Report Overview

South Korea E-Hailing Market Highlights

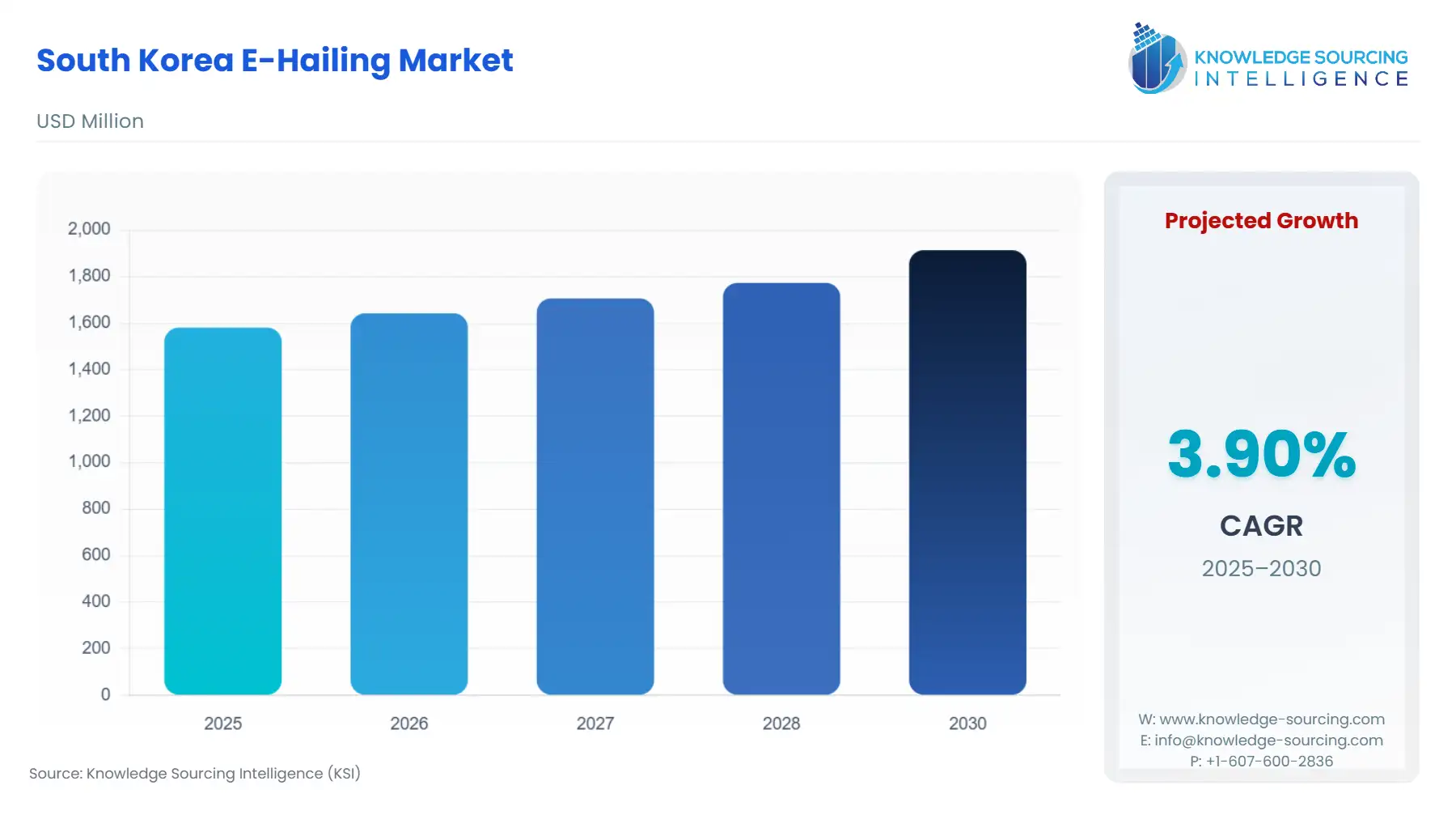

South Korea E-Hailing Market Size:

South Korea E-Hailing Market is expected to increase at a 3.90% CAGR, growing from USD 1.581 billion in 2025 to USD 1.914 billion by 2030.

The South Korea e-hailing market is promoted with the rise in smartphone adoption, along with the increase in urbanization and population density in major regions of the country. Additionally, the increase in smart autonomous vehicles in the country is boosting the demand for e-hailing services to increase operational efficiency and is also appealing to more users.

South Korea E-Hailing Market Overview & Scope

The South Korea E-Hailing Market is segmented by:

- Service Type: The ride-sharing service type is steadily growing in the country among the short-distance commuters, while the ride-hailing is a major segment due to convenience and easy booking, and consumers who are concerned about sharing rides with strangers.

- Device Type: The smartphone device type is expected to hold the largest share because of growing reliance on mobile e-hailing apps and internet penetration.

- Vehicle Type: The four-wheeler vehicle is anticipated to hold a significant share due to affordability and increased demand for spacious and premium vehicles.

- End User: The personal segment is estimated to grow at a substantial pace due to an increase in urban commuters and growing tourism in the country.

- Region: Seoul is the largest segment in the South Korea e-hailing market share due to the high population in the region, which leads to an increase in traffic congestion. The major population in the city utilizes popular e-hailing services such as Kakao Mobility.

Top Trends Shaping the South Korea E-Hailing Market

- Rise of Electric and Autonomous Vehicles:

- There is a rise in the adoption of smart autonomous ride-hailing services in South Korea, especially in congested city locations like Gangnam and other complex city centres.

South Korea E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Increase in Smartphone Ownership: The increase in smartphone adoption, along with tech tech-savvy population, is promoting the demand for fast and convenient mobility alternatives. Moreover, the utilization of app-based e-hailing platforms is growing in the country due to the growth in digitalization and internet penetration across the country. According to data from Invest Korea, the mobile internet access in the households of the country accounted for the highest globally with 99.98 percent in 2022, along with a significant mobile internet speed of 1050 Mb per seconds, which is the 2nd highest.

- Rise in Traffic Congestion and Population: The high population rate in the country especially in major cities such as Seoul and Busan, is leading to an increase in traffic issue which is promoting people to shift towards more convenient alternatives from private vehicle ownership or public transport services which is promoting e-hailing services For instance, according to the Seoul Metropolitan Government data, the Seoul population in the first quarter of 2025 was reported as 9.603 million. Further, the urban population in the country was 42.176 million in 2024, which is an increase from 42.123 million in 2023.

Challenges:

- Driver Shortages and High Operational Costs: The issue related to the lack of drivers in the country, along with labour rights and strict competition with traditional taxis, is expected to hamper the e-hailing service in South Korea. Additionally, the fluctuation in the price of fuels and the high cost of EVs are also expected to challenge the market.

Regional Analysis of the South Korea E-Hailing Market

- Busan: it is a major port city of South Korea with strong tourism, which is promoting e-hailing services for the travel of tourists and high airport transfer.

South Korea E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including Uber Technologies Inc., Kakao Mobility, SoCar, TADA (VCNC Co., Ltd.), and MOVV, among others.

- Collaboration: In June 2025, the Seoul Metropolitan Government announced the expansion of the trial of the late-night autonomous taxi services across the Gangnam region. It involves operating three taxi services, which are free and run at night, and can be hailed using an app. This is done to avoid accidents and congestion in major areas of Seoul.

South Korea E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| South Korea E-Hailing Market Size in 2025 | USD 1.581 billion |

| South Korea E-Hailing Market Size in 2030 | USD 1.914 billion |

| Growth Rate | CAGR of 3.90% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Seoul, Busan, Incheon, and Others |

| List of Major Companies in the South Korea E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

South Korea E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Province

- Seoul

- Busan

- Incheon

- Others

Our Best-Performing Industry Reports:

Navigation:

- South Korea E-Hailing Market Size:

- South Korea E-Hailing Market Key Highlights:

- South Korea E-Hailing Market Overview & Scope

- Top Trends Shaping the South Korea E-Hailing Market

- South Korea E-Hailing Market Growth Drivers vs. Challenges

- Regional Analysis of the South Korea E-Hailing Market

- South Korea E-Hailing Market Competitive Landscape

- South Korea E-Hailing Market Scope:

- Our Best-Performing Industry Reports: