Report Overview

Australia Data Center Market Highlights

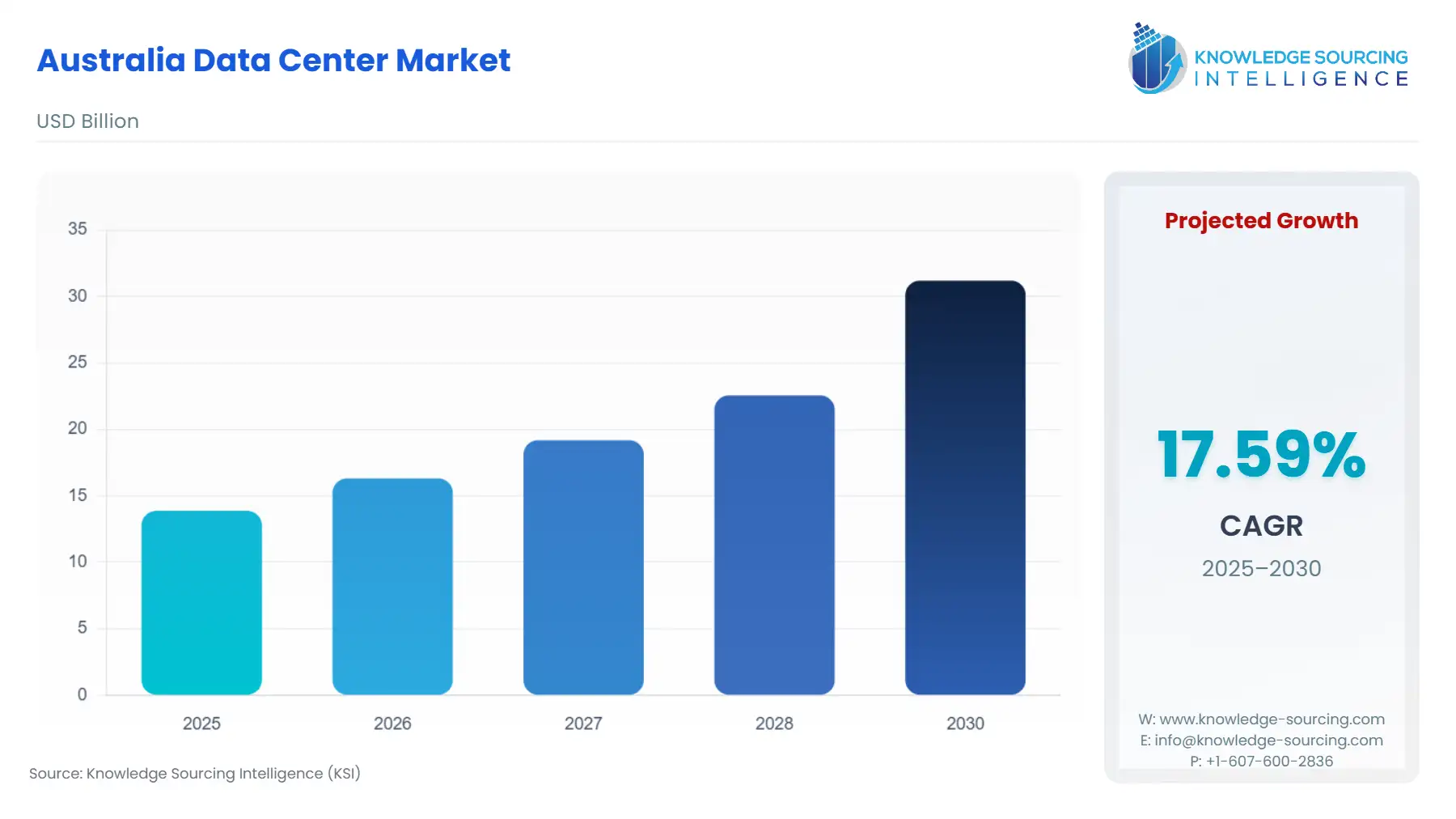

Australia Data Center Market Size:

The Australia Data Center Market is anticipated to grow at a CAGR of 17.59%, increasing to USD 31.200 billion in 2030 from USD 13.880 billion in 2025.

The Australian data center market is a critical component of the nation's digital infrastructure, fueled by accelerating demand for data storage, processing, and connectivity. This requirement stems from a nationwide push toward digital services, the mainstream adoption of cloud computing by enterprises, and the increasing volume of data generated by modern applications. Australia's political stability and robust economy position it as a key hub for data services in the Asia-Pacific region, attracting both domestic and international investment. The market's evolution is directly tied to the need for low-latency, high-availability infrastructure to support applications ranging from e-commerce and media streaming to advanced analytics and artificial intelligence.

Australia Data Center Market Analysis

- Growth Drivers

Digital transformation is a foundational driver, as businesses across all sectors shift their operations to digital platforms. This transition generates vast datasets and necessitates reliable, high-performance computing resources. Consequently, enterprises increasingly require data center services, either through dedicated facilities or colocation, to manage their expanding IT footprints. The widespread adoption of cloud-based services further amplifies this trend; as organizations migrate to the cloud, they create a strong and persistent demand for the underlying data center capacity that hosts these services. This is particularly evident in the hyperscale segment, where large cloud service providers require immense and scalable infrastructure to support their growing customer base.

- Challenges and Opportunities

A primary challenge confronting the market is the high cost of energy, which accounts for a significant portion of operational expenses for data center operators. The energy-intensive nature of power and cooling systems creates an imperative for operators to seek out efficiency gains. This challenge presents a concomitant opportunity, catalyzing innovation in energy management, cooling technologies, and the integration of renewable energy sources. The scarcity of available land in prime metropolitan areas like Sydney and Melbourne also poses a constraint on new facility construction. However, this obstacle creates an opportunity for providers to develop multi-story data centers or to strategically expand into secondary markets and regional hubs, enabling the deployment of edge computing facilities closer to end-users.

- Supply Chain Analysis

The Australian data center supply chain is globally integrated, with a heavy reliance on international vendors for critical hardware components such as servers, network infrastructure, and cooling systems. Key production hubs are located in Asia and North America. Logistical complexities and dependencies arise from this international procurement, with potential for disruptions due to global supply chain pressures. This reliance underscores the importance of resilient supply chain strategies for Australian operators.

Australia Data Center Market Government Regulations

Key government regulations in Australia have a direct and measurable impact on market expansion.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Australian Government | Australian Privacy Principles (APPs) under the Privacy Act 1988 | Increases demand for onshore data storage services, as businesses seek to ensure compliance with laws governing the handling and disclosure of personal information. |

| Australian Government | Security of Critical Infrastructure Act 2018 | Mandates enhanced security and risk management for critical infrastructure assets, including data centers, driving demand for facilities that meet stringent security and resilience standards. |

| Australian Government | Digital Transformation Agency (DTA) Hosting Strategy | Promotes the use of certified, onshore data centers for government data, creating a direct and robust demand signal for local providers. |

Australia Data Center Market Segment Analysis

- By Technology: Hyperscale Data Center

The hyperscale data center segment is driven by the monumental demand from global cloud service providers, social media platforms, and large-scale enterprises. The growth imperative for this segment is scale, speed of deployment, and a focus on power efficiency. Hyperscale operators, such as AirTrunk and NEXTDC, respond to this by building vast, modular facilities that can be rapidly expanded to meet the needs of their anchor tenants. This segment's growth is directly tied to the increasing global and regional adoption of cloud-based services like AWS, Google Cloud, and Microsoft Azure, all of which require a physical presence in Australia to serve local customers with low-latency access. The ongoing demand for artificial intelligence and big data analytics further propels this segment, as these workloads require massive compute and storage capacities that only hyperscale facilities can provide.

- By End User: Banking, Financial Services, and Insurance (BFSI)

The BFSI sector's demand for data center services is a function of its critical need for security, regulatory compliance, and business continuity. Financial institutions handle vast quantities of sensitive client data and are subject to strict regulatory oversight, which compels them to invest in robust and secure data infrastructure. This creates a strong demand for high-tier colocation facilities (Tier III and Tier IV) that offer redundancy and certified uptime. The BFSI sector's digital transformation, including the shift to digital banking and the adoption of fintech solutions, further accelerates this requirement. These digital services require low-latency connectivity and high-availability platforms, making premium data center services an operational necessity rather than a mere convenience.

Australia Data Center Market Competitive Analysis

The Australian data center market is a competitive landscape dominated by a mix of international and domestic players. The strategic focus for market leaders is on capacity expansion, particularly in the hyperscale and colocation segments, and an emphasis on sustainable operations.

- Equinix, Inc.: As a global leader, Equinix's strategy in Australia centers on its extensive global interconnection platform. The company provides a robust ecosystem that allows its customers to directly and securely connect to partners, networks, and cloud service providers. This focus on interconnection creates a network effect, driving demand for their colocation services. Equinix's offerings are designed to support a wide range of use cases, from hybrid multi-cloud to financial trading and content delivery, with a particular emphasis on low-latency connectivity.

- NEXTDC Limited: NEXTDC is a key domestic player with a strong focus on building a national network of interconnected data centers. The company's strategy revolves around providing premium, high-availability facilities with a strong emphasis on sustainability and innovation. NEXTDC's focus on building a robust ecosystem and direct cloud access through its AXON platform creates a strong demand signal from enterprises seeking seamless hybrid IT solutions. The company's strategic expansion in key capital cities, including its large-scale developments, directly addresses the growing need for scalable and sovereign data infrastructure.

Australia Data Center Market Developments

- June 2025: NEXTDC secured new senior debt facilities of A$2.2 billion, increasing its total available debt to A$5.1 billion to support capital expenditure for national expansion and meet growing demand for AI infrastructure.

- August 2025: Equinix announced a partnership with leading alternative energy providers to power its AI-ready data center growth, demonstrating its commitment to sustainability and meeting the power requirements of AI workloads.

- July 2024: AirTrunk opened its new AI-ready data center in Malaysia, accelerating innovation and the energy transition in the region, a development that highlights the company's regional expansion strategy.

Australia Data Center Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 13.880 billion |

| Total Market Size in 2031 | USD 31.200 billion |

| Growth Rate | 17.59% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Data Center Type, Tier Level, Region |

| Geographical Segmentation | New South Wales, Sydney, Victoria, Other |

| Companies |

|

Australia Data Center Market Segmentation

- By Component

- Hardware

- Servers

- Network Infrastructure

- Cabling Infrastructure

- Power Infrastructure

- Cooling Infrastructure

- Physical Security

- Storage Infrastructure

- Software and Services

- Hardware

- By Data Center Type

- Colocation Data Center

- Enterprise Data Center

- Hyperscale Data Center

- Edge Data Center

- Micro Data Center

- By Tier Level

- Tier I

- Tier II

- Tier III

- Tier IV

- By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By End User

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Government & Public Sector

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Others

- By Region

- New South Wales

- Sydney

- Victoria

- Other

Our Best-Performing Industry Reports:

Navigation:

- Australia Data Center Market Size:

- Australia Data Center Market Key Highlights:

- Australia Data Center Market Analysis

- Australia Data Center Market Government Regulations

- Australia Data Center Market Segment Analysis

- Australia Data Center Market Competitive Analysis

- Australia Data Center Market Developments

- Australia Data Center Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 29, 2025