Report Overview

Spanish E-Hailing Market - Highlights

Spanish E-Hailing Market Size:

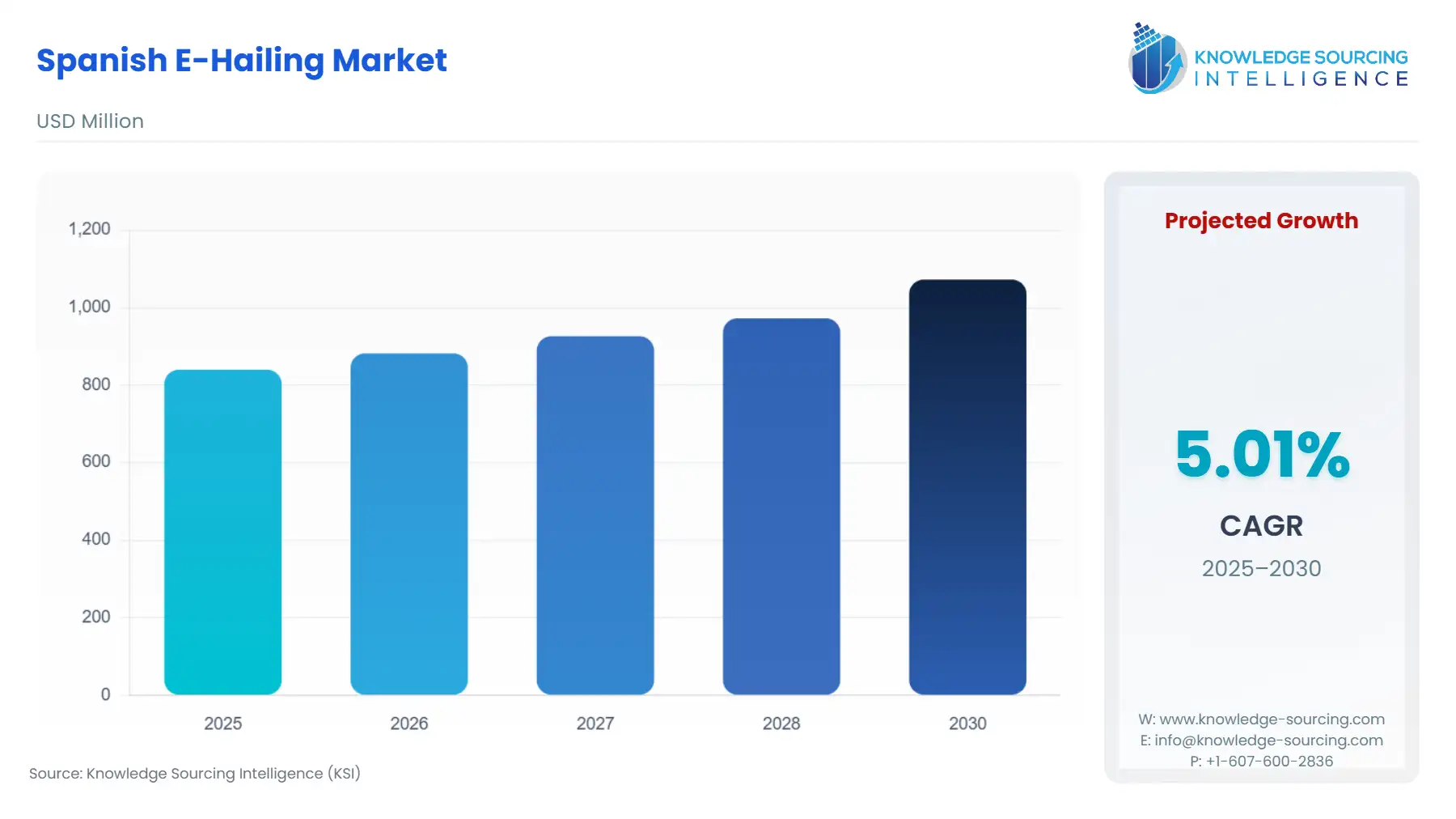

Spanish E-Hailing Market is expected to grow at a 5.01% CAGR, increasing from USD 839.876 million in 2025 to USD 1,072.596 million by 2030.

The Spanish E-Hailing Market is focused on consistent marking, supported by rising urbanization, saturated smartphone penetration, and a shift towards convenience, affordability, and reliability in transportation. With the congested populations in major cities in Spain, such as Madrid, Barcelona, Valencia, and Seville, e-hailing is becoming a popular alternative to vehicle ownership, public transport, and taxis. Utilizing advanced technologies, including GPS tracking, enabling digital payments, and using AI for optimal routes has given rise to an unprecedented level of end-user experience, leading to higher adoption rates. Alongside this, growth in sustainable mobility initiatives and government measures to reduce carbon emissions are prompting more e-hailing services to focus on pure electric and hybrid fleets.

Spain E-Hailing Market Overview & Scope:

The Spain e-hailing market is segmented by:

- Service Type: Among the markets within the Spanish e-hailing market by service type, the ride-hailing segment is becoming the fastest-growing service type because users are willing to opt for fast, flexible, and demand-based travel services in urban centres.

- Device Type: Inside the markets within the Spanish e-hailing market, by device type, the largest growing and most dominant class is smartphones, due to the country having an incredibly high smartphone penetration and strong mobile internet adoption.

- Vehicle Type: Among the markets within the Spanish e-hailing market by vehicle type, the fastest-growing and most leading class is the four-wheeler, as cars are the primary mode of travel for urban and inter-city travel within the country.

- End-User: The personal (B2C) segment of the Spain e-hailing market by end-user is the one with the fastest rate of growth. This is because more individual users are using ride-hailing apps for leisure, travel for tourism, and daily commuting.

- Region: Madrid's dense population, position as the nation's capital, and significance as a major business and tourism hub make it the region with the fastest rate of growth.

Top Trends Shaping the Spain E-Hailing Market

- Sustainability and the Transition to Green Mobility

- One of the trends within the e-hailing market in Spain is the increasing transition toward sustainability, as operators are likely to adopt electric and hybrid vehicles as part of the European Union’s Green Deal and national decarbonization initiative. With local governments (especially in metropolitan areas, including Madrid and Barcelona) working towards low-emission zones, establishing green fleets, and encouraging partnerships with e-hailing providers to promote environmentally friendly transportation options, companies are being motivated to adopt a more environmentally friendly stance in their reports and services. While this trend can reduce environmental footprint, it also changes the way a company is viewed by consumers, as more environmentally and socially conscious consumers look for greener ride options.

Spain E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- The Role of Tourism in Accelerating Growth: Tourists are contributing to the demand for e-hailing services in Spain, especially in Barcelona, Madrid, Valencia, and Seville, due to its position as one of the most visited countries in the world. Tourists (international and domestic) find it easier to use e-hailing services because they provide language support, price transparency, and safety assurances that traditional taxis cannot accommodate. With more tourists entering Spain during the peak summer months, as well as the festive tourist seasons, tourist demand is encouraging operators to add more cars and service times in tourist-intensive locations.

- Shifts in Consumer Preferences and Lifestyle: The cultural shift in Spain away from private vehicle ownership and toward shared mobility solutions is being driven by the country's urban populations and younger generations. Customers are increasingly using ride-hailing for daily commuting, leisure, and intercity travel due to rising fuel prices, expensive parking, and increased environmental consciousness.

Challenges:

- Limited Use of Three-Wheeler and Two-Wheeler Services: Two-wheeled and three-wheeled vehicles are common in Asia as they offer fast, cheap travel, but laws on street traffic are stricter, and a market niche has not been developed, so Spain has little interest in these vehicles. This lack of service diversity makes e-hailing less competitive for low-value, short-distance trip segments, especially in cities with significant traffic where such services would be useful.

Spain E-Hailing Market Regional Analysis

- Madrid: The city has a large population of office workers, daily commuters, and tourists from other countries, all of whom mainly depend on e-hailing services for quick and easy transportation. The city is aggressively supporting sustainable mobility projects, which have sped up the incorporation of hybrid and electric cars into e-hailing fleets and are in line with Spain's environmental goals.

Spain E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including Cabify, Uber, Bolt, Free Now, PideTaxi, TaxiClick, Reby, GetTransfer, Amovens, and Acciona Mobility.

- Collaboration: In May 2025, Bird, a global micromobility provider, partnered with FREENOW, Europe's multi-mobility app that focuses on taxis. The FREENOW app now incorporates almost 16,000 e-scooters and e-bikes from Bird in Italy, Spain, and France.

- Acquisition: In April 2025, by purchasing Cable Energía, the business that owns and runs the Shell Recharge network outside of Shell's service stations in Spain and Portugal, ACCIONA has made a major move in its electric mobility strategy.

Spain E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Spanish E-Hailing Market Size in 2025 | USD 839.876 million |

| Spanish E-Hailing Market Size in 2030 | USD 1,072.596 million |

| Growth Rate | CAGR of 9.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Catalonia, Madrid, Andalusia, and Others |

| List of Major Companies in the Spain E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Spain E-Hailing Market Segmentation:

By Service Type

- Ride Sharing

- Ride Hailing

- Others

By Device Type

- Smartphones

- Tablets

- Others

By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

By End-User

- Personal (B2C)

- Corporates (B2B)

By Region

- Catalonia

- Madrid

- Andalusia

- Others

Our Best-Performing Industry Reports:

Navigation:

- Spanish E-Hailing Market Size:

- Spanish E-Hailing Market Key Highlights:

- Spain E-Hailing Market Overview & Scope:

- Top Trends Shaping the Spain E-Hailing Market

- Spain E-Hailing Market Growth Drivers vs. Challenges

- Spain E-Hailing Market Regional Analysis

- Spain E-Hailing Market Competitive Landscape

- Spain E-Hailing Market Scope:

- Our Best-Performing Industry Reports: