Report Overview

Middle East and Africa Highlights

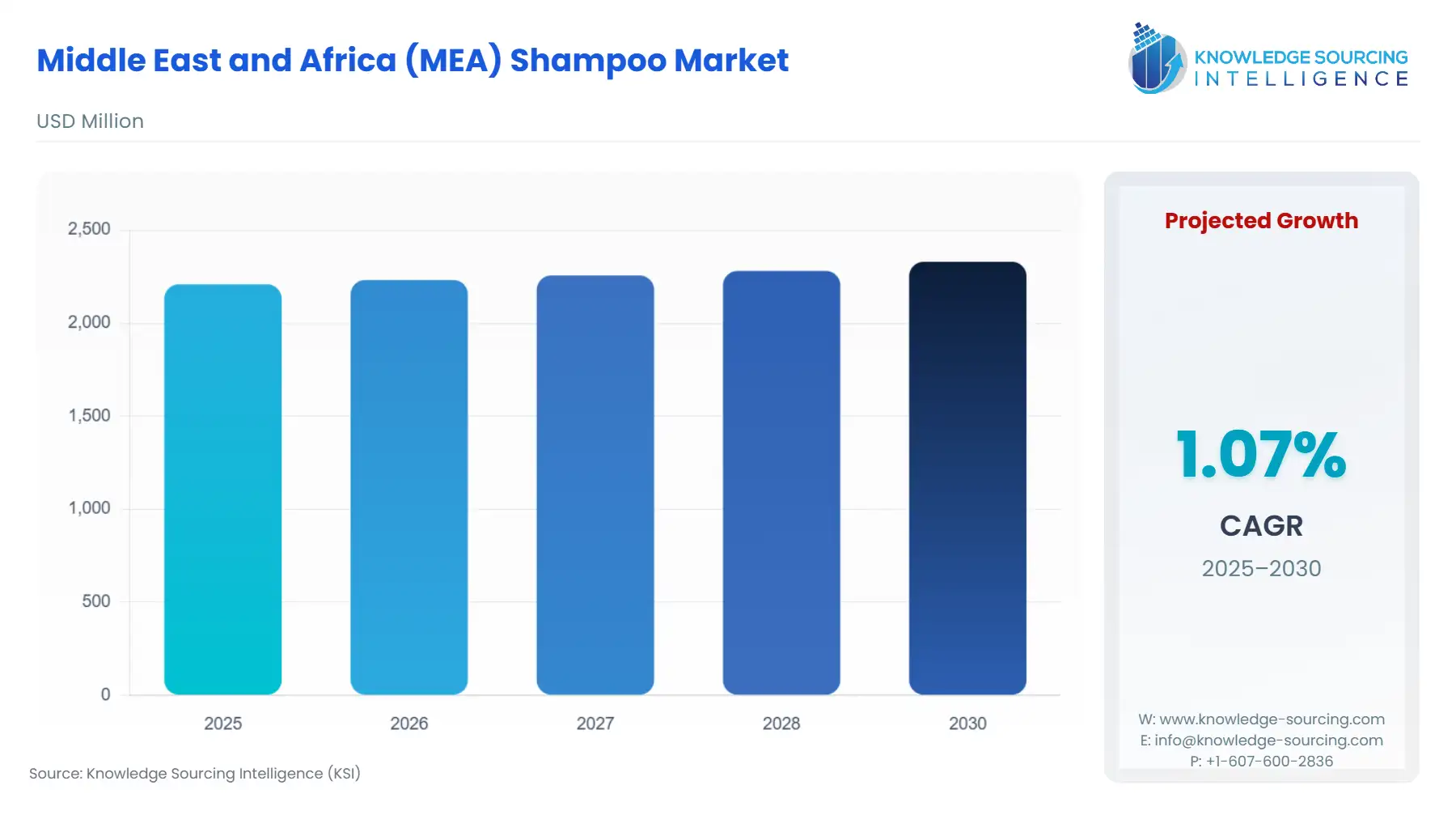

MEA Shampoo Market Size:

The Middle East and Africa (MEA) shampoo market is projected to grow at a CAGR of 1.07% during the projected period (2025-2030), reaching a market size of USD 2.330 billion by 2030 from USD 2.209 billion by 2025.

Long, healthy, and well-maintained hair is liked by customers in the Middle East, where hair care is a major cultural concern. Conventional beauty practices, like the use of natural hair care products like oils and herbs, still have an impact on regional customer preferences. Urbanization and disposable wealth in nations like Saudi Arabia, the United Arab Emirates (UAE), and Iran have raised demand for high-quality hair care products, such as shampoos. Africa, on the other hand, is a culturally varied continent with a wide range of hairstyles and economic situations. Several factors, including climate, cultural customs, and colonial legacy, impact the hair care business in Africa. The preferences of consumers in various African nations may range, ranging from loving natural hair textures to looking for solutions that target certain hair issues like breakage, dryness, or scalp problems. In both the Middle East and Africa, there has been a growing movement for natural and organic hair care products.

MEA Shampoo Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The MEA shampoo market is segmented by:

- Product: The MEA shampoo market is divided into two segments based on product, non-medicated/regular and medicated/special purpose. The non-medicated/regular segment is anticipated to lead the MEA shampoo market share due to widespread availability and rising mass-production product acceptance worldwide. Since non-medicated shampoos are easier to find and less expensive than their counterparts, non-medicated products are widely used. Additionally, the non-medicated shampoo segment's revenue is driven by the growing availability of over-the-counter versions at pharmacies and drug shops.

- Application: The market is separated into two segments based on application, domestic and commercial. The household segment is anticipated to lead the market because of the wide range of products available. Significant product use for personal hygiene purposes in the home and the growing number of toddlers and babies using baby shampoos are further factors propelling the household segment's growth. The growing number of businesses promoting their hair grooming products through celebrity endorsements and social media is expected to raise demand among home customers in the MEA.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. Across the MEA, these elements made a substantial contribution to the revenue generated by multinational corporations. The segment's growth is driven by expanding projects and capacity-building initiatives carried out by international corporations.

Top Trends Shaping the MEA Shampoo Market:

- Demand for Customized and Halal-Certified Products

Halal-certified shampoos that adhere to Islamic dietary regulations are in high demand in nations with a large Muslim population. Customers are also looking for individualized hair care products that are catered to their requirements. Local companies are taking advantage of this trend by providing halal-compliant, personalized goods.

- Shampoo Formulations Particular to Certain Climates

The severe and varied climate of the MEA region is one of its most distinctive features, and it directly affects the condition of the hair and scalp. High temperatures, exposure to sand, and hard water are all factors that cause hair dryness, breakage, and irritation of the scalp for consumers who live in the arid deserts of the Gulf (such as Saudi Arabia and the United Arab Emirates). On the other hand, high levels of humidity and pollution in sub-Saharan areas like Nigeria and Ghana lead to frizz, excessive oiliness, and fungal scalp diseases.

MEA Shampoo Market Growth Drivers vs. Challenges:

Drivers:

- Retail Infrastructure Expansion: Shampoo sales in MEA are structurally driven by the expansion of contemporary retail establishments such as hypermarkets, pharmacies, beauty chains, and specialist boutiques. Retail modernization is accelerating in nations like South Africa, Kenya, and the United Arab Emirates. Beauty chains both local and international (such as Sephora, Carrefour, Clicks, and Lifestyle) are growing. Imported brands are more readily available in smaller markets due to advancements in cross-border trade and transportation.

- Growth in E-Commerce and Digitalization: In MEA, one of the most significant factors driving the growth of the shampoo industry is digital transformation. Particularly in urban areas like Cairo, Lagos, Nairobi, and Riyadh, smartphone usage is high and is rising. A growing number of consumers are shopping on websites like Jumia, Amazon.ae, and Noon. Influencers have a big influence on consumer choices, particularly when they are beauty bloggers and micro-celebrities.

Challenges:

- Inadequate Distribution Facilities in Frontier and Rural Markets: A significant part of MEA still does not have formal retail networks, despite the rise of urban shopping. In many African nations, there is limited access to contemporary retail establishments in rural areas. High transportation expenses, inadequate road infrastructure, and logistical inefficiencies limit product availability and raise expenses for FMCG businesses. Regional firms' market expansion is slowed by the regulatory and tariff hurdles that frequently impede cross-border trade inside Africa.

- Economic Inequalities and Low Buying Power of Consumers: The economic disparity in the area is among the biggest obstacles. High rates of poverty, income inequality, and unstable currencies are problems in many sub-Saharan African nations. Most people live in low-income or unorganized economies, where they have little discretionary money to spend on high-end personal care items like shampoo. Value-based or multipurpose hygiene solutions are frequently preferred by consumers over high-end or specialty haircare products.

MEA Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including L'Oréal SA, Unilever PLC, Procter & Gamble Co., and The Estée Lauder Companies.

- Product Launch: In May 2025, The VIP Shampoo by Baspari was created especially to treat typical hair issues in the United Arab Emirates, including frizz, dryness, and breakage brought on by heat, humidity, and hard water.

MEA Shampoo Market Scope:

| Report Metric | Details |

| Middle East and Africa Shampoo Market Size in 2025 | USD 2.209 billion |

| Middle East and Africa Shampoo Market Size in 2030 | USD 2.330 billion |

| Growth Rate | CAGR of 1.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | United Arab Emirates, Israel, Saudi Arabia, Others |

| List of Major Companies in the Middle East and Africa Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

MEA Shampoo Market Segmentation:

By Product

By Application

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Manufacturers

By Region

- United Arab Emirates

- Israel

- Saudi Arabia

- Others