Report Overview

Baby Safety Gate and Highlights

Baby Safety Gate and Bedrail Market Size:

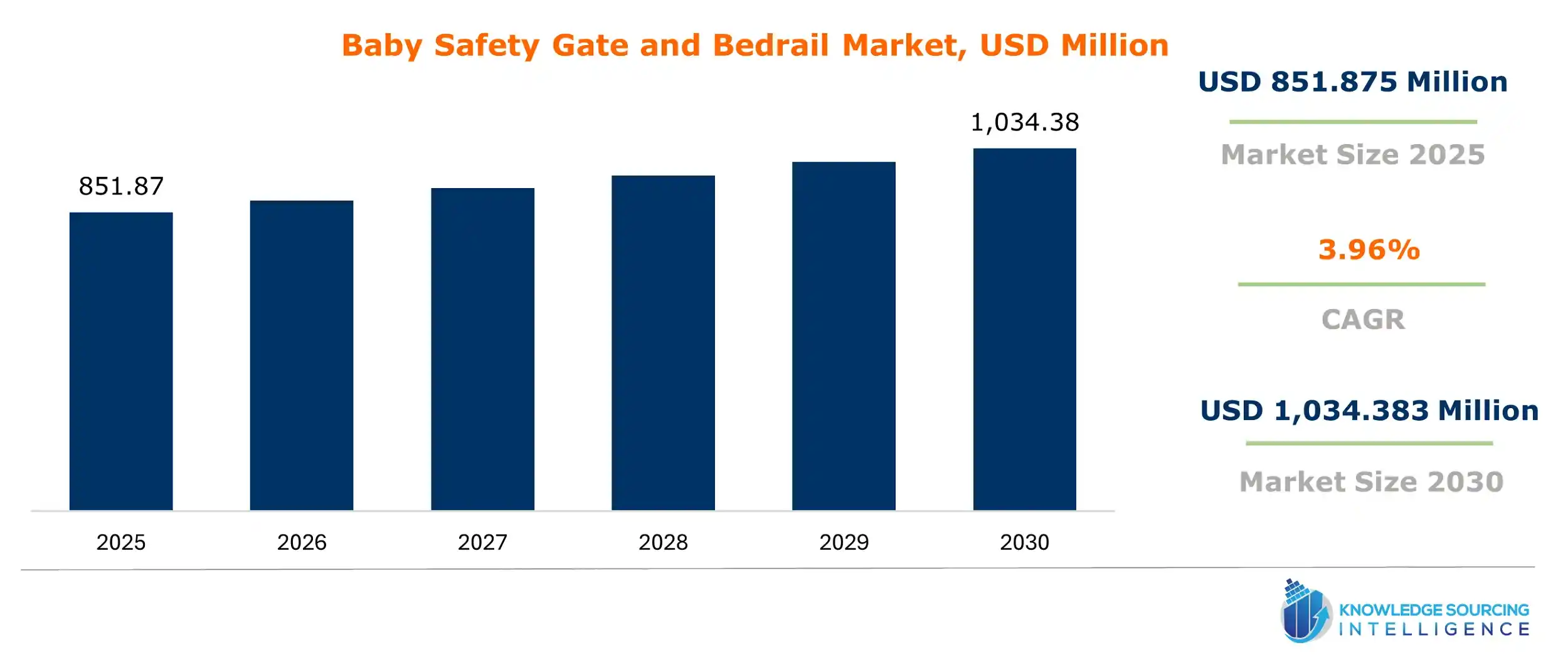

The Baby Safety Gate and Bedrail Market is expected to grow moderately at a 3.96% CAGR, reaching a market size of US$1034.383 million in 2030 from US$851.875 million in 2025.

Baby Safety Gate and Bedrail Market Key Highlights:

- Baby Safety Gate and Bedrail Market is growing moderately at a 3.96% CAGR.

- Companies are offering customizable solutions, boosting adoption of premium baby safety products.

- Rapid urbanization in developing nations is driving increased demand for safety gates.

- Online distribution channels are expanding rapidly, fueled by growing smartphone and internet access.

A baby gate is a safety device that is designed in a way to block certain areas in the home such as staircases, doorways or rooms to prevent toddlers or infants from entering those dangerous areas for infants. These are of materials such as metal, wood or plastic. Bed rails are products designed to keep babies from falling out of their beds by attaching the side of the bed with a railing kind of structure.

Increasing concerns about baby safety products are fueling market demand for these items. Additionally, the rise in disposable income and the expanding middle-class population, particularly in developing countries, are significant factors contributing to the increased adoption of various premium baby care products, which is expected to further enhance market growth over the next five years. Further, the companies operating in the market are offering customisable and personalized solutions to meet the demand of parents or consumers, which has contributed greatly to the adoption of these products. For instance, in February 2022, KidCo, Inc., the pioneering company that brought metal safety gates to the United States has introduced a top-tier lifetime warranty for all products sold in both the United States and Canada. According to the new policy, original customers are eligible for replacement components or a new product at the discretion of KidCo.

Moreover, the rapid urbanization occurring in developing nations such as China and India is leading to an increased adoption of baby care products, which is projected to significantly drive the growth of the baby safety gate and bedrail market in these regions during the forecast period.

Baby Safety Gate and Bedrail Market Growth Drivers:

- The rapid product innovation is propelling the market

A major factor propelling market growth during the forecast period is the ongoing commitment of companies to increase their R&D budgets for the development and launch of new products. This strategy helps them strengthen their market presence and gain a competitive edge over rivals, thereby further accelerating the market's rapid expansion. For example, in October 2023, one of the leading companies, KidCo, launched quick-install gates. These innovative baby safety gates offer significant cost savings by reducing packaging, boxes that are 80% smaller, and shipping expenses. They also pass savings on to the customers, priced 25% less than their other models, and are environment-friendly.

Baby Safety Gate and Bedrail Market Segment Analysis:

- The safety gates segment will hold a larger market share in the forecast period

The safety gates segment is expected to capture a larger market share throughout the forecast period. Key factors driving the growth of this segment include the increasing adoption of these gates in both developed and developing economies, driven by changing consumer preferences for high-quality baby care products. Additionally, the rising incidence of injuries among babies resulting from falls down stairs is contributing to the widespread adoption of baby safety gates in various countries. For example, data from the Canadian government indicates a significant number of cases involving toddlers falling down stairs. Thus, various regulations are stated by the governments of various countries regarding the proper material and installation of baby safety gates, propelling the market growth.

The bedrail segment is expected to hold a substantial market share and experience significant growth during the forecast period, driven by the increasing preference for bedrails among parents. These products are more affordable than toddler beds equipped with rails and guards. Additionally, bedrails can be easily attached to any standard bed, helping to prevent children from falling while crawling or rolling off the bed.

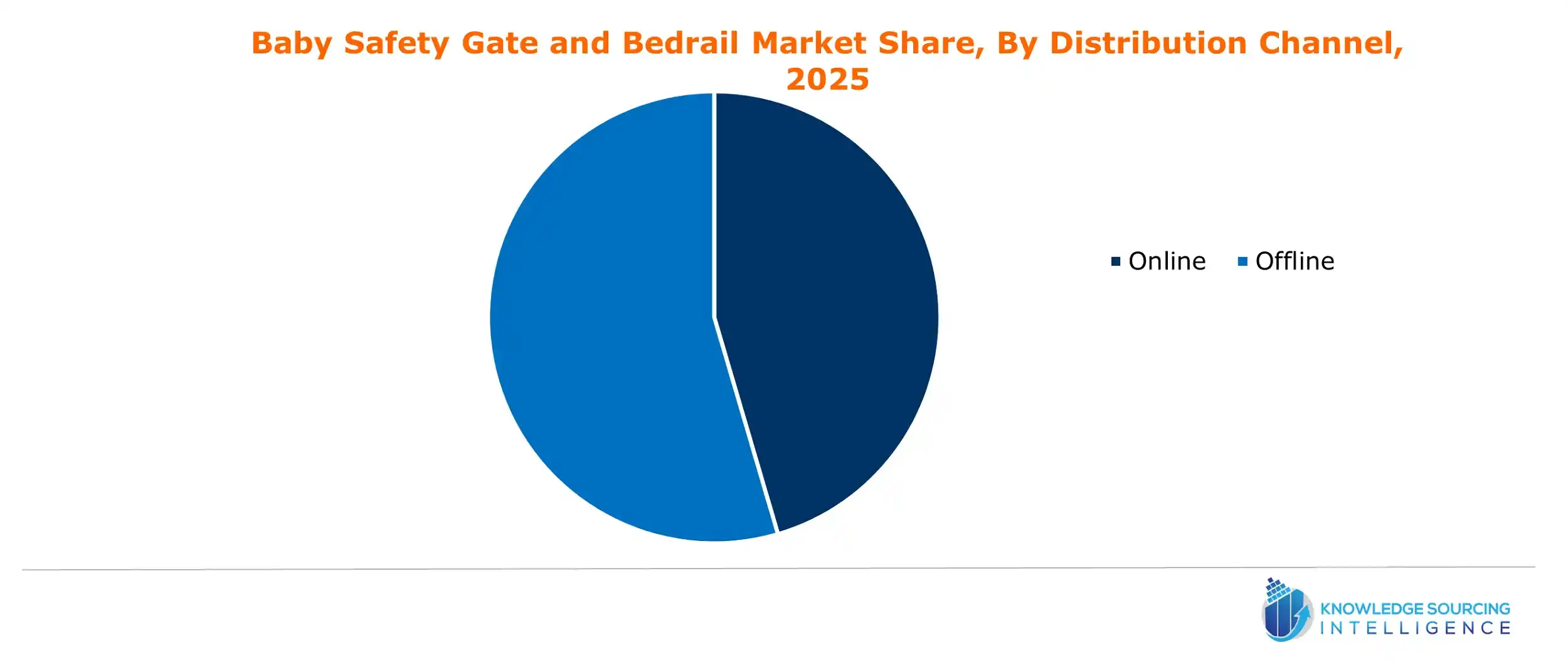

- Online distribution channel will be the fastest-growing segment

According to the distribution channel, the offline segment is expected to lead the market throughout the forecast period. Key factors contributing to this segment's dominance include consumers' preference for purchasing baby products from supermarkets and hypermarkets. Additionally, the increasing number of one-stop baby care stores is further enhancing its growth over the next five years.

Another factor driving the expansion of this segment in the coming years is the growing prevalence of smartphones and internet access, particularly in developing economies. This trend has also resulted in significant growth in the e-commerce sector, supporting the expansion of the online segment.

Baby Safety Gate and Bedrail Market Geographical Outlook:

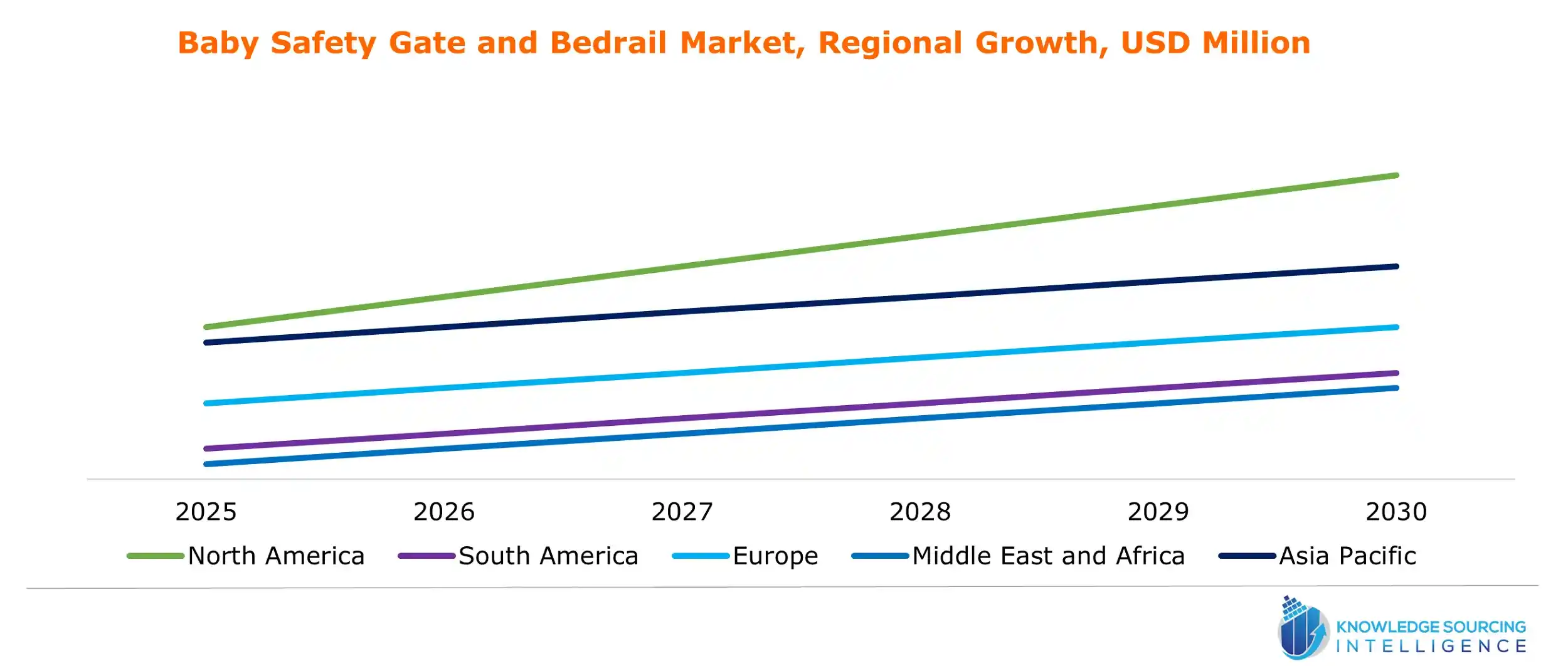

- North America and APAC will hold the largest market share during the forecast period

Geographically, the Baby Safety Gate and Bedrail market is divided into several regions: North America, South America, Europe, the Middle East, Africa, and Asia Pacific.

Geographically, the North American region is expected to maintain a significant market share, driven by the higher purchasing power of its population. Furthermore, the key players in the region is driving the market by meeting the demand, doing innovation, offering quality products etc.

In the Asia Pacific region, the market is expected to experience substantial growth throughout the forecast period, driven by the large population of children, including toddlers and infants, in countries such as India and China. This growth is further supported by the expanding middle-class population in these nations.

Baby Safety Gate and Bedrail Market Key Launches:

- In October 2023, KidCo, a leading provider of baby and children’s products, launched a quick-install gates lineup. It is priced 25% less than their other models, and the boxes are 80% smaller, offering cost savings.

Baby Safety Gate and Bedrail Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Baby Safety Gate and Bedrail Market Size in 2025 | US$851.875 million |

| Baby Safety Gate and Bedrail Market Size in 2030 | US$1034.383 million |

| Growth Rate | CAGR of 3.96% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Baby Safety Gate and Bedrail Market | |

| Customization Scope | Free report customization with purchase |

The Baby Safety Gate and Bedrail Market is analyzed into the following segments:

- By Product

- Safety Gate

- Bedrail

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America