Report Overview

UK Electric Vehicle Powertrain Highlights

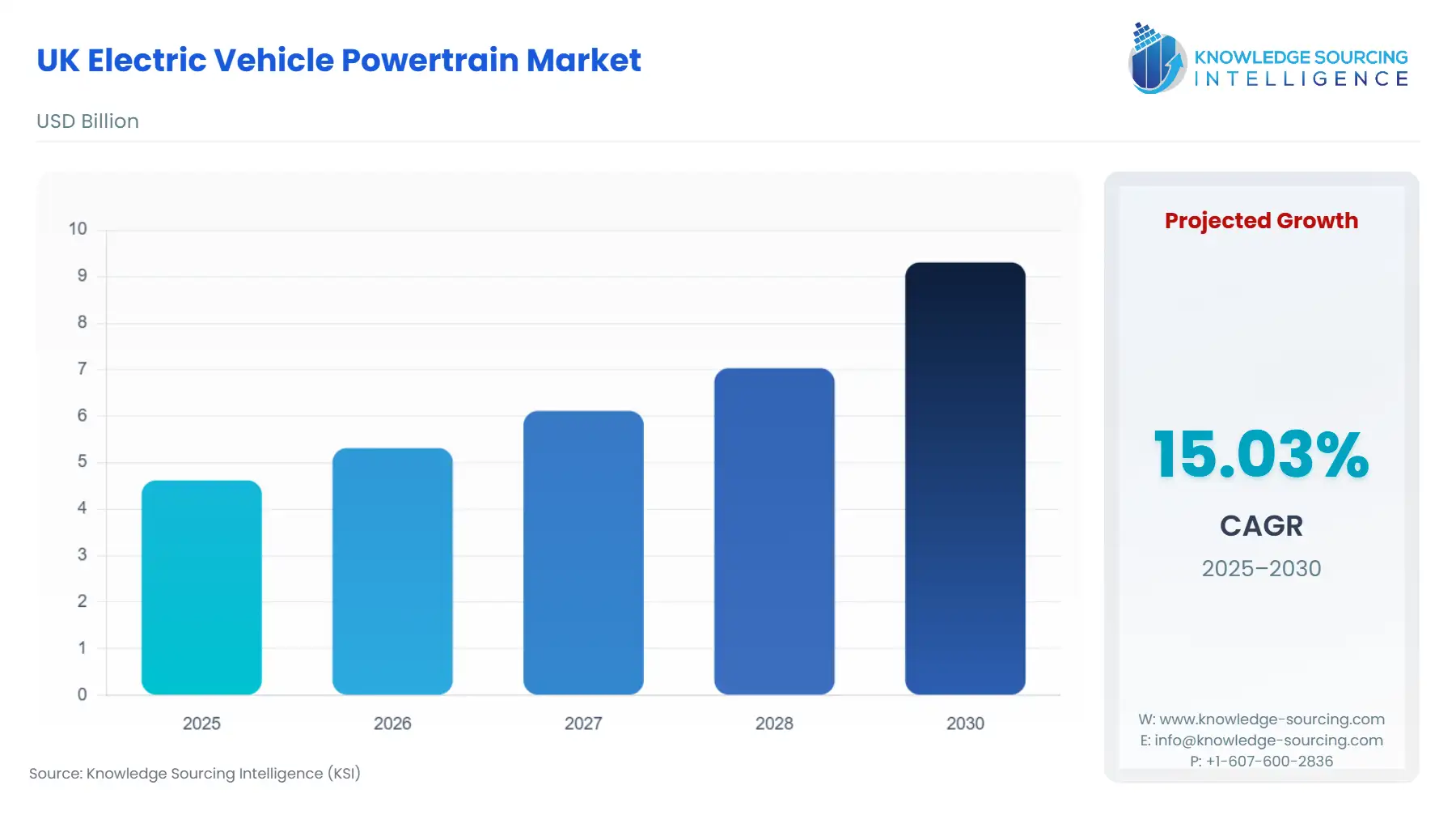

UK Electric Vehicle Powertrain Market Size:

The UK Electric Vehicle Powertrain Market is forecast to grow at a CAGR of 15.03%, attaining USD 9.306 billion in 2030 from USD 4.62 billion in 2025.

The UK Electric Vehicle (EV) Powertrain Market is undergoing a rapid, policy-driven transformation, shifting its center of gravity from internal combustion engine (ICE) components to sophisticated, integrated electric drive systems. This transition is less organic and more mandated, underpinned by the UK's commitment to achieving Net Zero by 2050, which necessitates the electrification of the transport sector. The core focus for the market has moved to establishing a resilient domestic supply chain capable of delivering high-efficiency components—specifically battery packs, power electronics, and electric motors—that meet the escalating performance requirements and range expectations of the rapidly expanding UK EV fleet. The market dynamics are defined by a tense interplay between government-set demand and global supply chain constraints, creating both an imperative for localization and a reliance on complex international dependencies, particularly for battery raw materials and cell manufacturing.

UK Electric Vehicle Powertrain Market Analysis

- Growth Drivers

The Zero Emission Vehicle (ZEV) mandate, which came into effect in January 2024, provides the single most significant, non-negotiable growth driver for powertrain. By mandating that a steadily increasing percentage of new vehicle sales must be zero-emission (e.g., 22% in 2024, rising to 80% by 2030), the policy directly compels manufacturers to increase the volume of fully electric vehicles, thereby creating a fixed and growing opportunity for complete EV powertrains. This regulatory pressure accelerates product development cycles and forces the retooling of production lines toward e-motors and inverters. Additionally, fleet electrification, particularly in the commercial vehicle segment, propels high-volume, standardized demand. Companies are shifting commercial fleets to electric models to benefit from lower running costs and the favorable tax treatment of EVs, directly increasing the demand for robust, high-durability electric drive units for vans and buses.

- Challenges and Opportunities

The primary market challenge is the significant "gigafactory gap." The Faraday Institution projects that the UK will require approximately 100 GWh of battery manufacturing capacity by 2030 to satisfy domestic automotive demand, yet a significant portion of this capacity remains unaddressed by current development plans. This lack of domestic cell production creates a strategic vulnerability and a dependency on imported battery packs, which represent the highest-cost component of the powertrain. This constraint limits the expansion of localized battery management systems and pack assembly. However, the opportunity lies in advanced component manufacturing. The drive for greater EV range and faster charging creates an opportunity for UK-based suppliers specializing in high-efficiency components, such as power electronics utilizing Silicon Carbide (SiC) semiconductors and sophisticated thermal management systems, both of which are critical for enhancing the performance of Battery Electric Vehicles (BEVs).

- Raw Material and Pricing Analysis

The EV powertrain, being a physical product, is fundamentally exposed to the pricing and supply chain volatility of critical raw materials. The cost of the battery pack, the single most expensive powertrain component, is heavily influenced by the global prices of lithium, cobalt, and nickel. Current battery production features complex value chains and is overwhelmingly reliant on East Asia for refined raw minerals and cell components. This reliance translates directly into pricing pressure for UK automotive OEMs, as fluctuations in global commodity markets and geopolitical stability directly impact the unit cost of imported battery packs. While the UK is moving to secure and develop its own battery supply chain, the immediate demand for powertrain components relies on an import-heavy model subject to international price setting.

- Supply Chain Analysis

The global supply chain for EV powertrains is characterized by a high degree of geographical concentration and complex logistics. Key production hubs for battery cells, cathodes, and anodes are predominantly in East Asia, creating a significant logistical complexity for UK manufacturers who must import these items. The UK's domestic supply chain strength is concentrated in late-stage assembly and certain high-value, low-volume components. Ford’s investment in its Halewood plant to produce electric drive units for its European EV lineup signifies a crucial effort to localize the final component assembly stage, reducing logistical risk for a high-volume part. However, this localization strategy remains dependent on the secure, reliable importation of upstream materials like rare-earth magnets for electric motors and semiconductor chips for power electronics.

UK Electric Vehicle Powertrain Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

UK |

Zero Emission Vehicle (ZEV) Mandate (2024) |

Directly mandates an increasing share of ZEV sales (22% in 2024), forcing manufacturers to allocate production capacity and component sourcing towards EV powertrains to avoid significant financial penalties (£15,000 per non-compliant vehicle). |

|

UK |

Automotive Transformation Fund (ATF) |

Government funding supports capital investments in the domestic EV supply chain, including gigafactories and powertrain component production. This reduces risks of private investment, directly increasing supply-side capacity and local content for the powertrain market. |

|

UK / EU |

EU-UK Trade and Cooperation Agreement Rules of Origin |

Phased rules require a specified percentage of EV battery and vehicle content to be sourced from the UK or EU to avoid tariffs. This acts as a strong incentive for OEMs to localize battery and e-motor production within the UK, driving domestic supply chain demand. |

UK Electric Vehicle Powertrain Market Segment Analysis:

- By Propulsion Type: Battery Electric Vehicle (BEV)

The Battery Electric Vehicle segment drives the overwhelming majority of high-value demand in the UK EV Powertrain Market. This segment requires a complete, dedicated electric drive unit (e-motor, inverter, and reduction gearbox) paired with the largest, highest-capacity battery packs. Its growth is exclusively driven by the ZEV mandate, which defines BEVs and Plug-in Hybrid Electric Vehicles (PHEVs) as Zero Emission Vehicles (PZEVs) for compliance purposes, but prioritizes BEV sales due to their lower-emission profile and long-term regulatory certainty. Furthermore, BEV demand is fueled by consumer preference for maximum driving range and the total cost of ownership benefits derived from lower maintenance requirements and fuel costs compared to Hybrid Electric Vehicles (HEVs). The pursuit of maximum range necessitates ongoing demand for technological upgrades in the powertrain, such as the adoption of 800V architectures and high-power density motors to reduce weight and increase efficiency.

- By Vehicle Type: Commercial Vehicle

The Commercial Vehicle segment, encompassing light commercial vehicles (LCVs) and heavier trucks and buses, represents a significant and rapidly growing source of predictable powertrain demand. The primary growth driver is economic: fleet operators seek to capitalize on government incentives, urban clean air zone access, and the substantial operational savings offered by electric vehicles. The segment's expansion focuses on high-durability, high-torque electric drive units and battery management systems designed for intensive duty cycles. Stellantis, for instance, has invested to start producing electric vans at its Ellesmere Port plant, following a £100 million investment, directly creating concentrated demand for robust, commercial-grade e-powertrains. This push toward fleet electrification provides a stable, large-volume pipeline for powertrain component suppliers, particularly for standardized e-axle architectures that can be scaled across various vehicle platforms.

UK Electric Vehicle Powertrain Market Competitive Analysis:

The UK EV powertrain market's competitive landscape is defined by a mix of vertically integrated automotive OEMs and specialist Tier-1 component manufacturers. The dynamic is shifting from import dependence to a strategic push for domestic manufacturing capacity.

- Ford Motor Company

Ford’s strategic positioning in the UK market shifted dramatically with its commitment to the £380 million transformation of its Halewood plant on Merseyside. This facility is being converted from a traditional transmission factory into a production site for electric power units. The Halewood plant, with an anticipated capacity of over 420,000 electric drive units annually, is strategically positioned to supply 70% of Ford's European EV demand, including units for the E-Transit Custom and Puma Gen-E. This localization secures a high-volume, strategically important component, reducing exposure to European-based supply chain risks and ensuring compliance with future Rules of Origin requirements.

- JLR (Jaguar Land Rover)

JLR is undertaking a £15 billion investment plan over five years to accelerate its path to electrification. This strategy necessitates a significant and sustained increase in demand for next-generation EV powertrains, including electric motors, power electronics, and battery systems, for its luxury and premium vehicle platforms. JLR’s commitment to electrifying its entire portfolio creates an extensive in-house demand pipeline, directly shaping the competitive landscape by attracting Tier-1 suppliers to co-locate or increase capacity within the UK to secure large-volume contracts.

UK Electric Vehicle Powertrain Market Developments

- December 2024: Ford Halewood Electric Drive Unit Production Begins.

Ford officially commenced production of its new electric drive units at the Halewood facility. The plant, transformed with a £380 million investment, began supplying e-drive units for key models, including the all-electric Puma Gen-E and E-Transit Custom. This milestone activates a crucial piece of the UK’s domestic powertrain manufacturing capacity.

- September 2023: Stellantis Ellesmere Port EV Production Start.

Stellantis began production of electric vans, including the Vauxhall, Opel, Fiat, Peugeot, and Citroën brands, at its Ellesmere Port plant. This followed a £100 million investment, directly translating into new, high-volume demand for electric powertrain components tailored for LCV applications within the UK.

UK Electric Vehicle Powertrain Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.62 billion |

| Total Market Size in 2031 | USD 9.306 billion |

| Growth Rate | 15.03% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Propulsion Type, Vehicle Type |

| Companies |

|

UK Electric Vehicle Powertrain Market Segmentation:

- BY COMPONENT

- Battery Pack

- Transmission

- Power Electronics

- Battery Management System

- Thermal Management System

- Others

- BY PROPULSION TYPE

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

- BY VEHICLE TYPE

- Passenger Car

- Commercial Vehicle

- Others