Report Overview

US Advanced Battery Market Highlights

US Advanced Battery Market Size

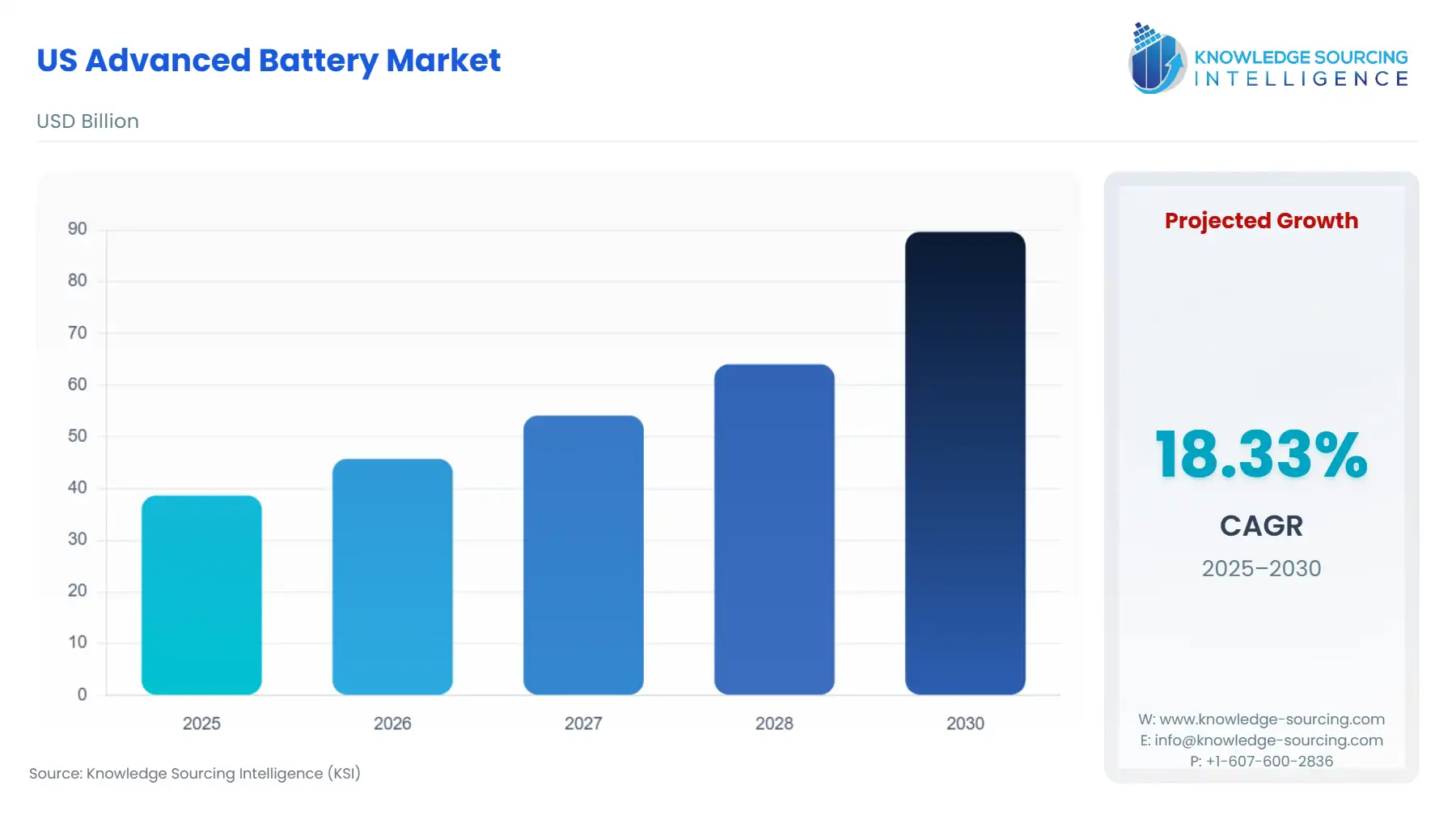

The US Advanced Battery Market is expected to surge at a CAGR of 18.33%, reaching USD 89.680 billion in 2030 from USD 38.650 billion in 2025.

The US Advanced Battery Market is undergoing a fundamental restructuring, moving from a technology consumer to a production powerhouse, a transition aggressively accelerated by federal policy. This shift is centered on securing the supply chain for technologies deemed critical to economic security and decarbonization goals. The US Department of Energy (DOE) emphasizes a strategy to leapfrog current-generation battery technology by investing in next-generation solutions, simultaneously securing near-term supply of lithium-ion batteries while fostering innovation. This strategic investment is not just creating capacity; it is fundamentally shaping future demand by favoring domestically produced and processed content.

US Advanced Battery Market Analysis:

- Growth Drivers:

Federal policy represents the most powerful and immediate growth driver, explicitly influencing market expansion. The IRA’s provisions, including manufacturing and consumer tax credits, directly increase the sales of electric vehicles (EVs) and deployment of stationary energy storage systems, thereby creating a guaranteed baseline demand for the core product: the battery cell. For instance, the tax credits for new and used EVs decrease the effective purchase cost for consumers, directly accelerating EV uptake, which translates into a massive, sustained demand signal for advanced automotive batteries. Concurrently, the DOE's National Blueprint for Lithium Batteries 2021-2030 codifies the goal of building a secure domestic supply chain, driving demand for new US-based critical mineral refining and battery component manufacturing facilities.

- Challenges and Opportunities:

A significant constraint is the global concentration of raw material processing. The United States still imports the vast majority of refined lithium, cobalt, and graphite, exposing domestic battery manufacturers to geopolitical instability and significant pricing volatility. This supply chain vulnerability creates a demand for innovative non-lithium-ion chemistries, such as sodium-ion and flow batteries, which utilize more abundant and domestically accessible materials. An accompanying opportunity is the push for a circular economy. DOE funding has been announced to develop technologies to enable a circular EV battery supply chain, creating a robust, localized demand for innovative battery recycling and materials regeneration processes, reducing long-term dependence on primary resource extraction.

- Raw Material and Pricing Analysis:

Advanced batteries are physical, material-intensive products, making raw material supply chain analysis critical. The prices of key materials like lithium carbonate and nickel have experienced significant fluctuations. Lithium carbonate prices, for example, saw a multi-fold increase from 2021 into early 2023, followed by a subsequent drop. These price swings directly impact the final cost of battery packs—which typically accounts for a substantial portion of an EV’s total cost—introducing commercial risk for manufacturers and impacting the price-competitiveness of domestically produced batteries relative to global counterparts. The shift toward Lithium Iron Phosphate (LFP) chemistry, which eliminates nickel and cobalt, is a market-driven response to mitigate these price and supply chain volatility risks, increasing demand for LFP-specific cathode materials.

- Supply Chain Analysis:

The advanced battery supply chain is predominantly globalized and structurally dependent on a few key production hubs in Asia for cell manufacturing, cathode and anode production, and, critically, critical mineral refining. The US market, while increasing its domestic cell assembly capacity, remains dependent on these foreign hubs for nearly all processed battery-grade raw materials and certain key components (e.g., separators and electrolytes). Logistical complexities involve specialized, compliant shipping of hazardous materials, which adds cost and lead time. The US strategy focuses on “friend-shoring” and onshoring to mitigate this dependency, specifically channelling billions in capital investment to create new domestic processing and manufacturing nodes, thus decentralizing the global production footprint.

US Advanced Battery Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| US Federal | Inflation Reduction Act (IRA) of 2022 | The tax credits tied to domestic content and manufacturing requirements (e.g., Section 45X) directly create and shape demand by incentivizing manufacturers to locate battery cell and component production facilities in the US. This policy accelerates the domestic manufacturing capacity for advanced batteries. |

| US Federal | Department of Energy (DOE) Funding Programs | Direct government capital investment (e.g., ATVM Loan Program, Bipartisan Infrastructure Law grants) de-risks private sector investment in novel technologies (e.g., solid-state, recycling) and critical mineral supply chain projects, stimulating demand for pre-commercial and first-of-a-kind production facilities. |

| California | Advanced Clean Cars II (ACC II) | State mandates require a substantial increase in zero-emission vehicle (ZEV) sales shares by automakers, effectively guaranteeing a massive, long-term regional demand for high-performance automotive battery packs. |

US Advanced Battery Market Segment Analysis:

- By Application: Automotive (Electric Vehicles) The electric vehicle (EV) sub-segment dictates the highest volume and most aggressive technology demands in the US Advanced Battery Market. The direct growth catalyst is the federal commitment to zero-emission transportation, specifically the consumer tax credits and fleet electrification mandates. This creates a hyper-accelerated need for high-energy density battery packs that support long driving ranges and fast charging capabilities. The average battery size in US electric cars remains significantly higher than the global average, driven by the consumer preference for larger vehicles (e.g., SUVs and trucks). This preference translates into a specific, high-capacity demand for Lithium-ion (Li-ion) battery cells, particularly those utilizing high-nickel content cathodes (NMC/NCA) to maximize energy density per volume. This requirement is directly responsible for billions in US Gigafactory construction announcements.

- By Technology: Solid-state Batteries Solid-state battery (SSB) technology represents a crucial opportunity for the US market by offering enhanced safety and higher theoretical energy density over traditional Li-ion batteries with liquid electrolytes. The need for SSBs is primarily driven by the imperative to reduce thermal runaway risk in automotive and aerospace applications and the need for battery packs that offer a step-change increase in range. The DOE’s targeted R&D funding for next-generation chemistries is actively pulling this technology from the lab to commercialization, establishing a strategic demand for SSB-related intellectual property and pilot-scale manufacturing capabilities. While currently a lower-volume segment, its inherent advantages position it to capture significant long-term demand from premium EV and defense applications once mass production scaling challenges are overcome.

US Advanced Battery Market Competitive Analysis:

The competitive landscape is characterized by a concentrated group of global leaders, primarily Asian-based, rapidly expanding their US manufacturing footprint to meet domestic content requirements. New US-headquartered entrants are focusing on the upstream supply chain and next-generation technology to establish a differentiated, proprietary position.

- Panasonic Energy (Panasonic Holdings Corporation): The company is strategically positioned as a core supplier to major US EV OEMs. Its announcement of a $4 billion battery manufacturing facility in Kansas signifies a direct move to secure high-volume demand from the automotive sector and comply with domestic content stipulations of the IRA. The Kansas facility is intended to deliver over 30 GWh annually, focusing on cylindrical lithium-ion cells essential for high-performance EVs.

- Freyr Battery: Freyr is leveraging a different strategic path by focusing on the development and production of semi-solid lithium-ion battery cells using sustainable manufacturing processes. Its planned US facilities are aimed at serving the growing demand from both the electric vehicle and the stationary energy storage segments, positioning itself as a technology-differentiated supplier in the rapidly expanding domestic market.

US Advanced Battery Market Developments:

- September 2025: The U.S. Environmental Protection Agency (EPA) began the unprecedented removal of lithium-ion batteries from the Vistra Corp. battery energy storage facility in Moss Landing, California, which was impacted by a January 2025 fire. This major cleanup highlights the growing challenge and demand for specialized lithium-ion battery recycling, safety, and disposal services.

- September 2024: The U.S. Department of Energy (DOE) announced over $3 billion for 25 selected projects across 14 states, funded by the Bipartisan Infrastructure Law. These grants are for building and expanding domestic facilities for battery-grade processed critical minerals, battery components, battery manufacturing, and recycling, explicitly accelerating domestic capacity addition across the entire supply chain.

US Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 38.650 billion |

| Total Market Size in 2031 | USD 89.680 billion |

| Growth Rate | 18.33% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

US Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket