Report Overview

Mexico Application-Specific Integrated Circuits Highlights

Mexico Application-Specific Integrated Circuits (ASIC) Market Size:

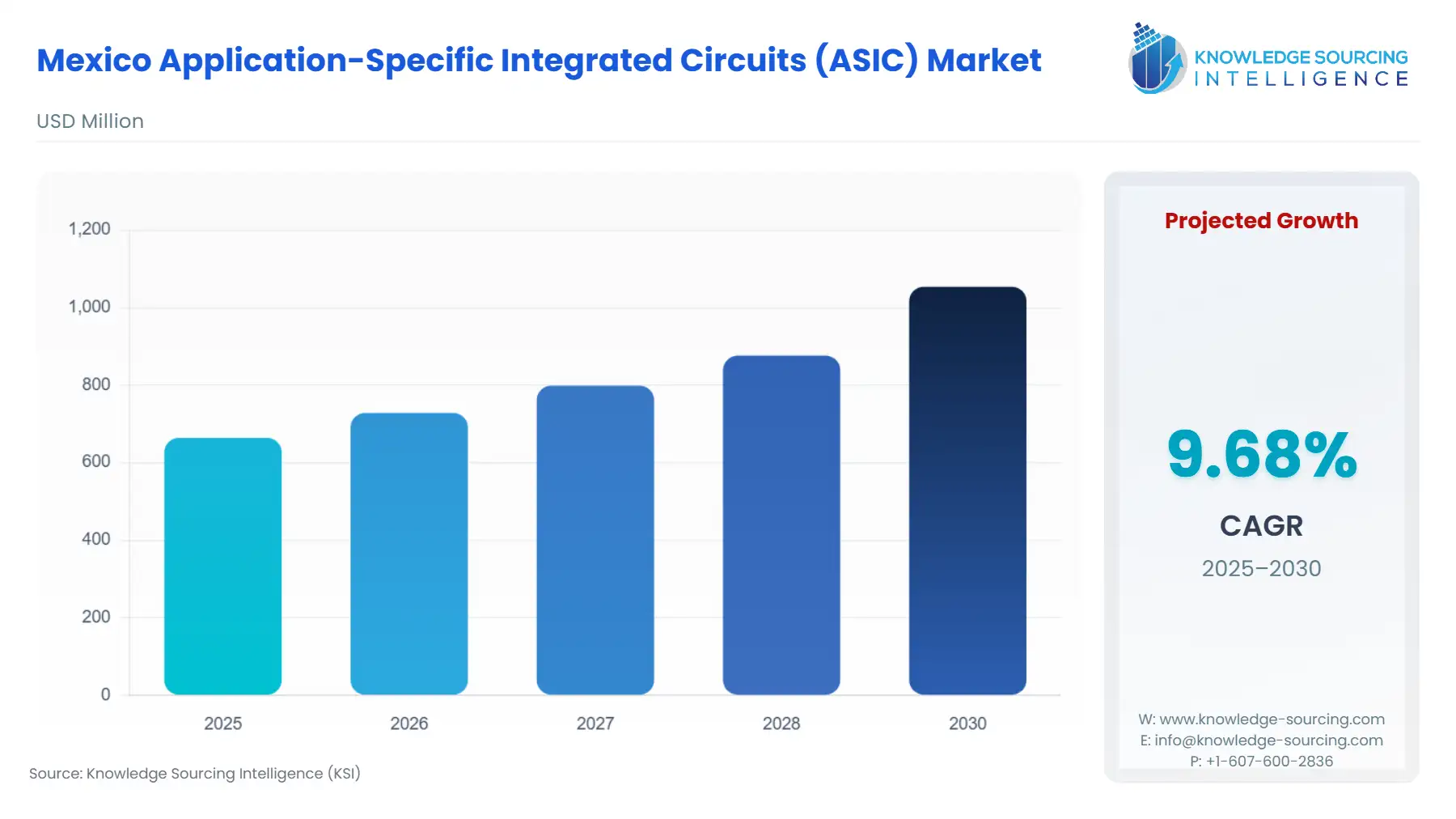

The Mexico Application-Specific Integrated Circuits (ASIC) Market is anticipated to advance at a CAGR of 9.68%, reaching USD 1.054 billion in 2030 from USD 0.664 billion in 2025.

The Mexican Application-Specific Integrated Circuits (ASIC) market is undergoing a structural transformation, moving beyond its traditional role as a final assembly hub into a critical node for high-value electronics integration within North America. This paradigm shift is primarily driven by macro-level geopolitical forces and subsequent industrial policy, positioning Mexico as a preferred destination for complex, semiconductor-dependent manufacturing. The integration of local manufacturing into sophisticated, just-in-time North American supply chains necessitates a commensurate adoption of tailored silicon solutions. This escalating requirement for localized performance optimization, coupled with the inherent power and size efficiency benefits of ASICs over general-purpose processors, forms the foundational catalyst for market expansion.

________________________________________________________________

Mexico Application-Specific Integrated Circuits (ASIC) Market Analysis

- Growth Drivers

The Nearshoring trend represents the single most potent growth driver, directly translating into increased demand for ASICs. As foreign companies relocate manufacturing capacity from Asia to Mexico to secure supply chain resilience and comply with USMCA content requirements, the domestic requirement for sophisticated electronic components escalates. Specifically, this relocation expands the production of high-value goods like automotive electronics, servers, and industrial control systems, all of which mandate custom-designed ASICs for competitive differentiation in performance and power. This dynamic means new factory establishments do not merely assemble; they integrate custom logic, directly boosting the demand for design-and-verification services and subsequent ASIC procurement.

The aggressive electrification of the Mexico-based automotive supply chain acts as a secondary, highly focused growth driver. The volume production of EVs, including models like the Ford Mustang Mach-E and various Chevrolet and BMW Group EVs, necessitates a drastic increase in the quantity and complexity of integrated circuits. Unlike traditional combustion engine vehicles, EVs require dozens of specialized ASICs for battery management systems, power train inverters, charging control, and high-speed in-vehicle networking. This technological shift compels Tier 1 and Original Equipment Manufacturers (OEMs) in Mexico to procure custom or semi-custom ASICs to meet stringent automotive safety integrity levels and energy efficiency standards.

- Challenges and Opportunities

A primary challenge facing the market is the infrastructural constraint surrounding energy and water supply. Semiconductor manufacturing and advanced packaging are energy- and water-intensive processes, and chronic issues with grid stability and capacity in certain high-demand industrial corridors temper the ceiling for domestic front-end capacity expansion. This constraint limits the market profile to ASIC design, testing, and advanced packaging, relying heavily on the global fab network for manufacturing. However, this challenge simultaneously creates a distinct opportunity: a heightened demand for energy-efficient ASICs. The imperative to manage power consumption in industrial and data center applications amidst energy supply uncertainty drives demand for highly optimized, low-power custom silicon (Full-Custom ASIC) that general-purpose components cannot match.

- Raw Material and Pricing Analysis

Application-Specific Integrated Circuits are physical products, making the raw material and pricing structure critical. ASICs are built on silicon wafers, which are then processed using numerous specialty chemicals and gases. Mexico does not host any major silicon wafer fabrication plants (fabs) or produce the hyper-pure silicon required for modern chips. Consequently, the pricing of ASICs is fundamentally decoupled from the Mexican economy, instead being dictated by global foundry pricing models (Taiwan, South Korea) and the cost of raw wafers, which fluctuate based on global polysilicon supply. Localized demand for ASICs in Mexico is highly inelastic to input price changes, as the value proposition is defined by performance and security, not material cost. The logistical cost of moving high-value, sensitive materials into Mexico for final assembly, testing, and packaging (ATP) becomes the localized pricing variable.

- Supply Chain Analysis

The ASIC supply chain is a globally distributed, highly complex network. Mexico's specific role is concentrated in the Assembly, Testing, and Packaging (ATP) segments, and the final integration of ASICs into end products. The critical upstream production hubs—wafer fabrication and lithography—are concentrated in East Asia. This concentration creates a critical logistical dependency, making the Mexican electronics manufacturing sector vulnerable to geopolitical and natural disaster-related disruptions overseas. The logistical complexities within Mexico involve securing and transporting high-value, sensitive chip cargo across border states, requiring specialized, high-security freight forwarding. The USMCA's rules of origin, designed to increase North American content, act as a powerful dependency factor, driving demand for co-located packaging sites to shorten the die-to-package transit time and achieve regional compliance.

Mexico Application-Specific Integrated Circuits (ASIC) Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Mexico | Environmental Law of the Mexican Federal Government (Ley General de Equilibrio Ecológico y la Protección al Ambiente) | This regulation governs the environmental impact of manufacturing, including the management of electronic waste (e-waste) and hazardous materials in semiconductor production. ASIC manufacturers are encouraged to develop environmentally friendly chips and adopt sustainable manufacturing practices, increasing demand for eco-conscious products in the Mexican market. |

| Mexico | National Institute of Ecology and Climate Change (INECC) | INECC oversees the regulation of energy consumption and greenhouse gas emissions within Mexico's industrial sectors. ASIC manufacturers are required to comply with energy efficiency standards in chip design and production, driving the demand for low-power, energy-efficient ASICs. This creates opportunities for the development of semiconductors for green technologies such as renewable energy and electric vehicles. |

| Mexico | Federal Telecommunications Institute (IFT) | The IFT regulates telecommunications infrastructure and the rollout of broadband and 5G networks across Mexico. With the expansion of 5G networks, there is an increasing need for high-performance ASICs designed for networking, low-latency communication, and optimized data throughput. As the demand for next-generation network devices grows, so does the need for specialized ASICs to support these advancements. |

| Mexico | Mexican Ministry of Economy (Secretaría de Economía) | The Ministry promotes investments in high-tech sectors, including semiconductors. Programs that incentivize the development of advanced technologies help foster innovation in ASIC design and manufacturing. The Mexican government also supports the growth of the semiconductor sector through trade agreements and incentives, boosting the demand for ASICs in applications such as automotive electronics, IoT, and consumer devices. |

| Mexico | National Defense Secretariat (SEDENA) | SEDENA regulates the defense sector, setting standards for secure communications, surveillance systems, and other military technologies. This regulation increases the demand for ASICs with specialized security features tailored to defense applications. These chips must meet high-security and reliability standards, driving demand for high-performance ASICs in the aerospace and defense industries. |

________________________________________________________________

Mexico Application-Specific Integrated Circuits (ASIC) Market Segment Analysis:

- By Application: Automotive

The Automotive segment serves as a foundational growth driver for the Mexico ASIC market, transitioning from a volume manufacturing base for internal combustion engines to a strategic hub for electric and connected vehicles. This technological pivot has significantly raised the "silicon intensity" of Mexican-produced vehicles. The shift to EVs creates distinct demand for custom ASICs optimized for high-voltage power management (e.g., IGBT gate drivers), battery monitoring units, and high-speed in-vehicle networking. ASICs are essential here because they offer the deterministic, real-time processing capabilities and high thermal tolerance required to meet the functional safety standards (ISO 26262) mandated by global OEMs like BMW and General Motors, which operate assembly plants in Mexico. Furthermore, the integration of advanced sensors and computational requirements for ADAS features—ranging from simple object detection to full autonomy—drives specific demand for custom accelerator ASICs that handle the massive parallel processing loads of AI and machine learning at the edge, where power efficiency is paramount. The increasing localization of Tier 1 and Tier 2 suppliers under the USMCA rules reinforces the Mexican-based demand for these advanced, custom silicon solutions.

- By Application: Data Centers & Cloud Computing

The emergence of Mexico as a significant Data Center and Cloud Computing market—fueled by hyperscalers establishing regional presence—creates an unprecedented demand for high-performance ASICs. These modern data centers require custom silicon, primarily for AI acceleration (e.g., specialized tensor processing units, or TPUs), network switching, and storage optimization. Unlike standard computing, hyperscale operations prioritize the total cost of ownership (TCO), which is heavily influenced by energy consumption and cooling. This focus compels providers to seek ASICs that offer the optimal computation-per-watt ratio. The resulting demand is concentrated on Full-Custom and semi-custom ASICs that offload generic central processing unit (CPU) tasks, such as networking protocol processing or video transcoding, onto specialized hardware. The localization of AI workloads for regional financial services and e-commerce platforms further solidifies this requirement, as low-latency, real-time AI inference requires purpose-built accelerator ASICs. Foxconn's involvement in superchip programs within the region exemplifies this shift toward domestic sourcing of data-center-grade packaging and integrated circuits.

________________________________________________________________

Mexico Application-Specific Integrated Circuits (ASIC) Market Competitive Environment and Analysis:

The competitive landscape within the Mexican ASIC market is dominated by large, multinational semiconductor design and manufacturing firms, leveraging their global technology leadership to service the localized growth driven by Nearshoring and automotive electrification. Competition manifests primarily in the form of design-in support, technical field application engineering, and supply chain reliability rather than local fabrication capacity. Major players compete intensely to secure design wins in the dominant end-user segments: automotive (Infineon, NXP), data centers (NVIDIA, AMD, Broadcom), and industrial/IoT (Microchip, STMicroelectronics).

- NXP Semiconductors

NXP maintains a powerful strategic position in Mexico, primarily anchored by its extensive portfolio in the automotive and industrial segments. The company's positioning is highly aligned with the country's manufacturing strengths in vehicle production and factory automation. NXP's key offering includes the S32 automotive platform, which provides a comprehensive suite of processors, including custom-designed ASICs for domain control, battery management, and secure gateway functions. By focusing on hardware-software co-design, NXP ensures its ASICs meet the stringent safety and security requirements of the global OEMs operating in Mexico. The company's long-standing operational presence in Mexico, including design and R&D centers, provides a localized technical advantage critical for securing design wins with Mexican-based Tier 1 suppliers.

- Infineon Technologies

Infineon's strategy in Mexico is deeply integrated with the country's role in power electronics and the EV revolution. The firm specializes in power and sensor ASICs, critical components for electric vehicle inverters, charging stations, and industrial power supplies. Its product lineup, including the AURIX family of microcontrollers (which often incorporate ASIC elements) and power ASICs, directly addresses the growing demand for highly robust and thermally efficient silicon solutions in Mexican-produced EVs and industrial IoT applications. Infineon leverages its global expertise in wide-bandgap materials like Silicon Carbide (SiC) to position its ASIC solutions as essential components for energy efficiency, a critical factor for manufacturers facing Mexican grid constraints.

- NVIDIA

NVIDIA's competitive presence is concentrated on the high-end computational ASIC demand from the burgeoning Data Center & Cloud Computing and Automotive segments. The company's custom ASICs for AI acceleration, such as its specialized GPUs and Data Center Processing Units (DPUs), are non-negotiable components for hyperscalers setting up AI-centric regional data centers in Mexico. In the automotive sphere, NVIDIA positions its DRIVE platform, which utilizes custom ASICs for autonomous driving and in-vehicle infotainment, targeting the sophisticated electronics architecture of next-generation, high-performance vehicles being assembled in Mexico. NVIDIA's strategy is not about local production volume but about supplying the core, high-value, computational ASICs that drive the intelligence and functionality of the most advanced end-products.

________________________________________________________________

Mexico Application-Specific Integrated Circuits (ASIC) Market Developments:

- September 2025: NVIDIA and Intel Announce Joint Development of Custom Data Center and PC Products. NVIDIA and Intel Corporation announced a collaboration to jointly develop multiple generations of custom data center and PC products. This partnership includes Intel designing and manufacturing custom data center and client CPUs with NVIDIA NVLink interconnect technology. This event signifies a major strategic shift in the supply of high-end computational ASICs, potentially impacting Mexican data center operators who procure systems from both companies by introducing a new class of integrated chip architectures optimized for AI and high-performance computing (HPC).

- June 2025: AMD Exceeds Energy Efficiency Goal for AI and HPC. AMD announced in its Corporate Responsibility Report that it had exceeded its 30x25 AI energy efficiency goal, achieving a 38x improvement in node-level energy efficiency for AI training and HPC since 2020. This development, based on their processor technologies (which include specialized ASIC accelerators), is highly relevant to the Mexican market. Hyperscalers and corporate data centers in Mexico, which face energy constraints, will prioritize the adoption of high-efficiency silicon to manage operational costs and power consumption, directly increasing the demand for AMD's advanced ASIC-based products.

________________________________________________________________

Mexico Application-Specific Integrated Circuits (ASIC) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.664 billion |

| Total Market Size in 2031 | USD 1.054 billion |

| Growth Rate | 9.68% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Process Technology, Product Type, Application |

| Companies |

|

Mexico Application-Specific Integrated Circuits (ASIC) Market Segmentation:

- BY PROCESS TECHNOLOGY

- Advanced Nodes

- 3 nm and below

- Leading-Edge Nodes

- 5 nm

- 7 nm

- Mid-Range Nodes

- 10 nm

- 12 nm

- 14 nm

- 16 nm

- Mature Nodes

- 22 nm and above

- Advanced Nodes

- BY PRODUCT TYPE

- Full-Custom ASIC

- Semi-Custom ASIC

- Standard Cell-Based ASIC

- Gate-Array Based ASIC

- Programmable ASIC

- Others

- BY APPLICATION

- Consumer Electronics

- Automotive

- Networking & Telecommunications

- Data Centers & Cloud Computing

- Healthcare

- Industrial & IoT

- Defense & Aerospace

- Others