Report Overview

Food Additives Market Report, Highlights

Food Additives Market Size:

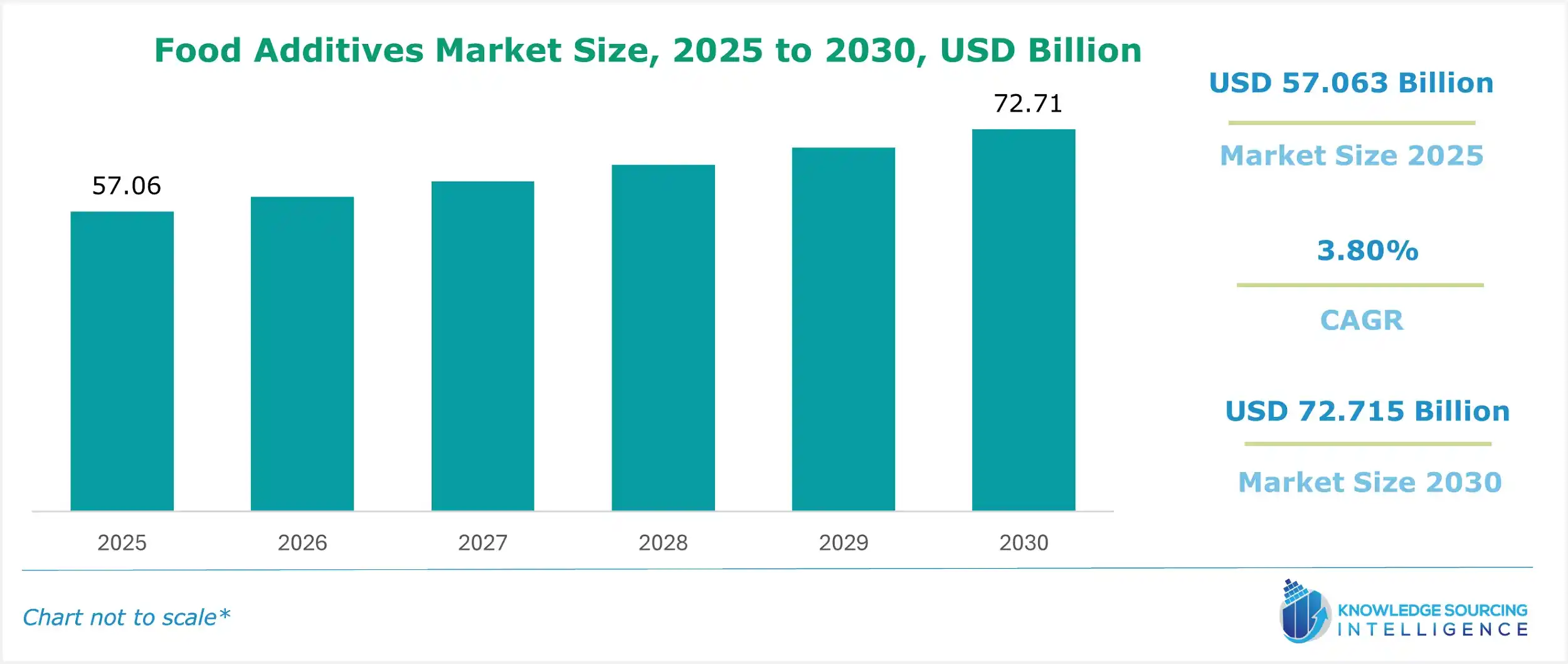

The food additives market is projected to grow at a CAGR of 3.80% over the forecast period, increasing from USD 57.063 billion in 2025 to USD 72.715 billion by 2030.

Food Additives Market Trends:

Food additives are substances added to food and beverages to preserve flavor, enhance taste, improve appearance, and maintain texture and nutritional value. Common examples include preservatives, emulsifiers, sweeteners, colorants, and stabilizers. These additives play a vital role in ensuring the safety, shelf life, and visual appeal of packaged and processed food products.

With the global shift toward urban living, the demand for food additives is growing rapidly. Urbanization has led to lifestyle changes, where consumers increasingly rely on ready-to-eat meals, processed snacks, and convenience foods. These products often require additives to meet consumer expectations for flavor, safety, and longevity.

According to the World Bank, the global urban population was estimated at 4.45 billion in 2021, rising to 4.52 billion in 2022, and reaching 4.6 billion in 2023, representing about 57% of the world’s population. This demographic shift is accompanied by higher disposable incomes and growing access to modern retail channels, which significantly influence food purchasing behaviors.

Consumers in urban areas are also becoming more health-conscious, fueling demand for clean-label and natural food additives made from plant-based or minimally processed sources. This trend is encouraging food manufacturers to reformulate products with fewer artificial ingredients while maintaining performance and taste.

As urbanization continues and food habits evolve, the global food additives market is expected to expand further, driven by innovation, consumer awareness, and the demand for functional, safe, and sustainable food ingredients.

Food Additives Market Growth Drivers:

- The increasing global demand for processed food and beverage products is projected to propel the food additives market expansion.

A major factor driving the global food additives market is the increasing demand for processed food and beverage products worldwide. With this growth, the demand for food additives in the manufacturing process of the products will increase significantly.

The Agriculture and Agri-Food Canada, or AAFC, in its 2023 report, stated that in the year, the total sales of food and beverage processing were recorded at US$167.5 billion. The agency further stated that the meat processing sector occupied the largest share, with about 25.5%, followed by grain & oilseed milling at 12.7%. The dairy product manufacturing and bakeries & tortilla processing sectors accounted for 10.9% and 10.6% shares, respectively.

The increasing demand for a wide range of beverage items has led to an exponential rise in the incorporation of various food additives, for instance, to enhance the quality of the product, extend its shelf life, or consider the tastes of the consumers. Accordingly, the leading manufacturers of these additives are also funding research work in the development of some new additives that not only improve product qualities but also help in addressing some product trends. For example, natural clean labels will play a big role in the growth of the industry in the coming years.

Moreover, the consumption of both alcoholic and non-alcoholic drinks has increased significantly. More specifically, the demand for alcoholic beverage markets is on the rise due to millennials, especially in developed regions such as North America and Europe, which have a strong culture of consuming alcohol.

Additionally, the beverage industry is highly competitive, with various domestic and international firms leading the market. For example, Nouryon offers water-soluble cellulose-based gums called Akucell® and Cekol® that improve the look and flavor of a variety of foods, such as protein and fruit-flavored drinks, baked goods, dairy products, frozen desserts, sauces, noodles, and low-fat and gluten-free foods.

This demand has also increased the sales of alcoholic beverages in the United States. For instance, $7.2 billion in nearly flat vodka sales, and sales of mezcal and tequila increased 7.9%, or $476 million, for a total of $6.5 billion.

Food Additives Market Geographical Outlook:

Based on geography, the food additives market is segmented into North America, South America, Europe, the Middle East, and Africa, and the Asia Pacific. Due to the growing number of elderly individuals and a rise in health-conscious consumers, there is an increasing demand for healthy alternatives. The market is growing owing to the extensive use of additives in food and beverages throughout the market in forms such as colorants, sweeteners, emulsifiers, flavor enhancers, and preservatives, among many other uses. There is also a rise in demand for packaged and convenience foods, which use more additives.

Moreover, access to processed and convenient types of foods has increased for consumers due to the growth in the number of retailers, retail channels, and formats. This, in turn, is increasing the demand for food additives within the US food and beverage industry. Organized retailing also gives consumers the advantage of the label and other aspects at focused prices, quality, and services. Due to price competition with both national and store brands, the retail food market in the US is on the increase, which is also increasing the market for food additives in the United States. For instance, retail and food services sales in the United States were projected to reach $714.4 billion in September 2024, which is a rise from US$711.3 billion in August of the same year.

Food Additives Market Key Players:

- Cargill Incorporated- Cargill Incorporated is a leading and one of the largest privately held corporations in the world, dealing with diverse portfolios including agriculture, food production, and industrial services. As part of its business strategy, it follows a multifaceted approach based on innovation, sustainability, and market expansion. In particular, it has invested in research and development by optimizing nutrient blends and incorporating new additives to increase food efficiency. It partners with suppliers who are up to environmental and social standards, ensuring sustainability in its business. It has expanded into regions of the Asia-Pacific to position itself high in the market.

- ADM- Archer-Daniels-Midland Company, established in 1902, is a multinational food processing and transportation company based in the United States. It mainly works in segments of oilseed processing, corn processing, and providing agricultural services like transportation and logistics. It has more than 420 crop procurement sites and 270 plant procurement facilities worldwide. It is a global nutrition provider company that offers varied products like flour & grains and complete feed to poultry species in human and animal feed, respectively. It also provides products for Industrial BioSolutions and services like transportation and logistics. It offers Animal Feed Additives & ingredients like Amino Acids, Feed Additives, Ingredients like Anco FIT, Biuret, and enzymes like Empirical Phytase through its brand “Pancosa” for species of aquaculture, poultry, equine, swine, and others.

Food Additives Market Key Developments:

- March 2024 - The Institute of Food Technologists (IFT) introduced an educational toolkit to assist in clarifying the utilization of food additives and preservatives in the production of food.

List of Top Food Additives Companies:

- Cargill Incorporated

- ADM

- Novozymes

- DuPont

- Chr. Hansen Holdings A/S

Food Additives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Food Additives Market Size in 2025 | USD 57.063 billion |

| Food Additives Market Size in 2030 | USD 72.715 billion |

| Growth Rate | CAGR of 3.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Food Additives Market |

|

| Customization Scope | Free report customization with purchase |

Food Additives Market Segmentation:

- By Additives Type

- Preservatives

- Ascorbic acid

- Citric acid

- Sodium Benzoate

- Others

- Sweeteners

- Sucrose

- Fructose

- Glucose

- Others

- Flavors and Spices

- Natural flavor

- Artificial flavor

- Spices

- Flavor Enhancers

- Monosodium Glutamate (MSG)

- Hydrolyzed soy protein

- Autolyzed yeast extract

- Others

- Stabilizers and Thickeners, Binders, Texturizers

- Gelatin

- Pectin

- Guar gum

- Others

- Emulsifiers

- Soy lecithin

- Mono and di-glycerides

- Egg yolks

- Others

- Preservatives

- By Application

- Bakery and Confectionery

- Processed and Canned Food

- Fruits and Vegetables

- Frozen Foods

- Beverages

- Dairy Products

- Meat and Seafood

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- United Kingdom

- Italy

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Others

- North America