Report Overview

UAE E-Hailing Market - Highlights

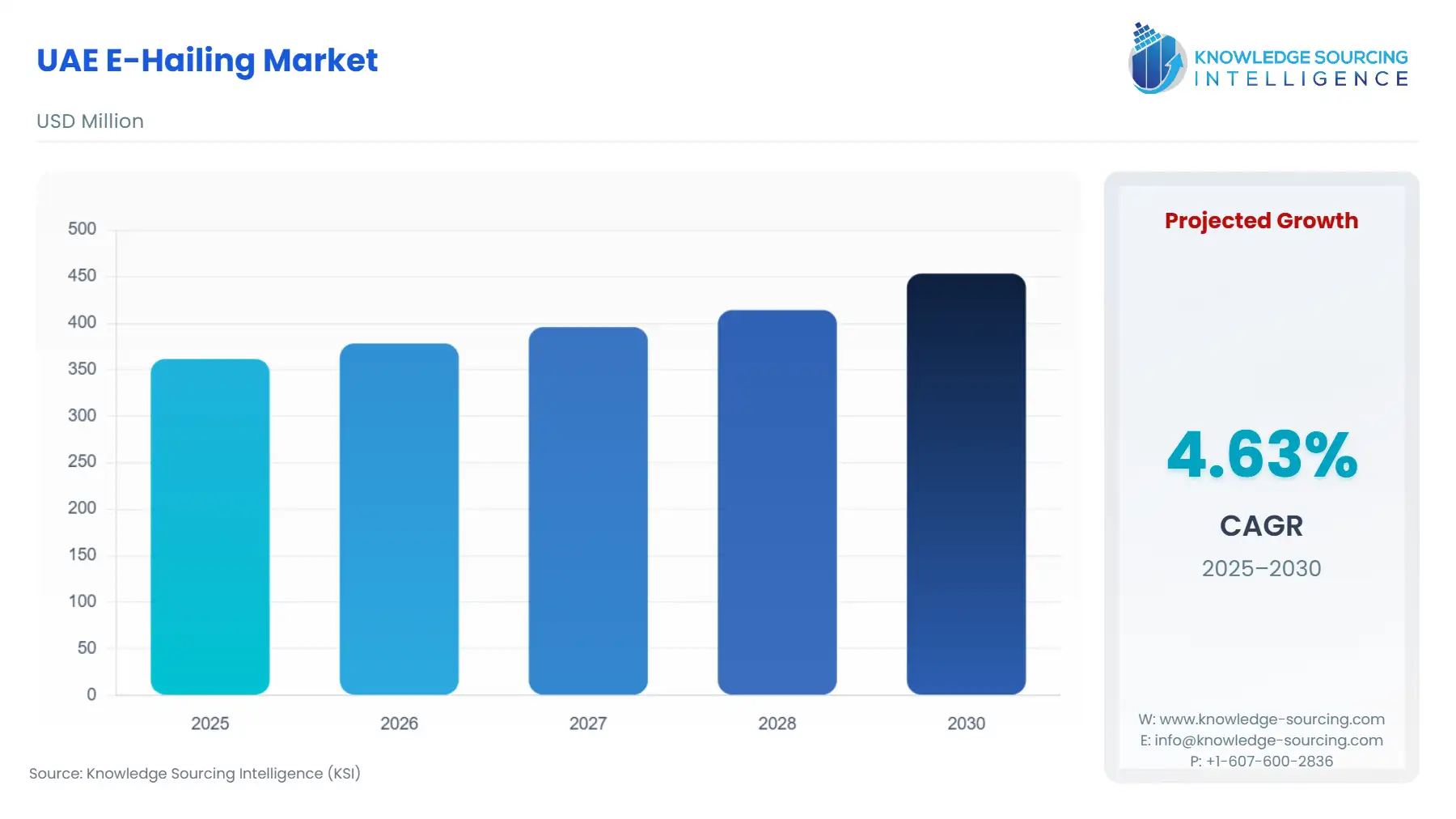

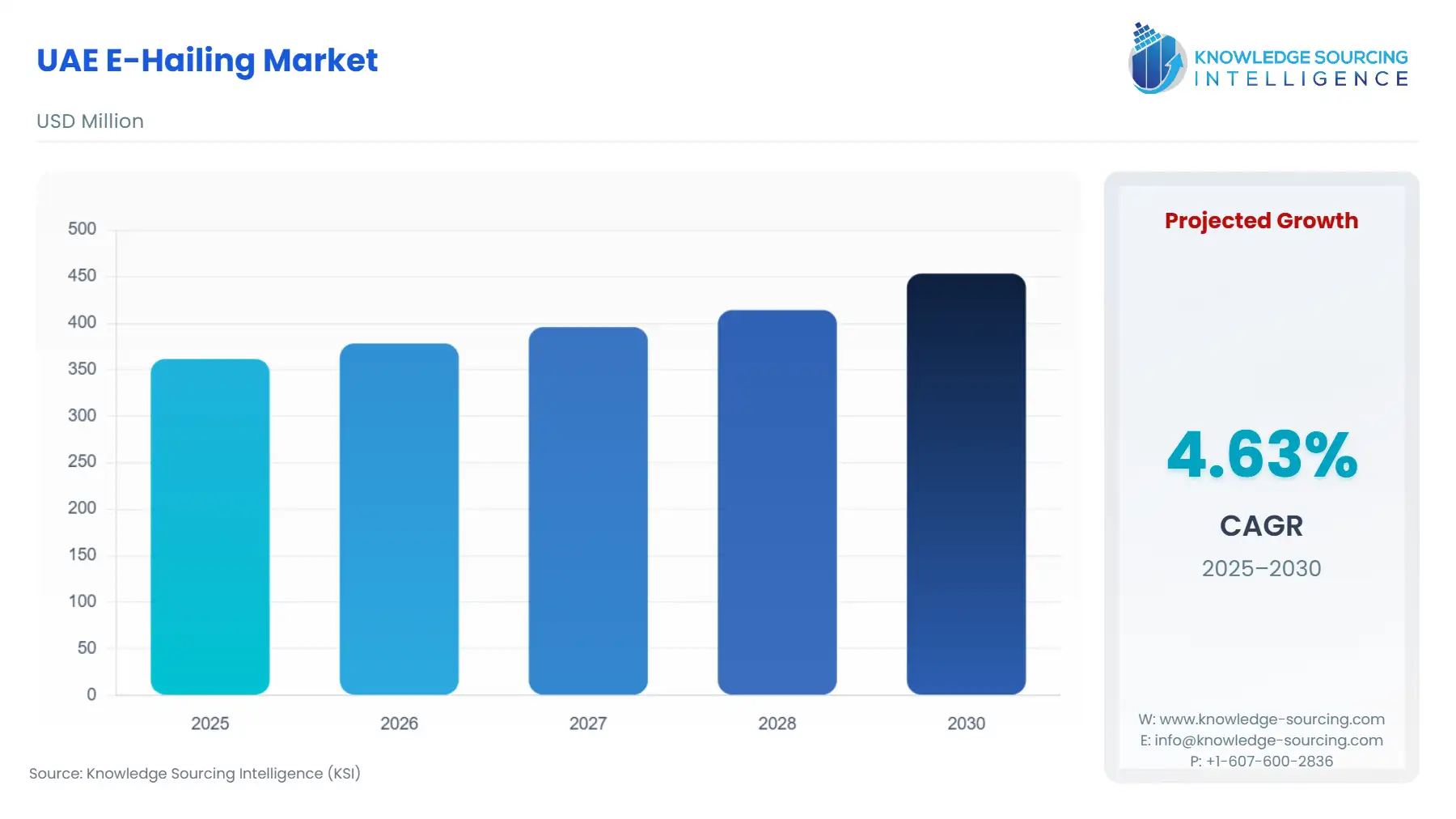

The UAE E-Hailing Market is projected to increase at a 4.63% CAGR, growing from USD 361.548 million in 2025 to USD 453.313 million by 2030.

UAE E-Hailing Market Key Highlights:

The e-hailing market in the UAE is growing steadily due to the high smartphone penetration and strong tourism numbers, as well as government initiatives to improve urban mobility. Ride-hailing services are generating strong demand in UAE cities, particularly Dubai and Abu Dhabi, from residents and overseas tourists who are primarily looking for the convenience and safety of an app. There is a relatively high level of service across the e-hailing market, which is supported by government regulation and developed by a combination of partnerships between international players, local taxi operators, and transport authorities to ensure a reasonable level of quality and consistency in a country where taxi services are also highly regulated. Other factors impacting the e-hailing market include opportunities to integrate with public transport and the trend towards cashless payments; ridesharing occurs in conjunction with the increasing popularity of electric and hybrid vehicles.

________________________________________________________________

UAE E-Hailing Market Overview & Scope

The UAE e-hailing market is growing steadily and is at the heart of the mobility sector. At the core of the ride-hailing growth story are regulations and a rising use among consumers; Dubai’s Roads and Transport Authority (RTA) has achieved 16% growth in digital revenues in 2024, reaching AED 4.427 billion compared to the previous year. The total number of transactions across digital channels has reached 679.6 million, including 13.4 million transactions through RTA’s smart applications. App downloads have risen by 18% compared to 2023, with 3.742 million downloads, while the number of registered users on RTA apps has increased by 27.5%, reaching 1.94 million. Furthermore, the number of parking tickets issued through smart applications has grown to 29.973 million, a 24% increase.

According to latest government figures for 2024, an average of 3 km of unnecessary driving per trip has been eliminated, resulting in a reduction of nearly 20,000 tonnes of carbon emissions. Limousine and specialised services are gaining traction, 50 percent of trip numbers growth for the first half of 2024 shows the increased number of operators on the roads, and demand for luxury mobility.

On the consumer side as well, a digital-first approach (not surprisingly) is core. Riders exhibit a strong preference for app-assured booking, cashless payment, and short delivery times; more than 74 percent of e-hail bookings in 2024 recorded a waiting time of less than 3.5 minutes. Apart from easy, convenient booking and reliability, and real-time tracking, sustainability-focused riders are increasingly prioritizing hybrid/electric family in a market that is already tokenized, and served by apps through regulated players. In short, the UAE e-hailing market is building a mature ecosystem through robust regulatory frameworks, optimized fleet use, widespread adoption of digital payments, and a rapid shift in rider expectations to safe, cleaner, and faster travel.

This indicates the uplift in digital interaction with RTA mobility apps, demonstrating 18 percent growth in app downloads and 27.5 percent growth in registered users. Higher uptake of official mobility apps bolsters the UAE e-hailing landscape by broadening the pool of active digital users, boosting volumes of ride-booking, and facilitating the move away from street hailing towards regulated app-based services. The greater the number of residents and visitors that gravitate towards a verified digital channel, the clearer the operators’ visibility of demand will become, resulting in quicker dispatching and higher utilisation of fleet; in short, improving service reliability whilst making the lives of passengers more convenient, and building a more efficient and sustainable mobility ecosystem.

Key market players in the UAE e-hailing industry include Uber, Bolt, Yango, and Careem, each offering app-based on-demand mobility across major emirates. These platforms compete on availability, pricing, and service quality, while partnerships with local regulators and taxi operators strengthen fleet access, improve rider experience, and support wider digital mobility adoption.

The UAE e-hailing market is segmented by:

- Service Type: Among the markets within the UAE e-hailing market by service type, the ride-hailing segment is becoming the fastest-growing service type because users are willing to opt for fast, flexible, and demand-based travel services in urban centres.

- Device Type: Inside the markets within the UAE e-hailing market by device type, the largest growing and most dominant class is smartphones, due to the country having an incredibly high smartphone penetration and strong mobile internet adoption.

- Vehicle Type: Among the markets within the UAE e-hailing market by vehicle type, the fastest-growing and most leading class is the four-wheeler, as cars are the primary mode of travel for urban and inter-city travel within the country.

- End-User: The UAE E-Hailing market is segmented into personal (B2C) and corporate (B2B). The personal (B2C) segment is experiencing rapid growth. The personal (B2C) segment represents the largest and most dynamic user base in the UAE e-hailing market, driven significantly by individual residents, expatriates, and, importantly, tourists. With the UAE ranking among the world’s most visited destinations and Dubai alone welcoming millions of visitors annually, tourism is one of the strongest growth engines for B2C e-hailing demand. According to UNWTO, by 2030, the total number of tourist trips is expected to reach 37.4 billion, international and domestic. Revenue is expected to reach an annual growth rate (CAGR 2021-2026) of 17.13%, resulting in a projected market volume of USD 949,579 million by 2026. Moreover, sustainable Investments in the tourism sector have been oriented towards Green Transitions, suggesting frameworks to shift from a growth to a sustainable paradigm in the long term, thereby developing financial instruments for resilience and renewal of the tourism sector.

Moreover, according to the United Arab Emirates Ministry of Economy and Tourism, in 2022, the contribution of the travel and tourism sector to the UAE’s GDP was nearly AED 167 billion, which is equivalent to 9% of the total GDP. In 2022, the total spending of international tourists amounted to AED 117.6 billion. Tourists rely heavily on app-based mobility for airport transfers, hotel to attraction trips, shopping, dining, and city tours, especially since public transport coverage outside major metro corridors remains limited. This constant influx of short-term visitors directly increases ride volumes, peak-hour usage, and platform revenues for services such as Careem, Uber, and local operators.

Furthermore, the progression in tourism scales, and e-commerce & social media influences has provided a major boost to the E-Hailing sector growth in the United Arab Emirates. According to the Dubai Department of Economy and Tourism, in 2024, the number of international overnight visitors in Dubai reached 18.72 million, representing a 9% year-on-year increase compared to the 17.15 million visitors recorded in 2023.

Moreover, tourism-driven events such as international exhibitions, the Abu Dhabi Grand Prix, global conferences, concerts, and festivals further amplify B2C demand through temporary but significant spikes. The convenience, safety assurance, multilingual interfaces, and transparent pricing offered by e-hailing platforms make them the preferred mobility choice for tourists unfamiliar with local routes. This strong and predictable tourist demand encourages service providers to expand fleets, introduce premium ride options, enhance airport-focused services, and upgrade user experience features. Comprehensively, the Personal (B2C) segment is closely linked with the UAE’s thriving tourism ecosystem, making tourism a core factor shaping market scalability, seasonal patterns, and long-term growth in the country’s e-hailing industry.

- Region: As the nation's center for business, tourism, and technology, Dubai is the state with the fastest rate of growth in the UAE e-hailing market.

Top Trends Shaping the UAE E-Hailing Market

- Increasing the Quality of Ride Services: The UAE ride-hailing market is geared more toward premium experiences and luxury offerings. Riders expect relatively new vehicle models, competent drivers, and higher levels of service. Providers display fleets comprised of luxuriously appointed vehicles like Lexus, BMW, Tesla, and Mercedes to attract corporate clients, high-net-worth clients, and tourists. Even non-premium rides in both Dubai and Abu Dhabi maintain a higher level of service, which is markedly different than the regional competitors; therefore, premiumization is the key trend.

________________________________________________________________

UAE E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Integration with the Infrastructure of Public Transportation: The UAE invests heavily in metro, tram, and bus services. There are efforts to join these services with e-hailing services to provide seamless mobility with first-mile and last-mile connectivity. To illustrate, in Dubai, companies have made e-hailing pickup points at metro stations, and apps are now adding the possibility of trip planning to include both public transport and ride-hailing legs in a single itinerary. Integrated services provide the opportunity for reduced reliance on private vehicles, thereby contributing to sustainable urban mobility.

- Strong Development in the Hospitality and Corporate Sectors: Strong corporate, tourism, and hospitality sectors add up to large B2B demand. Hospitable hotels and e-hailing apps allow guests easy access to mobility around the city, and businesses can maintain corporate accounts for easy management and control over staff travel. Strong pockets of demand are notably focused on business parks and free zones such as DIFC, ADGM, and JAFZA, where there is a significant demand for corporate ride packages, airport transfers, and executive car fleets.

Challenges:

- Strict Government Rules and Licensing Restrictions: The e-hailing market in the UAE is closely regulated by the government through entities such as the RTA in Dubai and the ITC in Abu Dhabi. Regulations are encouraging but restrictive. This is reducing pricing flexibility for platforms compared to global markets, where dynamic pricing is much more commonplace. The need for professional drivers also drives up costs and limits supply in times of peak demand.

________________________________________________________________

UAE E-Hailing Market Regional Analysis

- Dubai: Dubai’s e-hailing market is expanding rapidly, supported by the emirate’s strong digital infrastructure and government-led smart mobility initiatives. The Roads and Transport Authority (RTA) has encouraged regulated e-hailing growth by integrating app-based services with the city’s transport ecosystem, enabling seamless mobility options for both residents and visitors. High smartphone penetration, widespread 5G connectivity, and a tech-savvy population create a natural environment for the rapid adoption of on-demand mobility services.

________________________________________________________________

UAE E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Electric Vehicle

- By Payment Method

- Online

- Cash

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Region

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Others

UAE E-Hailing Market Overview & Scope

The UAE e-hailing market is segmented by:

- Service Type: Among the markets within the UAE e-hailing market by service type, the ride-hailing segment is becoming the fastest-growing service type because users are willing to opt for fast, flexible, and demand-based travel services in urban centres.

- Device Type: Inside the markets within the UAE e-hailing market by device type, the largest growing and most dominant class is smartphones, due to the country having an incredibly high smartphone penetration and strong mobile internet adoption.

- Vehicle Type: Among the markets within the UAE e-hailing market by vehicle type, the fastest-growing and most leading class is the four-wheeler, as cars are the primary mode of travel for urban and inter-city travel within the country.

- End-User: The personal (B2C) segment of the UAE e-hailing market by end-user is the one with the fastest rate of growth. This is because more individual users are using ride-hailing apps for leisure, travel for tourism, and daily commuting.

- Region: As the nation's center for business, tourism, and technology, Dubai is the state with the fastest rate of growth in the UAE e-hailing market.

Top Trends Shaping the UAE E-Hailing Market

- Increasing the Quality of Ride Services: The UAE ride-hailing market is geared more toward premium experiences and luxury offerings. Riders expect relatively new vehicle models, competent drivers, and higher levels of service. Providers display fleets comprised of luxuriously appointed vehicles like Lexus, BMW, Tesla, and Mercedes to attract corporate clients, high-net-worth clients, and tourists. Even non-premium rides in both Dubai and Abu Dhabi maintain a higher level of service, which is markedly different than the regional competitors; therefore, premiumization is the key trend.

UAE E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Integration with the Infrastructure of Public Transportation: The UAE invests heavily in metro, tram, and bus services. There are efforts to join these services with e-hailing services to provide seamless mobility with first-mile and last-mile connectivity. To illustrate, in Dubai, companies have made e-hailing pickup points at metro stations, and apps are now adding the possibility of trip planning to include both public transport and ride-hailing legs in a single itinerary. Integrated services provide the opportunity for reduced reliance on private vehicles, thereby contributing to sustainable urban mobility.

- Strong Development in the Hospitality and Corporate Sectors: Strong corporate, tourism, and hospitality sectors add up to large B2B demand. Hospitable hotels and e-hailing apps allow guests easy access to mobility around the city, and businesses can maintain corporate accounts for easy management and control over staff travel. Strong pockets of demand are notably focused on business parks and free zones such as DIFC, ADGM, and JAFZA, where there is a significant demand for corporate ride packages, airport transfers, and executive car fleets.

Challenges:

- Strict Government Rules and Licensing Restrictions: The e-hailing market in the UAE is closely regulated by the government through entities such as the RTA in Dubai and the ITC in Abu Dhabi. Regulations are encouraging but restrictive. This is reducing pricing flexibility for platforms compared to global markets, where dynamic pricing is much more commonplace. The need for professional drivers also drives up costs and limits supply in times of peak demand.

UAE E-Hailing Market Regional Analysis

- Dubai: This growth is due to Dubai’s large number of international visitors, population, smartphone penetration, and government initiatives for digital mobility. The RTA has encouraged e-hailing under its Smart City and sustainability agenda, contributing to seamless mobility and curbing congestion as well as carbon emissions by eliminating the number of street-hail taxis roaming in Dubai.

UAE E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including Uber, Bolt, Yango, Careem, Udrive, Dubai Taxi Corporation, Sharjah Roads & Transport Authority, Blacklane, Hala, and Arabia Taxi Abu Dhabi.

- Expansion: In May 2025, the Bolt platform will offer more than 6,000 DTC taxis, including Ladies and Family Taxis (Pink Taxis) and People of Determination Taxis. This expansion demonstrates DTC's plan to improve the comfort and convenience of commute planning for locals and visitors using digital efficiency.

- Collaboration: In October 2024, as part of DTC's growth strategy, the strategic partnership with Bolt, which is making its debut in the UAE, will offer cutting-edge e-hailing solutions while improving consumers' digital mobility experiences and growing smart transportation services across the Emirate.

UAE E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| UAE E-Hailing Market Size in 2025 | USD 361.548 million |

| UAE E-Hailing Market Size in 2030 | USD 453.313 million |

| Growth Rate | CAGR of 4.63% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Dubai, Abu Dhabi, Sharjah, Ajman, and Others |

| List of Major Companies in the UAE E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

UAE E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Region

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Others

Our Best-Performing Industry Reports:

Navigation:

- UAE E-Hailing Market Size:

- UAE E-Hailing Market Key Highlights:

- UAE E-Hailing Market Overview & Scope

- Top Trends Shaping the UAE E-Hailing Market

- UAE E-Hailing Market Growth Drivers vs. Challenges

- UAE E-Hailing Market Regional Analysis

- UAE E-Hailing Market Competitive Landscape

- UAE E-Hailing Market Scope:

- Our Best-Performing Industry Reports: