Report Overview

Electric Vehicle Battery Polymer Highlights

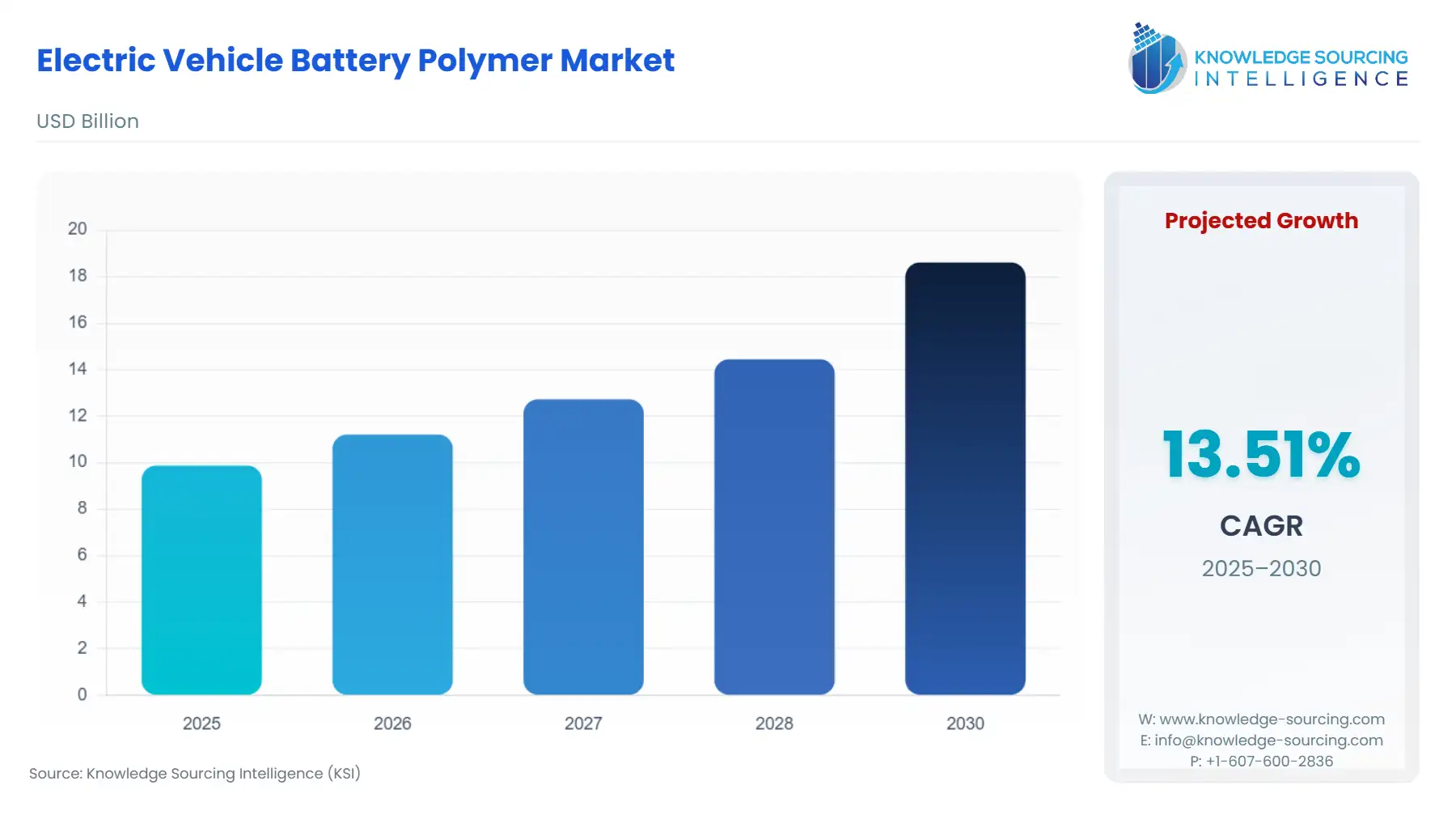

Electric Vehicle Battery Polymer Market Size:

The electric vehicle battery polymer market will grow from USD 9.876 billion in 2025 to USD 18.614 billion in 2030 at a CAGR of 13.51%.

Electric Vehicle Battery Polymer Market Introduction:

The electric vehicle (EV) battery polymer market is pivotal in advancing battery performance and safety. EV battery separators ensure ionic flow while preventing short circuits in lithium-ion cells. Lithium-ion battery binders enhance electrode stability, improving cycle life. Solid polymer electrolytes and gel polymer electrolytes offer safer, more flexible alternatives to liquid electrolytes, enhancing energy density and thermal stability. Battery encapsulation materials protect cells from environmental factors, while thermal interface materials (TIMs) for EVs manage heat dissipation, critical for performance and longevity. Battery pack housing materials, often lightweight composites, provide structural integrity, enabling efficient, durable, and safe EV battery systems for next-generation mobility.

Electric Vehicle Battery Polymer Market Trends:

The global market for electric vehicle (EV) battery polymers is expected to grow significantly, driven by the rising adoption of electric vehicles worldwide. Polymers are critical in EV battery systems, contributing to lightweight designs, enhanced efficiency, and compliance with stringent environmental regulations. The surge in EV sales, particularly in countries like China and India, is a key driver of demand for battery polymers, as automakers seek materials that optimize performance and range.

The increasing use of polymers in EVs is largely due to their ability to reduce vehicle weight, a critical factor in improving energy efficiency and extending driving range without compromising battery recharge times. Polymers are utilized in battery casings, separators, and insulation components, enhancing the power-to-weight ratio and supporting the production of lighter, more efficient vehicles. Additionally, polymers are integral to EV powertrains and structural components, such as interior and exterior body parts, further boosting market growth.

The EV battery polymer market is evolving rapidly, driven by solid-state battery polymers that enhance safety and energy density. High-energy-density battery materials and fast-charging battery polymers are critical for extending range and reducing charge times. Flame-retardant polymers for batteries mitigate thermal runaway risks, while lightweight battery materials improve vehicle efficiency. Thermal stability battery polymers ensure reliable performance under extreme conditions, and ionic conductivity polymers enhance charge transfer in solid-state systems. These advancements align with industry demands for safer, more efficient, and high-performance EV batteries, shaping the future of electric mobility.

Government policies play a pivotal role in this market’s expansion. Stringent emission regulations enforced by agencies like the U.S. Environmental Protection Agency (EPA) and similar bodies globally are pushing automakers toward low-emission vehicles. Incentives such as tax credits, subsidies, and investments in charging infrastructure are accelerating EV adoption, particularly in the Asia-Pacific region, which is witnessing robust growth due to ambitious environmental targets. These policies not only promote EV manufacturing but also increase the demand for advanced polymers used in battery and vehicle production.

The expansion of charging infrastructure in both developed and developing nations further supports market growth by addressing consumer concerns about EV accessibility, indirectly boosting the need for polymers in battery systems. However, challenges such as high production costs and the need for advanced polymer technologies could pose constraints, particularly in emerging markets.

The EV battery polymers market is set to expand due to rising EV adoption, supportive government policies, and the push for lightweight, efficient vehicles. The Asia-Pacific region, with its aggressive environmental goals and growing EV market, is expected to lead this growth, though ongoing innovation in polymer technologies will be crucial to overcoming cost and scalability challenges.

Electric Vehicle Battery Polymer Market Segment Analysis:

- The exterior segment by polymer component is expected to expand the EV polymer market.

Due to the increasing awareness and concern for sustainability in buildings, exterior wall systems are likely to witness a huge demand. One of the segments of the market deals with different types of clapboards. They include ventilated and non-ventilated façades, curtain walls, and other products and services. The ventilated facade segment is expected to grow more in this segment because this type of design helps regulate humidity levels better while offering great defense from external factors.

The curtain wall segment is also expected to grow because, more often than not, in wall systems, fabrication, and construction are shorter across them than any other wall structures. The development of the nonventilated façade segment will still grow. This growth is also because of the many benefits it offers the designers, such as creativity in designs, a fast construction period, wonderful insulation, and efficiency in dealing with sound.

One factor propelling this market’s expansion is the increasing demand for energy-saving and environmentally friendly exterior wall systems, especially in emerging nations. They further explained that it will likely increase due to the advancement of new architectural designs, still on dry construction, and the inclination toward environmentally friendly buildings.

Additionally, there is a future perspective in the growing EV polymeric parts market as the weight of automotive parts is decreased through polymer application. Additionally, engine revolutions, as well as fume emissions, are minimized. Besides, plastics have several times better impact and twisting strength than metallic components. Therefore, polymers are preferred when it comes to outer appearance design. The expansion of the exterior is one of the prevalent approaches since the demand for EVs is increasing due to various government recommendations and policies. These policies promote the use of lightweight materials and modern systems that enhance a culture of efficiency without compromising safety standards.

- The elastomers segment by type is predicted to contribute majorly to the market during the forecast period.

The global silicone elastomer market is forecasted to grow enormously in the next few years, which is expected to positively impact the EV polymer market's growth. The High-Temperature Vulcanize (HTV) segment emerged as one of the largest shares of the silicone elastomer market in 2023 and is expected to grow at the fastest rate in the years to come. HTV elastic materials are agents high in organic silicone, which provide thermal stabilization and mechanical strength, and they find application in the automotive, aerospace, and electronics sectors. Thermal stability, chemical endurance, and mechanical properties will propel the HTV and RTV segments of the silicone elastomers market growth.

This segment, established on building type and nature of the constituent materials, is also likely to grow considerably and remain in a leading position in the coming years. These materials have proven helpful in the building and construction industry, mainly as sealants, adhesives, and coatings. After all, they can withstand the environment and get deformed elastically. In summary, the silicone elastomers market will experience considerable expansion owing to the fast growth in the adoption of advanced materials widely used in diverse sectors, like automotive, aerospace, and construction.

Electric Vehicle Battery Polymer Market Geographical Outlook:

- The Asia Pacific region will have a significant electric vehicle battery polymer market share.

The major economies of China, Japan, India, and South Korea dominate the regional economic stability. In addition, this region covers some of the greater emerging markets, such as the ASEAN countries.

The Asia-Pacific region is also predicted to have the largest market size during the forecast period due to the abovementioned reasons, given that most countries with large production development capacities facilitate the use of these products.

This trend is projected to continue in the Asia Pacific electric vehicle battery polymer market, especially due to the rising rate of EV adoption, particularly in China and India, among other places. The region's efforts towards reducing carbon emissions and increasing the use of green transportation contribute to expanding the regional market.

In addition, the EV battery market in China is expected to witness an upward trend. The major player in the Chinese industry, CATL, announced ambitions towards a new generation of EV battery development with improved energy density parameters in 2023. This will also be an asset for EV battery polymers, forecasted to grow in the Asia Pacific region in the upcoming years.

Additionally, as per government policies in China, the country is likely to embrace EVs, which will further cause the expansion of the electric vehicle battery polymer market. Similarly, India is one of the major countries where battery polymers for EVs are quickly gaining popularity within the Asia-Pacific region. India has set a target for electric car outreach with plans to reach thirty percent of all new car sales being electric cars by 2030. This increase is, however, anticipated to be more specific with the growing number of EVs as people become more aware of the dangers of air pollution.

Some of the growth drivers behind the electric vehicle battery polymer market in the APAC economy include the scale-up of charging infrastructure, lighter-weight materials to enable longer battery life, and less energy to be used within the same vehicle to achieve longer driving range. There are also positive growth factors, like the increasing automotive production sectors in the region and rival companies, which are encouraging this market.

List of Top Electric Vehicle Battery Polymer Companies:

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- LyondellBasell Industries N.V.

Electric Vehicle Battery Polymer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Electric Vehicle Battery Polymer Market Size in 2025 |

US$9.876 billion |

|

Electric Vehicle Battery Polymer Market Size in 2030 |

US$18.614 billion |

| Growth Rate | CAGR of 13.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Electric Vehicle Battery Polymer Market |

|

| Customization Scope | Free report customization with purchase |

Electric Vehicle Battery Polymer Market Segmentation:

- By Component

- Exterior

- Interior

- By Type

- Elastomers

- Silicone Elastomer

- Synthetic Rubber

- Fluoroelastomer

- Engineering Plastics

- Polyphenylene Sulphide (PPS)

- Acrylonitrile Butadiene Styrene (ABS)

- Fluoropolymer

- Polyurethane

- Thermoplastic Polyester

- Polycarbonate

- Polyamide

- Others

- Elastomers

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Indonesia

- Others

- North America