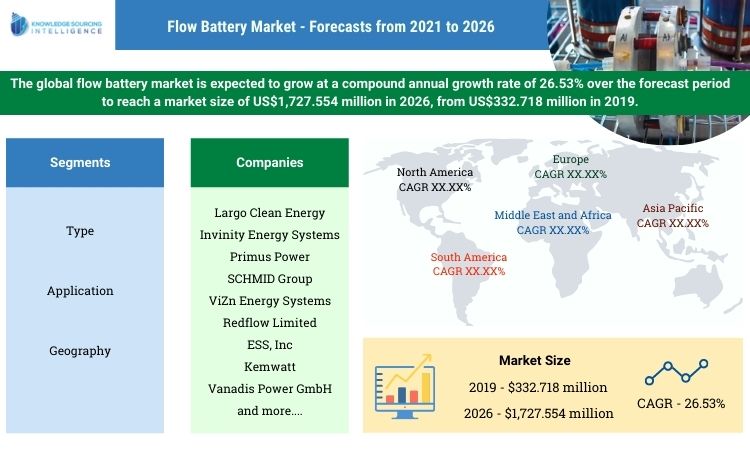

Flow Battery Market Size, Share, Opportunities, COVID 19 Impact, And Trends By Type (Redox Flow Battery, Organic Flow Battery, Hybrid Flow Battery, Membraneless Flow Battery), By Application (Commercial And Industrial, Utilities, Defense, Others), And By Geography - Forecasts From 2021 To 2026

- Published : May 2021

- Report Code : KSI061611336

- Pages : 104

The global flow battery market is expected to grow at a compound annual growth rate of 26.53% over the forecast period to reach a market size of US$1,727.554 million in 2026, from US$332.718 million in 2019. The market is expected to surge in the coming years, because of the rising usage of flow batteries for renewable energy and applications. There has been a surge in the solar and wind energy companies, that have been looking for novel and advanced solutions to keep and maintain the flow of electrons, when the sun doesn’t shine or when the wind ebbs. Flow batteries are used in these applications, as they are capable of storing sufficient electricity to power hundreds and thousands of applications, for a substantial number of hours. Another major advantage of a flow battery is that the material used in the battery can be reused and cross-contaminated across the negative and positive electrode components. Major companies have been spending a significant sum of capital to develop novel and advanced solutions for the market. These trends are expected to have positive development for the market, during the forecast period.

The growth in solar energy demand.

According to the United Nations, the decade of significant investments in the period between the years 2010 to 2019, quadruples renewable capacity, globally, from approx. 414 GW to around 1,650 GW. Solar power and capacity hold a major share in renewable capacity growth. Its capacity rose more than an estimated twenty-six times between the years 2009 to 2019. The capacity rose from 25 GW to approx. 663 GW. The total investments in renewable energy were around USD 2.6 trillion in 2019, out of which USD 1.3 trillion were invested in solar energy and power. The solar capacity of 663 GW by the year 2019, was sufficient to provide electricity per annum to around 100 million homes in the United States of America. Companies have been developing novel and affordable solutions in recent years, which is expected to drive the overall market growth during the forecast period. The cost-competitiveness had been down 81% for solar PV since the year 2009, till the year 2019. According to the OECD and the United Nations, solar energy and solar power, have been the fastest-growing energy source in the world. The two organizations also estimated that by the year 2040, solar energy or solar low carbon technologies, could provide and supply, more than 30% of the global energy supply. Major countries have been investing a significant sum of capital to increase and enhance their overall solar capacity. According to the International Energy Agency (IEA) Study in the year 2019, China had a major share in the solar PV capacity, with approx. 32.6% of the worldwide capacity. The country had a capacity of 204,700 MW in the year 2019. The United States had a share of approximately 12.1%, with a total capacity of 75,900 MW. Japan, Germany, and India had a share of around 10%, 7.8%, and 6.8%, with a total solar PV capacity of approx. 63,000 MW, 49,200 MW and 42,800 MW. Major companies and institutions have been developing novel and advanced flow battery solutions for the market. For instance, in September 2020, researchers and scientists at India’s prestigious Indian Institute of Technology, Chennai had announced the development of a novel kilowatt scale vanadium redox flow battery, intending to store energy and electricity generated by solar and wind projects. The researchers also stated that the novel system could be deployed directly for industrial-scale stacks, and especially for grid-level storage. This development is expected to have a positive impact on the market during the forecast period.

Growth in wind energy demand.

According to the Global Wind Energy Council, 60.4 GW of wind energy capacity was installed in the year 2019, globally. The installed capacity saw an approx. 19% surge from installations as compared to the year 2018. The report also stated that the total wind energy capacity was at 651 GW, in the year 2019. The market is being driven by the growth of wind energy installations in The United States and China, as both of these nations accounted for 60% of novel capacity in the year 2019. The International Energy Agency stated that net wind capacity installations were expected to reach 65 GW capacity, by the year 2020. According to the International Energy Agency, 350GW of wind power is expected to be added, worldwide, by the year 2050. There has been a surge in the development of offshore wind technology, which is expected to drive the market, during the forecast period. An increase in investment in the development of advanced and innovative flow battery solutions for wind power is expected to have a positive impact on the market.

Latest Developments.

- In May 2021, ESS Inc, one of the major producers of flow batteries announced that it had been publicly listing its stock through a merger with a special purpose acquisition company. The company aims to increase its capacity and capitalize on the advantage of the company’s manufacturing process. With additional and extra funding, the company would expand its manufacturing and production to 16 GWh, across three major continents. This development is expected to have a positive impact on the market, during the forecast period.

- In May 2021, Largo Resources, one of the key suppliers of vanadium, had announced that it would launch its product line of redox flow batteries for energy and power storage. The company had been establishing an approx. 1.4 GWh of annual and yearly battery stack production capacity. The company had also stated that it would produce its novel product line in Massachusetts, USA.

- In May 2021, Vopak announced that it would join Elestor in the development of the latter’s hydrogen bromine flow battery. Both the companies stated that they had been aiming to scale and increase the energy and power storage capacity of these novel flow batteries from approx. 200 kWh to 3000 kWh, in a respective period of two years.

Flow Battery Market Scope:

| Report Metric | Details |

| The market size value in 2019 | US$332.718 million |

| The market size value in 2026 | US$1,727.554 million |

| Growth Rate | CAGR of 26.53% from 2019 to 2026 |

| Base year | 2019 |

| Forecast period | 2021–2026 |

| Forecast Unit (Value) | USD Million |

| Segments covered | Type, Application, And Geography |

| Regions covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies covered | Largo Clean Energy, Invinity Energy Systems, Primus Power, SCHMID Group, ViZn Energy Systems, Sumitomo Electric Industries, Redflow Limited, ESS, Inc, Kemwatt, Vanadis Power GmbH |

| Customization scope | Free report customization with purchase |

Segmentation:

- By Type

- Organic Flow Battery

- Redox Flow Battery

- Hybrid Flow Battery

- Membraneless Flow Battery

- By Application

- Utilities

- Commercial & Industrial

- Defense

- Others

- By Geography

- North America

- USA

- Canadá

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- South Africa

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Frequently Asked Questions (FAQs)

Q1. What will be the flow battery market size by 2026?

A1. The global flow battery market is expected to reach a market size of US$1,727.554 million by 2026.

Q2. What are the growth prospects for the flow battery market?

A2. The flow battery market is expected to grow at a CAGR of 26.53% over the forecast period.

Q3. What is the size of global flow battery market?

A3. Flow Battery Market was valued at US$332.718 million in 2019.

Q4. Who are the major players in the flow battery market?

A4. Major industry players profiled as part of the flow battery market report are Largo Clean Energy, Invinity Energy Systems, Primus Power, SCHMID Group, ViZn Energy Systems, Sumitomo Electric Industries, among others.

Q5. What factors are anticipated to drive the flow battery market growth?

A5. The flow battery market is expected to surge in the coming years, because of the rising usage of flow batteries for renewable energy and applications.

1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. The Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Global Flow Battery Market Analysis, By Type

5.1. Introduction

5.2. Organic Flow Battery

5.3. Redox Flow Battery

5.4. Hybrid Flow Battery

5.5. Membraneless Flow Battery

6. Global Flow Battery Market Analysis, By Application

6.1. Introduction

6.2. Utilities

6.3. Commercial & Industrial

6.4. Defense

6.5. Others

7. Global Flow Battery Market Analysis, by Geography

7.1. Introduction

7.2. North America

7.2.1. United States

7.2.2. Canada

7.2.3. Mexico

7.3. South America

7.3.1. Brazil

7.3.2. Argentina

7.3.3. Others

7.4. Europe

7.4.1. UK

7.4.2. Germany

7.4.3. France

7.4.4. Italy

7.4.5. Others

7.5. The Middle East and Africa

7.5.1. Saudi Arabia

7.5.2. South Africa

7.5.3. Others

7.6. Asia Pacific

7.6.1. Japan

7.6.2. China

7.6.3. India

7.6.4. South Korea

7.6.5. Taiwan

7.6.6. Thailand

7.6.7. Indonesia

7.6.8. Others

8. Competitive Environment and Analysis

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisitions, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. Company Profiles

9.1. Largo Clean Energy

9.2. Invinity Energy Systems

9.3. Primus Power

9.4. SCHMID Group

9.5. ViZn Energy Systems

9.6. Sumitomo Electric Industries

9.7. Redflow Limited

9.8. ESS, Inc

9.9. Kemwatt

9.10. Vanadis Power GmbH

Largo Clean Energy

Invinity Energy Systems

Primus Power

SCHMID Group

ViZn Energy Systems

Sumitomo Electric Industries

Redflow Limited

ESS, Inc

Kemwatt

Vanadis Power GmbH

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Connected Agriculture Market Size & Share: Report, 2021-2026 | Sep 2021 | |

| Pyrometer Market Size, Share & Trends: Industry Report, 2021-2026 | Jun 2021 | |

| Radiotherapy Market Size & Share: Industry Report, 2021-2026 | Jul 2021 | |

| Data Center Colocation Market Size & Share: Report, 2023 - 2028 | Jun 2023 | |

| Industrial Enzymes Market: Size, Share, and Insights, 2029 | Mar 2024 |