cost accounting of components with possible tariffs, as well as their source, both to improve product margins but also to absorb price increases while making projects economically viable.

In an environment where trade defences drive up material costs and require infrastructure to be politically secure, the implications of government incentives as seen under the legislation introduced in the IRA must be understood to minimise or counter these increased costs. The impact of defensive trade taxes, combined with government incentives, should support the growth and stability of PVNB in markets like the U.S. and Europe; however, the trajectory of these markets depends on the way these challenges are addressed. The long-term success of the PVNB market depends on the transformative capacity of supply chain obligations and policy frameworks, which support domestic manufacturing while providing tariff-free production for solar technologies that integrate with the public infrastructure of electricity systems.

The consistent growth in renewable energy across many metrics indicates a planetary policy push towards cleaner infrastructure, which further enables the rise of PVNBs. When governments and developers alike seek to diversify land use and incorporate sustainable use of energy into road and rail networks, PVNBs offer a multifunctional option that satisfies energy and sustainability goals. The ability of PVNBs to address noise pollution while providing energy serves well in the context of broad national strategies to promote renewables and decarbonise the transport infrastructure. This means, in effect, that renewable expansion is not an incidental trend that supplements PVNB market uptake, but a direct supporter of renewable PVNB market uptake, especially in the context of road corridors.

Photovoltaic Noise Barrier Market Geographical Outlook:

- The market is projected to grow in the North American region.

The United States is experiencing a significant increase in noise pollution, which is anticipated to propel market growth in the long term. For instance, according to the estimates from the American College of Cardiology, those living in areas with high levels of noise pollution are at higher risk of suffering from heart attacks compared to others. In addition to this, one out of twenty persons in New Jersey suffered from a heart attack mainly due to noise pollution from air traffic, highways, and trains, among others. These factors represent a lucrative opportunity for applying photovoltaic noise barriers with favourable R&D investment in upcoming years by key players.

Additionally, the rising adoption of solar energy in the country will expand till the forecast period. It is driven by increasing environmental consciousness among the population and the functionality of Photovoltaic noise barriers in the generation of clean and renewable solar energy. For instance, as per the estimates of the Office of Energy Efficiency and Renewable Energy, five states of the United States, namely California, Hawaii, Nevada, Vermont, and Massachusetts, generated more than 15% of their total electricity using solar energy, with California leading at 27.5%. This represents that the growing penetration of solar energy will aid the development of photovoltaic noise barriers.

In 2020, Peachtree Corners emerged as the first in the United States to implement solar roadways. The deployed panels are expected to deliver 21% increased performance, creating a new solar system overall.

The demand for noise barriers will expand till the forecast period due to numerous government initiatives in the country. For instance, in 2022, in Massachusetts, solar noise barriers were placed across the highways and are anticipated to generate 802,000kWh of electricity on an annual basis.

Apart from this, the regulatory framework in the U.S. supports photovoltaic noise barriers (PVNBs) through federal noise mitigation policies and renewable energy incentives. Here are the U.S. regulatory frameworks relevant to Photovoltaic Noise Barriers (PVNBs).

- Noise Control Act (1972):

Supports noise mitigation through federal noise emission standards; enables state and local Departments of Transportation (DOTs) to implement noise barrier projects, including PVNBs.

- FHWA Type I/II Guidelines:

The Federal Highway Administration allows PVNBs in both new highway projects (Type I) and retrofitting of existing barriers (Type II), encouraging broader integration.

- State Renewable Standards (e.g., CA RPS, NY CES):

Renewable energy generated from PVNBs can be credited toward state-mandated renewable portfolio targets, improving their financial and environmental feasibility.

Furthermore, key market developments are supporting innovations in the photovoltaic noise barrier in the coming years. In December 2024, Healthy Infrastructure unveiled eSun Solar Noise Barriers, custom-designed for highway noise walls. These advanced barriers are compatible with any traditional post-and-panel systems, reducing noise pollution while generating clean, renewable energy, redefining the role of noise barriers in infrastructure.

Moreover, SoliTek, in partnership with construction firm Stalcorp, developed two innovative photovoltaic noise barrier projects in Lithuania as of June 2024. These projects mark a significant milestone as some of the first in both Lithuania and the broader Baltic region to combine solar energy generation with noise reduction infrastructure. The initiative reflects a strong alignment with the objectives outlined in the newly introduced European Solar Charter, promoting sustainable and multifunctional infrastructure solutions.

Furthermore, the application of photovoltaic noise barriers will expand multifold in the upcoming years due to the growing number of densely populated urban cities in the United States, which contribute to more noise pollution. For instance, according to the Centre for Sustainable Systems, around 89% of the country’s population is expected to live in urban areas by 2050.

Photovoltaic Noise Barrier Market Key Developments:

- Mitrex, one of the leading players in the United States market, introduced its latest product related to PVNB in 2022. The company is focused on bringing sustainable products across the North American region that provide an enhanced level of aesthetics for application on highways and roads. Therefore, Key developments in the market are anticipated to support innovations under the photovoltaic noise barrier in the coming years.

- Onyx Solar has completed over 500 projects globally, including photovoltaic noise barriers, showcasing its expertise in integrating PV technology into infrastructure.

Photovoltaic Noise Barrier Market Key Players:

- Solar Innova designs, manufactures, and supplies high-quality PV modules and systems that convert sunlight into energy. It also provides high-quality technical support to all, accommodating both technical and commercial needs. Solar Innova has fulfilled various internal quality control requirements and is consistently striving to enhance the quality and functionality of its technologies.

- SoliTek, a European family-owned company, is a top choice for a variety of solar solutions. It has been providing a comprehensive solar energy package since 2023 by adding energy storage batteries for residential use to its product line.

- Mitrex is a leader in sustainable solutions, skillfully fusing innovative architecture and solar technology. Every stage of the process, from automated manufacturing to solar product installation, is planned with environmental consciousness.

Photovoltaic Noise Barrier Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Photovoltaic Noise Barrier Market Size in 2025 | US$7.172 billion |

| Photovoltaic Noise Barrier Market Size in 2030 | US$21.738 billion |

| Growth Rate | CAGR of 24.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Photovoltaic Noise Barrier Market |

|

| Customization Scope | Free report customization with purchase |

The Photovoltaic Noise Barrier Market is segmented and analyzed as:

- By Configuration

- Top-Mounted

- Integrated

- By Solar Panel Type

- Monocrystalline

- Polycrystalline

- Thin-Film Solar Panel

- By Application

- Motorways

- Freeways

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Photovoltaic Noise Barrier Market Size:

- Photovoltaic Noise Barrier Market Highlights:

- Photovoltaic Noise Barrier Market Overview:

- Photovoltaic Noise Barrier Market Drivers:

- Photovoltaic Noise Barrier Market Geographical Outlook:

- Photovoltaic Noise Barrier Market Key Developments:

- Photovoltaic Noise Barrier Market Key Players:

- Photovoltaic Noise Barrier Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025