Report Overview

Saudi Arabia E-Hailing Market Highlights

Saudi Arabia E-Hailing Market Size:

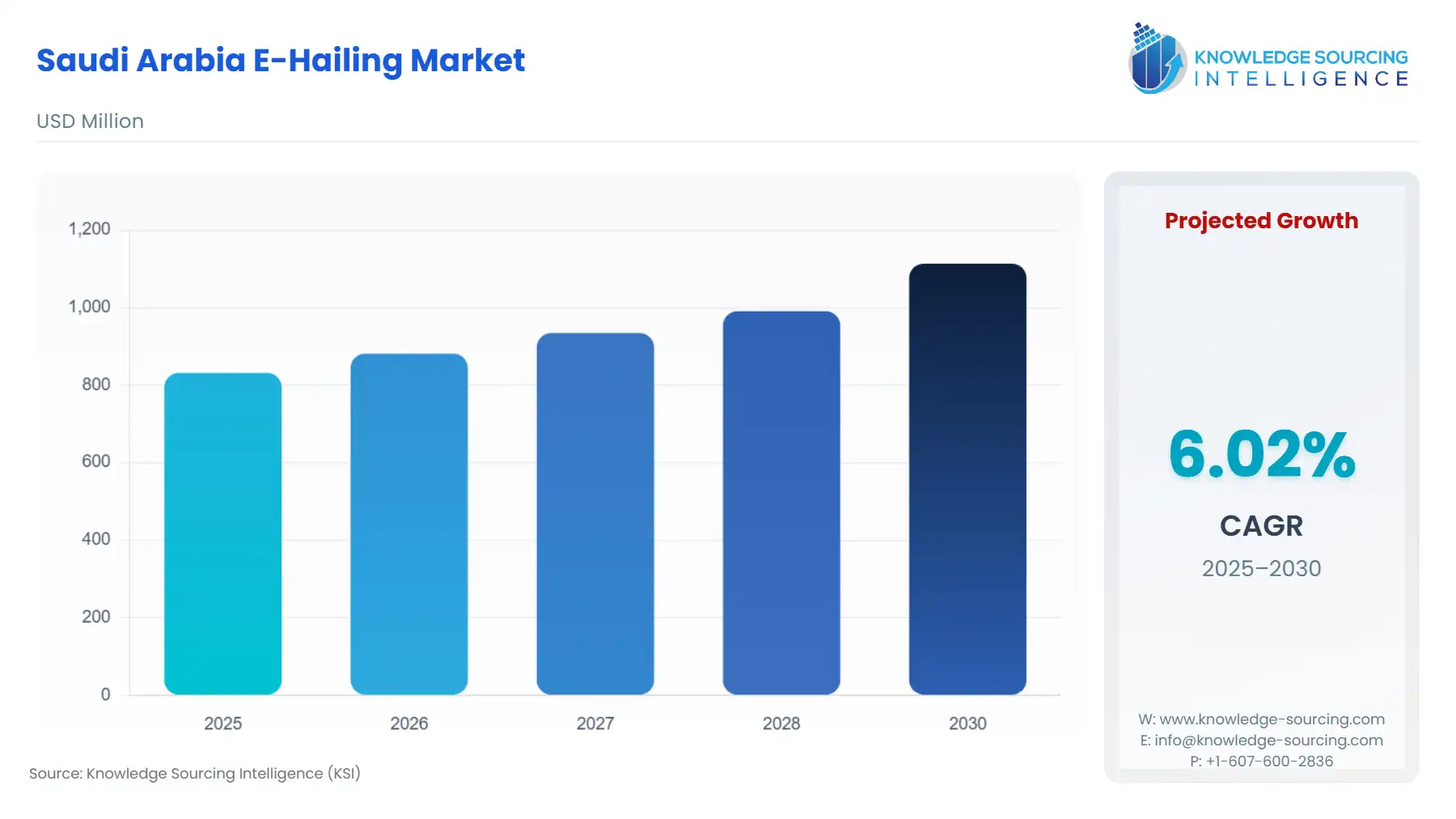

Saudi Arabia E-Hailing Market, with a 6.02% CAGR, is forecasted to expand from USD 831.560 million in 2025 to USD 1,113.652 million by 2030.

The E-Hailing Market in Saudi Arabia is undergoing a phase of significant growth, largely impacted by the digital transformation of the Kingdom, strong policy support, and increased consumer adoption of on-demand mobility solutions. One of the main reasons for the sector's rapid growth is the use of advanced technologies by the platforms. For instance, AI-driven routing, dynamic pricing, integrated safety systems, and real-time tracking to deliver rapid and reliable mobility experiences.

Improvements in strategy by the Public Transport Authority (PTA), cooperation of Saudization directives, and the Wasl digital compliance ecosystem have brought greater structure and transparency to the sector, thereby significantly boosting passenger confidence in the public transport system. The move to sustainability, mainly supported by the Saudi Green Initiative and national EV programs, is changing the strategies of the fleet as e-hailing operators introduce electric and low-emission vehicles.

Saudi Arabia E-Hailing Market Overview & Scope

The Saudi Arabian E-Hailing Market is growing significantly due to the rapid digital transformation, the increasing use of smartphones, and the government's strong support for smart mobility solutions under Vision 2030. Additionally, the demand for e-hailing services is being positively impacted by the rising adoption of electric vehicles in the Kingdom, aligning with its decarbonization targets, which is being facilitated by investments in EV infrastructure and clean transport initiatives. As a result of the increasing competition, firms are putting more resources into loyalty schemes, multi-modal integration, and partnerships with public transit operators for better market penetration.

Some of the main regulatory reforms that have a major influence on the e-hailing market in Saudi Arabia are the PTA public transport regulations for e-hailing that require the licensing of operators and drivers; the Saudization policy for ride-hailing that stipulates a higher proportion of Saudi national drivers; the E-Hailing Permit System (Wasl Integration) that guarantees the digital connection of platforms with government databases for compliance and safety; and the Women’s Driving Reform of 2018 that led to an increase in driver supply and greater access to mobility. These changes have not only improved transparency, safety, and operational accountability but have also facilitated the sector's formalization and rapid growth. According to the IEA report in May 2025, the public investment fund of the Kingdom has set a target to locally manufacture 150,000 electric vehicles (EVs) in 2026, and 500,000 EVs per year by 2030.

Saudi Arabia is seeing a shift in its e-hailing scenario from being a mere convenience-driven service to becoming one of the most essential sources of the national mobility ecosystem. Thus, the market is expected to witness long-term growth that will be supported by innovation, regulatory modernization, and the fact that consumers' expectations will keep evolving.

Major contributors to the Saudi Arabian E-Hailing Market are Uber Technologies Inc. and Bolt, two global players that have a strong brand image and availability of the service in many places. Moreover, domestic and regional platforms like Jeeny, Takamol Mobility, Kaiian, and CliX provide the market with services that are well accepted culturally and pricing strategies that are localized. New mobility models are introduced by companies like Indrive, which supports the negotiation of fares, while Ejaro, Ego, and Rehlacar focus on peer-to-peer vehicle sharing, car rentals, and flexible mobility options. Hence, these firms are collectively creating a varied, rapidly expanding, and increasingly decentralized mobility scene throughout the Kingdom.

The Saudi Arabian e-hailing market is segmented by:

- Service Type: Among the markets within the Saudi Arabia e-hailing market by service type, the ride-hailing segment is becoming the fastest-growing service type because users are willing to opt for fast, flexible, and demand-based travel services in urban centres.

- Device Type: Inside the markets within the Saudi Arabia e-hailing market by device type, the largest growing and most dominant class is smartphones, due to the country having an incredibly high smartphone penetration and strong mobile internet adoption.

- Vehicle Type: Among the markets within the Saudi Arabia e-hailing market by vehicle type, the fastest-growing and most leading class is the four-wheeler, as cars are the primary mode of travel for urban and inter-city travel within the country.

- End-User: The personal (B2C) segment of the Saudi Arabia e-hailing market by end-user is the one with the fastest rate of growth. This is because more individual users are using ride-hailing apps for leisure, travel for tourism, and daily commuting.

- Region: Najran’s fast rise is due to the changing shape of mobility in Saudi Arabia, while smaller, regional centers are growing at a faster rate.

Top Trends Shaping the Saudi Arabia E-Hailing Market

- Driving Women and Transforming Mobility

The legislation made it not only possible to create a larger pool of drivers but also helped create a larger market, given the increasing number of women in the workforce who needed dependable transportation to get to and from work. Ride-hailing services have adjusted by providing safer and more personalized service for female passengers and hiring women as drivers. This changing demographic forms a longer-term structural driver of growth and is creating an inclusive and mainstream ride-hailing environment.

Saudi Arabia E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Market Competition with Trends of Consolidation: Saudi Arabia's e-hailing market is already crowded with global leaders such as Uber and Careem leading the pack, while under pressure from a growing network of local players. Competitive pressures are forcing innovation in products and pricing, and have made customer service a competition. Meanwhile, the industry is consolidating through strategic M&A and partnerships that help operators attain scale while also driving down costs and fulfilling regulatory mandates more successfully. This is likely to be the continuing norm and will result in a market where only the most flexible platforms will grow.

- AI, Technology Integration, and the Prospects of Autonomous Transportation: In Saudi Arabia, e-hailing companies are using AI to forecast demand, predict drivers' locations, and the optimal routes; to reduce time to pick up, and eventually, through intelligent dispatching, reduce the pickup time of a rider. Saudi Arabia is taking its first steps towards autonomous mobility with pilot projects for autonomous cars and robotaxis in some smart cities such as NEOM. If implemented on a mass scale, autonomous fleets could help to reduce the cost of operations for platforms and would help Saudi Arabia’s goal of being at the forefront of futuristic mobility.

- High Smartphone Penetration and Digital Adoption: One of the strongest growth factors for the Saudi Arabian E-Hailing Market is the high penetration of smartphones and the accelerating digital adoption, resulting in a scenario where app-based mobility is spontaneously becoming the consumers' transportation choice. The Kingdom is among the top countries in the world in terms of smartphone usage and is supported by almost total 4G/5G coverage, affordable data plans, and the availability of digital services for all socioeconomic segments. Such a strong digital base has allowed the easy onboarding of users to e-hailing platforms, as they can simply download apps, set up payment methods, and book rides.

The Communication Space and Technology Commission report displayed multiple indicators and figures that illustrated the users' behaviour and online activities in the Kingdom during 2024. According to the report, internet penetration in Saudi Arabia has reached 99%. Additionally, mobile phones were the most popular gadgets for internet access, accounting for 99.4% of the total usage as opposed to other devices.

Saudi Arabia is listed as one of the five leading G20 countries in terms of mobile internet speed, which is a clear indication of the country's digital infrastructure advancement and development. This has been a significant factor in the growth of internet penetration and in making its services accessible to a larger number of people

Challenges:

- Strict Regulations and the Cost of Compliance: The Transport General Authority (TGA) regulates the Saudi e-hailing industry, enforcing stringent regulations on driver qualifications, vehicle eligibility, safety requirements, and pricing schemes. For example, drivers are subject to background checks and fines for trip cancellations, and cars must meet certain age and quality requirements. Although these regulations protect consumers and guarantee service quality, they also raise platform operating costs and restrict fleet management flexibility.

Saudi Arabia E-Hailing Market Segmentation Analysis

- By End-User: Personal (B2C)

Based on end-user, the Saudi Arabian e-hailing market is segmented into personal (B2C) and corporate (B2B). Ongoing efforts to bolster digitization, followed by geographic shifts, have provided new growth prospects for the application of digital platforms for personal use. Similarly, the growing traffic congestion has led people to opt for better alternatives that assist in daily commutes and offer high safety & convenience. Hence, e-hailing fulfils such criteria, thereby making it an ideal choice for individuals.

Moreover, ride-hailing services have played a major role in meeting urban area mobility. As the urban population increases constantly, the prevalence of ride-hailing is anticipated to grow simultaneously. According to the data provided by the World Bank, in 2024, nearly 85% of the Saudi Population lived in urban areas. Similarly, e-hailing has provided the most convenient way for women to commute daily. For instance, according to the “Uber Saudi Arabia Economic Impact Report 2024”, nearly 74% of women used the app to go shopping, while 59% used it to visit restaurants & cafes.

Furthermore, domestic tourism is also growing in Saudi Arabia, with people travelling across cities for vacation and leisure purposes. According to the Ministry of Tourism, in 2024, the total domestic tourism spending reached SAR 115.28 billion, and the same source stated that the majority of travelling was for personal leisure. Hence, such a high frequency of personal travelling has further impacted the usage of e-hailing.

Likewise, the improved digital infrastructure that caters to the growing demand for high-speed bandwidth, followed by booming smartphone penetration, has also propelled the usage of e-hailing platforms. Major companies such as Uber have a well-established presence in Saudi Arabia, where the company offers various services, including Uber X, Uber X-Saver, and Uber Share. The company launched “Uber Teens” in 2024, which offers ride service for teens aged 13-17 years.

Saudi Arabia E-Hailing Market Regional Analysis

- Najran: Expanding footprint of digital transportation as a service is powered by growing smartphone adoption, minimum qualification requirements, and regulatory facilitation of a broader driver population. In regions like these, it's easier to get growth due to limited alternative transport infrastructure, local demand upswing, or the strategy of platforms to onboard riders as well as drivers.

- Riyadh: The capital of Saudi Arabia is experiencing a significant technological transformation, followed by the establishment of major policies and initiatives, such as “Saudi Vision 2030,” which aims to turn major Saudi Arabian cities into modern, vibrant metropolises. Such favourable polices have bolstered digitization in Riyadh, with people using platforms for shopping as well as daily commuting.

Likewise, as a major tourist destination, Riyadh further holds high market potential for e-hailing as tourists use it to book affordable and convenient transportation. According to data provided by the Ministry of Tourism, in 2024, the total number of domestic tourists who visited Riyadh reached 17.60 million, marking a significant 7.64% growth over the number of tourists who visited the city in the preceding year.

Additionally, the same source also stated that the total spending of domestic tourism was SAR 29.49 billion. The growing internet penetration, followed by smartphone adoption, has also played an integral role in driving e-hailing services in the city. Similarly, the strategic collaboration of major market players such as Uber, Careem, and Bolt, which offer an extensive range of services, has defined the consumer demographic in Riyadh.

Growing traffic congestion has impacted the ownership of personal vehicles in Riyadh, with average commute timing peaking at hours. Such long hours further impact the overall fuel consumption of passenger vehicles, and e-hailing offers a cost-effective way to travel in local areas without compromising comfort, owing to which its preference over personal vehicle ownership is gaining traction in the city, thereby augmenting the overall market expansion.

Saudi Arabia E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including Uber, Bolt, Careem, Jeeny, Takamol Mobility, Indrive, GAZAL, Ejaro, Ego, and Rehlacar.

- Acquisition: In February 2024, the Saudi Arabian investment firm Tasaru Mobility Investments said it would strategically purchase a 38% minority stake in Holon, a Benteler subsidiary, to increase sales of fully electric and autonomous vehicles. To support regional ride-hailing and ride-pooling businesses, a production facility will be established in Saudi Arabia, advancing the kingdom's goal of sustainable mobility.

Saudi Arabia E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Growth Rate | CAGR during the forecast period |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Riyadh, Mecca, Medina, Najran, and Others |

| List of Major Companies in the UAE E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Saudi Arabia E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Region

- Riyadh

- Mecca

- Medina

- Najran

- Others