Report Overview

US Electric Vehicle Battery Highlights

US Electric Vehicle Battery Market Size:

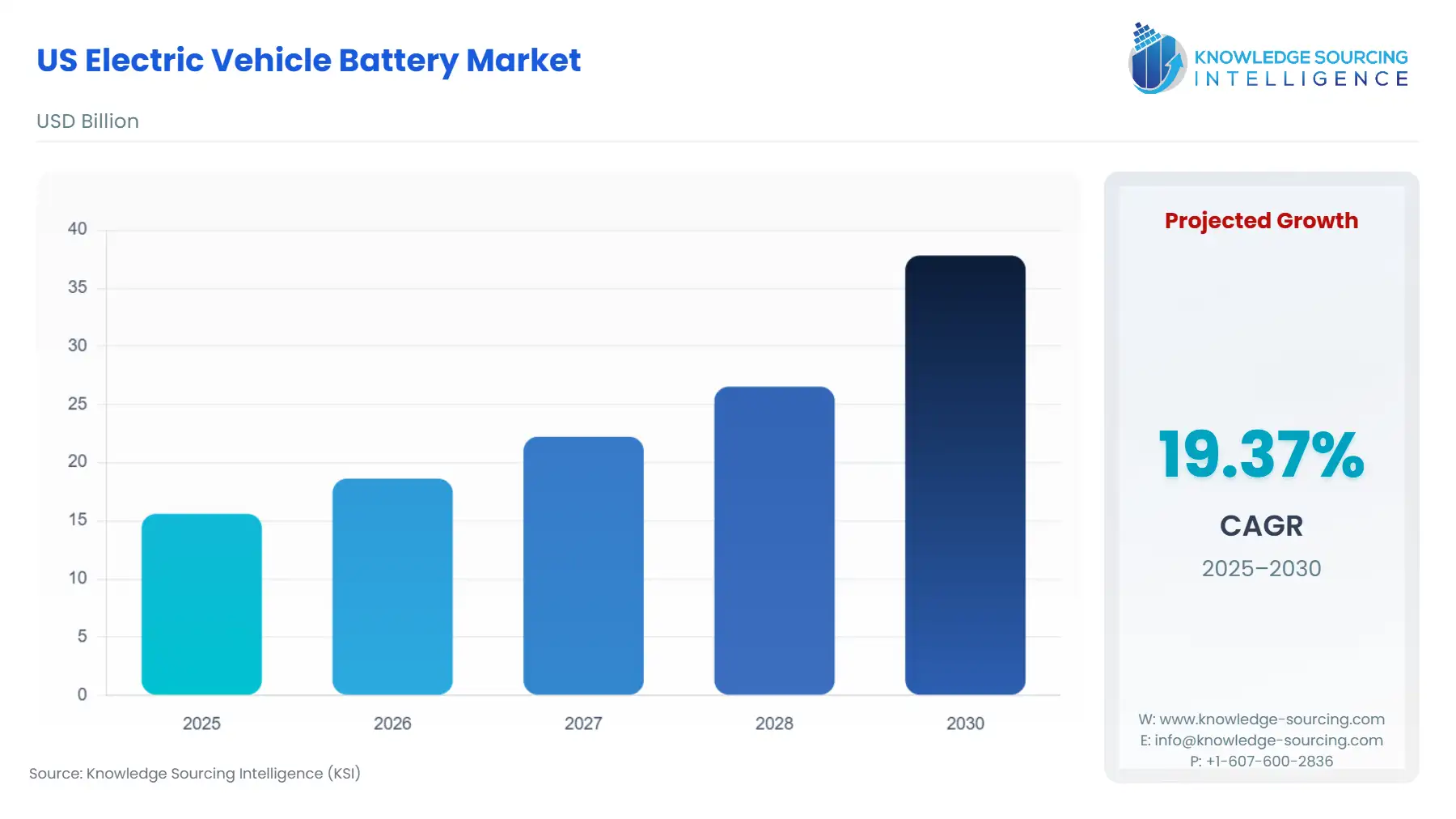

The US Electric Vehicle Battery Market is projected to expand at a CAGR of 19.37%, increasing to USD 37.820 billion in 2030 from USD 15.602 billion in 2025.

The US Electric Vehicle (EV) Battery Market is undergoing a rapid, policy-driven transformation, shifting from a nascent, import-reliant sector to one characterized by substantial domestic manufacturing investment. This inflection point is fundamentally driven by the imperative to localize the entire battery supply chain, an effort critical for achieving national energy security and insulating the rapidly growing electric vehicle segment from geopolitical and logistical volatility. The market's structural evolution is defined by massive capital commitments from global and domestic players, primarily aimed at establishing a vertically integrated "Battery Belt" across the American South and Midwest, directly linking cell production with the largest EV assembly plants.

US Electric Vehicle Battery Market Analysis

- Growth Drivers

The primary growth catalyst of the US EV Battery Market is the Federal Policy Environment. Regulations like the Advanced Manufacturing Production Credit (45X) within the Inflation Reduction Act (IRA) provide tax credits for domestic battery cell and module production, making US-manufactured batteries more cost-competitive for automakers. This directly increases the necessity for batteries sourced from new or expanded US production facilities, with the total projected domestic manufacturing capacity pipeline exceeding 1,100 GWh annually by 2030. A secondary driver is accelerating EV adoption, evidenced by over 1.5 million EVs sold in 2024, contributing to an in-use fleet of over 5.7 million vehicles. This growth directly translates into heightened demand for battery cells and packs to supply both original equipment manufacturing (OEM) assembly lines and the subsequent aftermarket for maintenance and replacement.

- Challenges and Opportunities

A significant challenge is the Critical Mineral and Active Material Gap. The U.S. supply chain remains dependent on imports for the complex processing required for materials like graphite, nickel, and cobalt. This dependency exposes domestic battery manufacturers to global commodity price volatility and supply chain disruptions, posing a constraint on the potential scale of US battery production and increasing the risk profile for large-scale capital deployment. The primary opportunity lies in Next-Generation Technology and Recycling. Advances in solid-state batteries offer the potential for improved safety and energy density, which would increase consumer demand for EVs by mitigating range anxiety. Simultaneously, building a robust, commercial-scale domestic recycling industry—supported by initiatives like the DOE's ReCell Center—represents an opportunity to establish a circular economy that will locally secure a long-term supply of critical materials for future battery manufacturing, reducing import reliance.

- Raw Material and Pricing Analysis

As the EV battery is a physical product, the pricing dynamics of its core components are critical. The global prices of key battery materials, particularly lithium, nickel, and cobalt, directly dictate the final cost of a battery cell, which accounts for a substantial portion of the EV's total manufacturing cost. Price volatility acts as a significant headwind for domestic manufacturers who must compete with global producers benefiting from established supply chains. The drive for cost reduction has propelled the adoption of Lithium Iron Phosphate (LFP) chemistry, which eliminates costly and geopolitically sensitive materials like nickel and cobalt, thereby stabilizing input costs and directly supporting mass-market EV demand. Conversely, the push for higher-performance batteries for premium segments reinforces the need for high-nickel chemistries, maintaining pricing pressure on the nickel market.

- Supply Chain Analysis

The US EV battery supply chain is characterized by a high degree of global complexity and a mandated, accelerating shift toward regional localization. Key production hubs for cells remain concentrated in Asia (South Korea, China, and Japan), which currently dominate the processing of raw materials into high-purity battery chemicals. The US supply chain’s logistical complexity involves securing pre-processed active materials (CAM/AAM) from abroad before final cell assembly in newly constructed US gigafactories. This dependency on foreign processing for critical intermediates represents the current strategic vulnerability. The goal of federal policy is to create a resilient, North American-centric chain, moving beyond mere assembly to include domestic mining, refining, and active material production, primarily concentrated in a developing "Battery Belt" across states like Michigan, Kentucky, and Georgia.

US Electric Vehicle Battery Market Government Regulations:

Key governmental and regulatory frameworks directly shape market operations and demand dynamics.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Inflation Reduction Act (IRA), 2022 |

The Advanced Manufacturing Production Credit (45X) directly creates demand for US-made battery cells by offering a tax credit per kWh of domestic production, incentivizing foreign and domestic manufacturers to onshore capacity. |

|

United States |

Bipartisan Infrastructure Law (BIL), 2021 |

Provided substantial funding for battery processing, manufacturing, and recycling R&D. This acts as a catalyst for new domestic supply chain entrants, aiming to secure long-term, domestic material supply and lower future manufacturing costs. |

|

United States |

Environmental Protection Agency (EPA) / Infrastructure Investment and Jobs Act |

Mandates for developing best practices for end-of-life battery collection and recycling. This establishes the framework for a circular economy, creating future demand for domestic recycling facilities. |

US Electric Vehicle Battery Market Segment Analysis:

- By Battery Type: Lithium Ion

Lithium-ion batteries continue to command the US EV market segment due to the combination of technological maturity and scalable manufacturing economics. The segment is overwhelmingly driven by the cost-performance ratio, which benefits from decades of R&D and global supply chain optimization. Incremental improvements in energy density, power output, and charge-discharge cycling—particularly in Nickel Manganese Cobalt (NMC) and LFP variants—sustain their market position. The primary growth factor is the Immediate Need for Proven, Scalable Solutions to meet rapidly increasing OEM production targets. Solid-state technology, while promising higher theoretical performance, remains commercially non-viable for mass-market vehicles due to high production costs and scalability challenges, thus reinforcing Lithium-ion's dominance as the default, reliable power source for all vehicle types currently in production.

- By Vehicle Type: Commercial Vehicles

The commercial vehicles segment, encompassing medium- and heavy-duty trucks and buses, represents a disproportionately high-value demand segment for battery packs. The segment is specifically driven by Total Cost of Ownership (TCO) Economics and Operational Reliability rather than peak range. Commercial operators prioritize battery packs with extremely long cycle life (durability), fast charging capabilities (to minimize downtime), and robust thermal management for continuous, heavy-duty operation. Government fleet electrification mandates and corporate sustainability targets are accelerating procurement, which translates into a specific, high-capacity demand for large-format, modular battery systems designed for ruggedization and high energy throughput, pushing manufacturers to develop distinct product lines separate from passenger car solutions.

US Electric Vehicle Battery Market Competitive Analysis:

The US competitive landscape is a nexus of international joint ventures and aggressive capacity expansion, heavily influenced by federal incentives. Competition centers on securing long-term OEM contracts, vertical integration capabilities, and superior manufacturing scale to capitalize on tax credits.

- LG Energy Solution (LGES): A dominant strategic player, LGES has established a strong US footprint through multiple, multi-billion-dollar joint ventures with major US automakers. Their strategy centers on colocation—building battery production facilities adjacent to or near major OEM assembly plants (e.g., in Ohio and Tennessee). This positioning allows them to minimize logistical complexity, mitigate transportation costs, and satisfy domestic content requirements mandated by the IRA, thereby capturing significant, guaranteed demand. Their product portfolio is anchored in high-nickel pouch cells for high-performance and long-range BEVs.

- SK On: SK On has made substantial capital commitments in the US, notably in Georgia, demonstrating a focus on creating an independent, large-scale domestic manufacturing base. Their positioning strategy is Capacity Aggregation, aiming to deliver high-volume battery supply to multiple major automakers, including their joint venture with Hyundai Motor Group. This approach emphasizes supply reliability and the economies of scale from their multi-plant regional hub, which is crucial for automakers seeking to de-risk their component sourcing.

US Electric Vehicle Battery Market Developments:

- September 2025: The U.S. Department of Energy (DOE) is finalizing a deal to take a minority equity stake (reportedly 5%) in Lithium Americas and a separate 5% stake in its Thacker Pass joint venture with General Motors (GM). This is part of the negotiations surrounding a $2.26 billion federal loan for the Thacker Pass lithium mine in Nevada. The project is critical to building a domestic battery supply chain, aiming to produce enough battery-quality lithium carbonate for up to 800,000 EVs annually, reducing reliance on foreign sources.

- April 2025: CATL, a global battery giant, unveiled three new battery products at its Super Tech Day, including the Naxtra sodium-ion battery and the Freevoy Dual-Power Battery. While a global launch, these technologies impact the US market through international supply chains and adoption by global OEMs. The Naxtra battery, a mass-produced sodium-ion cell, aims to reduce dependence on lithium and cobalt, offering strong performance in extreme temperatures. The Freevoy Dual-Power system is a pioneering cross-chemistry design, combining different battery types to meet diverse performance needs like long range and superfast charging.

US Electric Vehicle Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 15.602 billion |

| Total Market Size in 2031 | USD 37.820 billion |

| Growth Rate | 19.37% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Battery Type, Propulsion, Cell Form, Vehicle Type |

| Companies |

|

US Electric Vehicle Battery Market Segmentation:

- BY BATTERY TYPE

- Lithium Ion

- Solid-state

- Lead-Acid

- Hybrid Nickel Metal

- Others

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- BY BATTERY CELL FORM

- Cylindrical cells

- Prismatic cells

- Others

- BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

- Others