Aerosol Cans Market Dynamics: Regulatory Impacts, Consumer Demand, and Technological Innovation

Introduction

The???????? aerosol can industry is at a very interesting point where changes in regulations, consumer expectations, and technological advancements are all having a significant impact. Once looked at as a stable packaging category, aerosol cans have become a vibrant, innovation-rich segment with a wide range of applications from personal care to industrial maintenance. The industry has been dealing with more stringent environmental regulations in recent years, such as those for volatile organic compounds (VOCs), greenhouse-gas-heavy propellants, and end-of-life waste management. Meanwhile, consumers want products that are easy to use, perform well, look good, and are environmentally friendly. These factors have therefore led to a flurry of technological innovations, advanced valves, lightweight cans, bag-on-valve systems, hybrid propellants, materials with high recycling efficiency, and digitalised production ????????lines.Market Overview and Growth Outlook

The???????? global aerosol can market keeps on showing gradual growth over time, despite the negative impacts of sustainability demands, raw material price fluctuations, and changing consumer preferences. The market is still heavily dependent on personal care products like deodorants, dry shampoos, shaving foams, body sprays, and hair styling products. Besides, household cleaning sprays, air fresheners, disinfectants, and automotive maintenance aerosols are attracting a significant volume. Moreover, industrial applications such as lubricants, corrosion inhibitors, paints, and speciality chemicals are adding to the sector’s size beyond the limits of household and automotive uses. Although aerosol cans were usually related to mass-market applications, a significant change has occurred with premiumization becoming a dominating factor. Brands are increasingly providing next-generation nozzle technologies, ultra-fine mist delivery, ergonomic packaging, minimalistic designs, and eco-friendly material selection. This premium positioning has facilitated both the perceived and real value of aerosol products, which in turn has enabled them to be sold at higher price levels and be more differentiated at retail ????????shelves. The???????? industry’s transition from tinplate steel to aluminium is another major trend that was done very smoothly. Aluminium provides very good barrier properties, is light in weight, is resistant to corrosion, and can be recycled almost indefinitely. The movement is also brand sustainability goals-driven, and by regulatory requirements that place a high value on circular materials. While the number of steel cans is still large because of cost advantages and strong structural properties, the aluminium share is still increasing. Growth forecasts beyond the next ten years predict a gradual but increasingly innovation-dependent path. The boom in health and hygiene that started during the global pandemic period is still driving the demand for disinfectant sprays, sanitising aerosols, and medical-grade spray products. The emerging markets in Asia, Africa, and Latin America are experiencing the rise of disposable incomes, the growth of the urbanisation process, and the increased adoption of convenience-focused packaged goods, which is thus further fueling the global ????????growth. Ball???????? Corporation, together with Alcoa and Unilever, introduced the very first consumer personal and home care packaging that is made from aluminium produced by a carbon-free smelting route, ELYSIS®. This is a major step for a sustainable package and an industrial collaboration; the aerosol can made with 50% ELYSIS aluminium and 50% post-consumer recycled content is the first such incident to be ????????recorded.Regulatory Drivers Reshaping the Aerosol Market

Regulation???????? is a major factor in the vector and speed of aerosol market evolution. Various governments have implemented stricter regulations on emissions, chemical safety, recyclability, product labelling, and transportation. These regulations are not fixed; they change as science and the environment ????????change.VOC Emissions and Air-Quality Controls

Volatile???????? organic compounds (VOCs) are one of the major causes of air pollution and the formation of ground-level ozone. Largely, aerosol formulations, most notably in paints, adhesives, air fresheners, and cleaning sprays, have been made of VOC-rich solvents. Agencies dealing with the environment all over the world have enforced tight restrictions on VOCs for each product category, thus limiting the maximum permitted VOC ????????content. These regulations compel manufacturers to:- Reformulate products using low-VOC solvents

- Increase adoption of water-based systems

- Reduce or eliminate ingredients known to contribute to smog

- Reengineer valves to ensure fine mist delivery despite lower solvent levels

Restrictions on Fluorinated Propellants and High-GWP Gases

A???????? major regulatory trend that has a significant impact on aerosol cans is the worldwide reduction of fluorinated propellants, in particular, hydrofluorocarbons (HFCs), which are the main contributors to greenhouse gas emissions. Many countries have imposed severe limitations on the use of gases with a high global warming potential ????????(GWP). This has resulted in the industry moving rapidly toward:- Hydrofluoroolefins (HFOs) with significantly lower GWP

- Hydrocarbon blends (propane, butane, isobutane) where flammability is manageable

- Dimethyl ether (DME), valued for its solvency and spray efficiency

- Compressed air and nitrogen, especially in bag-on-valve (BOV) systems

Waste Management, Recyclability, and Extended Producer Responsibility (EPR)

The???????? majority of aerosol cans are made from either aluminium or tinplate steel, both of which are very recyclable materials. Nevertheless, the fact that the cans are pressurised makes them a little bit more complicated to resell; thus, they require proper emptying and puncturing operations at recycling facilities. Many regions have introduced laws relating to Extended Producer Responsibility (EPR), which makes producers of packaging responsible for the post-consumer lifecycle of their products. This has far-reaching implications, such as:- Monomaterial packaging usage is being incentivised to make recycling simpler

- Design changes for easier recovery of valves and actuators are being facilitated

- Creation of economic pressure for improvement in collection and sorting systems

- Driving brands to use a higher recycled content in their packaging

| Regulation / Regulatory Area | Authority / Region |

| VOC Emission Standards | U.S. Environmental Protection Agency (EPA) |

| F-Gas Regulation | European Chemicals Agency (ECHA) |

| REACH Chemical Safety Standards | European Union (EU) |

| Packaging & Packaging Waste Directive | European Commission |

| Extended Producer Responsibility (EPR) Rules | EU Member States / Canada / Japan |

| Dangerous Goods Transportation Standards | U.S. Department of Transportation (DOT) |

| Hazard Communication Standards (HazCom) | Occupational Safety and Health Administration (OSHA) |

| Aerosol Dispensers Safety Directive | European Union (EU) |

| Consumer Product Safety Standards | Consumer Product Safety Commission (CPSC) |

Consumer Demand: Evolving Expectations and Market Shifts

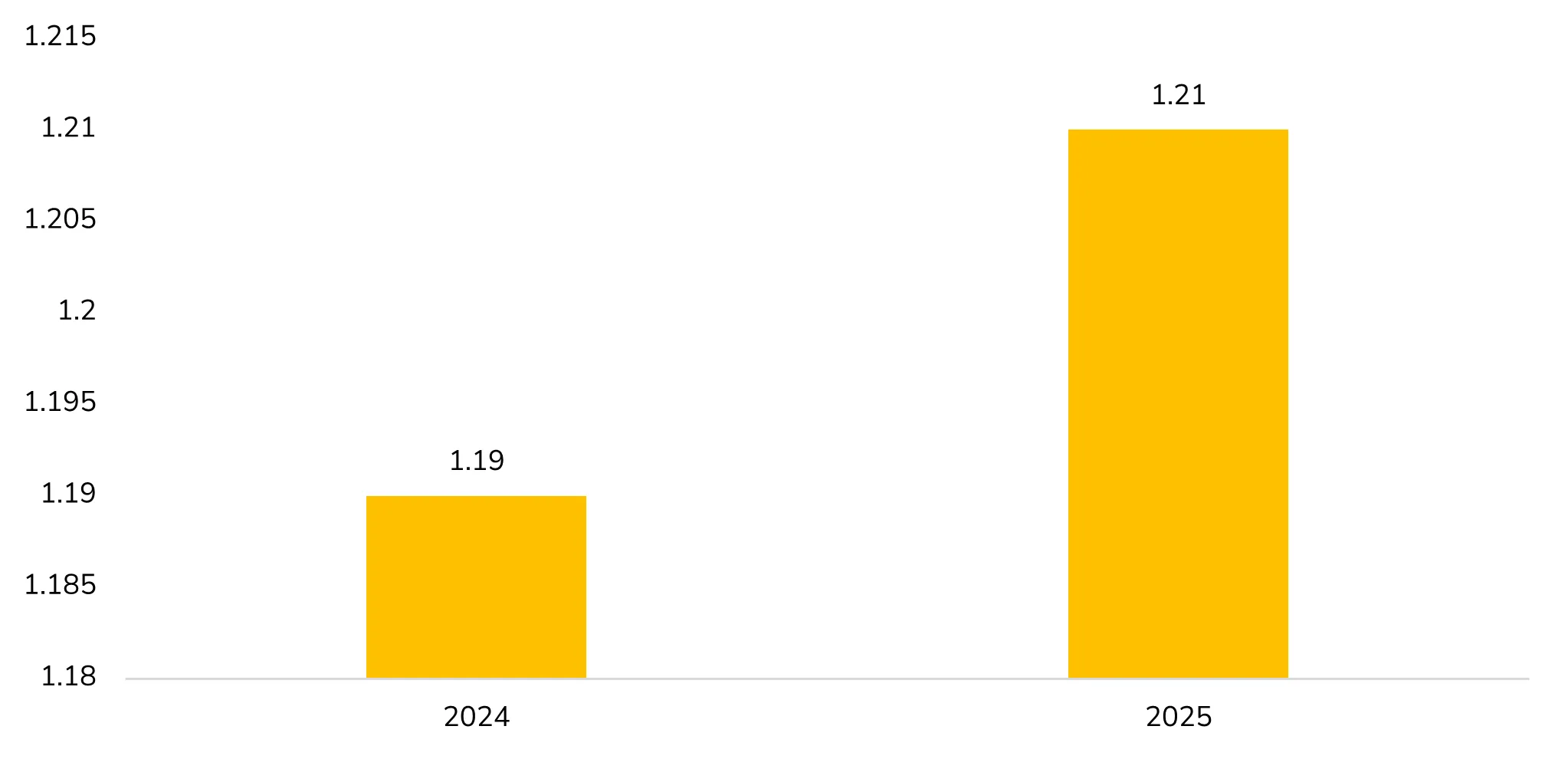

Consumer???????? demand has turned into one of the most influential powers to reshape the modern aerosol can market, and it is the main reason behind changes in product formulation to can design and marketing strategy. Basically, consumers of today require more than just functionality of products; they want aerosol products that can provide them with superior convenience, give them a consistent performance, and a pleasant user experience. One of the main reasons why aerosols are still attractive to buyers in a wide range of personal care, household maintenance, and automotive categories is that they can dispense products evenly, hygienically, and with one-handed ease. Since a growing number of consumers are choosing fast and mess-free applications, manufacturers are spending money on advanced valves and actuators that can give up a finer spray, non-clogging performance, and accurate directional ????????control. Moreover,???????? sustainability has become a major factor in consumer purchasing decisions. Buyers, especially the younger generations, are more willing to select brands that show a clear commitment to the lessening of their environmental impact. As a result, there has been a significant rise in the preference for aerosol cans made from materials that are highly recyclable, like aluminium, and the use of more eco-friendly propellants has been promoted. The increasing number of consumers who are concerned about the environment is not just a passing trend, but rather a structural change, which keeps on transforming product design all along the aerosol value ????????chain. One???????? of the major changes has also been the runaway growth of premiumization. Aerosol consumers are slowly but surely becoming a group who fork out a lot of money for attractive products, nice textures, and enhanced sensory experience novelty. For example, in the personal care sector, high-end deodorants, dry shampoos, and styling sprays make good use of elegant metallic finishes, soft-touch coatings, minimalistic designs, and ergonomic actuators to attract buyers. On the other hand, in the household/automotive care sectors, premium-format aerosols featuring, for instance, specialised nozzles, long-lasting performance, or advanced cleaning strength are also increasingly popular. This is supported by a shift towards the release of transparent information regarding health and safety. Buyers want labels that are easy to understand, ingredients in simple terms, allergen information, and standard compliance that guarantees product safety and customer care. Hence, a market has emerged whereby aesthetics, safety, sustainability, and performance are the major factors influencing people's buying ????????decisions. According???????? to the International Organisation of Aluminium Aerosol Container Manufacturers (AEROBAL), the volume of aluminium aerosol cans supplied by its members to the 27 EU member states, and the UK has gone up marginally. It was a rise from 1.19 billion to 1.21 billion ????????units from 2024 to 2025. Volume of aluminium aerosol cans supplied to 27 EU states and the UK, In Billion, 2024-25 Source: International Organization of Aluminum Aerosol Container Manufacturers

Source: International Organization of Aluminum Aerosol Container Manufacturers

Technological Innovations Transforming Aerosol Packaging

Technological???????? innovations are the main driver of changes in materials, manufacturing processes, and dispensing systems in the aerosol can industry. These innovations have become the core of competitiveness in the industry. A very important breakthrough, for instance, is the advent of bag-on-valve (BOV) technology that has been the trend in recent years. The BOV system uses an internal pouch to separate the product from the propellant, thus allowing the use of safer and more environmentally friendly compressed gases such as air or nitrogen. BOV also provides almost complete product evacuation, better hygiene, and the ability to dispense in any direction; thus, it is a perfect match for high-end cosmetics, medical sprays, food applications, and speciality household products. Its expanded usage is indicative of a larger industry trend that is characterised by increased safety, performance, and environmental ????????responsibility. Propellant???????? innovation is yet another area that is rapidly evolving. As rules become stricter for propellants with high global warming potential, producers are looking for alternatives that can give good performance and have less environmental impact. For instance, hydrocarbon propellants have been widely used due to their lower climate impact, while a few new low-GWP such as next-generation HFO propellants, are being looked at in those sectors where precision and stability are of utmost importance. Besides, compressed gases have also become trendier, particularly those in BOV-based products and hybrid systems. These innovations, together with the advancements in valve technology, enable aerosol producers to keep the spraying performance at the same level or even better than it, without propellant restrictions and environmental ????????requirements. Material???????? innovation and production efficiency are still evolving just as fast. Lightweighting, the practice of cutting down the metal used in each can without losing the ability to resist the pressure, has become a standard for manufacturers who are pursuing sustainability goals. Now it is possible to produce cans that are both durable and resource-efficient due to high-strength aluminium alloys and advanced tinplate formulations. Meanwhile, the industry is experimenting with recyclable polymer components for valves and actuators to a lesser extent, to be able to recycle the whole package. All???????? Over Spray represents the top-tier aerosol packaging that provides a highly continuous, strong mist with 360º dispensing. Different bag capacities, valve types and actuators are offered to All Over Spray customers for their various application ????????requirements. Moreover, digitalisation is changing the manufacturing scene as well. Current production lines are equipped with robotics, inspection systems powered by AI, digital printing technologies, and devices for real-time monitoring of pressure that help to increase precision, make defects less frequent, and enable mass customisation. Aerosol cans have largely become an increasingly smart, efficient, and environmentally friendly packaging solution due to these innovations taken ????????together.Strategic Market Dynamics

The???????? strategic dynamics of the aerosol can market are a result of a complicated mixture of supply chain pressures, competitive structures, branding strategies, and geographic expansion. One of the most significant forces is raw material volatility. Aluminium, steel, propellants, and, on top of that, a few highly specialised components such as valves and actuators, are all vulnerable to fluctuating global prices, which are driven by geopolitical tensions, mining output, energy costs, and trade policies. Such fluctuations make direct impacts on manufacturing margins and thus, companies are often forced to take the initiative of turning to more stable alternatives like metals with a high recycled content or a diversified supplier network. Manufacturers are taking more steps to materialise their hedging strategies by renegotiating long-term contracts and localising their production to be able to withstand price shocks and, at the same time, ensure supply ????????continuity. Moreover,???????? the competition within the market is changing as well, where consolidation is becoming increasingly prevalent in the whole sector. In response to the escalating costs of regulatory compliance and the necessity of technological sophistication for survival, large companies with a global reach are buying up regional manufacturers or collaborating through joint ventures to gain a stronger position in the market. Integrated producers with extensive R&D capabilities, access to eco-friendly materials, and highly efficient production lines are gradually becoming more attractive to customers. This merger leads to the creation of economies of scale in sourcing, innovation, and distribution, which helps to maintain the dominance of the leading players, and at the same time, it becomes tougher for the small manufacturers who do not possess a specialised niche to ????????survive.Key Challenges Facing the Aerosol Market

Sustainability and Perception Issues

Whereas???????? aerosol cans are very recyclable, as a result, there are still consumer misconceptions. For example, some people mistakenly think that aerosol cans hurt the ozone layer (a problem that was caused by CFCs that were phased out more than 30 years ago). It is the industry's main priority to clarify these misconceptions and, at the same time, to keep improving the sustainability ????????performance.High Cost of Technological Upgrades

Changing???????? over to new propellants, BOV systems, or advanced valves involves a high cost in R&D and new filling-line infrastructure. Small manufacturers are frequently unable to raise such capital, and this may lead to their rapid ????????consolidation.Complex Global Regulatory Landscape

Companies operating globally must navigate a patchwork of regulatory norms across regions. Ensuring compliance across different jurisdictions demands extensive testing, documentation, and reformulation.Future Outlook of the Aerosol Can Market

The???????? aerosol can market's future is largely determined by a sustainability blend of pressures, changing regulations, new technologies, and demographic trends. Within the next ten years, the industry is likely to go through a bigger change than the one it has had before in its entire history. One of the biggest changes will be the general use of clean-label and eco-friendly aerosol products. As buyers continue to choose products with a minimalistic ingredient profile and transparent safety claims, producers will reformulate their products to meet the demand for compositions that are more gentle, safer, and more natural. In the beauty, skincare, household cleaning, and medical sprays industries, the companies are expected to discontinue the use of legacy solvents and start using plant-based or biodegradable materials that are in line with the health and environmental ????????standards.Conclusion

The???????? aerosol can industry is undergoing a fundamental change, influenced by stricter regulations, more discerning consumers, and rapid technological innovations. Even though the pressure to comply with regulations makes it difficult for the industry, the aerosol can sector is benefiting from it as a lift for innovation, like safer propellants, smarter valves, lighter materials, circular packaging, and digital production systems are becoming increasingly visible. Consumer willingness to pay for ease, sustainability, attractiveness, and excellent performance pushes the industry to provide even more innovative solutions. Manufacturers who change by investing in R&D, going green, using advanced technologies on a large scale, and following global regulatory standards will be the leaders of aerosol packaging’s next era. Aerosol cans, as the market changes, are getting beyond just a means of packaging and becoming a representation of the bigger change to environmentally friendly, high-tech consumer ????????products.Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently