Report Overview

Gallium Nitride Device Market Highlights

Gallium Nitride Device Market Size:

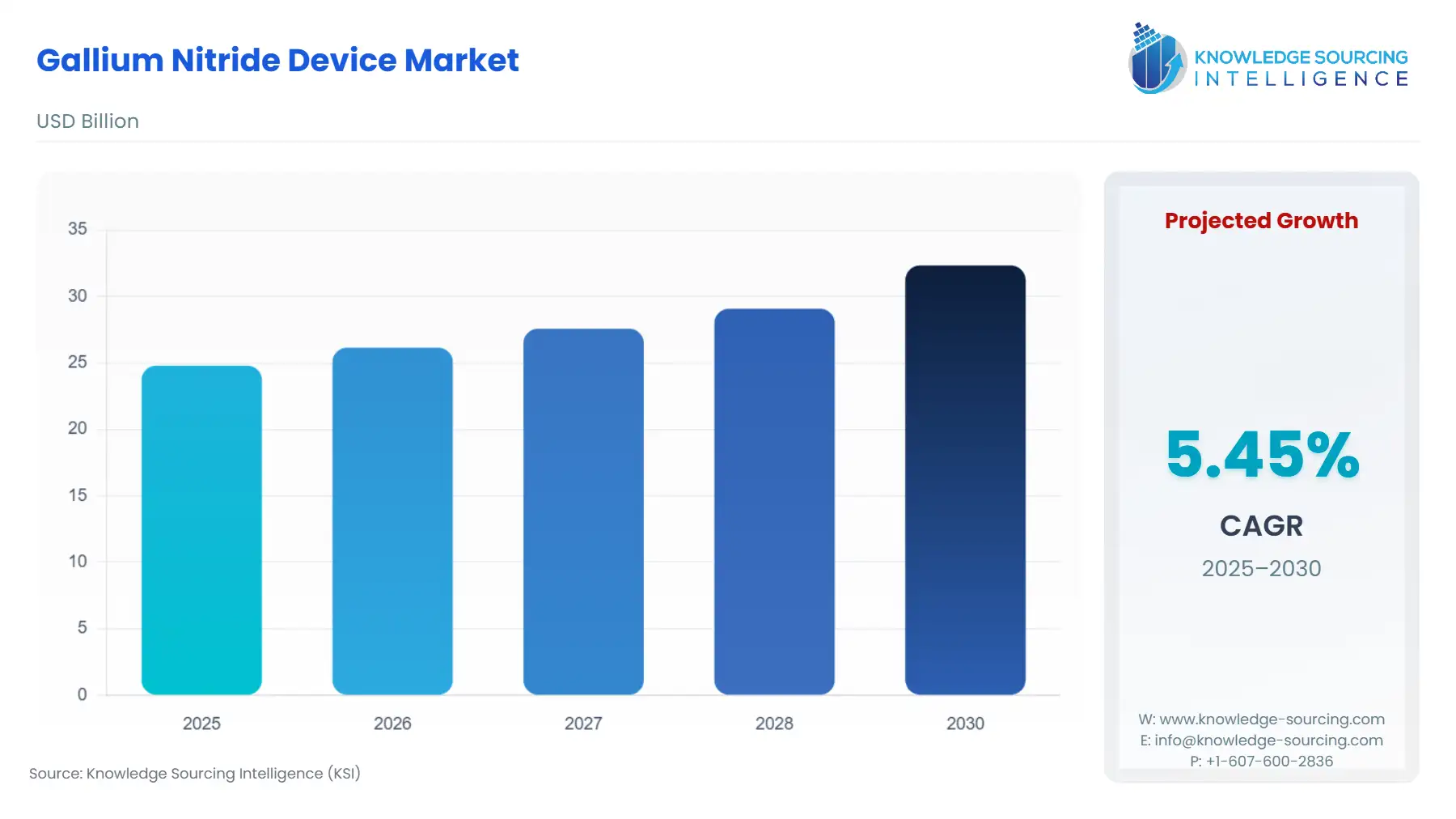

The Global Gallium Nitride Device Market will climb from USD 24.805 billion in 2025 to USD 32.342 billion in 2030, registering a 5.45% compound annual growth rate (CAGR).

Gallium Nitride Device Market Trends:

Gallium Nitride, commonly known as GaN, is used in developing semiconductor devices. GaN is a rigorous yet mechanically stable wide bandgap semiconductor with higher breakdown strength and faster switching speed. Its higher thermal conductivity and low resistance make it an ideal semiconductor for electronics and other devices.

By creating a GaN epilayer on a silicon surface, silicon manufacturer can reduce their manufacturing cost by removing the need for specialization with the existing manufacturing infrastructure. This layer also enables the production of larger silicon wafers at a lower cost. Furthermore, it has been observed that the power devices based on GaN technology outperform those based on silicon at a noteworthy rate. Hence, GaN is gaining more popularity as a semiconductor due to its better performance.

Gallium Nitride Device Market Drivers:

- An increase in consumer electronics and a surge in the adoption of renewable energy are anticipated to drive the market size of the global gallium nitride industry during the forecasted period

The prime reason driving the market growth is the booming demand for consumer electronics and telecommunication services. Increased disposable income is anticipated to raise the demand for consumer electronics.

Furthermore, technological advancements have significantly increased the need for telecommunication services, driving market growth. A report published by Cisco predicts that IP traffic will increase at a quadruple rate, reaching 4.8 Zettabytes per year in 2022 from 1.5 Zettabytes per year in 2017. To accommodate booming demand, the wireless industry plans to establish 5G networking from 4G, and is projected to increase the industry demand for GaN during the forecasted period.

Gallium Nitride Device Market Segment Analysis:

- By end-user, consumer electronics and telecommunications are anticipated to grow significantly.

The global gallium nitride market is segmented by end-users into consumer electronics, telecommunication, renewable energy, automotive, defense, and others. The consumer electronics, telecommunication, and renewable energy segments are predicted to hold a dominating share of the global industry during the forecasted period. Rising internet penetration and growing demand for technologically advanced services will drive the telecommunication sector’s expansion. This penetration of the 4G network and the growing development of 5G networking for enhanced communication are projected to drive GaN demand.

Moreover, with the outbreak of coronavirus and the adoption of a work-from-home culture, the demand for wireless communication services surged exponentially. Containment measures implemented by the government included the physical shutdown of many institutions, which then opted for virtual platforms to continue operations. Hence, the demand for wireless networking surged significantly, which increased the need for telecommunication services and, therefore, the GaN market.

Gallium Nitride Device Market Geographical Outlook:

- Asia-Pacific is anticipated to have robust growth

Growing disposable income and a rise in technology penetration increased the demand for consumer electronics, particularly in the Asia Pacific region. Smart devices, in particular, saw a surge in users with increasing penetration. The number of smartphone users in 2021 was 3.8 billion, or 48.3% of the global population, as per data provided by bankmycell.com.

On the other hand, the number of mobile phone users stood at 4.88 billion, or 62.07% of the global population. In total, there were 5.28 billion people who owned mobile devices. Growing penetration of smart devices is expected to drive the gallium nitride industry’s expansion at a quadruple rate during the forecasted period. Technological innovation in the sector is expected to open new growth opportunities for the GaN market.

The Asia Pacific GaN market is projected to show lucrative growth. With industrialization, consumer electronics manufacturing companies are mushrooming in the region owing to low labor costs, high production potential, and easy outsourcing policies. Furthermore, increased disposable income has surged the demand for smart devices and other consumer electronics, supporting market growth.

The booming renewable energy sector will also play a significant role in the market development. Growing energy and power demand and a rising human carbon footprint on the Earth’s surface have increased the preference for developing renewable energy. To meet the demand, the government is implementing new energy projects. The TuNur Project in the Sahara Desert was sanctioned in 2021 and is estimated to install 2,250 MW solar CSP, generating 9.400 GWh of renewable energy. Pecan Prairie Solar Project in Texas, sanctioned in 2020, will generate 13.310 MW of capacity and supply energy to 50,000 homes. Growth in offshore and onshore solar power plants is expected to provide robust growth potential for the global gallium nitride market.

Gallium Nitride Device Market Key Development:

- In January 2025, Guerrilla RF Inc. launched GRF0020D and GRF0030D, the first in a new class of GaN on SiC HEMT power amplifiers. These provide up to 50W of saturated power for customers within the wireless infrastructure, military, aerospace, and industrial heating markets.

- In December 2024, ROHM Semiconductor and TSMC partnered for the development and volume production of gallium nitride power devices for electric vehicle applications.

- In September 2024, Infineon Technologies Inc. developed 300 mm power gallium nitride wafer technology. Infineon became the first company to develop this technology, and it is expected to drive the GaN-based power semiconductors substantially.

Gallium Nitride Device Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Gallium Nitride Device Market Size in 2025 | US$24.805 billion |

| Gallium Nitride Device Market Size in 2030 | US$32.342 billion |

| Growth Rate | CAGR of 5.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East, and Africa, Asia Pacific |

| List of Major Companies in Gallium Nitride Device Market |

|

| Customization Scope | Free report customization with purchase |

Gallium Nitride Device Market Segmentation:

By Wafer Size

- 2 inch

- 4 inch

- 6 inch

By Voltage

- Up to 40 Volts

- 40 to 100 Volts

- Greater than 100 Volts

By End-User

- Consumer Electronics

- IT & Telecommunication

- Automotive

- Aerospace & Defense

- Healthcare

- Others

By Geography

- Americas

- USA

- Europe Middle East and Africa

- Germany

- France

- Netherlands

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Taiwan

- Others