Report Overview

Climate Tech Market Size, Highlights

Climate Tech Market Size

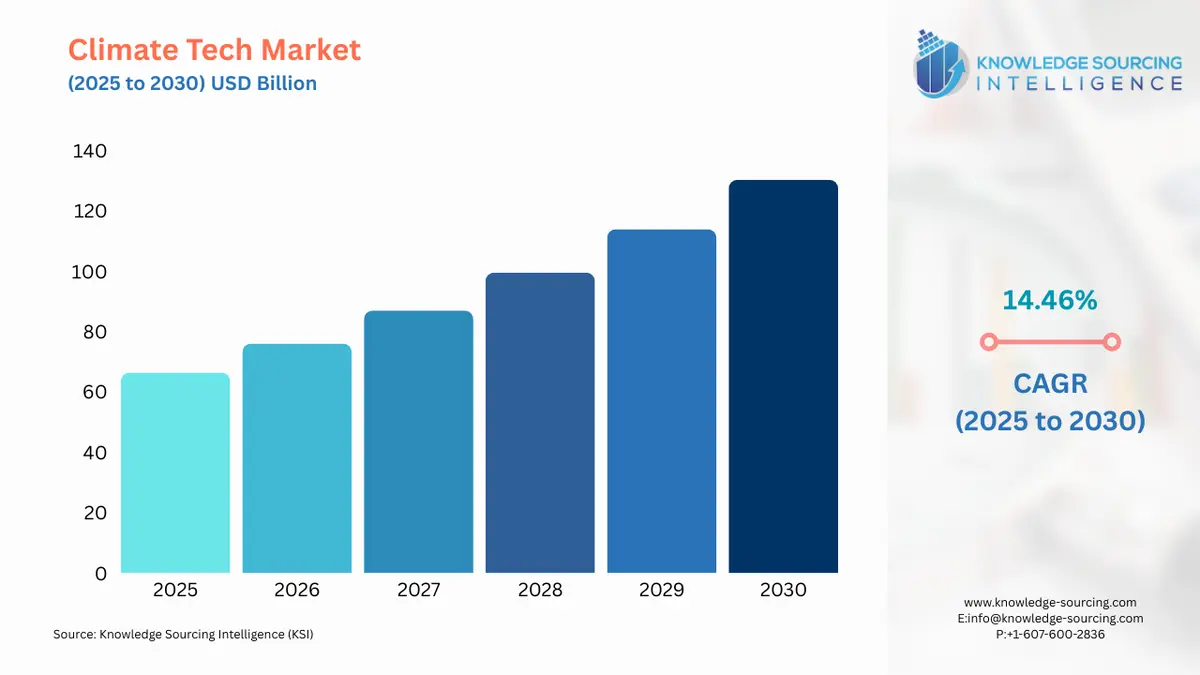

The climate tech market is predicted to grow at a CAGR of 14.46% thereby reaching US$130.349 billion in 2030 from US$66.374 billion in 2025.

Climate tech encompasses a wide array of technologies specifically designed to address the challenges faced by multiple sectors due to climate change. These technologies aim to minimize GHG (Greenhouse Gas) emissions, improve pollution control measures, and enable communities to adapt to dynamic climatic change.

Growing global warming has bolstered the demand for innovative technologies to restore biodiversity, driving the demand for climate tech. Furthermore, the ongoing shift towards e-mobility, investment in renewable projects, and initiatives to bolster the study of climate change have further created a new framework for the market to prosper in the coming years.

Major weather & climate monitoring organizations are investing in improving their technical infrastructure to enhance the accuracy of their obtained results and measurements, which has further led to an upward market trajectory. However, the high associated investments for the development of such technologies may limit their expansion scope in certain nations that lack the basic infrastructure, thereby posing a challenge for the overall market growth.

Climate Tech Market Drivers:

- The growing electric vehicle transition has propelled the market growth.

Automotive constitutes one of the major portions of carbon emissions, which drastically affects the climate and biodiversity. To reduce this impact, governments worldwide are investing in new technologies, such as alternative fuel for transportation and electric vehicle development, which has positively impacted the scope for climate tech in the transportation sector.

According to the International Energy Agency’s “Global EV Outlook 2024”, in Q1 of 2024, global electric vehicle sales witnessed 25% growth over Q1 2023 and by the end of the year, this figure is expected to reach near 17 million. In major regions & economies, namely China, Europe, and the United States, the percentage share of electric vehicle sales will reach up to 45% in China, 25% in Europe, and 11% in the US.

Furthermore, the demand for e-fuel is also on the rise for the commercial vehicle segments, including heavy-duty trucks and buses, followed by improvement in their sales volume. The same report stated that in 2023, the global E-Truck sales experienced 35% growth over 2022. This booming EV transition will positively drive market growth.

- Favorable investments in smart grids and power projects have stimulated market expansion.

Climate technology mitigates the impact of environmental changes, enabling countries to improve their adaptive capacities without sabotaging their industrial productivity. The ongoing shift towards renewable energy sources such as solar, wind, and hydro to phase out fossil fuel usage for power development has accelerated investments in various renewable energy projects.

For instance, in August 2024, the Biden administration announced an investment of US$140 million in clean energy projects, which involved the establishment of solar plants in the Kentucky and Nevada regions to increase household access to clean energy supply. Likewise, as per the June 2024 press release, the European Union dispersed nearly EUR2.967 billion in 10 EU member states to support 39 energy projects. These projects involved modernizing the energy system and reducing GHG emissions in the transportation and industrial sectors.

- Initiatives to bolster carbon capture storage (CCS) capacity have positively impacted the overall market expansion.

Climate change has become one of the major issues which have hampered the global food security and biodiversity. Hence, various innovations, developments, and investments in technologies such as carbon capture storage (CCS) and renewable energy solutions are being implemented to reduce the negative impact of climate change.

For instance, in June 2024, Aker Carbon Capture formed a joint venture with SLB to combine their expertise and innovative solutions to accelerate the development of carbon capture technologies that will be used in industrial decarbonization. Likewise, in December 2023, the Singapore Economic Development Board[1] and the S-Hub consortium Shell Singapore Pte. Ltd and ExxonMobil Asia Pacific Pte. Ltd formed a MoU to coordinate the planning and development of carbon capture projects that will enhance the permanent capture & storage of CO2 by 2030.

Climate Tech Market Geographical Outlook

- Asia Pacific is predicted to expand at a significant rate.

The climate tech market, region-wise, is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The market in the APAC regions is expected to show significant growth during the given timeframe. This growth is attributable to favorable investment in renewable energy projects and carbon capture technologies followed by EV transition in major regional economies.

According to the International Council of Clean Transportation, in 2023, China accounted for 66% of the global electric vehicle production and 33% of new light-duty electric vehicles sold globally. The same source further stated that battery electric vehicle adoption in other major APAC economies, namely Japan, South Korea, and India, also experienced positive growth in comparison to the previous year.

The countries' governments have implemented favorable policies to reduce carbon emissions and bolster their storage, further increasing regional market growth. For instance, in June 2023, the JOGMEC (Japan Organization For Metals and Energy Solution) selected seven projects aimed at capturing CO2 emitted from major sectors such as oil & refineries, steel, electric, chemical, and pulp & paper. The projects bolster the country's efforts to achieve full-scale carbon neutrality by 2050.

Climate Tech Market Key Developments:

Climate Tech Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Climate Tech Market Size in 2025 | US$66.374 billion |

| Climate Tech Market Size in 2030 | US$130.349 billion |

| Growth Rate | CAGR of 14.46% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Climate Tech Market |

|

| Customization Scope | Free report customization with purchase |

The Climate Tech market is segmented and analyzed as follows:

- By Type

- Climate Modeling

- Prediction Tools

- Carbon Capture Technologies

- Others

- By Product

- Hardware

- Software

- By End-User

- Agriculture

- Energy & Utilities

- Industrial

- Transportation

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America