Report Overview

Mexico Advanced Battery Market Highlights

Mexico Advanced Battery Market Size:

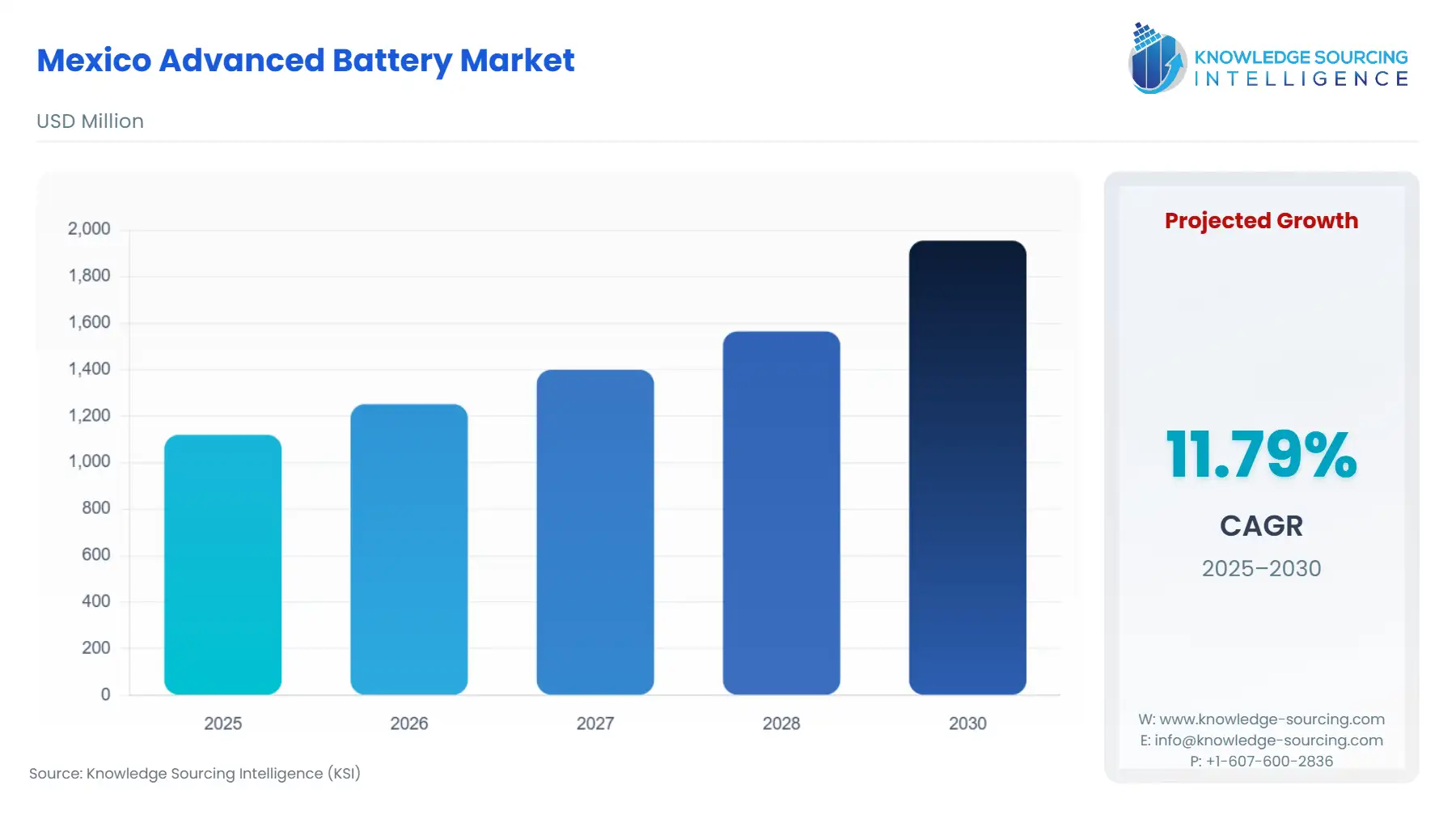

The Mexico Advanced Battery Market is expected to rise at a CAGR of 11.79%, reaching USD 1.955 billion in 2030 from USD 1.12 billion in 2025.

The Mexican advanced battery market is navigating a pivotal transition, shifting from a primarily import-dependent supply chain to an emerging regional manufacturing hub, heavily influenced by its proximity to the U.S. automotive sector and recent energy policy reforms. The core of this transformation is rooted in the strategic convergence of ambitious clean energy targets and the aggressive electrification mandates of the North American automotive industry. This foundational context is rapidly elevating the country's significance within the global battery ecosystem, specifically for lithium-ion and other high-density chemistries essential for electric mobility and grid stability applications.

Mexico Advanced Battery Market Analysis:

- Growth Drivers:

Mexico's expanding electric vehicle (EV) manufacturing base is the paramount growth driver, generating immediate and massive demand for advanced batteries. Global Original Equipment Manufacturers (OEMs) are making significant investments, such as BMW Group's battery manufacturing facility in San Luis Potosí and production of EV models like the Ford Mustang Mach-E. This localization, driven by the desire to meet local content requirements under the United States-Mexico-Canada Agreement (USMCA) and shorten logistics routes (nearshoring), directly translates to increased Automotive application demand for high-capacity battery packs. Simultaneously, the new regulatory framework under the National Energy Commission (CNE), specifically mandating energy storage for large-scale solar generation, compels the immediate need for utility-scale Energy Storage Systems (ESS), stabilizing the grid and mitigating intermittency.

- Challenges and Opportunities:

A primary challenge remains the reliance on imported critical raw materials such as lithium, cobalt, and nickel, which creates supply chain vulnerability and price volatility for local battery assemblers. This import dependency directly elevates production costs, posing a headwind to affordability, which, in turn, can dampen demand in the domestic Consumer Electronics and lower-end EV segments. However, this challenge presents an opportunity for domestic value chain integration. The establishment of LitioMX, the state-owned company, aims to develop a national lithium value chain, which, if successful in extracting and refining lithium from the Sonora deposits, could secure a local supply of cathode material, significantly reducing material-cost-related constraints and propelling sustained, cost-competitive growth for local manufacturers.

- Raw Material and Pricing Analysis:

Advanced batteries are physical products whose pricing dynamics are directly tied to the highly volatile global commodity markets for lithium, cobalt, and nickel. Mexico lacks significant domestic refining and processing infrastructure, rendering its local battery manufacturing vulnerable to global price fluctuations. For example, battery pack prices saw a substantial decline in 2023, driven by a global oversupply of critical minerals, making EV batteries more cost-competitive; however, this relief is temporary, with any new geopolitical or mining disruption quickly reversing the trend. The concentration of global lithium and nickel refining in a few countries exacerbates this price volatility and necessitates local manufacturers to prioritize stable, long-term sourcing contracts to maintain predictable demand pricing for their end-products.

- Supply Chain Analysis:

The advanced battery supply chain in Mexico is currently concentrated at the final assembly and integration stages, primarily supporting the automotive industry. Mexico acts as a critical node for nearshoring, receiving cells and modules from key production hubs in Asia and, increasingly, from the United States, for final assembly into battery packs and integration into EVs. Logistical complexities center on transporting bulky, hazardous battery components across the border, yet this is deemed more manageable than shipping fully assembled vehicles or high-volume cells from overseas. The dependency remains heavily skewed toward foreign-sourced cells, which limits the country's economic value capture and underscores the imperative for domestic cell manufacturing to strengthen the supply chain's resilience against global disruptions.

Mexico Advanced Battery Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Mexico Federal | Electricity Industry Law (LIE) / National Energy Commission (CNE) | Mandates BESS integration for certain renewable energy projects (e.g., the 30% solar storage rule), creating mandatory demand for utility-scale batteries to ensure grid stability and reliability. |

| Mexico Federal | Law of Lithium Nationalization (LitioMX) | Grants the state exclusive rights over lithium exploration, exploitation, and utilization, injecting regulatory uncertainty for private mining projects but establishing a state-led effort to secure domestic supply of key raw materials for battery production. |

| North America | USMCA (United States-Mexico-Canada Agreement) | Drives localization (nearshoring) of EV production and component manufacturing in Mexico to meet regional content value requirements, which directly stimulates foreign direct investment in battery assembly and component plants. |

Mexico Advanced Battery Market Segment Analysis:

- By Technology – Lithium-ion Batteries: The Lithium-ion (Li-ion) Batteries segment dominates the advanced battery market, driven almost entirely by the escalating production of electrified vehicles and grid-scale ESS deployment. The superior energy density and cycle life of Li-ion technology make it the essential choice for automotive OEMs in Mexico, where EV production reached over 200,000 units in 2024. This necessity is further propelled by the preference for high-performance EV models requiring large battery packs. Furthermore, the mandatory requirements for BESS integration into solar projects favor Li-ion for its scalability and proven operational profile in utility applications. New investments by automakers in dedicated battery assembly and production facilities near their vehicle plants solidify the technology's central role, guaranteeing continued high demand for Li-ion cells and modules. The segment’s growth is directly correlated with the automotive industry’s commitment to electrification and the pace of renewable energy interconnection.

- By Application – Automotive: The Automotive application segment, encompassing Electric Vehicles (EVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs), is the single largest growth driver for advanced batteries in Mexico. The country's strong foundation as a global automotive manufacturing hub, coupled with nearshoring dynamics, ensures a high volume of battery pack requirement. The production of electrified vehicles in Mexico has experienced a dramatic increase, establishing a powerful and sustained pull for high-capacity, high-performance batteries, primarily Li-ion. This necessity is not primarily dependent on domestic sales, which, while growing, remain a fraction of total vehicle sales; instead, it is structurally dependent on the significant volume of EVs manufactured in Mexico for export to the U.S. market under USMCA. The strategic decision by major OEMs to co-locate battery assembly with vehicle production facilities minimizes logistics costs and reinforces the long-term, structural demand for automotive batteries.

Mexico Advanced Battery Market Competitive Analysis:

The competitive landscape is characterized by a mix of global Tier 1 automotive suppliers, specialized ESS providers, and emerging local assembly companies. The market's competitive intensity is currently concentrated on securing supply contracts with the major automotive OEMs and utility-scale renewable energy developers.

- BMW Group: The company’s investment of $540 million into a new battery manufacturing facility adjacent to its San Luis Potosí plant, announced in May 2024, strategically positions it for vertical integration. This move secures a local, North American-compliant supply chain for the battery packs needed for its next-generation EV platforms, creating a captive demand stream and simultaneously accelerating the need for local component suppliers.

- Jabil: As a major global electronics manufacturing services (EMS) company with a significant footprint in Mexico, Jabil leverages its operations in places like Chihuahua to manufacture complex components. Their strategic positioning is focused on providing full-service design and manufacturing solutions for electric vehicle components, including battery management systems and other electronic elements of the advanced battery pack.

- Prime Power Omega: A local Mexican company specializing in the manufacture of lithium batteries for industrial applications, such as electric forklifts (motive power). This specialized focus allows the company to address a crucial local niche, differentiating its growth drivers from the large-scale automotive sector by servicing the growing logistics and industrial material handling segments.

Mexico Advanced Battery Market Developments:

- February 2025: The Governor of Sonora, Mexico, announced efforts to finalize an agreement with a major international manufacturer, potentially Foxconn, to establish an electric battery factory in Ciudad Obregón. This factory is a key part of the larger state initiative to support the local electric vehicle manufacturing project, Olinia, which aims to produce affordable, sustainable mini electric vehicles, starting with a planned launch in 2026. This would significantly bolster local battery production capabilities in Mexico's lithium-rich region.

- May 2024: BMW Group commenced construction of a new $540 million battery manufacturing facility next to its existing San Luis Potosí plant to support the production of its Neue Klasse electric vehicles, according to the company’s official newsroom.

- February 2023: The Mexican government signed a decree to accelerate the nationalization process of lithium, formally commissioning the state-owned company, LitioMX, to develop the lithium value chain from supply to battery materials, as published in official government documents.

Mexico Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.12 billion |

| Total Market Size in 2031 | USD 1.955 billion |

| Growth Rate | 11.79% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

Mexico Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket