Report Overview

Global Beer Market - Highlights

Beer Market Size:

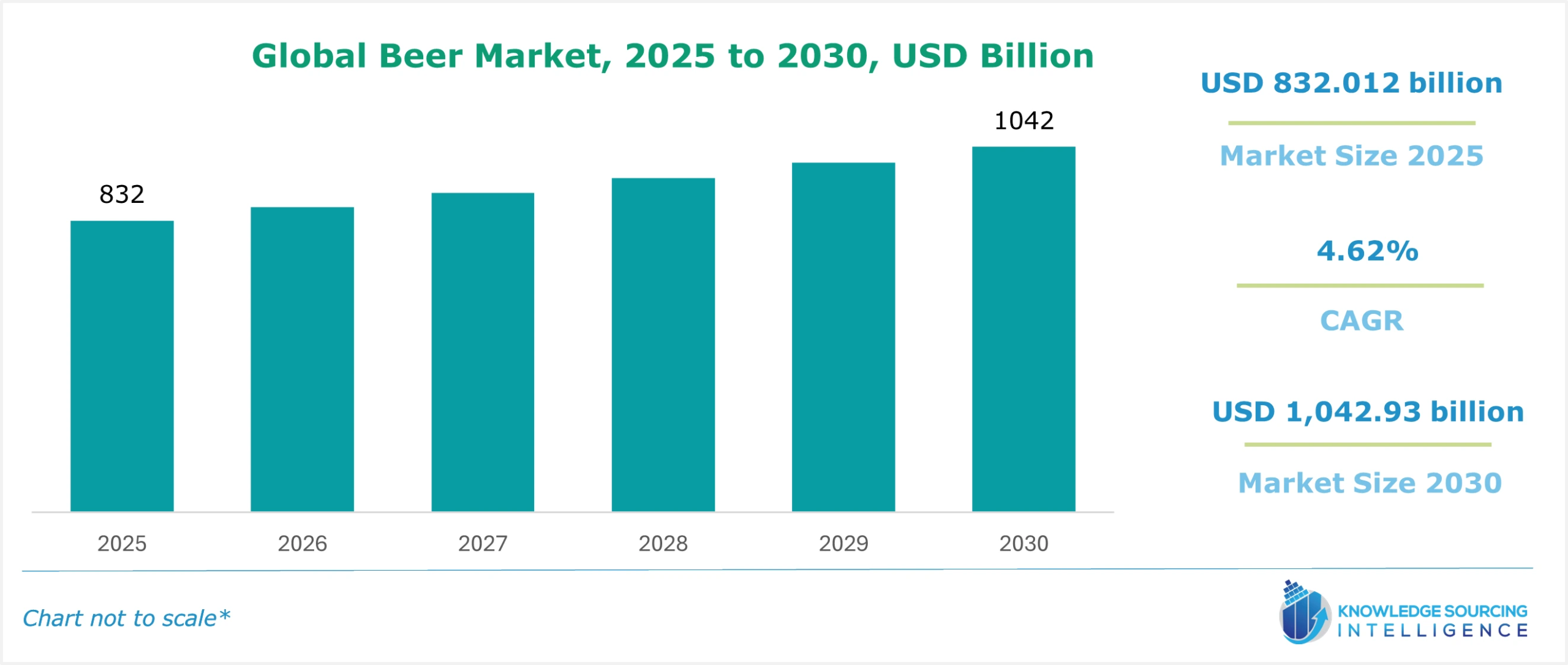

The global beer market is estimated to grow at a CAGR of 4.62%, from US$832.012 billion in 2025 to US$1,042.93 billion in 2030.

Beer Market Key Highlights:

-

Breweries are expanding globally: Increasing brewery numbers are driving beer market growth worldwide.

-

Health-conscious trends are boosting demand: Low-alcohol and no-alcohol beers are gaining popularity rapidly.

-

Europe is leading consumption: High beer production and consumption are fueling market share.

-

Innovations are enhancing flavors: New brewing technologies are diversifying beer offerings globally.

Beer is a widely consumed alcoholic beverage around the world. It's made by the fermentation of cereal, water, grains, and yeast for a specific amount of time. Herbs and fruits are frequently added to the drink to give it a distinctive taste and fragrance. Beer has an alcohol concentration that ranges from less than 3% to 40% by volume (ABV), depending on the style and ingredients used in the formulation. When consumed in moderation, beer has been demonstrated to help reduce heart and circulatory system diseases such as atherosclerosis, angina, stroke, and heart attack.

Beer Market Trends:

Beer, when compared to other alcoholic beverages, has a significant market share and is growing in popularity among millennials and Gen Z, thanks to its diverse formulations, flavors, and taste offerings. Initially, flavored beer was primarily consumed in Europe and North America, but its demand has been expanding worldwide in recent years, significantly benefiting the total beer industry. The introduction of innovative brewing technologies in developing nations has also positively impacted consumption habits. Furthermore, customers are increasingly seeking novel, varied, and delicious products, driving the beer market’s expansion.

Several primary reasons, including an increase in breweries worldwide and the rising global beer demand, are driving the global beer market. Additionally, the popularity of low-alcohol beverages has risen steadily, and revenues of non-alcoholic and limited beer have increased in conjunction with the growing demand from health-conscious consumers. Changing consumer tastes as a result of the new products are also predicted to boost market expansion over the forecast period. Another motivator is that low-alcohol beers are now less expensive than their high-alcohol counterparts, particularly those with an ABV of 2.8 percent or less. The situation is particularly prevalent in European countries such as Sweden, where brewers are attempting to improve the low alcohol byproduct. However, provincial legislation restricting beer promotion stifles the entire market's expansion.

Further, the beer market globally is expected to witness significant expansion driven by the growing global demand and increasing popularity of non-alcoholic and limited beer. Moreover, the growing per capita disposable income worldwide, especially in developing regions like the Asia Pacific, is also promoting an increase in beer consumption. The changing lifestyle, coupled with urbanization, is also a major factor fuelling the demand for beer, especially in the younger demographic as a social and refreshment beverage.

Moreover, the increase in the number of brewers leads to boosting the market with the introduction of diverse beer flavors, styles, and innovations in beers, such as flavored beer and no or low alcoholic beers. This caters to the changing consumer base that prefer low-alcohol beers, especially the health-conscious population. According to the Brewers of Europe's Statistics Report 2024 Edition, the number of brewers increased from 12,722 in 2021 to 12,848 in 2023 in the region. The highest number of brewers was in France, with 2,500, followed by Germany with 1,492 brewers in 2023. This increasing trend will promote innovation in beer and cater to growing consumer demand in the coming years.

Additionally, new product innovations that align with the changing consumer taste preferences will contribute to expansion in the beer demand during the forecasted period. For instance, in October 2024, VIVIR Tequila launched Café Stout in partnership with Salt Beer Factory. This new beer product features a unique blend of classic coffee bitterness and smooth malt of a stout. VIVIR Tequila is among the leading premium craft beer and other alcoholic beverage manufacturers, which offers multiple beer products.

The global beer market is highly consolidated, with the top 6–7 companies accounting for nearly 80% of the total market share. These major players include Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, China Resources Snow Breweries, Molson Coors Beverage Company, Asahi Group Holdings, and Diageo PLC. These companies have a strong historical legacy, broad geographical reach, and extensive production and distribution scale, allowing them to dominate across both developed and emerging markets. However, the market also features a large number of regionally strong players who do not have a significant global footprint but are well-known in local or national markets, such as Som Distilleries and Breweries Ltd. (India), B9 Beverages Pvt. Ltd. (India, known for Bira 91), Brimstage Brewery Co. Ltd. (UK), and Adie Broswon Group (India). These regional breweries cater to niche consumer bases. They are often recognized for their localized branding, craft-style offerings, and high experimentation in flavors and brewing innovation, allowing them to stand out in competitive local markets despite limited global presence.

Beer Market Growth Drivers:

- Increasing beer brewing worldwide

The increase in the global production of beer is expected to propel the production and demand for beer. A brewery is a company or business that produces various types of beers. The Brewers Association of the USA, in its report, stated that the total count of breweries in the nation witnessed an increase over the past few years. The association stated that in 2021, the total brewery in the nation was recorded at about 9,384, of which about 9,210 were craft brewers. The total brewery count in the country increased to 9,824 in 2022, with about 9,675 craft breweries. In 2023, the association stated that in the USA, the total count of brewers reached 9,906, an increase of about 0.8% over the past year, which included about 9,761 craft breweries.

Similarly, in its report, the Brewers of Europe stated that the region's count of active breweries was recorded at 12,879 in 2022, which increased from 12,738 breweries in 2021. The agency further stated that in 2022, France had the highest number of brewers in the region, with about 2,500 active breweries, followed by the UK and Germany, having 1,830 and 1,507 breweries, respectively.

- Growing global consumption of beer

The increasing consumption of beer globally is among the key factors estimated to boost the demand for beer in the international market. This growth is driven by the rise in population, especially urbanization, which leads to the adoption of westernised style, including socializing in restaurants, promoting the demand for beer as it is a popular refreshment and social outing beverage.

According to the World Bank data, about 57 per cent of the population lived in urban areas in 2023, which is expected to increase to 70 percent by 2050, with more than 4 billion people living in cities as of 2024, which is expected to grow by almost 2.5 billion by 2050, as per United Nations.

The European beer trend 2024 data from Brewers of Europe stated an increase in beer consumption in the region, with 351,468 thousand hectoliters (HL) in 2021, which grew to 353,364 thousand HL in 2023. Further, the highest consuming country was reported to be Germany with 74,564 thousand HL in 2023, followed by the United Kingdom at 44,316 thousand HL. Meanwhile, Spain and Poland reported 43,042 thousand HL and 32,270 thousand HL consumption of beer in the same year.

Additionally, the beer consumption per capita was highest in the Czech Republic at 128 litres per person in 2023, followed by Austria at 99 litres per person. Germany and Poland reported beer consumption per capita at 88 litres and 87 litres, respectively, for 2023, as per the same source. This trend is expected to support the market growth in the coming years.

Beer Market Geographical Outlook:

- Europe is forecasted to hold a major share of the global beer market.

The largest proportion is projected to be held by Europe. Beer is an important part of the culture in many European countries. The European Union is one of the world's most important beer-producing regions. As per the Brewers of Europe, 401,945 thousand hectoliters of beer were produced in 2022. Europe is among the biggest producers and consumers of beer and other alcoholic beverages. Countries like Germany, the UK, France, and Spain are home to some of the world's biggest beer producers.

- The US is also anticipated to lead the market expansion

The United States is one of the leading beer-producing nations, and with the growing shift towards rich flavour beers, followed by rapid urbanization, is expected to drive the overall beer demand in the United States, thereby increasing the overall market growth in the country.

Likewise, the growing popularity of pubs and bars among the younger generation, coupled with the growing strength of the population aged 21 years and older, is projected to increase beer demand. According to the US Census, in 2023, nearly 75% of the total population aged 21 years and above were considered to be of legal drinking age.

These increased numbers have led to the opening of such establishments, further propelling the overall beer demand in the United States. Hence, according to the Brewers Association, in 2023, nearly 165 new brewery pubs were opened while the number of closing establishments reached 145, signifying that the pub openings outpaced the closings.

According to the Brewers Association’s “Annual Craft Brewing Industry Production Report”, in 2024, the total strength of breweries in the USA reached 9,922, marking an addition of 84 brewers compared to 2023. Moreover, as per the same source, the retail dollar value of craft beer in the same year stood at USD28.8 billion, representing a 3% growth over the 2023 value, thereby outlining a steady performance in the on-site sales.

Furthermore, the ongoing innovations in brewing process followed by well-established presence of major market players namely The Boston Beer Company, Heineken Holding NV, and Sierra Nevada Brewing Co., among others, which have actively participated in new beer development to meet the dynamic customer trends in the US market is also an additional driving factor for the overall market expansion.

Beer Market Products and Major Players:

Anheuser-Busch Companies, LLC is among the leading multinational alcoholic beverage brewing companies based in the USA. The company operates multiple global brands, providing various types of beverages, like Budweiser, Bud Light, Natural Light, Busch Beer, and Presidente Beer. In the global beer market, Budweiser is among the company's leading brands, offering products like Budweiser Zero, Budweiser Nitro Gold, and Budweiser Chelada, among others. Budweiser is a medium-bodied, flavorful, crisp American-style lager. It is brewed with barley malt and a blend of hop varieties. It contains 5.0 alcohol by volume, offering 145 calories per 12oz, 0G fat per 12oz, and 10.6G carbs per 12oz.

Carlsberg Breweries A/S is a Danish corporation that is among the biggest brewers of alcoholic beverages worldwide. The company operates various brands under its ownership, which offer a wide variety of beers in the global market. The company's brands include Zhiguli, Semper Ardens, Merak, KB, Hanninger, and Carlsberg, among others. Its products include Carlsberg 1883, Carlsberg Smooth Draught, Carlsberg Nordic Ale, and Carlsberg Elephant.

Beer Market Key Developments:

Beer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Beer Market Size in 2025 | US$832.012 billion |

| Beer Market Size in 2030 | US$1,042.93 billion |

| Growth Rate | CAGR of 4.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Beer Market |

|

| Customization Scope | Free report customization with purchase |

Beer Market Segmentation:

- By Type

- Lager

- Ale

- Stouts

- Others

- By Packaging

- Bottle

- Can

- By Distribution Channel

- On-trade

- Off-trade

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Russia

- Germany

- UK

- Spain

- Poland

- France

- Italy

- Others

- Middle East and Africa

- Middle East

- South Africa

- Namibia

- Rest of Africa

- Asia Pacific

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Australia

- Philippines

- Others

- North America